Kwarkot

iStar (NYSE:STAR) and Safehold (NYSE:SAFE) announced early last Thursday morning that they had reached an agreement to combine. The only thing that was a surprise was how quickly the agreement was reached.

That announcement set off a flurry of activity for me. That morning I spoke with President and Chief Investment Officer Marcus Alvarado, CFO Brett Asnus, and EVP for Investor Relations Jason Fooks. Then I listened to two investor presentations and dug into the associated presentations.

We got my analysis of the merger into the hands of members of High Yield Landlord mid-day on Friday. By then I was on the phone with CEO Jay Sugarman, learning a lot more details.

This article to the public site, delayed a few days, is focused on the main points and the end of the story. It may help you decide whether to invest, or whether to come learn more details from the article linked above and future coverage.

You will find on SA, now and later, other comments on this combination. None of them will reflect the time spent, depth of research, or degree of communication with management that lie behind what you find here.

What’s more, my money is on the table. I have been substantially long Safehold and/or iStar for more than two years.

A Bit of Background

Ground leases have been used for centuries by the wealthy in Europe and especially Britain. They have enabled landowners to protect their assets while taking income from them.

Under a ground lease, the lessee has use of the land for a very long time, like 99 years, after which the land and everything on it returns to the landlord. The land and all structures also return to the landlord in the event of default, making ground-lease payments extremely secure.

A modern ground lease has to protect the interest of four parties, the landlord, the building owner, and one lender for each of them. Safehold was founded to buy land and lease it using modern ground leases.

The basic story is Modern Business 101. The more capital-light any business can become, the higher its return on equity. (See, for example, The Value Equation by Chris Volk.)

This applies every bit as much to businesses using real estate as to those using computers. Ground leases reduce the capital needed to buy or construct the buildings needed by a business, increasing the return on equity.

It is hard to see why some authors and commenters have had such a hard time grasping this.

A Bit of History

iStar established Safehold in 2017, to establish and grow the modern ground-lease business. The intent was to use the assets of iStar to support the explosive growth of Safehold to a self-sufficient size.

That job is now done. Safehold has a ground lease portfolio approaching 6 $B in investments.

Safehold Investor Presentation

And if you exclude the value of the shares of SAFE it holds, the book value of iStar is negative (see the Q2 2022 Earnings Call Presentation). This made it time to internalize the management of Safehold and find a way to liquidate iStar. Since iStar is messy, the details are messy.

Special committees of the two Boards, including only external directors, got together (25 times!) and played “let’s make a deal”. Where they ended up does not please everyone, but that will soon be water under the bridge.

Here we look beyond the mess. Let’s see what things will look like after the deal closes.

Simple and Safe Safehold

Safehold will be almost entirely a pure-play, ground-lease company and soon should have a credit rating at the A level. They will issue debt and equity and use those funds to grow their ground-lease portfolio.

Free float, which was small, will be large. A substantial majority of their shares will float on the market.

As described in my previous articles, writing such ground leases creates a lot of value. The value is driven by the escalators in the leases.

Despite the escalators the value of existing ground leases does vary in a bond-like way as interest rates change. In the present phase of high growth, though, the value associated with growing the portfolio adds a lot. I found this value to be a minimum of half again as large as the portfolio itself.

There is also value in the eventual return of assets, on which a bit more is below. I discussed all these in my most recent article.

In addition to the pure ground-lease business, Safehold will be the General Partner for two supporting Funds, holding only a minority of the Limited Partner interests. These funds will provide financing and loans to support the firms that employ ground leases as they work toward construction. Safehold will get a bit more income from this.

Safehold will also get a bit of income as a management fee from SpinCo, discussed next, during the years it takes to wind that down. The sum total for that specified in the current agreement is $55M.

Existing holders of SAFE shares will retain their current fractional ownership of Safehold.

Sufficiently Stable SpinCo

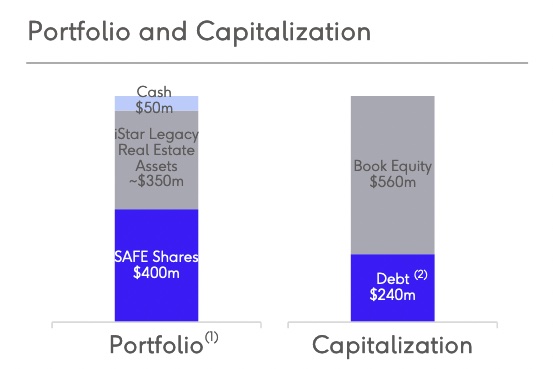

As is often true, this SpinCo is born to die. Here is the initial distribution of assets:

iStar Presentation

SpinCo will be seeded with $400M in shares of SAFE. This provides stability, liquidity, and a strong balance sheet. It will have $50M of cash and be liable for $55M of management fees over the first four years.

