Waldemarus/iStock via Getty Images

Ivanhoe Electric Inc. (NYSE:IE) is trying to make a profit out of the demand for metals necessary for the electrification of the United States. Using its own proprietary technology Typhoon, management made an assessment of resources in old mines, and found copper, gold, and zinc. IE has to work a lot to obtain more information about the mineral resources found. However, if the numbers delivered by the company are correct, we could be talking about a total valuation of more than $1 billion. Yes, the risks are not small, and we are talking about a speculative play, which may not be for conservative investors. With that, there seems to exist significant upside potential in the market.

Ivanhoe Electric

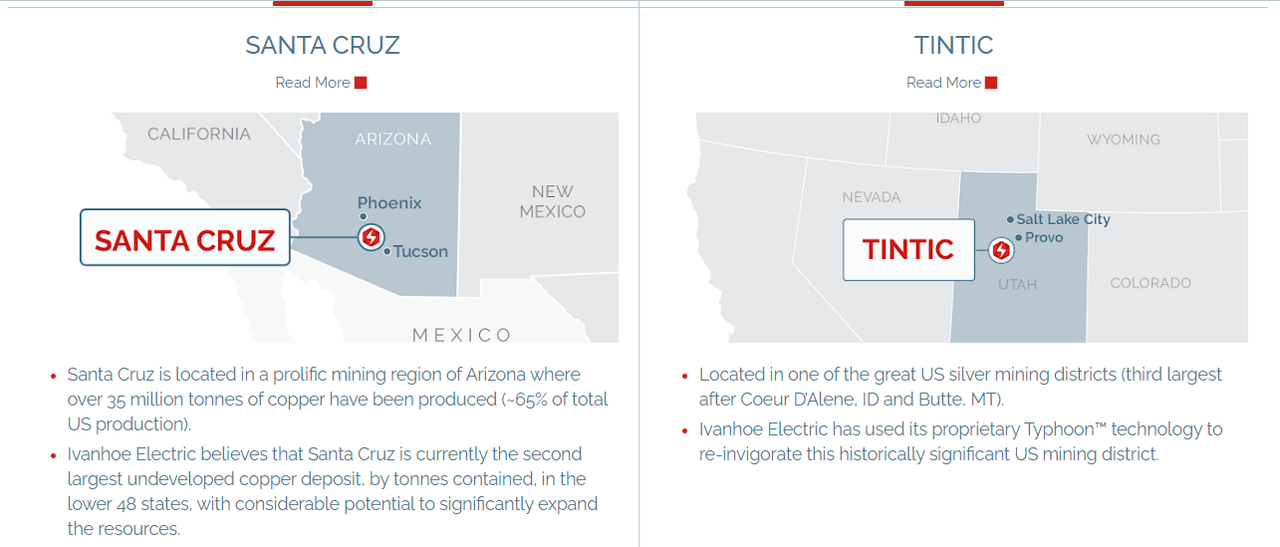

Ivanhoe Electric is a minerals exploration and development company targeting mineral deposits to produce metals necessary for electrification of the US economy.

