Yuichi Yamazaki/Getty Images News

Introduction

I first heard of Fanuc Corporation (OTCPK:FANUY, OTCPK:FANUF) almost a decade ago, when a financial pundit spoke of this robotics company pioneering automation aimed at manufacturing. Then, just recently I was visiting an external collaborator in regard to my job, and while walking through their production I saw the Fanuc logo on a set of robots operating a delicate manufacturing process concerning fragile containers. I asked the guy showing me around their production how they perceived Fanuc, and he was quick to respond that they delivered great solutions. Now, that might not be representative as there are other robotics companies out there besides Fanuc, but it did spark my curiosity, and here we are.

Who Is Fanuc

Fanuc is a Japanese corporation founded in 1958 as a subsidiary of the much better known Fujitsu, being spun off as a separate company some years later, in 1972. The company had its early focus on advanced applications within numerical control, what we today refer to, as CNC (Computer Numerical Control), which is production machinery capable of mass producing uniform and complex parts in metal and other materials, while being guided by computer software.

In 1982, Fanuc entered into a joint venture with General Motors (GM) to produce and market robots, with Fanuc providing the equipment and GM, the management. Later in 1987, Fanuc entered into a similar partnership, this time with General Electric (GE), focusing on CNC machinery. Eventually, Fanuc took over the facilities in the U.S., and as such, a robotics company was born with a global presence.

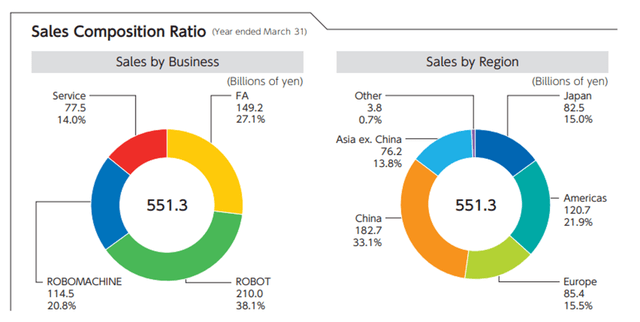

Today, Fanuc is divided into three product segments. First being “FA,” referred to as Basic products, where Fanuc provides CNC machinery including relevant components and software. Secondly, “Robot,” focusing on robotic arms which can improve stability and quality in work, while removing human workers from potentially dangerous environments. Lastly, “Robomachine,” larger and dedicated robotics for ultra-precision work.

Fanuc has a very diversified revenue base, with 15% in Japan, 22% in the Americas, 15.5% in Europe, 33% in China and 14% in Asia excluding China. As such, customers are global and include electronics manufacturers, automotive manufacturers – anything related to industrial production where processes can be standardized or carry sufficient value to justify installing robots to improve process quality or remove workers from potentially harmful, dirty, or dangerous environments.

Fanuc lives by a philosophy of “reliable, predictable, easy to repair,” meaning Fanuc also offers life-time maintenance on equipment still in operation at the customer. In Japan alone, Fanuc conducts roughly 90.000 repairs annually, of which roughly 10% is on products which were manufactured more than 40 years ago, quite impressive as you normally would expect complicated machinery to last much shorter.

The value add of robotics is easily exemplified, as media were allowed to visit a Panasonic factory in Amagasaki that produces two million TV sets a month with only 25 people in the production. Talk about having succeeded in securing automated processes.

The industrial robot sector, like many others, have a number of large companies who set the pace. In this situation, we have the big 4, including:

- ABB (ABB), a Swiss/Swedish electrical equipment company with an FY2021 revenue of $29 billion.

- Fanuc with FY2021 revenue of $6 billion.

- KUKA (OTCPK:KUKAF, OTCPK:KUKAY), a German industrial robotics company with an FY2021 revenue of $3.7 billion.

- Yaskawa (OTCPK:YASKY, OTCPK:YASKF), a Japanese industrial robotics company with an FY2021 revenue of $4.1 billion.

Outside the big four, we have companies such as Comau from Italy, Epson from Japan and Teradyne from the US. Teradyne is not a pure play but has been making recent acquisitions within robotics to grow its offering and focus, for instance the $285 million acquisition of Universal Robots who is a leader within “cobots” (collaborative robots), a type of robot not surrounded by a protective fence or perimeter.

Summarizing, Fanuc belongs to the industry leadership within industrial robotics.

Fanuc From A Financial Standpoint

According to fortune business insights, the industrial robots market was valued at $15.6 billion in 2021, projected to grow at a CAGR of 11.4% to reach $35.68 billion in value by 2029. That’s a significant growth opportunity well ahead of the global GDP growth. The Asia Pacific, including Japan, China and India is expected to be host to most of that growth, being well in line with Fanuc’s existing geographical footprint in terms of revenue distribution. The report sights Fanuc as one of the key companies to be part of this growth.