The three main legacy assets will be Asbury Park, Magnolia Green, and an oceanfront parcel in the entertainment district of Coney Island. None of these can be sold readily, if at all, right now.

As an example, here is what Jay Sugarman told me about Asbury Park:

We’re fairly confident that the book value at Asbury is an attractive one, but you’ve got still a dozen or more parcels to sell. All have to go through the permitting process at the town, which is quite lengthy. We can feel pretty confident about what the revenues are going to be, but the costs to get there are harder to predict as is the timeframe.

We can’t sell them right now in the middle of a very, very delicate political process. We are the largest landowner. We can make trades with the city and no single buyer of a parcel can make holistic trades with them. We’ve done a tremendous amount of infrastructure work for the city. We’ve rebuilt the boardwalk, we’ve put in new streets, new streetlights, new landscaping, new crosswalks, new curbs, new sidewalks. You can’t possibly do that if you only own one parcel, but because we own so much of it, we can help accelerate the process for an individual parcel buyer by guiding them through it.

Some people have asked, “Can’t you just sell the whole thing at once?” I think that’s not the path at Asbury, it’s not realistic. We’re the master developer, all roads lead to us and we’ve got a lot of projects in process already that we would not be able to turn over to somebody new. So that one, I think is going to pay down over time in chunks.

SpinCo is well set up to cover its costs while it monetizes these remaining assets over the next few years, and then it will liquidate.

Existing holders of STAR shares will own 37% of Safehold directly, and 14% indirectly through SpinCo. Whatever value the get from the legacy assets, net of debt, will be small compared to likely appreciation of their SAFE holdings.

The Simultaneous Surprise

Simultaneous with the announcement of the combination was another announcement that is possibly of greater import for shareholders. MSD Partners not only purchased $200M of shares of SAFE from iStar. They also purchased 1% of the Safehold Caret units for $20M, implying a $2B valuation from them all.

The Caret units hold the rights to the value of the eventual return of assets to Safehold. (More precisely, they hold rights to all earnings of Safehold beyond that from the ground-lease rents.) Common shareholders of SAFE will own, after that sale, about 83% of the Caret units.

Here is what President and Chief Investment Officer Marcus Alvarado had to tell me about all that:

This is a huge, huge day for Safehold. Michael Dell’s family office is one of the most respected investors out there in the landscape, and certainly in the family office space. And they are investing 200 million into New Safehold, via their purchase of iStar SAFE shares. But they’re also buying 1% of Caret at a $2 billion valuation. It is common equity of Caret. There are no redemption rights or structure.

At the valuation of $2B, this translates to $27 per share (59% of the close for SAFE last Friday.) And you can bet that MSD Partners sees the Caret units as undervalued and likely to increase in value from here.

You can also bet that MSD Partners has put and will put very substantial quantities of time into understanding and monitoring Safehold. That time should dwarf the dozens of hours per year I have been putting in.

There has been much debate about the value of the Caret units. Many considered it to be zero, including some SA authors.

Others have seemed to think that those units were entirely owned by management as a vehicle to rip off the shareholders, or that they granted shares of common SAFE stock to management This is not correct. I discussed what is correct here.

Guess what, guys? You were wrong about all that.

The Action and What to Own

We have long been convinced that the real value of SAFE, and by implication of STAR, has been far above its present price. In our view, thinking accurately about the current assets, the value of their growth, and the value of the Caret units makes this pretty obvious.

In the hours after the announcement on Thursday, several of us discussed it at length in our chat room at High Yield Landlord. This led some members to make amazing returns by playing the initial crash and later recovery of STAR on that day.

Other members made decisions about whether to hold SAFE or STAR going forward. SAFE seems the more secure choice, with lots to go right and little to go wrong. But STAR will pay off more strongly if the disposition of those legacy assets is faster or more lucrative than the base plan describes.

Personally I’m long SAFE. The publisher of HYL, Jussi Askola, is long STAR. You get to decide for yourself.

Be the first to comment