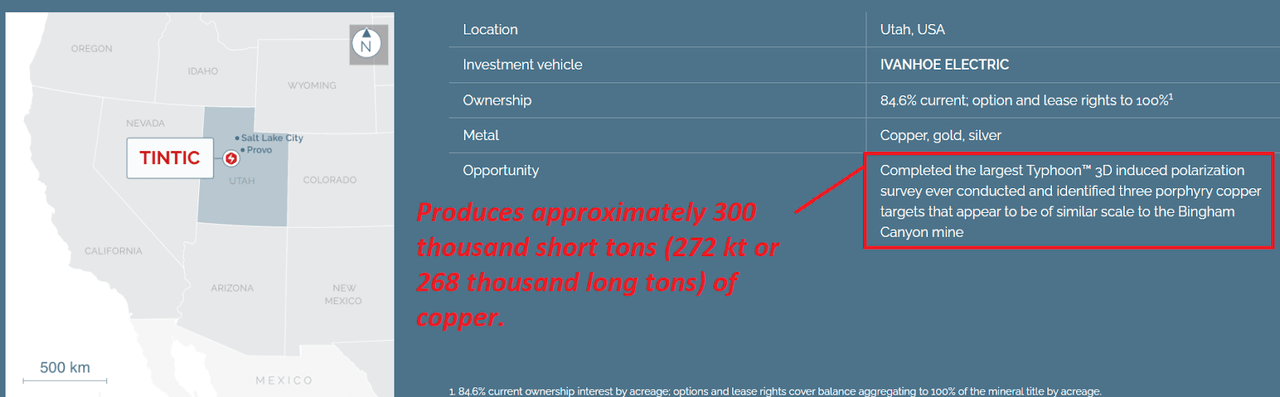

The company’s largest assets are in Arizona and Utah. Ivanhoe’s asset in Arizona is the Sacaton mile, which is said to be the second largest undeveloped copper deposit by tonnes contained. The asset in Utah, called Tintic, is a bit less developed, but Ivanhoe Electric is using its proprietary Typhoon technology for exploration purposes, and also received data from previous mines in the area.

Company’s Website

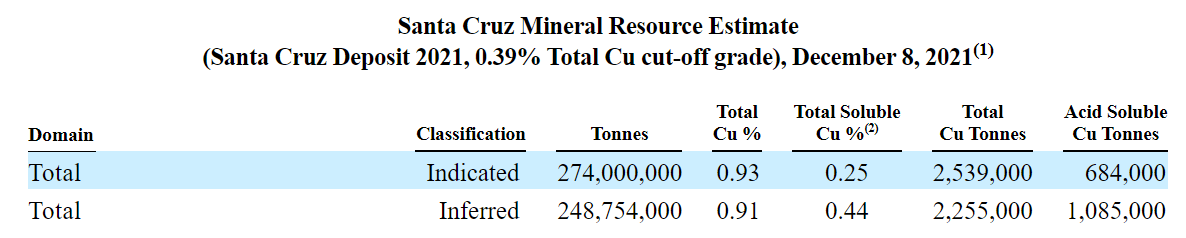

The Santa Cruz mineral deposit includes 2.539 million indicated copper tonnes and a concentration of 0.93% of copper. Let’s note that the company will have to make further economic assessments to report proven mineral deposits. Yes, there is a lot of potential, but a lot of work has to be done.

