Tunatura/iStock via Getty Images

Investment Summary

Here at HBI, we’ve been actively uncovering selective opportunities within the broad healthcare biosphere. There are now numerous growth companies offering potential remedial breakthroughs in an otherwise complex disease segment. Within the domain, we’ve also positioned along the value chain for eye conditions and diseases, all the way from the medical route to surgical intervention. For instance, we recently reviewed The Cooper Companies (NYSE:COO) and reaffirmed our hold thesis on the stock.

In that vein, we’re here today to discuss our findings on IVERIC bio, Inc (NASDAQ:ISEE), a company with expertise in the retinal dystrophy and degeneration market. We’ve been constructive on ISEE for some time, but its most recent developments surrounding its Zimura label are what are most appealing in the investment debate.

With the company continuing to build momentum around Zimura, along with improving market data, we rate ISEE a buy at a price objective of $36.5.

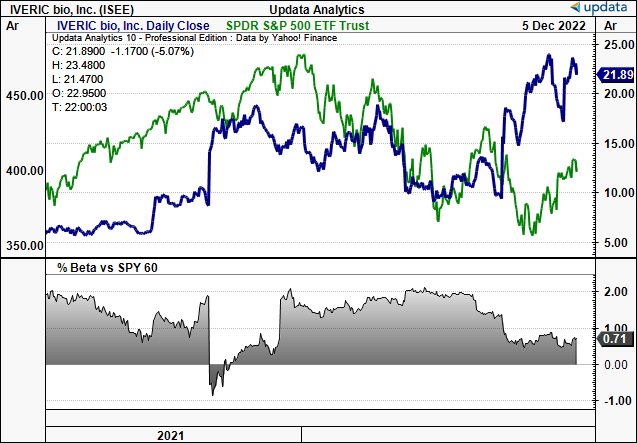

ISEE 2-year price evolution vs. S&P 500

Data: Updata

Key catalyst to move the needle: Zimura

We’d note that our investment thesis is predicated on the recent developments of ISEE’s Zimura. Here, we’ll do a deep dive into what the compound is, the various treatments it is indicated for, and link this back to the broad market opportunity, to help investors make the most informed appraisal possible.

Zimura is a monoclonal antibody injection developed by ISEE for the treatment of geographic atrophy (“GA”), a degenerative condition of the retina associated with advanced age-related macular degeneration (“AMD”). These are two key terms that we’ll go into greater detail on here today. Zimura works by blocking the formation of new blood vessels in the retina, reducing the photoreceptor cell damage caused by AMD, and helping to stabilise vision in patients with this condition.

The medication is administered as an intravitreal injection directly into the eye, typically on a monthly basis. Improvements in vision typically occur within 4-8 weeks of the first injection, with the full effects of the treatment apparent after three to six months. Furthermore, studies have shown that patients are able to maintain or even improve their vision for longer periods of time with the use of Zimura.

Turning first to GA, it is a form of age-related macular degeneration that results in the loss of photoreceptors and retinal pigment epithelium in the macula. It is characterized by progressive and irreversible vision loss, making it a significant ocular pathology in the geriatric population. The primary etiology of GA is uncertain; however, theories suggest that it is linked to the accumulation of lipofuscin and other toxic metabolites within the retinal pigment epithelium. As such, metabolic dysfunction and oxidative stress are thought to play an important role in the pathogenesis of GA.

Over the years, a multitude of studies have been conducted to identify potential treatments for GA with the aim of inhibiting the progression of the debilitating condition. A plethora of pharmacological agents have been tested, including anti-vascular endothelial growth factor (“VEGF”) drugs, statins, and nonsteroidal anti-inflammatory drugs (“NSAIDs”). However, the most promising avenue of exploration has been the application of anti-angiogenic and neuroprotective agents.

These agents have been shown to reduce the progression of GA by targeting the metabolic and oxidative stress pathways that contribute to its development. In recent times, photodynamic therapy (“PDT”) has emerged as another promising potential treatment for GA.

AMD on the other hand is a prevalent age-related condition affecting the macula – the central part of the retina responsible for the detailed and central vision in humans. It is the leading cause of severe vision loss in individuals aged 60 and above, with an estimated 11mm Americans currently affected. The pathogenesis of AMD is complex and involves a convergence of genetic and environmental risk factors.

Age is the most notable contributor, with AMD prevalence rising with advancing years. Genetic susceptibility has been linked to specific alleles of the CFH, ARMS2, and HTRA1 genes, while lifestyle factors such as smoking and obesity have been associated with a higher risk of AMD. Both smoking and obesity are associated with a 1.5–2.5x greater risk of contracting the condition.

The presence of comorbidities, such as hypertension and diabetes, has also been implicated in the prevalence of AMD. The treatments for AMD mainly involve medical and surgical interventions. The current standard of care involves a combination of medical and surgical interventions. Medical management includes the use of vitamins, antioxidants, and other drugs, while surgical treatments include interventions such as laser therapy and photodynamic therapy. In some cases, a combination of treatments may be employed. Therefore, there exists a need for a medical and remedial breakthrough in the segment, which forms the bedrock of our thesis on ISEE.

ISEE Market opportunity

The AMD market is a burgeoning sector of the pharmaceutical industry that offers a range of medications and therapies for the condition. While the market is still in its infancy, it is predicted to experience an impressive CAGR of 8.2% from 2018–2024, driven by the rising prevalence of AMD, favorable demographic trends, and increasing demand for more effective treatments. Meanwhile, more recent analysis corroborated these geometric growth estimates into 2030. According to the National Eye Institute, the prevalence of AMD is projected to double by 2050, making it a critical concern for public health officials and medical professionals around the globe.

