vernonwiley

Main Thesis & Background

The purpose of this article is to evaluate the iShares Select Dividend ETF (NASDAQ:DVY) as an investment option at its current market price. This strategy of this fund is “to track the investment results of an index composed of relatively high dividend paying U.S. equities”.

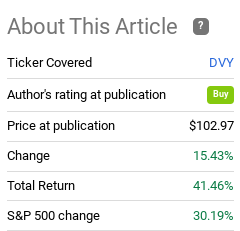

I used to cover DVY on a regular basis but it gets quite a bit of coverage on Seeking Alpha so it has been a while since I wrote about it. Looking back, however, I noticed that I did write about this fund favorably just over three years ago, and it has performed very well in the interim:

Fund Performance (Seeking Alpha)

With this in mind, I thought I should take another look at DVY to understand what is driving this strong performance, if it can continue, and whether or not a “buy” rating makes sense headed in to 2023.

After review, I think DVY is a decent ETF but I am taking a more cautious view on it. The markets have rallied a bit over the last few weeks, making me reluctant to get too aggressive on anything at the moment. Further, DVY has performed well in 2022 but that is largely a result of its heavy Utilities exposure. If interest rates keep rising and/or investors begin to take a more risk-on approach, this is a sector that is at risk. Finally, I think this ETF has a solid make-up overall, but I continue to be unimpressed by its relatively high management fee when I consider what comparable funds charge. Despite these negatives, I do see potential for a path higher for DVY in the coming months, which balances out to tell me a “hold” rating is appropriate now.

Want Dividends? You’re In Good Company

To start this review I want to talk about why investors may be considering dividend plays as a whole. As readers are surely aware, when one types in “dividend ETF” in a search engine or investment platform, they are met with a plethora of options. Finding the “best” ETF for this theme is a difficult challenge, perhaps finding the “best” is a fool’s errand because it doesn’t even exist. In any event, let us consider the why behind wanting dividend plays at all right now.

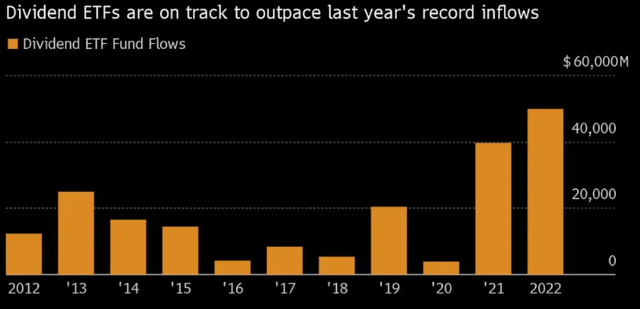

It should be no surprise to my followers that I am passionate about dividend ETFs, as my name “Dividend Seeker” implies. But I want to emphasize it isn’t just myself who finds these theme attractive. Over the course of the last two years more and more investor capital is flowing in to funds with “dividend” as an objective. In fact, 2022 has seen a surge of interest in this type of play, far outpacing what was already a record year in 2021:

Dividend ETF Inflows (Bloomberg)

My point here is that investors considering dividend ETFs, whether DVY or otherwise, are in good company. There has been a major shift in investor sentiment towards these funds and that bodes well for supporting the share prices of the underlying companies. With economic uncertainty and geo-political risks making headlines, the relative safety offered by consistent dividends is very much in favor. Further, the income stream is useful as investors contend with a rising interest rate environment.

To me, it is logical that investors will be drawn to income-producing plays in the current macro-climate. Given the trend has been accelerating as 2022 has gone on, I see this as a bullish indicator for DVY.

DVY A Relative Bright Spot In 2022

Let us now consider more recent performance. As I mentioned, I was pleasantly surprised by how DVY performed in the three years since my last bullish piece on the fund. Yet, I don’t currently own it, so it got me to questioning whether or not I should.

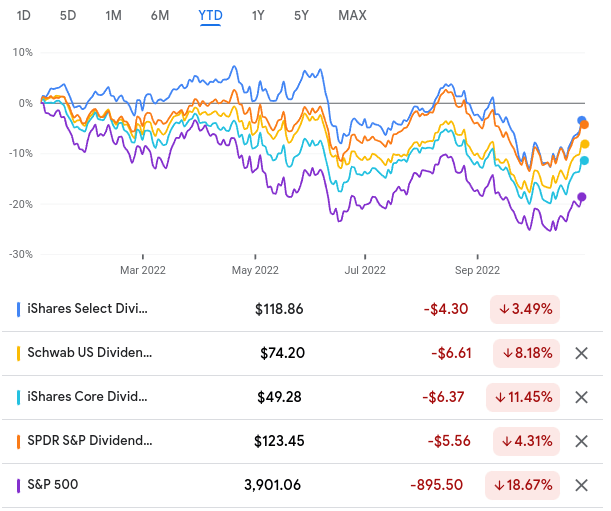

To come up with an answer, it was useful for me to compare DVY against the dividend ETFs I own and recommend. These include the Schwab Dividend Equity ETF (SCHD), iShares Core Dividend Growth ETF (DGRO), and SPDR S&P Dividend ETF (SDY). Simply put, I already have dividend ETFs I am quite happy with, so if I want to pull capital away from those funds and in to another, I should have a compelling reason to do so!