Prospectus

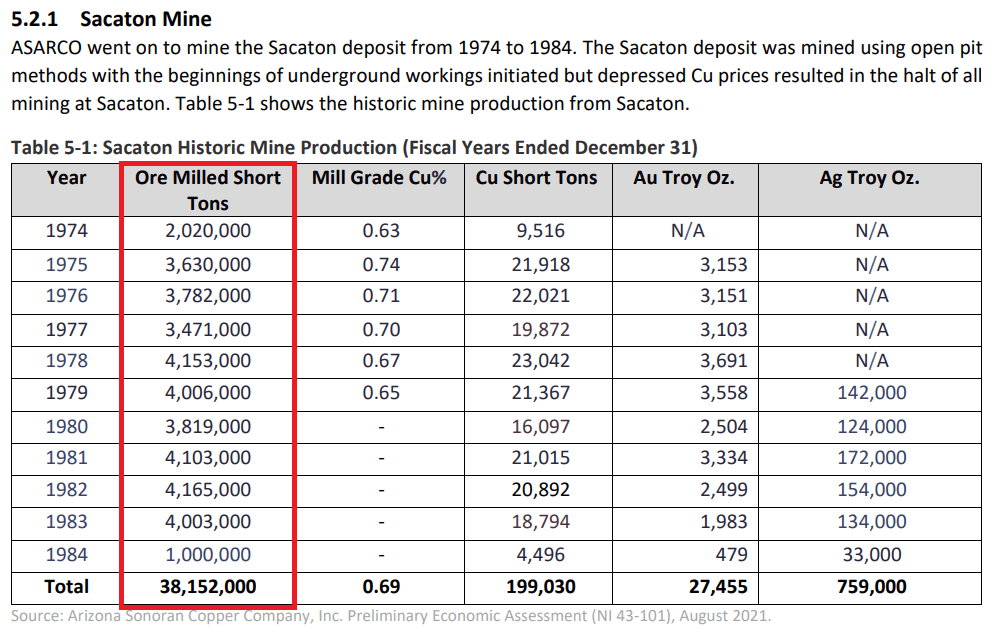

I found information about the amount of copper production from 1974 to 1984. In my view, we can run a valuation model using previous production figures. From 1972 to 1985, the mine reported around 21k-23k short tons of copper. I believe that future production will be larger than these figures because today we count with more technologies than in the 70s.

Technical Report

I believe that it is a great time to review Ivanhoe’s business plan because the company is about to drill in 2022. In my view, if drilling brings beneficial news about the mineral resources in Arizona, the stock price could trend higher.

Drilling is ongoing and will continue through 2022. Engineering studies are also underway, with the objective of releasing an updated resource statement in the second half of 2022. Source: Prospectus

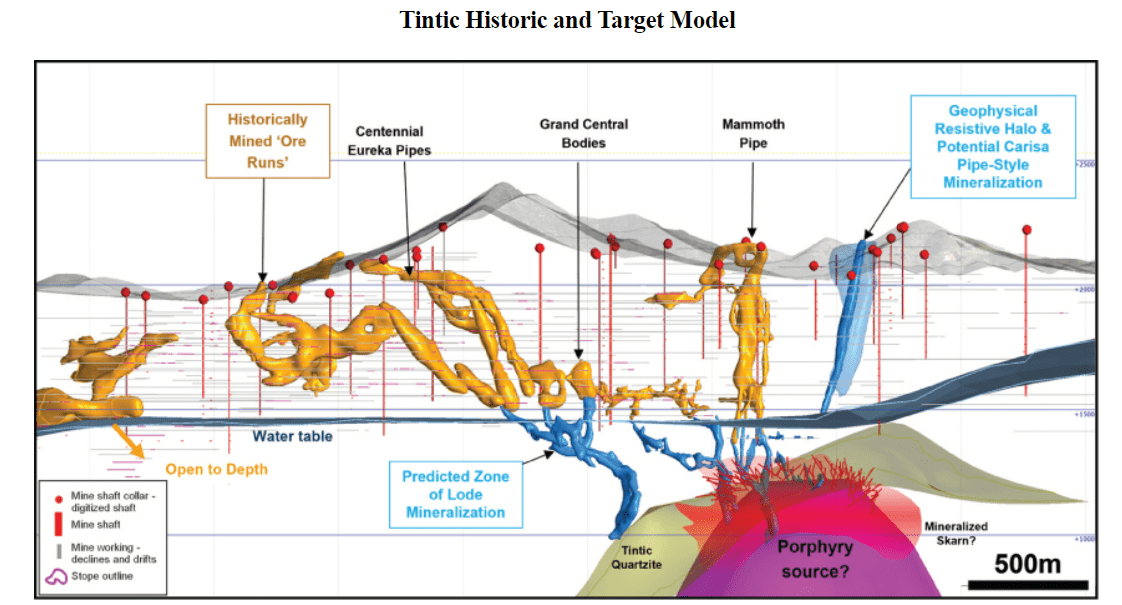

With regards to the asset in Utah, the company provided some estimates about the geological model and potential production. Management noted that miners were producing close to 116 kt of copper per year in the past. I believe that this figure could be used for assessing the net present value of the project.

