tobiasjo/iStock via Getty Images

As mentioned in the bullets, the world has become a more dangerous place with autocrats Putin in Russia and Xi in China flexing their muscles in very disturbing ways. As a result, investors should consider making a sector bet: the iShares U.S. Aerospace & Defense ETF (BATS:ITA). This fund has an admirable track record and holds the highest quality U.S. defense contractors in a relatively concentrated portfolio.

Investment Thesis

The investment thesis supporting the defense & aerospace sector are relatively obvious, straight-forward, and powerful. As you no doubt know, Putin invaded Ukraine back in February. The war has turned into a proxy war with (Russia+Iran) pitted against (NATO+global Democracies) and has resulted in two new NATO members (Sweden & Finland).

As of December 7th the United States has appropriated $21.8 billion in weaponry, communications, and other military assistance (drones, anti-aircraft missiles, etc.) for Ukraine. FY22 & FY23 appropriations include $14.05 billion to replenish Department of Defense (“DoD”) equipment stocks that have been drawn down to supply Ukraine.

Meantime, China has become more belligerent with respect to Taiwan. In July, China surrounded the island and held live-fire military maneuvers. The threat was obvious: a complete blockade.

Clearly the defense contractors in the ITA ETF are going to benefit from increased military defense spending to adequately deal with the provocations from President’s Putin and Xi.

Meantime, the commercial aviation sector is recovering from the drastic demand destruction it suffered during covid-19. This week, Boeing (BA) landed a contract from United Airlines (UAL) to supply up to 200 aircraft. Meantime, space exploration has also been ramping up. These are strong tailwinds for the aerospace sector. Also, Delta Air Lines (DAL) said yesterday that it expects $5-$6 in EPS in 2023 and “over $7 per share” for 2024. Both figures were significantly above consensus estimates ($4.80 and $6.62, respectively). In 2023, revenue is anticipated to grow 15-20% yoy. Obviously the commercial industry is more healthy than it has been in years.

So, let’s take a closer look at the iShares U.S. Aerospace & Defense ETF to see how it has positioned investors for success going forward.

Top-10 Holdings

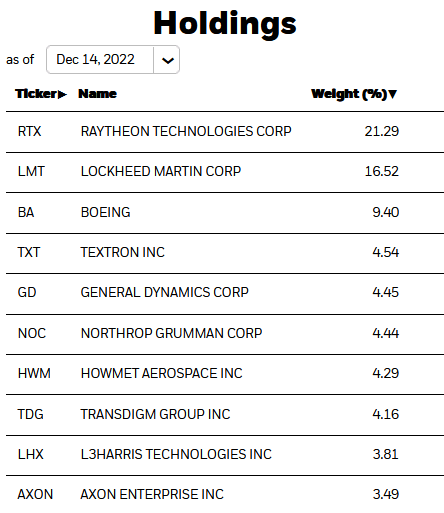

The top-10 holdings shown below were taken directly from the iShares ITA ETF webpage and equate to a concentrated 76.4% of the entire 36 company portfolio:

iShares

As mentioned in the bullets, the top-two holdings are Raytheon Technologies (RTX) and Lockheed Martin (LMT), which – in aggregate – equate to nearly 38% of the entire portfolio.

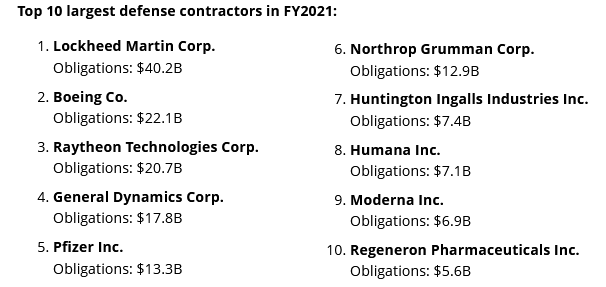

According to Bloomberg’s top-10 list of defense contractors based on FY21 revenue, Raytheon Tech was the 3rd U.S. largest with $20.7 billion in FY21 defense related revenue:

Bloomberg

Earlier this month, Raytheon won a $1.2 billion order for surface-to-air missiles for Ukraine. On a CNBC interview in October, CEO Greg Hayes described the National Advanced Surface To Air Missile System (“NASAMS”) system:

It is a short-range air defense system, and it can fire [an AIM-120 Advanced Medium-Range Air-to-Air Missile] and it could knock down everything in the sky from drones to ballistic missiles to fighter jets.

Today, Raytheon won a $619 million contract “to procure long-lead materials, parts and components for Lot 17 F135 propulsion systems in support of the F-35 Lighting II Joint Strike Fighter aircraft for the Air Force, Marine Corps, Navy, non-U.S. Department of Defense partners, and Foreign Military Sales customers.”

Earlier in the week, RTX announced a $6 billion share buyback plan. RTX stock is up 18% this year.

Lockheed Martin, the largest U.S. defense contractor (by far), is the #2 holding with a 16.5% weight. Yesterday, the German government approved the purchase of 35 F-35 Lockheed Lightning II jets. F-35 program executive officer Lt. General Michael Schmidt reported that Germany is the ninth foreign military country to join the program. Lockheed expects the F-35 program in totality will have 550 jets working together from more than 10 European countries by the 2030s. Note that Lockheed Martin also made the Orion spacecraft that recently circled the moon and returned safely to Earth. LMT is up 39% over the past year, yields 2.5%, and trades with a forward P/E = 18x.

