tumsasedgars/iStock via Getty Images

It Begins with a Box

The parcel arrived as promised, holding a small and soon-to-be cherished reward – a medallion commemorating the completion of the 2021 Virtual Marathon sponsored by the New York Road Runners (NYRR) club. Policies to stop the spread of COVID-19 had shut down the usual round of footraces in New York City, including the iconic 2020 New York City Marathon, all orchestrated by the NYRR. The NYRR turned to ‘virtual events.’ Even more important than the accomplishment of running 26.2 miles, this particular trophy bestowed proof of a return to normalcy after a punishing year and half of lockdowns and social distancing – a calendar with more footraces and fewer Zoom calls.

Little did this analyst know, there was a sophisticated apparatus behind her package and the treasures it held. It was the efforts of Stran & Company (NASDAQ:STRN), a specialist in promotional products and branded merchandise, that ensured the medallion was promptly delivered to the right person at the right address. Stran also made certain the prize was accompanied by a proper ‘race bib’ with the correct entry number.

Much was at stake for the NYRR. The Virtual Marathon was intended to attract as many runners as possible back to the NYRR sphere of influence – especially those who could not qualify or did not feel safe enough to rejoin their fellows in the resumed-live, but scaled-down marathon in early November 2021. Thus, Stran delivered more than medallions for NYRR. It delivered motivation to renew NYRR membership and pay fees for additional races – virtual and in-person – cash flows critical to NYRR’s future.

The Art of Branded Incentives

The case is strong for using branded products to promote consumer loyalty. The Promotional Productions Association International (PPIA) found in a 2017 survey that 90% of consumers later recall the brand of a promotional item. This compares to 67% brand recall for print ads and 44% recall for digital ads, according to neuromarketing firm True Impact. What is even more impressive is that 70% of consumers remember the call to action that came with the promotional item. Such effective results give brand owners a good reason to make incentives and gifts a consistent part of their marketing program.

Industry research firm IBISWorld estimates the addressable market for promotional products in the U.S. alone is near $17.8 billion in 2022. The COVID-19 pandemic negatively impacted the industry beginning in 2020, but it has returned to pre-pandemic levels as regular activities resumed in late 2021. IBISWorld analysts have forecast an annualized industry growth near 1.9%.

Distinguish by Custom Services

Stran offers businesses and organizations a unique mix of promotional solutions for the achievement of their marketing and programmatic goals. Central to Stran’s service menu is sourcing and distribution of promotion and rewards products on behalf of brand owners. Stran takes care of the nitty-gritty, including artwork creation, print-on-demand, kitting, inventory management, warehousing, point-of-sale displays, and delivery to the door, among other essential activities for successful loyalty and incentive programs.

The Company also offers sophisticated e-commerce services such as designing and hosting online retail shops and online business-to-business platforms. To make things even easier for a client with an online shop, Stran can take care of product sourcing, inventory management, and fulfillment.

Stran personnel work closely with a client’s marketing department or consultants to design and promote the right merchandise to win the widest brand recognition and loyalty. The Company’s creative team can design gamification tools, integrate social media exposure, or set up incentive plans to reward employees or customers.

Customer Logos (Stran & Company Presentation)

Clients are wide-ranging from small brand owners to large, multinational corporations. The Company offers a well-populated ‘look who loves us’ slide in its investor presentation, providing evidence of a diverse client base. Of course, the logo of New York Road Runners with its signature blue runner silhouette is in the mix. Many of the other client brands are more quickly recognized such as Verizon (VZ), Samuel Adams, Coca-Cola (KO), Timberland, Abbott Laboratories (ABT), and Samsung (OTC:SSNLF), among other international operators.

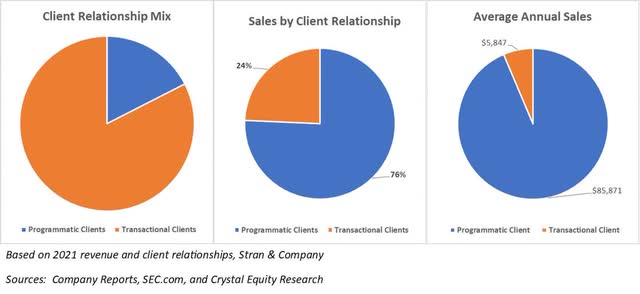

Strong client links appear to be a key driver of revenue for Stran. Indeed, the Company reports revenue in segments according to the nature of its relationships. Clients that have contracted for ongoing services are classified as Program Clients. Such services are often related to inventory management, warehousing, creative services, or an online retail platform. The rest are considered Transactional Clients who engage Stran for a particular event or task, leaving Stran with no ongoing responsibilities…or revenue. For example, in 2019, Stran was hired by a third-party to provide support to the U.S. Census Bureau for the 2020 Census, an event that will not come around again for a decade. (More on the census project below.)