In this vein, 2022 just may give someone that reason. While each of the funds I listed, including DVY, are all down this calendar, we should recognize how poorly stocks as a whole have performed. So while DVY has lost a few percentage points, it has edged out my three dividend ETF holdings. And, perhaps most importantly, all of them have roundly beaten the S&P 500:

YTD Performance (Google Finance)

This is another factor that suggests DVY is worth a look. In what has been a very tough year for investors, DVY has held it together pretty well. When dividends are factored in, the fund is sitting with a loss in the 1.5 – 2% range. Not bad at all.

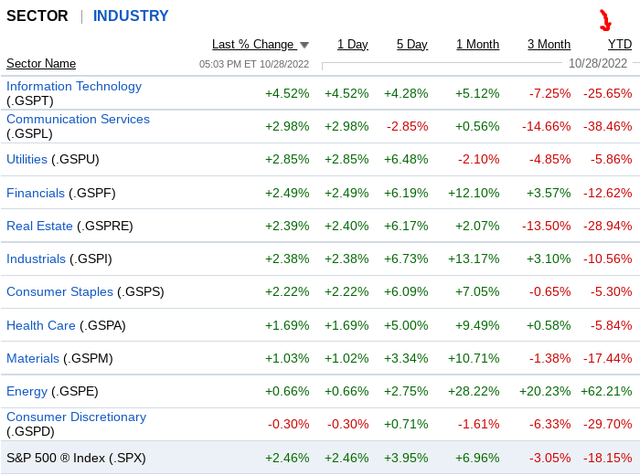

To be fair, a loss is still a loss, and there have been stocks that have seen strong gains this year. But for sector investing the only area in the green in 2022 is Energy. Utilities, Health Care, and Staples are all sitting with a modest loss, but everything else is heavily in the red:

YTD Sector Performance (Fidelity)

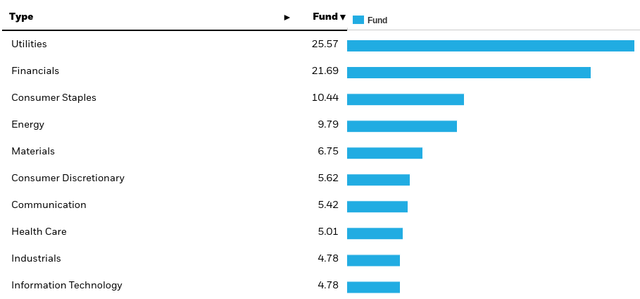

This explains why DVY has out-performed. Three of its top four sectors have either small year-to-date losses or are positive for the year:

DVY’s Sector Weightings (iShares)

The conclusion I draw here is that DVY was built for this type of environment. If the environment remains constant for the rest of Q4 and in to early 2023, then I continue to expect out-performance for this fund. That supports why my rating is at least “hold”, and justified why current owners of this product may very well want to keep on owning.

What Are Some Downsides?

Let us now move to some of the reasons why I am reluctant to initiate a position in DVY right now at the expense of my other holdings. The primary of which is the fund’s expense ratio. At .38 basis points annually, it simply compares negatively to the dividend ETFs already in my portfolio:

| Fund | Expense Ratio |

| DVY | .38% |

| DGRO | .08% |

| SDY | .35% |

| SCHD | .06% |

Source: iShares; State Street; Schwab

This is a very simplistic attribute so I won’t spend a lot of time on it. But the bottom-line is DVY is expensive to own. The fund’s expense ratio has declined from .40% since I began covering it a decade ago, dropping to .39% and now .38%. But that decline has been too little, too late in my opinion. The standard across the ETF universe has been shrinking fees and DVY doesn’t pass the test in this regard. That deducts from total return and likely turns potential investors off from buying it.

Utilities Are Pricey, At Risk Of More Fed Hikes

As my followers are aware, I have been a promoter of the Utilities space for the long-term. I like how it balances out my portfolio from the Tech-heavy U.S. market indices, and I also appreciate the more stable revenue streams and dividend payouts. Through 2022, I have continued to advocate for this exposure, so I want to be clear I do not view DVY’s 25% allocation to the Utilities sector negatively. I think this inclusion is broadly a positive. But that does not mean the sector is not prone to risks like everything else. And, looking ahead to the first half of 2023, interest rate risk remains top of mind.

