mysticenergy/E+ via Getty Images

The iShares Global Energy ETF (NYSEARCA:IXC) is an exchange-traded fund exposed to companies producing and distributing oil and gas. The fund invests across the world, and its benchmark index is the S&P Global 1200 Energy Sector Index. Do not be mistaken by the benchmark index’s name; IXC is not widely diversified, it has only 47 holdings as of March 31, 2022. The S&P Global 1200 Energy Index consists of all members of the S&P Global 1200 that are classified within the GICS energy sector.

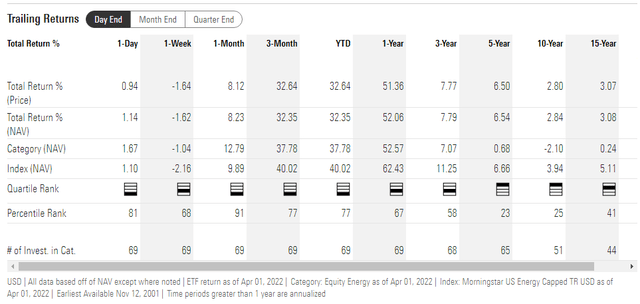

IXC was launched on November 12, 2001. Longer-term ‘total return’ performance has been unimpressive. Over 10-year and 15-year time frames, the annualized total return has been between 2.80% and 3.07% (see summary table from Morningstar below).

So, the total return over time has barely out-performed U.S. CPI inflation. That does not mean that the fund cannot out-perform for shorter periods though, owing to misvaluations. I recently (October 2021) thought IXC was undervalued, and it has out-performed since then, also this rise has been buoyed by the developing Russo-Ukrainian War that has heated up significantly since, with the outright invasion of Ukraine by Russia (from late February 2022). Commodity prices have spiked which has helped IXC’s portfolio that includes significant oil and gas producers.

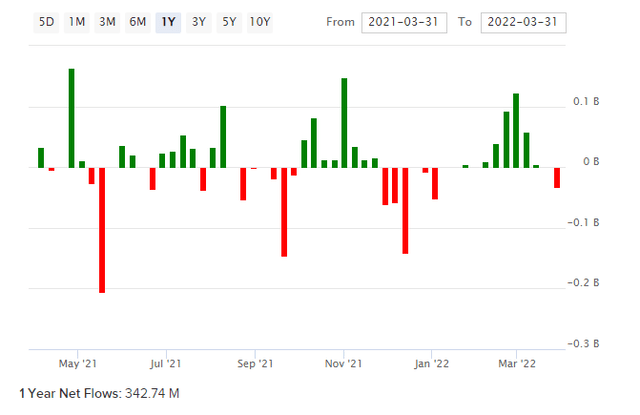

IXC fund flows have been positive over the past year, though they have also been greatly subject to the whims of changing sentiment. Most recently we have seen some outflows (as shown in the chart below).

I don’t know how the Russian invasion of Ukraine will develop, although the probability of nuclear war is likely very small, as it would not likely benefit any side or stakeholder. What is possible is that, before Victory Day, on May 9, 2022, Russia will want to have some kind of political win to celebrate. It is generally thought that Russia expected a “quick win” in Ukraine, which has not come to pass owing to fierce military resistance in Ukraine coupled with high levels of foreign (military) aid. Nevertheless, before Victory Day it is possible that Russia will come to a deal that might involve significant de-escalation in exchange for, for example, the withdrawal of Western sanctions, and certain concessions from Ukraine (in order to put a stop to the fighting).

This is all speculation. The war could continue for months and years, but most would agree that this would unlikely benefit Russia’s longer-term economic and social well-being. Hopefully cooler heads prevail. In any case, IXC’s exposure to energy/commodity producers should enable strong near-term earnings; in the longer run, we should however not expect massive returns on equity for the sake of valuation.

I previously thought there was just over 25% upside potential in IXC, and since then, IXC has risen by about 25% on a total-return basis. Noting that last time I used a U.S. equity risk premium only, and that IXC technically has international exposures, I will revise my previous estimate especially in light of higher equity risk premiums and yields more recently (as well as a higher IXC share price).

