andresr/E+ via Getty Images

Global X MSCI Colombia ETF (NYSEARCA:GXG) offers exposure to a comparatively top-heavy basket of Colombian equities, with a remarkable tilt towards financials and energy. Incepted in February 2009, the fund oversees an around $25 million portfolio comprising just 23 holdings. The cornerstone of its investment strategy is the MSCI All Colombia Select 25/50 Index. Its closest peer at the moment is the iShares MSCI Colombia ETF (ICOL), with a similar AUM, though it is due to be liquidated in August, which would be discussed in greater depth below.

Today, I would like to share a bit of criticism about this EM investment vehicle. It does not mean the fund lacks advantages completely. Contrarily, they are aplenty. Yet they are not enough to justify a bullish rating this time.

GXG might seem alluring for the inflationary environment

What is specific about GXG? In my view, GXG may look like an all-in bet on inflation. What is driving this daring conclusion?

First, the Banco de la República, the central bank of this Latin American nation, is decidedly hawkish amid surging prices across different categories, including energy and food. It has never been that aggressive since 2009, with the recent 150 bps hike announced on July 29 sending the benchmark interest rate to 9%. The central bank is aiming at 3% inflation, yet the figure including energy and regulated items increased from 9.1% in May to 9.7% in June, spurring quick and decisive action from the regulator.

In this regard, I believe that in case price growth defies monetary counter-measures, the regulator would act accordingly, but more likely the interest rate increases would be much lower.

It goes without saying that hefty rates are a boon for banks, as their net interest income edges higher, thus allowing them to deliver higher profits overall, bolster the balance sheet, etc. And GXG is markedly overweight in financials that account for more than 41%, with common and preferred shares in Bancolombia S.A. (CIB), representing around 23.6% of the net assets as of writing this article. For better context, in the 1Q22, the bank reported a 15.4% increase in the net interest income before provisions to COP 3,700 billion, explaining that the monetary policy was the key contributor.

It would be pertinent to remark that GXG’s exposure to financials is materially larger compared to peers. Specifically, the iShares Latin America 40 ETF (ILF) has just 27% of the net assets allocated to the sector. The Mexico ETF (EWW) is also much lighter in financials (16%), precisely like the Brazil fund (EWZ) with 22% deployed to the banks and the like.

That is to say, as inflation persists, the Colombian banks enjoy higher profits backed by higher interest rates. Moreover, although the cost of capital is going up, there is little to worry about Colombia’s economic trajectory as, even despite surging inflation, in July, the central bank revised the 2022 GDP forecast to 6.9%, an upgrade from the 6.3% rate anticipated previously. It chimes well with the IMF’s most recent estimate for the Latin America and the Caribbean region which specified a 3% real GDP growth this year followed by 2% in 2023.

Next, the great oil price question.

Investors are nothing short of arguments to consider crude oil the main beneficiary of spiraling inflation. The benchmarks have been on a tear this year amid geopolitics and the energy crisis (and the petroleum market remains tight), engendering the meteoric rise in petroleum players’ profits, cash flows, and valuations. And GXG is overweight in the energy sector stocks too. Ecopetrol S.A. (EC), an integrated company generating most of its EBITDA from upstream, is its major holding sporting a 12.9% weight. EC exports most of its crudes to Asia (~54% in Q1 2022) and the U.S. Gulf Coast (marginally above 40%). On the back of the oil price rally, EC reported an over 79% increase in 1Q22 total revenues, while the consolidated EBITDA rose almost 2x.

There are other petroleum companies in the portfolio, including Canacol Energy (OTCQX:CNNEF) and Parex Resources (OTCPK:PARXF); overall, the energy sector accounts for almost 20% of the net assets.

Why the inflation thesis is wrong

But what is wrong with this way of reasoning?