Total historical production from the Main and Southwest Tintic District is estimated at 2.18 Moz gold, 209 Moz silver, 116 kt copper, 589 kt lead and 63 kt zinc, from both surface and underground sources. Source: Prospectus

Prospectus

The company also noted that the Tintic project appears similar to the Bingham Canyon mine, which produces an average of 272 kt of copper. In my view, if Ivanhoe discovers such a large amount of copper, the company’s valuation will likely be larger than the current market capitalization.

We believe the 72 km2 Typhoon™ survey that we conducted at Tintic in 2018 and 2019 is the largest 3D Induced Polarization (“IP”) survey ever completed. Three porphyry copper targets were identified by this survey (Rabbits’ Foot, Sunbeam and Deep Mammoth), which appear to us to have similar characteristics to the mineralized porphyry at the Bingham Canyon mine. These targets are fully permitted for drilling in 2022 through our subsidiary, TC&G which holds 100% of these permits. Source: Prospectus

Company’s Website

The Valuation Of The Mines Sums More Than One Billion Dollars Only Including The Production Of Copper

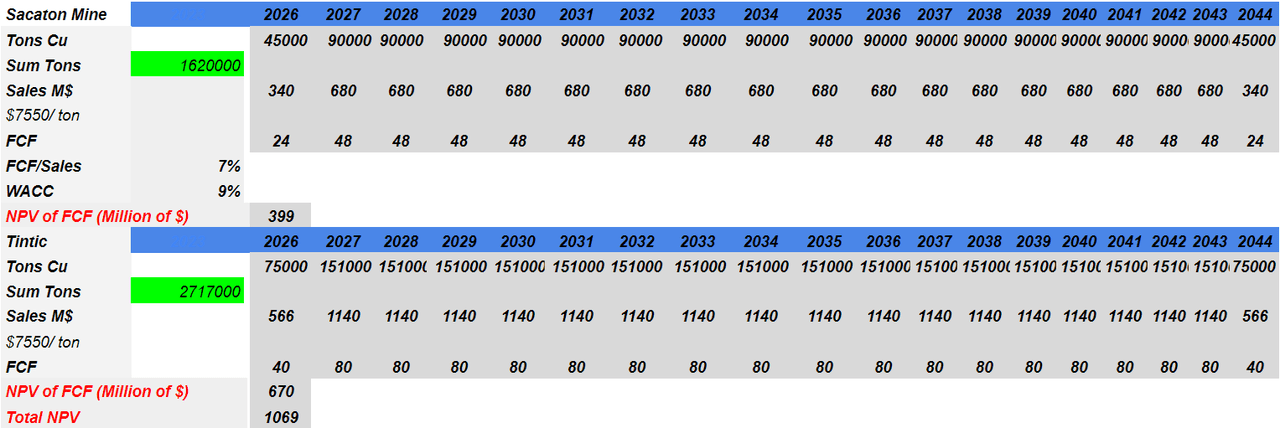

Taking into account previous production figures of copper, I assumed production of 90k tons of copper from Sacaton Mine and 151k from the Tintic project. I assumed that production would start from 2026, and would end in 2044. The sum of produced tons would equal 1.6 million in the Sacaton mine and 2.7 million in Tintic.

I also used FCF/Sales of 7%, which is a conservative figure for copper miners, and a discount of 9%, which was also used by management:

The weighted average discount rate used to determine the operating lease liabilities was approximately 9%. Source: Prospectus

As shown in the figures below, with an estimated price of $7.5k per ton, the Sacaton mine obtains a net present value of $399 million. The Tintic project would obtain a net present value of $670 million. In sum, I obtained a net present value of $1.06 billion for both projects.

Author’s Work

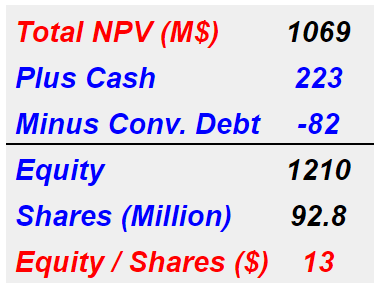

If we add the cash in hand, subtract the convertible debt, and divide by the current share count, the equity per share would be close to $12-$13. The company currently trades at less than $11, so I would say that it is undervalued.