Less than 350 of the Company’s 2,000 active customer relationships are considered Program Clients, but their contracts provide as much as three-quarters of Stran’s revenue. Based on revenue reported in 2021, it is estimated that on average each Program Client contributes about $85,000 to sales each year. This compares to $5,800 average revenue per year from Transactional Clients. It is clear why Stran sales personnel try to upsell customers to service contracts involving value-added services such as creative work, an online store, or inventory management.

STRN Client Relationships (Company Reports, SEC, Crystal Equity Research)

Strengths Against a Well Populated Competitive Field

Stran generates value for its clients by transparently facilitating the special moments when prize boxes are opened and that coveted logo appears. The Company differs from most other players on the field by having a ‘triple threat’ of talents under one roof: promotional product sourcing, warehousing and fulfillment, and branded online retail platforms. As a consequence, Stran competes with quite a number of different companies in one arena or another, ranging from advertising agencies to online retailers to small, localized promotional products suppliers to larger branded merchandise vendors.

Stran management counts as many as 40,000 participants in just the promotional products segment alone. The trade organization Advertising Specialty Institute (ASI) lists HALO Branded Solutions as the largest player in this segment followed by Staples Promotional Products in second place. ASI estimates the top forty players account for only one-third of promotional products sales.

There is quite a bit of risk when there are many contenders. For example, most of the promotional items that are favored by clients, such as T-shirts or cups, can be procured from multiple sources and sometimes at discounted pricing. Price undercutting is a typical competitive tactic in the promotional products arena.

To meet competitive threats head-on, Stran holds out as a quality service provider with unique platforms that give clients convenience and rich benefits. For example, the Company has invested in well-established enterprise software platforms for its online retail offering, making it possible to offer sophisticated e-commerce solutions to Program Clients. The online shops are customizable and scalable. Even Transactional Clients get the benefit of efficient order processing through the Stran platform.

From Stran’s perspective, its software investments have made it possible to approach a wide range of prospects, large and small. The Company has also proven its platforms can be used across multiple industries, including sports, healthcare, food production, beverages, and clothing, among others.

Clients find it difficult to get the same optionality and service level from competitors, giving Stran the benefit of ‘stickier’ customer relationships. Management reports its client contracts average three to five years in duration.

Financial Performance: Rocking and Rolling with a Growth Operation

Stran has created efficiencies in its promotional products marketing process that can deliver earnings to shareholders. However, investors need to look very closely at recent financial reports to find the evidence. Indeed, at just a cursory glance, it looks like Stran is struggling.

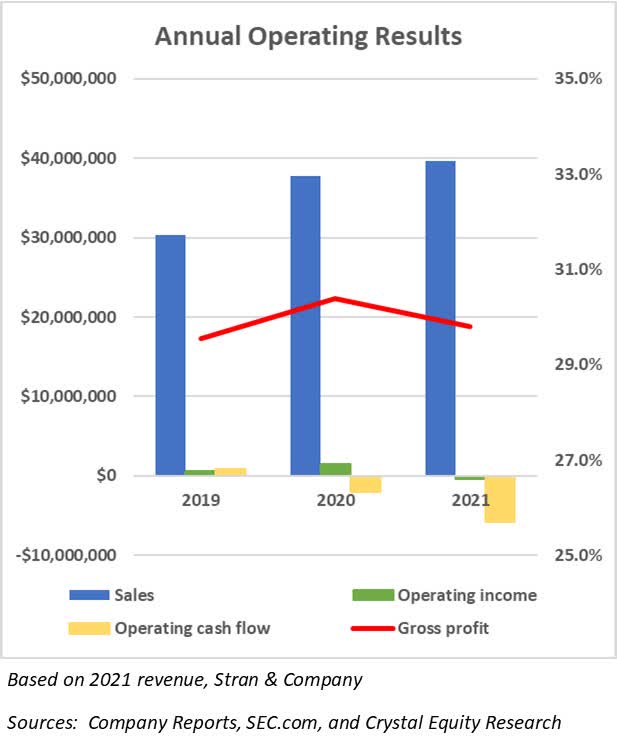

The Company reported in its annual filing with the U.S. SEC, $39.7 million in total sales in 2021, representing 5.2% year-over-year growth at the top line. However, even as the previous two fiscal years had been profitable, the Company reported an operating loss of $437,879.