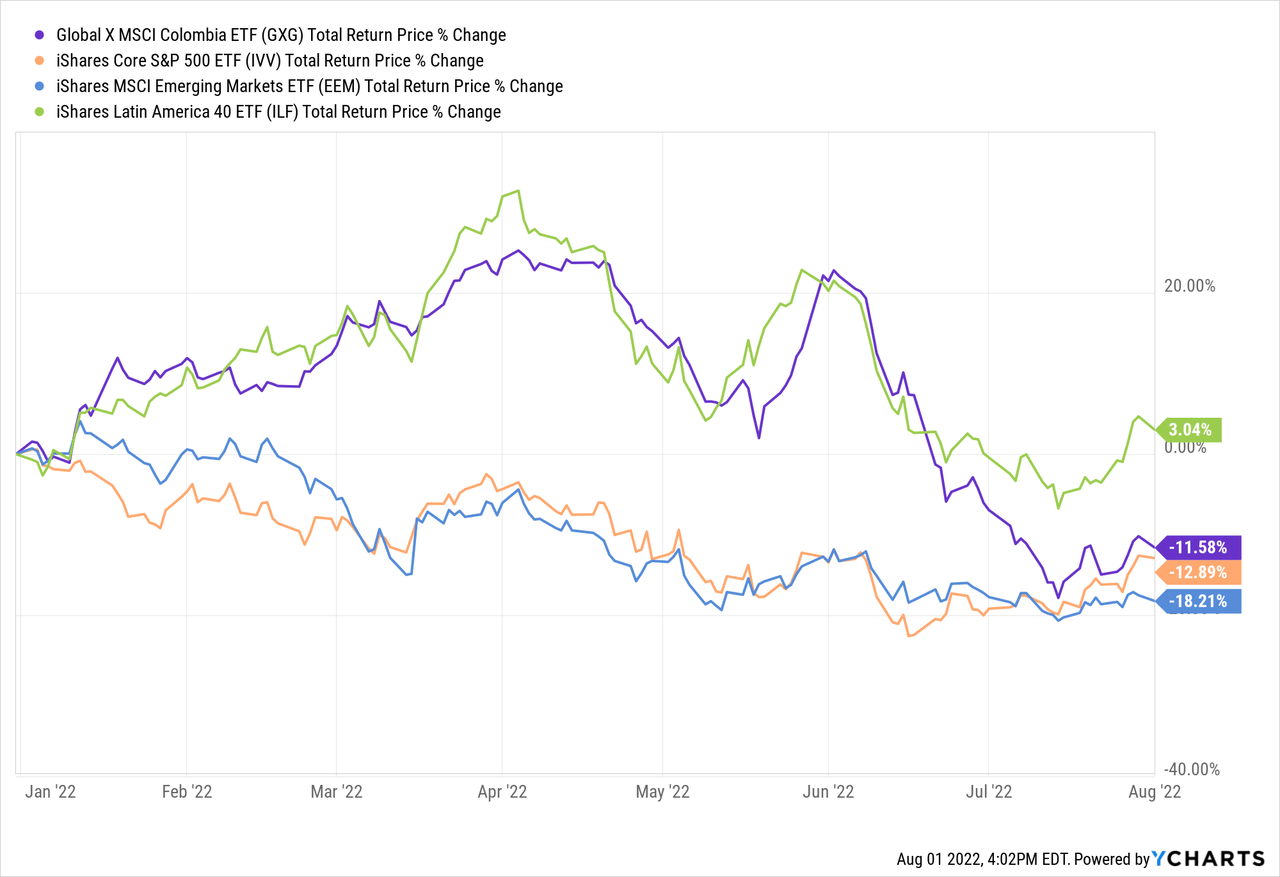

I would love to conclude this creates a perfect backdrop for a bullish thesis. The downside of this premise is the meaningfully weaker peso that steeply declined especially in recent weeks, putting it on the list of the worst-performing EM currencies. The dismal COP’s performance is the top reason why GXG has underperformed the iShares Core S&P 500 ETF (IVV) YTD despite leading during the first months of the year.