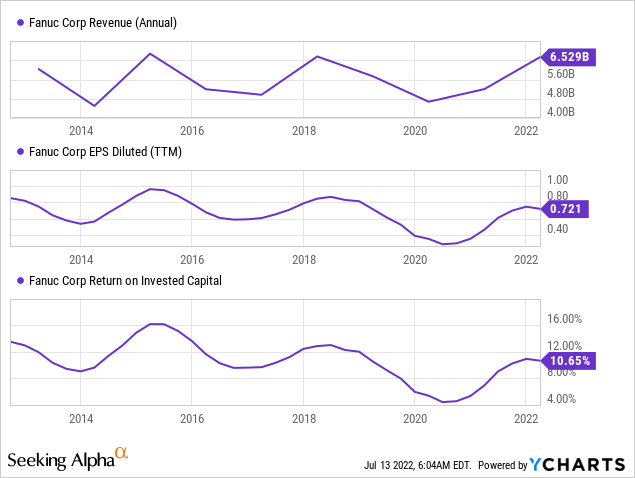

Despite being part of a heavily growing market, Fanuc exhibits very obvious cyclical behavior both in terms of revenue and earnings, resulting in an acceptable ROIC, mostly staying above 10%. One of my favorite measures, ROIC basically gauges to what extent management is able to drive profitability from investments, something we as shareholders should keep an eye on.

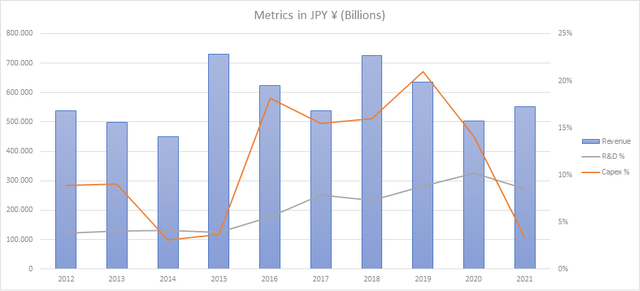

Above I’ve highlighted revenue over the past decade in combination with spend allocated to Capital investments and R&D as a percentage of revenue. First of all, R&D exhibits a growing trend throughout the observation period, with capital investments being very volatile in nature, but consistently making up a significant chunk of total revenue – which is very volatile.

An important observation concerning the marketplace for robotics, is the growing need for allocating R&D to broaden one’s portfolio while striving to maintain an edge compared to one’s competitors in terms of innovation and pushing the technology. In that regard, operating in this industry is expensive. In 2012, Fanuc had 5,198 employees, while having 8,256 by 2021, with revenue barely having grown comparing the two years up against one another, despite operating in a growing market.

Fanuc is at the end of the day a profitable company, with a very high operating margin mostly above 20%, although it has been trending downwards in the past decade, as a natural consequence of what I laid out before. Fanuc is also self-funded, with zero debt on the balance sheet and a $5 billion cash position.

Summarizing, Fanuc is a profitable company at the forefront of its industry with zero debt and a strong cash position, but also with volatile financial performance and eroding margins as lack of expansion in revenue while growing its R&D and number of company employees. Given the company has no debt and a strong cash position is a clear plus, but the strong volatility in the profit and loss statement is less pleasing.

Lastly, Fanuc has also been paying a dividend, with the payout ratio over the last decade mostly being a flat 30% or 60% depending on the given year. Do note these levels are prior to the conversion between JPY & USD. In the last five years, the payout ratio has more often than not been a flat 60%. Fanuc pays a bi-annual dividend with the next installment expected in September, currently trading at a yield of 2.3% with a consensus expected forward yield for 2023 at 2.8%.

Valuation & Closing Remarks

Fanuc is down 44.4% from its recent high and down 28.2% YTD. Earnings have diminished in recent years, but with the stock price down, so has the price to earnings ratio. Consensus estimates are for Fanuc to improve its earnings in 2022 through 2024 without fault. In recent years, however, it has been a much bumpier ride than a straight line up and to the right. As such, I’m a bit skeptical as to the likelihood of Fanuc making those expectations come to life.

Currently, the company is trading with a forward P/E of 22.5 and forward 1y P/E of 21.4. Levels that don’t seem unreasonable for companies who can grow on par with the expected industry growth of a CAGR at above 11% until the end of this decade. Only problem being that Fanuc has struggled with elevating its revenue consistently.

Despite the significant drawback in Fanuc’s stock price, this doesn’t yet represent an appetizing opportunity. As I view it, the uncertainties of the past inevitably also impact the understanding of what is to come, and I don’t believe Fanuc warrants that premium today, at least not in my portfolio.

Be the first to comment