FactoryTh

Lower Copper Prices Create Interesting Opportunities In The Mining Industry

Copper futures, which expire in December 2022 (HGZ2), are not expected to rise in the coming months as factors such as recession risk and China’s zero tolerance for the new outbreaks of COVID-19 will weigh on demand for the red metal. China is the largest consumer of copper in the world, while in a recession the supply of copper tends to exceed what is needed to meet industry orders around the world.

The price of $3.45 per pound at the time of writing will come under downward pressure due to the above factors. Furthermore, an increasingly strong US dollar due to the US Federal Reserve’s aggressive interest rate policy will not help reverse the ongoing trend.

Falling copper is depressing the share price of many US and Canada-listed copper producers, with those most exposed to commodity price changes paying the highest price.

While this won’t please shareholders in these copper mining stocks, it will create opportunities to add to positions in anticipation of the commodity’s next favorable cycle by taking advantage of attractive market valuations. This implies the potential to realize amazing capital gains. If increased volatility could cause stock prices to plummet when copper prices trade lower, it should also do the opposite once copper prices recover.

Ivanhoe Mines Ltd. Draws Investors’ Attention

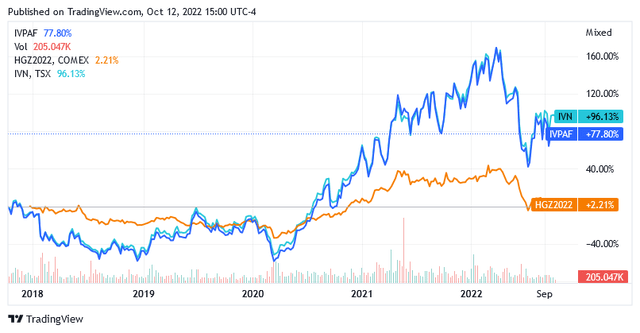

Ivanhoe Mines (OTCQX:IVPAF) (TSX:IVN:CA) shares are attracting investors’ attention due to their high volatility relative to copper, as illustrated in the chart below. But that’s not all.

Shares have strong upside potential that is expected to unfold between 2023 and 2024. During this period, some projects will start producing copper, while another project should contribute significantly to the current production level.

And what about the price of copper?

This should come back strongly due to the following scenario. By that time [between the end of 2023 and 2024], the COVID-19 virus that started the 2020 pandemic should be fully under control and written off to seasonal flu levels, while economic growth should begin to recover amid lower inflation, assuming the global economy will have a recession.

Ivanhoe Mines’ Mineral Activities in the Democratic Republic of the Congo

Based in Vancouver, Canada, Ivanhoe Mines is principally engaged in mineral activities on three projects in southern Africa.

The first of these metallic projects is the development of copper deposits called Kamoa-Kakula, located underground in the Democratic Republic of Congo.

Kamoa-Kakula achieved a record volume of copper sold in the second quarter of 2022, approximately 85,794 tons of payable copper, resulting in revenue of $494.1 million at market prices.

Net income for the second quarter of 2022 was a record $351.5 million, according to the company, while earnings before interest, taxes, depreciation and amortization of $286.3 million represented a margin of 58% of total revenue.

Payable copper production increased a whopping 65.2% sequentially, implying for the miner the sustainment of $1.15 per pound in the total cost of sales [up 6.5% sequentially] and $1.42 per pound in total cash costs [up 17.54% sequentially].

Kamoa-Kakula produced 142,916 tons of copper over an extended six-month operating period in 2022, more than doubling the production of 94,655 tons of red metal in the previous six months.

In the Democratic Republic of the Congo, Ivanhoe Mines also wants to significantly upgrade a mine to produce the metals. The project is called Kipushi, and Ivanhoe Mines is conducting construction works together with a Congolese state-owned mining company called Gécamines, aimed at realizing underground mining activities to produce zinc and copper.

The two parties have established the Kipushi Corporation joint venture, which believes it can bring the site into production in 2024, with costs expected to remain low as almost all the infrastructure needed to conduct the mining activities is already in place.