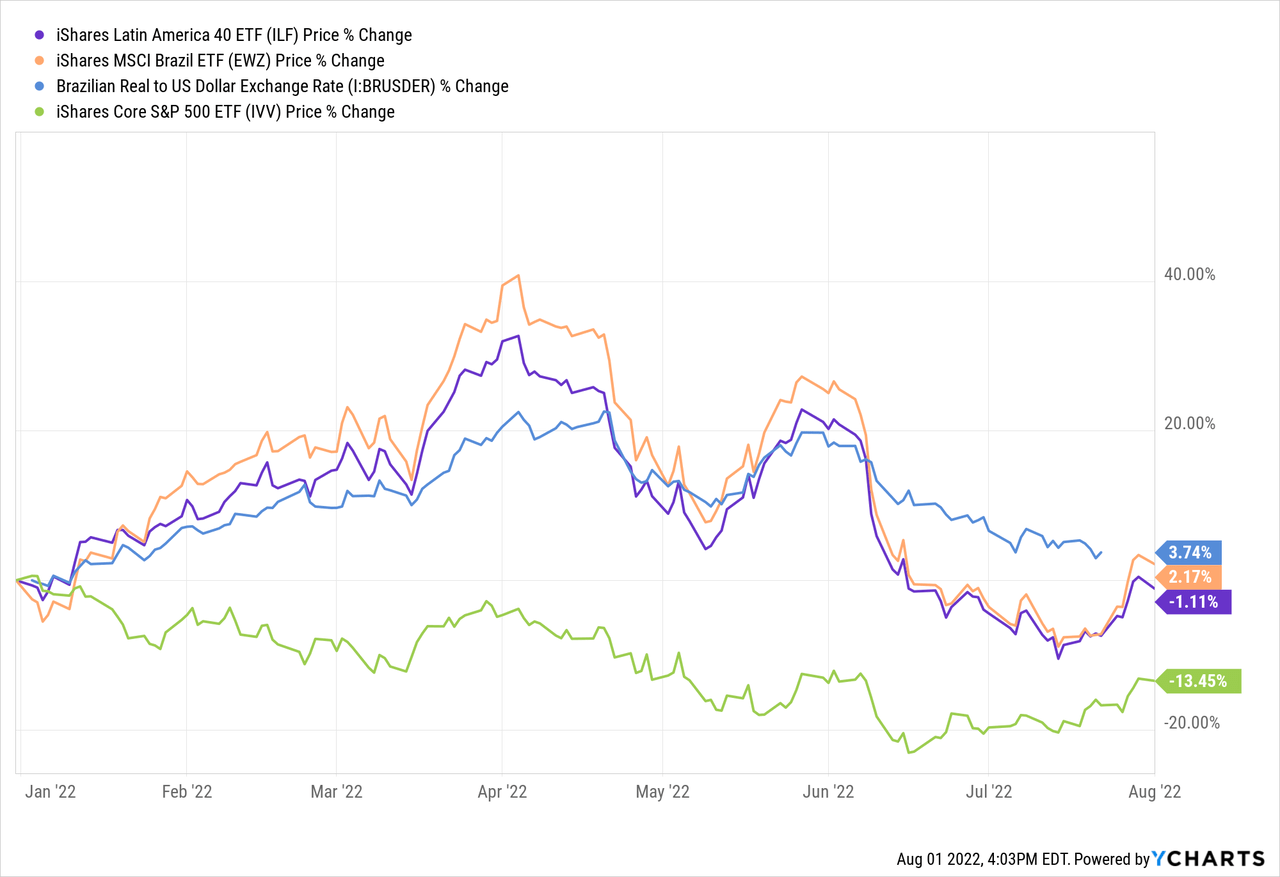

At the same time, Brazil-heavy ILF remains well ahead of IVV thanks to the robust real.

Additionally, this hypothesis fails to observe other risk factors that sent the peso plunging, also impacting equity valuations, namely the result of the presidential election won by Gustavo Petro. Petro’s economic plans might be amongst the bearish factors, principally those including the phase-out of oil and coal.

Final thoughts

GXG is an interesting option to benefit from the recovery in the Colombian peso should the interest rate increases reinvigorate bullish sentiment and the market shrugs off the political uncertainty.

As I laid out above, it looks like a solid bet on global inflation to continue, but with one downside that essentially nullifies its ability to deliver gains amid the surging CPIs – the factor of the U.S. dollar appreciation backed by the hawkish Fed. At least for now, I do not anticipate a 150 bps move from the Banco de la República.

It is also tough to say whether the political risk priced in the peso will be shrugged off soon.

It is worth noting that GXG is comparatively cheap, with a phenomenal P/E of slightly below 6x according to the fund. Just to bring a bit more color, CIB has forward Price/Earnings of 4.77x, combined with a forward Price/Book ratio of 0.83x. This is a tremendously low level, even by the financial sector standards, so CIB justifiably bears an A Valuation rating at the moment. Besides, Ecopetrol is trading at a massive discount to Exxon Mobil (XOM), with an EV/Production ratio of 65x vs. 118x. ConocoPhillips (COP) has an ~77.4x multiple, though Equinor (EQNR) is trading with just ~55.2x EV/Production.

Anyway, GXG’s historical risk-adjusted returns do not speak in favor. Both 5-year Sortino and Sharpe ratios are negative, precisely, like IVV’s, as the CAGR is (6.2)%. IVV managed to deliver a 12.8% gain.

Also, GXG and ILF both demonstrated volatility almost double IVV’s level, with standard deviations of ~31.5% and ~31.7% vs. 17.3%. GXG’s D- Risk grade is barely a coincidence.

Additionally, there is another issue worth paying closer attention to. As ICOL is due to be liquidated in August, this is a dire warning to all the small-AUM ETFs investors hanging over their holdings. When net assets are too small, it makes no sense for a fund to continue operating with losses mounting as fees do not cover its expenses. GXG oversees a portfolio of a size similar to IVOL, ~$25.3 million vs. $20.5 million.

I should acknowledge that the allure of the GXG ETF at this point is its dismal performance in the recent months that essentially erased its earlier 2022 gains. However, the EM-specific risks are what makes me skeptical.

So even though Colombian equities start looking oversold while the macro backdrop remains more or less favorable, I would not assign it a Buy rating. GXG is a Hold.

Be the first to comment