The advent of novel treatments for AMD, the rise in the prevalence of the condition, a robust product pipeline, and the growing consumer base [due to an aging population] have been the primary catalysts for the expansion of the market. In addition, the expiration of patents on several well-known medications has allowed competition to spur innovations in current formulations from a diverse array of companies, fuelling the rapid growth of the market for AMD treatments. Zimura is case in point here.

However, the market may be constrained by stringent FDA regulations and a lack of insurance or Medicare coverage for the cost of these medications. This would in fact be a key risk to ISEE’s growth route in our opinion.

In addition to the growing prevalence of AMD, advancements in technology are also expected to drive growth in the GA market. New treatments for AMD are being developed at reasonable cadence, Zimura the most recent inclusion into the race. These treatments are anticipated to improve patient outcomes and increase the demand for treatments for geographic atrophy. Specifically, the global GA market was valued at $2.6Bn in 2019 and is forecasted to reach $4.8 billion by 2027, experiencing a CAGR of 7.5%. Growth is set to be underscored by similar drivers to the AMD market.

ISEE: The technical picture

Given the lack of earnings, we decided to investigate ISEE’s technicals to gauge how the market is positioning in the stock.

You can see below that ISEE has rallied throughout the course of the entire past 2 year period form the March 2020 selloff.

To our knowledge, there aren’t too many other names that have presented with this kind of sustained chart upside throughout the 2022 bear market.

ISEE now tests the 250DMA after riding its 50DMA as support from the October bounce.

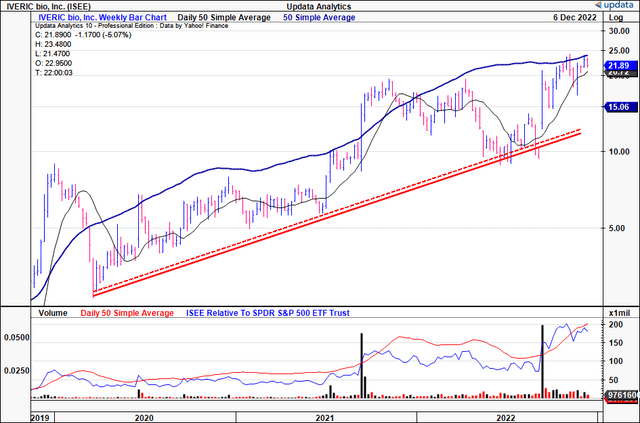

Exhibit 2. ISEE 3-year price evolution [weekly bars, log scale]

Data: Updata

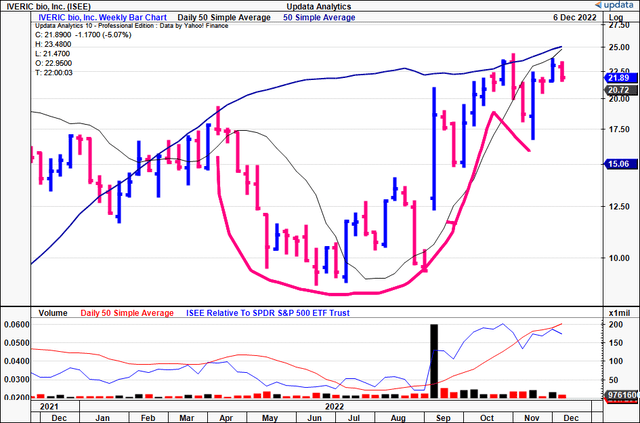

Looking at more recent price action, the stock has just moved off a 33-week cup and handle, with the stock now bouncing off the handle for the last 4 weeks as seen below.

At the same time, weekly volume has been supportive, along with convergence of the 2 moving averages as listed above. We believe the stock has legs to extend this current uptrend.

Exhibit 3. 33-week cup and handle with moving averages converging to the upside

Data: Updata

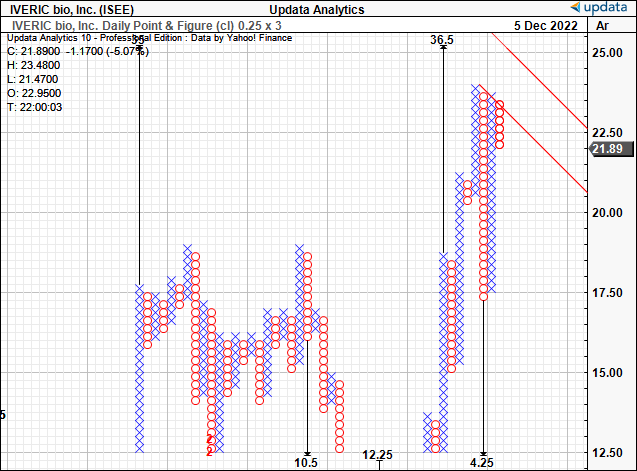

It’s not surprising to see upside targets to $36.5, which we base as our first price objective in the name.

This would fetch 66.7% upside potential, and therefore confirms our bullish thesis.

Exhibit 4. Upside targets to $36.5

Data: Updata

In Short

We rate ISEE a buy on the company’s recent developments and the momentum it is building around its Zimura segment. We are seeking an initial price objective of $36.5 or 66.7% return potential.

Be the first to comment