The Kipushi Zinc Project, located on one of the world’s highest-grade zinc ore deposits, is expected to produce 240,000 tons per year of the base metal using underground mining techniques and a concentrator, according to a feasibility study completed in recent months.

With a feasibility study zinc price of $1.40 per pound, which should be well above a historical average, the after-tax present value calculated using a discount rate of 8% was $1.4 billion, while the real after-tax return rate [IRR] stood at around 54%.

The IRR is very good considering that a project is usually profitable when the IRR is around 30-35%. But when the NPV is divided by the number of shares outstanding, which is 1.21 billion, the Kipushi Zinc project’s NPV is $1.2 per share or about 5.3 times below that current stock price of $6.38.

At current prices, the Kipushi Zinc Project would be overpaid relative to its estimated value. So it is worth waiting to see how far the continued downward trend in the stock price can narrow the gap between the stock price and the NPV of the Kipushi Zinc project.

Ivanhoe Mines’ Mineral Activities in South Africa

The company also intends to capitalize on the mineral discovery at a location called Platreef in South Africa. The Platreef project is located on the northern edge of South Africa’s bushveld complex. Here the company manages three of the platinum group metals [PGMs] discoveries, namely palladium, rhodium and platinum, in addition to nickel, copper and gold discoveries.

Development of the Platreef underground mine continues and, according to the company, more than 200 meters of lateral development of the property had been completed by the end of the second quarter of 2022. This figure should be welcomed as an indication that the activities leading to the construction of the metal production site are progressing rapidly.

Once construction of the mine is complete, production is expected to begin sometime in the third quarter of 2024, after which the mining operations can guarantee the production of the metals for approximately 20 years.

Copper concentrate output will be 191,000 tons per year over 5 years of production, while the group of precious metals, including palladium, rhodium, platinum and gold, should hover at 522,000 ounces per year over about 15 years of production.

In 2022, the company’s technicians prepared a feasibility study for Platreef characterized by the following parameters. The investment in this multi-metal mining project is expected to have an after-tax net present value [NPV] of $1.7 billion calculated using an 8% discount rate and long-term metal price estimates. While the internal rate of return [IRR] is expected to be 18.5%. When the estimates are revised in light of recent prices, which are significantly higher than long-term trends, the project’s NPV [8% discount rate] increases to $4.1 billion with an IRR of 29%.

At the time of writing, Ivanhoe Mines Ltd.’ shares traded at $6.38 per unit and the stock had 1.21 billion shares outstanding. This means that at best, the stock is currently nearly 2 times the NPV of the Platreef project, which is worth $3.4 per share.

The Platreef project can be used as a benchmark to determine if the market is asking a reasonable price for Ivanhoe Mines Ltd shares, as in the case of the Kipushi Zinc project.

However, in addition to being a developer of projects for future production, the company is also a current copper producer in Congo, depending on which the valuation of the share price must also be determined.

Near-Term Production Expectations

The company believes that Kamoa-Kakula can significantly increase its annual copper production if it can leverage the capacity of the concentrators to process larger volumes of mined material.

Over the coming months, a gradually increasing amount of material will be loaded into the plant’s facilities, exceeding the combined Phase 1 and Phase 2 processing capacity planning. This is because the process upgrade goes through subsequent stages. The company is currently in phase 3. The target is to process approximately 9.2 million tons of copper ore per year, of which 55% has been achieved by the end of Q2 2022.

Led by this project, Ivanhoe Mines is targeting twelve-month copper production of approximately 450,000 tons, which is 1.2 times [or more than 15%] the level that can be obtained by annualizing the record monthly production of 32,877 tons in July. The company thinks to accomplish the higher copper production target before the end of the second quarter of 2023.

For the full year 2022, copper concentrate production from Kamoa-Kakula should be in the range of 310,000 to 340,000 tons, which the company also estimates should result in a cash cost per pound in the range of $1.20 to $1.40. Therefore at lower costs than in the first half of 2022.