Boeing is the #3 holding with a 9.4% weight. After many fits-n-starts with the ill-fated 737 MAX airliner, Boeing has delivered 333 737 MAX planes so far this year. Just yesterday, Boeing won two military contracts that were, in aggregate, worth $364 million (see here & here). Boeing also built the 212-foot rocket known as the “Space Launch System” which propelled the Orion spacecraft into space. Orion splashed down last Sunday after a successful mission.

Northrop Grumman (NOC) is the #6 holding with a 4.4% weight. Northrop is the 6th largest U.S. defense contractor and on Dec. 5th the company won a $405.7 million contract by the U.S. Air Force for engineering services. NOC is up 39.5% over the past year and trade with a forward P/E = 21.6x.

L3Harris Technologies (LHX) is the #9 holding with a 3.8% weight. This week, LHX won a contract worth up to $886 million from the U.S. Army Communications-Electronics Command. The contract is to support intelligence, surveillance, and reconnaissance capabilities for the Army, the DoD, and the intelligence community. LHX is relatively flat over the past 12-months and trades with a forward P/E = 16.9x.

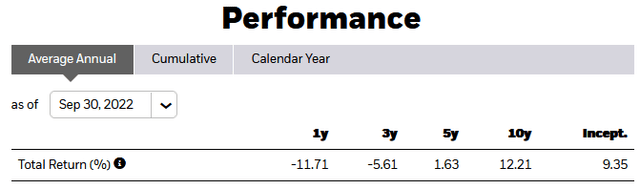

Performance

As can be seen from the graphic below, which was taken from the ITA webpage referenced earlier, as of the end of Q3 the ITA ETF has an admirable 10-year average total return of 12.2%:

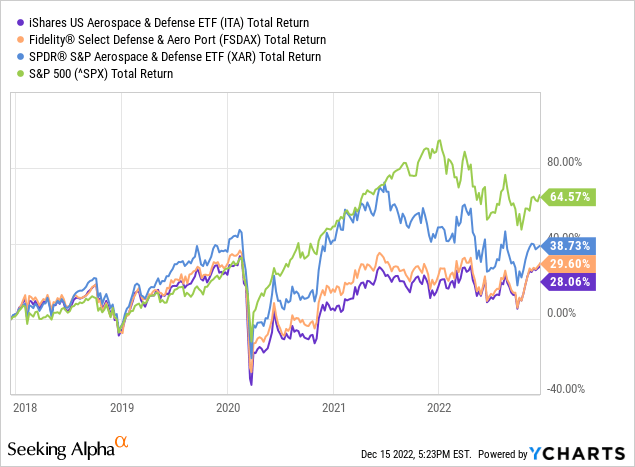

The following graphic compares the 5-year total returns of the ITA ETF with two of its peers – the Fidelity Select Defense & Aerospace ETF (FSDAX) and the SPDR S&P Aerospace & Defense ETF (XAR) – as well as the S&P500:

As can be seen from the graphic, the S&P500 has roughly doubled the D&A related ETFs, among which the XAR ETF appears to be the cream of the crop, outperforming both the iShares and Fidelity offerings. The XAR ETF has a 0.35% expense fee (4 basis points lower than the ITA ETF).

Risks

The defense & aerospace companies are not immune from the macro-investment environment, which includes significant headwinds: high inflation, higher interest rates, and a slowing global economy – in part – due to the uncertainty as a result of Russia’s horrific war in Ukraine that arguably broke the global energy & food supply chains and, as a result, is a significant cause of global inflation. Unfortunately for Ukraine and the world, there appears to be no end in sight to the conflict.

However, if there were a surprise end to the conflict, the market might pull-back support for the D&A sector.

Given recent market volatility (the S&P 500 was down 2.5% today while the ITA ETF was down 1.9%), I would advise any investor looking to establish a core position in the Defense & Aerospace sector to do so over time, and to take advantage of big market dips to dollar-cost average-in.

Summary & Conclusion

The ITA Defense & Aerospace ETF is a high-quality fund that holds the biggest and best U.S. defense contractors. Given the arming-up of the world as a result of China’s saber rattling on Taiwan and Russia’s war on Ukraine, Democratic & NATO governments around the globe are increasing their defense spending. Meantime, the commercial airline industry is strong and – as evidenced by Delta’s strong forward guidance – is expected to stay strong next year as well.

However, it would appear that the XAR SPDR S&P Defense & Aerospace ETF has a significantly better 5-year performance track-record. That being the case, if I owned ITA – which I rate a HOLD – I would probably sell it and buy the XAR ETF instead (this advice is given with no knowledge of your tax exposure, which is certainly worthy of your consideration).

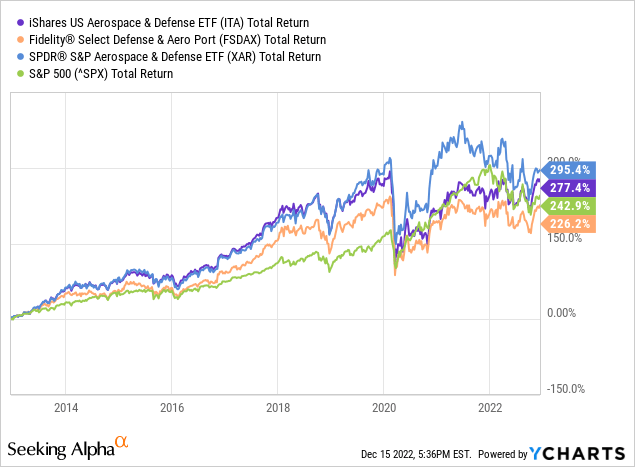

I’ll end with a 10-year total returns comparison, similar to the 5-year presented earlier, and note that the XAR ETF is, once again, the leader of the pack, outperforming even the S&P 500 by 50%+.

Be the first to comment