Author’s Work

Let’s note that Ivanhoe will likely produce more than copper. The company indicated resources of gold, silver, lead, and zinc. In my view, if the company decides to extract all these minerals, the total valuation of both mines will likely go beyond $1 billion.

Ivanhoe Electric Needs More Money To Finance The Development Of The Mines

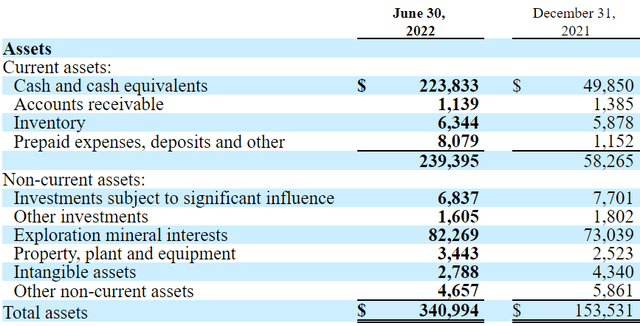

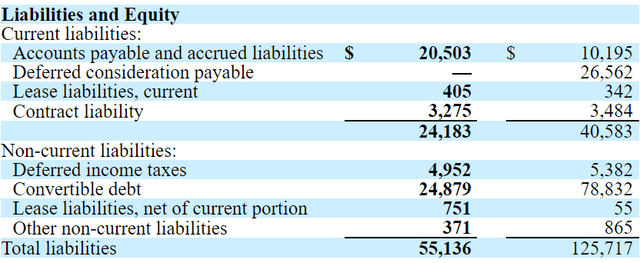

As of June 30, 2022, the company reported $223 million in cash, total assets worth $340 million, and total liabilities worth $55 million. The financial situation appears stable, but in my view, management will likely need much more cash to finance the development of the mines.

Ivanhoe reports convertible debt worth $82 million, which does not seem very significant. Considering that future cash flows are equal to $1.06 billion, the current amount of debt does not seem worrying.