The Balance Sheet Vs. Capex

The company notes in its second quarter 2022 earnings report that its balance sheet is solid, meaning that with $507.2 million in cash on hand, it should be able to continue mining, development and exploration activities with ease.

Some of the mineral activities include drilling that Ivanhoe Mines performs on 2,407 square kilometers of West Foreland license claim adjacent to the Kamoa-Kakula asset.

The larger capital expenditure of approximately $740 million relates to the Kamoa-Kakula project, which is intended to be funded entirely from the resources that the same Congolese asset can generate during operations.

However, while the Platreef and Kipushi projects and other activities will require approximately $205 million – $210 million per year, most of these projects are on track to be operational in less than 2 years.

The balance sheet was burdened with total debt of $505 million, resulting in a 12-month interest expense of $38.4 million as of the second quarter of 2022, but was fully offset by proceeds from the profitable disinvestment of short-term assets.

The Stock Price Is Low but Not Cheap

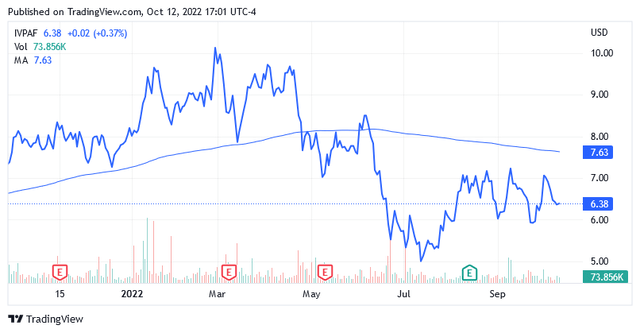

As of this writing, shares are trading at $6.38 for a market cap of $7.74 billion. Shares don’t look expensive as their levels are much further [60% away] from the higher limit of the 52-week $4.90-$10.32 range than the lower limit [30%].

Also, shares are trading about 20% below the long-term trend of the 200-day simple moving average of $7.63.

Ivanhoe Mines has a 14-day relative strength indicator of 46.22, which means the shares could still fall. The nearly 15% drop over the past year hasn’t taken the stock anywhere near oversold levels.

Due to the headwinds previously described, analysts said copper should hover around $3.12 per pound ahead of November 2023, a level already recorded in October 2020 when Ivanhoe Mines was valued at around $4 per share [1.6 times below the current level].

It’s possible that following the commodity, the stock will continue to trade lower over the coming weeks, becoming significantly cheaper in the process. If that happens, there’s an opportunity to maximize this copper miner’s amazing upside potential by buying shares.

On the Toronto Stock Exchange, shares traded at $8.95 with a market cap of $10.66 billion and a 52-week range of $6.41 to $13.15. Currently, the stock price is well below the long-term trend of the 200-day simple moving average of CAD$9.82.

Country Risk

The Democratic Republic of the Congo has natural resources like few countries in the world as there are deposits of valuable minerals and the country is home to the second rainforest in the world that provides valuable timber. The country is the fourth largest copper producer in the world with 1.8 million tons mined in 2021 after Chile, Peru and China. It also hosts the world’s first cobalt production at 120,000 tons mined last year. The country also produces diamonds, gold, coltan and oil.

However, Ivanhoe Mines’ assets are located south of the Democratic Republic of the Congo, in the most tranquil part of the Central African country and far from the most dangerous and unstable areas of the eastern provinces of Ituri and North Kivu.

Ivanhoe Mines’ assets are also far from the city of Goma, the capital of North Kivu province, where Nyiragongo – one of the world’s most dangerous volcanoes – woke up dangerously in May 2021 after years of inactivity. In 1977, Nyiragongo caused the deaths of 6,000 people.

Conclusion – Growth Potential in This Copper Miner

This Canadian miner has plenty of upside potential, but copper prices need to be favorable.

As copper makes its way to recovery, Ivanhoe Mines, which offers incredible upside potential, may become increasingly attractive.

Be the first to comment