For perspective, readers should remember that Utilities often have a negative correlation with interest rates. 2022 has seen a bit of a push away from this historical trend as investors decided the stability of the sector overrode that relationship due to geopolitical uncertainty and risks of an economic slowdown. But with rates likely to continue rising through next year, investors should be prepared that the historical norm of Utilities declining when the Fed raises rates could come to fruition. If that is the case, DVY will suffer.

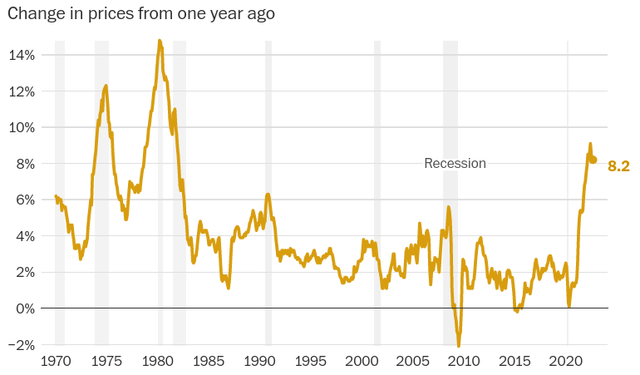

The point to emphasize in my view is that while inflation may be peaking, it remains well above the Fed’s desired target:

CPI Index (Bureau of Labor Statistics)

This reality has is why market traders now expect the Fed funds rate to reach 4.5%-4.75% in early or mid-2023 (The Fed’s policy rate is currently 3%-3.25%), according to data from the CME Group. This suggests the Fed will remain on a hawkish path, and could pressure the Utilities sector immensely.

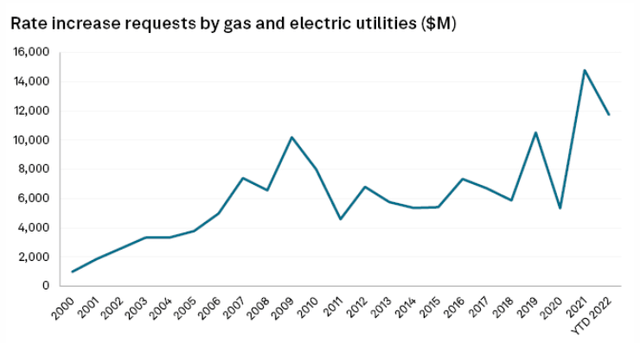

Again, I am not trying to be overly pessimistic here. The rate increasing theme has been in place in 2022 and Utilities have held up reasonably well. That trend could be the reality in 2023 as well, making these fears overblown. Further, utility companies across the country have been requesting rate increases to cope with inflation and higher input costs. If these requests are approved (or partially approved), that will increase revenues across the sector and provide investors with comfort that this is a way to combat inflation:

Aggregate Rate Increase Requests By Utility Providers (Nationwide) (S&P Global)

My view is this is a push-pull environment. There are positives and negatives to way – a scenario that often suggests “staying the course” is the most prudent avenue rather than making dramatic portfolio changes. But I would tie this discussion back to the above-average expense ratio of DVY. If one wants Utility sector exposure, I wouldn’t argue against that. But I personally see straight Utility ETFs, such as the Vanguard Utilities ETF (VPU) which has an expense ratio of .10%, as a more appropriate option. I can use that cheaper alternative to supplement my existing dividend holdings, rather than DVY.

Dividend Story Turned Positive In Q3

My last topic looks at the fund’s dividend. This was a metric that gave me some concern when looking at the first half of the year. DVY already saw its distribution drop on an annualized basis – not a good sign for a high inflation environment. Fortunately, the Q3 distribution soared compared to the payout in 2021, allowing the fund to showcase positive growth YTD so far:

| 2021 Jan – Sep Distributions | 2022 Jan – Sep Distributions | YOY Change |

| $2.98/share | $3.1/share | 4% |

Source: iShares

This shows a slow and steady income increase that I have come to expect with DVY. With a current yield over 3% and modest dividend growth, this confirms the use of this fund as an income play remains valid.

Bottom-line

All things considered, DVY has actually had a pretty good year. While total return is slightly negative, it compares favorably against the broader market and other dividend ETFs. If the current climate remains consistent in early 2023, investors can probably expect more of the same – affirming a reason for owning it. However, some risks are present too. DVY is heavily exposed to the Utilities sector, as well as Consumer Staples. If the Fed keeps on hiking rates as the market expects, both of these defensive areas could come under pressure. Finally, the expense ratio is unusually high – a thorn in the side of what is a pretty good fund by all other accounts. Therefore, I believe a “hold” rating is supported at current levels, and I suggest readers approach this ETF selectively going forward.

Be the first to comment