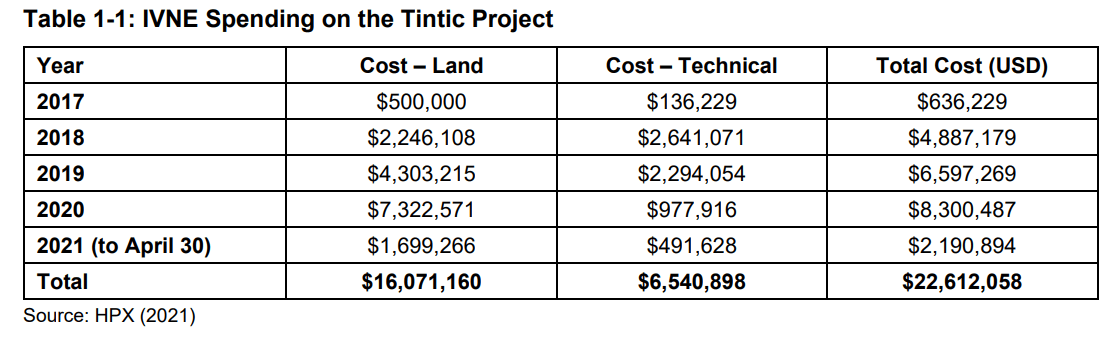

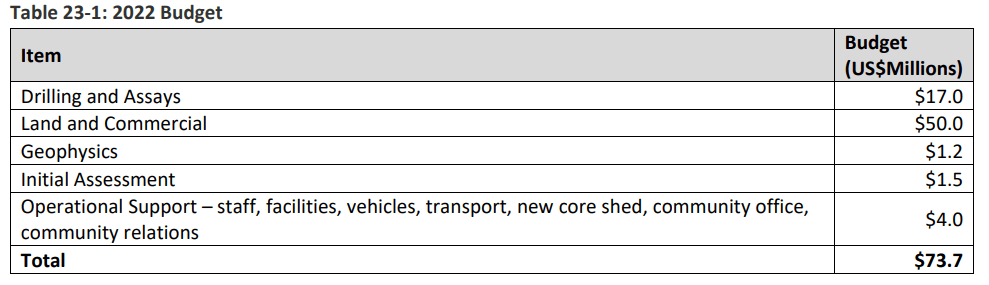

I reviewed the amount of money necessary. Considering recommendations from consultants, I believe that Ivanhoe needs close to $22 million per year for the Tintic Project and around $73 million per year for the Santa Cruz mine. With these figures in mind and the total amount of cash, I would expect management to sign more debt agreements. I also expect an increase in equity.

Report For Tintic

Report For Tintic

Risk: Mineral Projects Are At Exploration Stage

Ivanhoe Electric is still at an exploration stage. It means that management will need to conduct a lot more work before copper can be sold. First, the company will need to offer information about the amount of probable reserves, then report proven mineral reserves. Finally, management may have to finance the development of the mines. There is a lot of risk, but the reward will likely be large too. The company discussed these risks in the prospectus:

All of our mineral projects are at the exploration stage and are without identified mineral resources or reserves, except at the Santa Cruz Project, the Pinaya Project, the San Matias Project and the Ivory Coast Project, where we have an interest in declared mineral resources.

A significant number of years, several studies, and substantial expenditures are typically required to establish economic mineralization in the form of Proven Mineral Reserves and Probable Mineral Reserves, to determine processes to extract the metals and, if required, to construct mining, processing, and tailing facilities and obtain the rights to the land and the resources (including capital) required to develop the mining operation. Source: Prospectus

Risks From Inaccurate or Incomplete Data And Failed Forecasts

Ivanhoe and we obtained most data from existing information from previous mines as well as third parties. It is likely that the assessment of the mineral resources is different from what management expects. If the mineral resources are smaller than expected, the valuation of the company may be lower than what I calculated. Management may also require larger capital than expected, and the FCF/Sales may be lower than 7%. As a result, the equity per share would be smaller than what I obtained:

We have relied on, and the disclosure in the Santa Cruz and Tintic Technical Reports is based, in part, upon historical data compiled by previous parties involved with our mining projects. To the extent that any of such historical data is inaccurate or incomplete, our exploration plans may be adversely affected. Capital and operating cost estimates made in respect of our exploration and mining projects may not prove accurate. Capital and operating costs are estimated based on the interpretation of geological data, feasibility studies, anticipated climatic conditions and other factors. Source: Prospectus

Risks From Regulatory Issues

Ivanhoe will likely have to comply with regulatory laws and environmental laws, and may need the approval from the authorities. I wouldn’t expect much trouble because Ivanhoe is reopening old mines. With that, management provided certain information about these risks:

We are subject to environmental laws, regulations and permits in the various jurisdictions in which we operate, including those relating to, among other things, the removal and extraction of natural resources, the emission and discharge of materials into the environment, including plant and wildlife protection, remediation of soil and groundwater contamination, reclamation and closure of properties, including Tailings and waste storage facilities, groundwater quality and availability, and the handling, storage, transport and disposal of wastes and hazardous materials. Source: Prospectus

My Takeaway

With the recent increase in the price of copper and other metals necessary for electrification of the US economy, Ivanhoe is reopening old mines of copper, gold, and zinc. While the mines are still at an exploratory stage, I believe that future free cash flow could justify a valuation of much more than $1 billion. Keep in mind that only considering the net present value coming from the production of copper, the total valuation stands at $1.06 billion. I obviously see risks from regulatory laws, incomplete data, and failed forecasts. However, the upside potential appears significant.

Be the first to comment