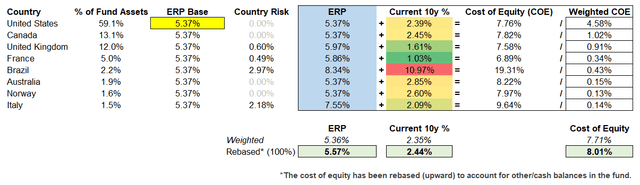

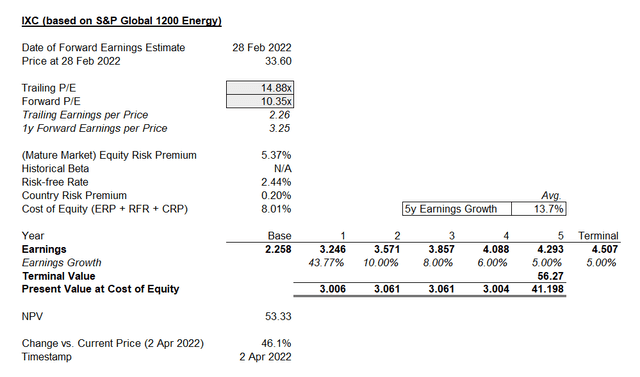

First off, the most recent U.S. equity risk premium estimate from Professor Damodaran reads 5.37%. The United States represents about 59% of IXC’s total assets; the bulk of the portfolio. Other major exposures are Canada and the United Kingdom, which have substantially similar assessed equity risk premiums (only the U.K., of these two, carries a suggested country risk premium of 0.60%, per Damodaran’s analysis). We also need to look at 10-year yields. The table below summarizes my estimate of IXC’s cost of equity.

With an overall cost of equity of circa 8.01%, IXC investors should demand relatively strong returns.

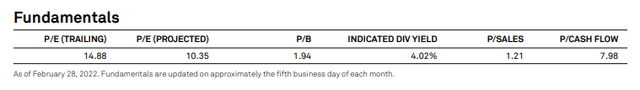

Referring to IXC’s benchmark index factsheet as of March 31, 2022, we find the February (prior month) month-end fundamental ratios below.

As commodity prices have rebounded, so has IXC’s trailing earnings base, while forward earnings estimates have strengthened too upon this base. Whereas before analysts were estimating circa 10% three- to five-year earnings estimates, the same “Long-Term Earnings %” figure from Morningstar now implies circa 20% average annual earnings growth. Analysts are possibly getting ahead of themselves. Instead, I will assume a similar softening of the earnings growth rate beyond the first year.

I previously had a year-one to year-six earnings growth rate of 6.8%. I am assuming the same again, assuming that commodity prices will be volatile on the downside as well as upside, and assuming we are not seeing a higher-for-longer regime for commodities. This may be wrong, but it is a starting point.

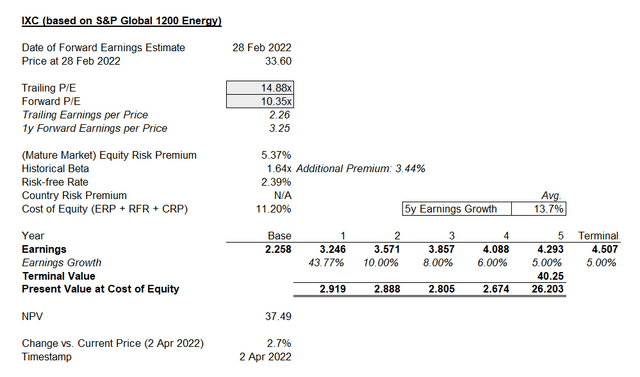

Interestingly my valuation has jumped, although this is in great part due to a lower cost of equity used (that is, in spite of a higher equity risk premium and higher weighted risk-free rate used versus before). The lower cost of equity is derived from my alternative method of using an international approach rather than scaling up the mature market risk premium (of 5.37%, in this case) by a measure of relative volatility (i.e., beta) of IXC. Country risk premiums are used as an alternative to beta. If I go back to the U.S.-only ERP and scale it by IXC’s beta of 1.64x, my valuation drops to upside potential of 2.7%.

Arguably this approach, also used by myself before, is a better (and clearly more conservative) reflection of IXC’s risk profile. We are basically trading country risk premiums for actual share price volatility as a measure of risk. While beta is imperfect, it makes sense intuitively that a concentrated portfolio of energy stocks is at least 50% more risky than investing in an ETF that tracks the S&P 500 U.S. equity index.

So, IXC is probably trading around fair value if we assume that commodity cycles will continue and that commodity prices are not going to persist for years at higher levels (or increasingly higher levels). This may well be wrong, but the risk/reward is no longer as strong as before.

Nevertheless, I would be neutral, on the basis that the current valuation is “fair”. This means that risk is probably fairly low. If earnings estimates get revised back down closer to my more modest estimates, the valuation will probably still look fine. If earnings actually do come in at a high growth rate of circa 20% per annum, IXC will then possibly out-perform the broader market over the medium term. So, the risk/reward still looks decent, but since I am cautious about commodity cycles (shortages are often followed by gluts) and shifts in sentiment, I would choose to be neutral for the foreseeable future.

Be the first to comment