Volha Barysevich/iStock via Getty Images

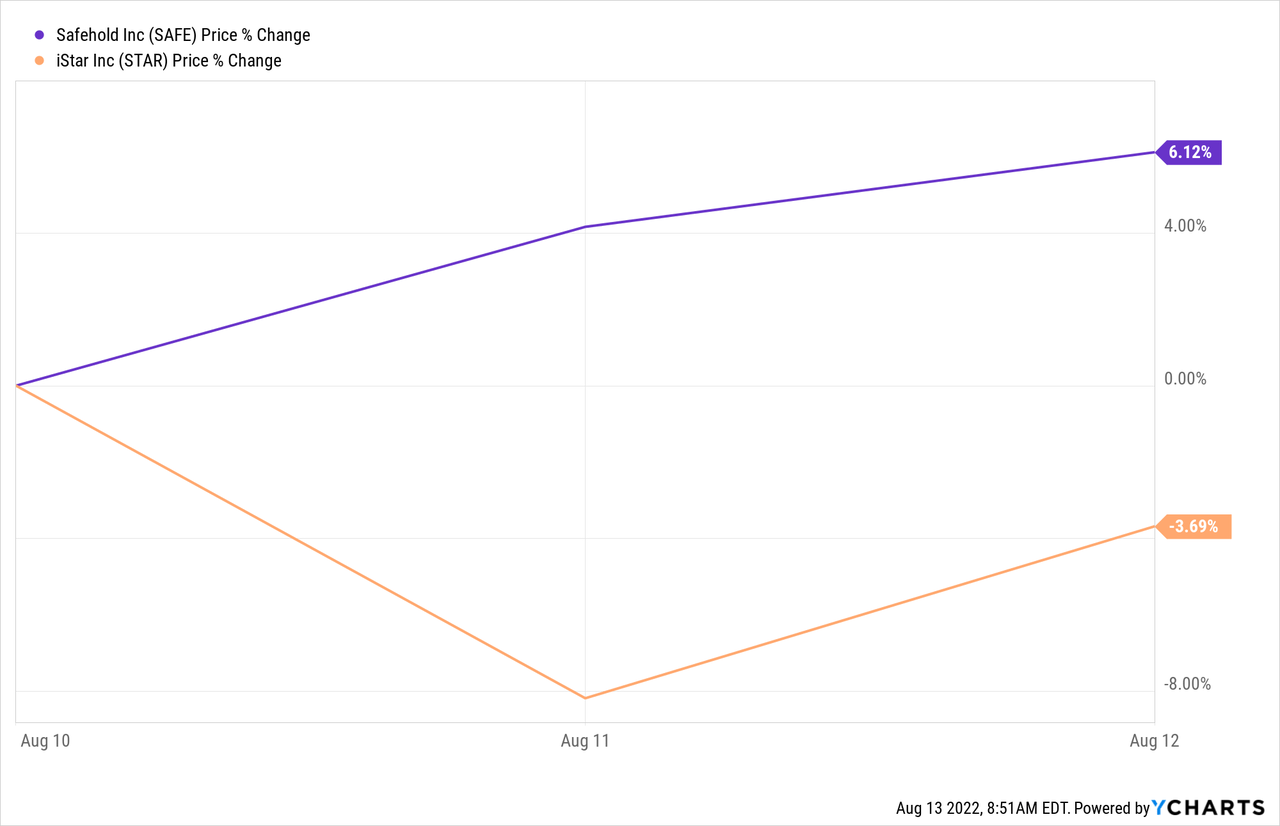

iStar Inc. (NYSE:STAR) and Safehold Inc. (NYSE:SAFE) merger has been speculated on for some time. The crux of the argument has always been that one company is better than two, as for as management expenses are concerned. This got more steam after STAR unloaded a very large portion of its non-Safehold assets. At that point, it was a matter of time, not a matter of faith. Investors bullish on the merger had naturally gravitated towards STAR as the company’s holdings of SAFE more than made up for its market capitalization. The news came on August 11, 2022 as the two announced the arrangement. To say STAR holders were disappointed, is perhaps an epic understatement.

Where do we go from here?