Up until the fourth quarter 2021, revenue had trailed the prior year. The unfavorable comparison at the top line was largely due to the completion of work related to the U.S. Census in 2020, which was by definition a one-time event and did not continue into 2021. In 2020, the U.S. Census work represented 27.1% of total sales. The Company also benefitted in 2020, from business related to personal protective equipment, but experienced a decline in volume as the coronavirus finally slowed in 2021. It was not until late 2021 that revenue contributions from acquired operations helped boost the top line to a 5.17% increase over 2020. Excluding the revenue related to the U.S. Census contract in 2020, year-over-year organic and acquired growth is estimated near 44% in 2021.

The operating loss in 2021 stemmed in large part from exceptional costs related to shipping of promotional products from low-cost manufacturing sites in Asia. According to the Freightos FBX Index, the cost of transoceanic shipping for a 40-foot container reached a high of $11,000 per container in mid-2021. This compares to $1,300 as recently as late 2019. Freight charges only abated about 15% in the final months of 2021. As a consequence, freight costs for Stran increased 85.5% in 2021, far faster than sales, cutting deeply into profits.

Stran management has also cited rising merchandize costs in 2021, largely resulting from pandemic-related inefficiencies in the world supply chain. However, the Company appears to be meeting the challenge, reporting that product costs fell to 60.4% as a percentage of sales in 2021. This compares to 64.0% in the previous year. Some of the improvement in gross margin on product purchases was accomplished in the first half of 2021, but the Company made significant improvement in the second half, when the cost of products was 58.1% of sales in the September quarter and 59.7% in the December quarter.

Gross profits appear solidly near 30% of sales even with high freight and product costs. Some of the efficiency may accrue from Stran’s affiliation with Facilisgroup, a software-as-a-service for the promotional products supply chain. The Company also found efficiency at the operating level. Operating expenses were held to 30.9% of total sales for the full-year 2021.

STRN Operating Results (Stran & Company, SEC, Crystal Equity Research)

Despite improvements in operating profitability in 2021, Stran reported the use of $5.8 million in cash resources to support operations. Investment in working capital is largely Stran’s reason for dipping into its bank account.

- First, the Company invested $2.7 million in inventory on behalf of its clients, 79% of which are branded products. Notably, the majority of inventory is subject to guarantees that require clients to purchase unsold inventory, thereby providing Stran an element of protection against slow sell-through.

- Second, at the end of December 2021, the Company was awaiting payment on an incremental $3.3 million in accounts receivable. Days sales outstanding increased to 83 days at the end of December 2021. While management’s discussion of its 2021 financial results is silent on the matter, the ending balance on accounts receivable could be a matter of timing and unpaid invoices could return to historic levels near 60 days. Importantly, doubtful accounts represent 3.4% of total accounts receivable outstanding.

Investors can expect the roller coaster ride to continue. Beginning in the first quarter 2022, Stran will report the impact of its most recent deal, the acquisition of G.A.P. Promotions for a mix of cash and stock. Future deal commitments and GAP’s working capital accounts will be added to Stran’s balance sheet. The quarter will also include a smidge of GAP revenue, costs, and expenses as well as legal and accounting expenses for the deal closing. The figures may not be large but will be enough to roil year-over-year comparisons, on which investors often make buy/sell decisions.

Acquisition Strategy

Simply converting existing Transactional Clients to higher-value Programmatic Clients provides Stran with a strong internal growth driver. As reliable as pumping existing customer relationships might be, leadership is not content to stop with that growth source alone. They have set their sights on scooping up market share by acquiring some of the numerous other players among their well-populated competition. New services capacities and fresh talent could be icing on the cake.

Many industries are highly fragmented, but not all are friendly to a roll-up strategy. The current dynamics in the promotional products and incentives marketing arena make the industry uniquely receptive to ‘acquire and consolidate’ tactics.

- First, the lack of a dominant leader makes it possible to close deals and complete intelligent integration objectives without getting clobbered by a harsh competitive response. Indeed, following an extended period of COVID-19-related business shutdown, travel restrictions, and social distancing that lasted in various forms for over a year and a half, many promotions products companies are in tatters. Customer relationships may still be intact, but eroded working capital makes it difficult for some to bid on new business. With its strong balance sheet and access to public capital markets, Stran looks more like an appealing ally than a threatening acquiror.

- Second, Stran has established a proven formula that can be applied to acquired operations to create value. Knowledge that a suitor has a ‘secret sauce’ helps attract sellers who are understandably focused on their own reputations. The Company has got it right in its first two deals, winning praise from sellers for fair treatment. Stran negotiators can parlay such accolades into references for future deals.

- Third, a consolidator needs a deal track record to demonstrate its ability to identify good acquisition targets and then successfully integrate them into the parent. Willingness to adopt best practices from acquired operations speaks loudly to Stran’s thoroughness in understanding its targets and capacity to recognize opportunity.