There are many small details to this transaction stemming from the cross ownership of assets and the desire to not damage SAFE’s investment grade rating. It is our opinion, that any delays that happened to this point, simply stemmed from making sure that the rating agencies were onboard and gave their blessing to this. Moody’s (MCO) actually revised its outlook to positive, based on this transaction. The end result was a $18.39 valuation for STAR based on $6.48 from SpinCo and a $43.45 price for SAFE.

Based on recent stock prices, book values and estimates on the pace of asset monetizations, each share of STAR would receive a combined implied value of approximately $18.39, comprised of interests in SpinCo with a book value of $6.48 per share and an estimated 0.27 shares of SAFE, which had a closing price of $43.45 on August 10, 2022.

Source: STAR Press Release

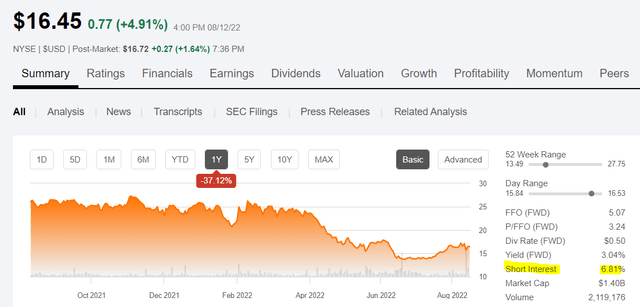

With SAFE over $46.00 on August 12 close, the market is showing a clear distaste for valuing the SpinCo by closing STAR at just $16.45. Why is that? It might have something to do with SpinCo’s setup.

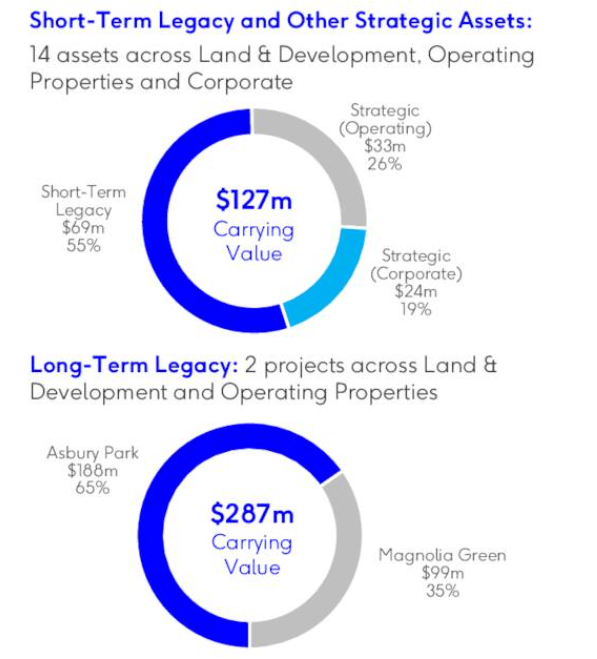

iStar will contribute its remaining non-ground lease related legacy assets, the largest of which are Asbury Park and Magnolia Green, and approximately $400 million of its SAFE stock to SpinCo. By retaining certain assets and pursuing their orderly monetization, SpinCo will enable iStar shareholders to capture their potential upside value.

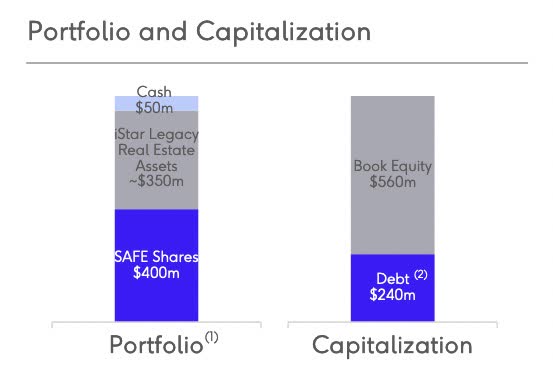

Additionally, SpinCo will be seeded with $50 million of cash and capitalized with a $100 million 8.0%, four-year term loan from New Safehold and up to $140 million of bank debt from Morgan Stanley Bank, N.A. which will be secured by $400 million shares of SAFE. iStar will distribute the equity interests in SpinCo to iStar shareholders on a one-for-one basis.

Source: STAR Press Release

That $400 million of assets is here.

iStar Presentation

The company will look like this.

iStar Presentation

There appears to be great potential here, at least on paper.