Deals Add Value

So far, Stran has done well by shareholders with its early acquisitions. In September 2020, the Company acquired the promotional products customer accounts from Wildman Business Group, a uniform supplier located in Indiana. In January 2022, Stran acquired G.A.P. Promotions, a full-service promotions agency specializing in the beverage industry.

With the Wildman deal, Stran gained over 1,400 new customer relationships, of which as many as 120 are strong candidates for upselling to program contracts. Certain account managers were also tatted over to Stran’s employee base, helping to ensure customer retention and bringing new talent to Stran’s sales and customer relationship teams.

Wildman made a material addition to Stran’s business at a time a significant project for the U.S. Census Bureau was winding down. Nonetheless, it appears Wildman’s pace of business may have slipped a bit since the deal closed in late September 2020. Wildman accounts contributed $2.2 million to the top line in the final quarter of 2020, and then generated $8.3 million in total sales in the full-year 2021. This compares to $10.0 million in total sales Wildman recorded in 2019.

G.A.P. Promotions gives Stran a significant presence in the beverage industry. Stran management found GAP was experiencing significant demand from its beverage brand owners but could not pursue it for the lack of adequate working capital. The Company will invest in GAP and make available Stran’s well-established supply chain connections with factories, decorators, printers, and warehouses. GAP reported $7.2 million in total sales in 2020. Stran management maintains it will be accretive to earnings in the first year in Stran’s fold. At least one of the GAP sellers has come along with the operation and is well-incentivized to make good since parts of the deal consideration are contingent on future performance.

Stretching Capital Resources

The Company’s most recent acquisition of G.A.P. Promotions in February 2022 may be exemplary of Stran’s strategy to conserve its cash resources and avoid equity dilution. Stran paid $500,000 in cash and $100,000 in restricted stock at the time of closing, with two additional cash installments totaling $480,000 promised in the next two years. Stran will also make two ‘earnout’ payments contingent upon subsequent operating performance. The structure helps ensure that Stran is not overpaying for acquired operations.

Nonetheless, acquisitions require capital for deal consideration as well as subsequent investment. At the end of December 2021, the Company reported $32.2 million in cash resources, fortified by $37.7 million in new capital raised through the sale of common stock in an initial public offering in November 2021, and a private round in December 2021. In total, the Company issued 9.4 shares of common stock at an average $4.56 per share and 9.4 million warrants with exercise price of $4.81 per share.

The Company also has access to a revolving line of credit up to $7.0 million. At the end of December 2021, the line had not been used, leaving Stran with only $1.6 million in payment commitments for acquisitions as long-term obligations.

Sum Up: Stock Price Discount for Uneven ‘Growth Stage’ Results

Stran addresses a large and growing market for promotional products and incentive marketing. It is distinguished in its competitive position with a sophisticated, technology-backed offering of quality services that keep clients in long-term contracts.

The Company also wins good marks for its strategy to grow through acquisition, both in terms of timing and tactics. It is well capitalized with ample cash resources and low debt to make good on deals.

Rather than a struggling operation, recent financial reports tell the story of growing pains in rapidly building company. Investors need to know what to pay for a stock supported by plenty of promises….and red numbers at its bottom line.

Unfortunately, valuing STRN shares is a challenge. The Company does not fit neatly into an established sector with numerous public companies, frustrating an effort to peg STRN against comparable stocks. Instead of looking at a specific sector, it is possible to compare STRN to a broader group of business services companies. Even with a comparable group at hand, Stran’s trailing earnings are negative and there are no published estimates of forward earnings. Thus, a multiple of sales or assets will have to stand in for an earnings comparison.

A group of 160 companies in the business and consumer service sector currently trade at a multiple of 2.28 times sales. Given trailing 12-month sales of $39.7 million and 21.0 million in fully diluted shares outstanding, this implies that STRN’s intrinsic value is near $4.31 per share.

Using a multiple of enterprise value times sales takes capitalization differences into account. Notably, this approach suggests an even higher intrinsic market value of $6.46 per share for STRN (based on $1.6 million in debt and $32.2 million in cash).

With the shares trading for less than a branded promo mug, STRN looks deeply undervalued. Uncertainty over uneven financial results may have turned some investors away, especially since the stock is not yet well seasoned only six months after its debut. Indeed, Stran’s leadership thinks the stock is so cheap, they have authorized a share repurchase program up to $10 million. If executed, the Company can use these cheap shares as currency in future acquisitions.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

Underwriters of the Prime series may have a beneficial interest in, serve as agents of, or act as advisors to the companies mentioned herein.

Be the first to comment