On March 24, iStar announced it is teaming up with developers Toll Brothers (TOL), K. Hovnanian and Somerset Development for a new phase of projects along the shore forecasted at $300 million. That’s on top of the $300 million the master developer says it has already spent in Asbury Park to transform a 1.25-mile stretch of oceanfront in the city.

According to iStar, together the three developments will create $3.6 million of new tax revenue – equivalent to approximately 15% of the total municipal share collected by the entire city last year. And the company said it will also contribute $1.9 million of annual special assessment payments to fund new public infrastructure in the waterfront development area.

Source: NJ BIZ

What was fascinating is that the $400 million of assets by themselves appear to be a non-starter for a separate company. They got $50 million in starting cash, a SAFE $100 million loan and an additional $140 million revolving credit loan secured by $400 million of SAFE shares. In other words, banks balked at that giving any kind of loan on these developmental assets and required a very heavy collateral with a loan to value of 35% ($140 million divided by $400 million). The unwritten joke here might be that banks demanded the level of safety that SAFE tries to create on its own ground leases. This likely comes from two facts. The first being that market conditions are still rough for junk debt and they likely would have gotten far better terms in late 2021 than they did today. The second of course is that Morgan Stanley (MS) knows that SAFE shares are still trading 100 times trailing adjusted funds from operations (AFFO) and 67% drop from here is not outside the realm of probabilities.

How To Play It

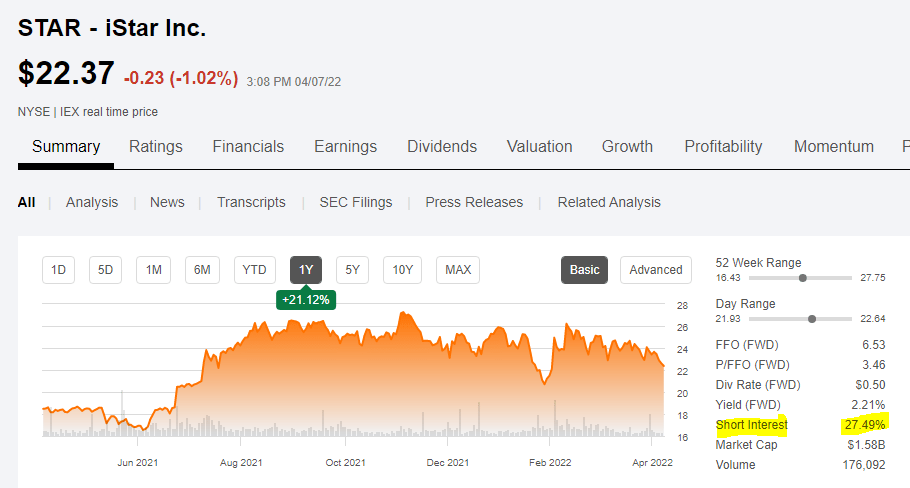

Merger arbitrage here is difficult as a long STAR, short SAFE is a bet on the spread and also you knowing what the real value of SpinCo is. In other words there is a real spread and a spread based on the differential value of SpinCo vs book value. Back when we covered this pair in April 2022, we had noted the large short interest on STAR.

Seeking Alpha April 2022

That tailwind has gone and short interest for STAR is now lower than that for SAFE (11.34%).

So an explosive upside move in STAR is now extremely unlikely.

This is a tough one to resolve, but we will still say that STAR is definitely undervalued relative to SAFE. Keep in mind that we think fair value of SAFE is about 45% lower, so there is that.

The STAR Preferreds, (NYSE:STAR.PD) with an 8% coupon, (NYSE:STAR.PI) with a 7.50% coupon and (NYSE:STAR.PG) with a 7.65% coupon trade close to par after removing accumulated dividends. They will be redeemed as part of the merger in Q4-2022 or Q1-2023. They remain a great cash parking place and in fact, a place where we have been hiding, ever since STAR announced sale of its triple net properties. They have handily outperformed both STAR and SAFE common shares and remain our best bet here.

SAFE does benefit from this transaction in terms of internationalization and reduced fees. It also gets management fees from SpinCo and a rather hefty interest rate on its loan. A credit upgrade might shave a few basis of spread off its debt. All good. The downside here is if SpinCo fails, liquidation of the collateral will add to stock price pressure. Also, reduced management fees won’t improve free cash flow much as a lot of it is paid in non-cash format.

The bigger issue to us remains that we don’t remotely believe in the valuation of the equity at current valuations. Credit/debt rating is not an endorsement of the stock at a certain valuation.

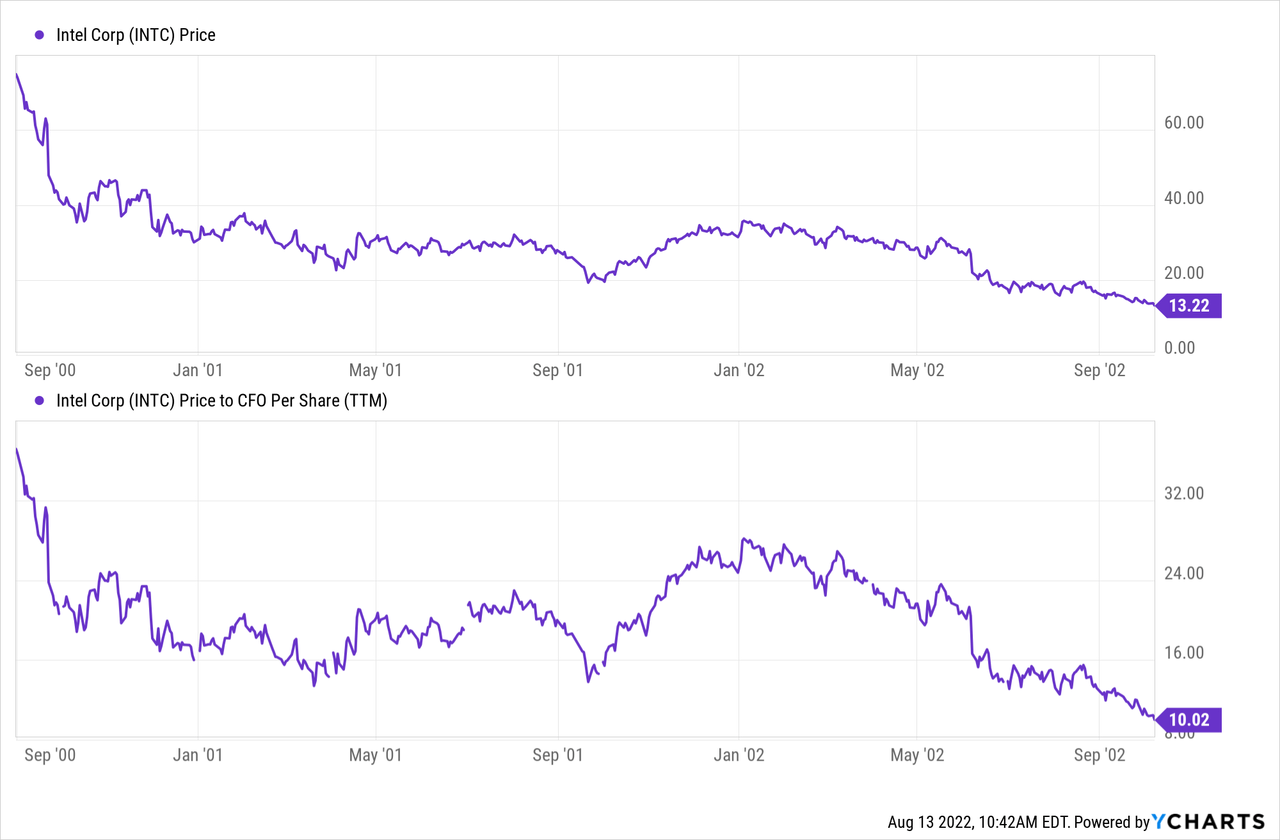

Intel Corp. (INTC) had an A credit rating in 2000 and the stock fell 80% in the next two years. Imagine how silly it would look if someone equated the credit rating with INTC going up over the next few years.

SAFE’s bubble has done just the first round of deflating. We maintain our neutral rating on SAFE and would look to get short in the $50-$55 range, looking for a sub $30 price ultimately.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints

Be the first to comment