alvarez

Energy is contagious. – Alex Elle

Introduction

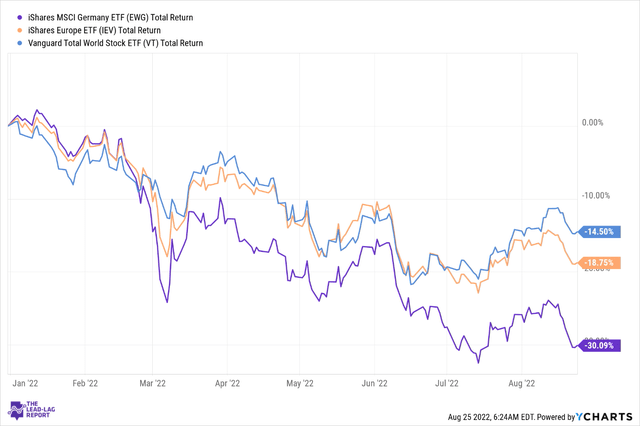

The iShares MSCI Germany ETF (NYSEARCA:EWG), with $1.36bn in assets under management (“AUM”) and 26 years of trading history, offers exposure to over 60 German large and mid-cap stocks. Unfortunately, this year has proven to be something of a disaster for this exchange-traded fund (“ETF”) stalwart, as it has given up 30% of its market cap. It consequently also has underperformed not just European stocks (by 1.6x), but global stocks as well (by 2.1x), both of whom have had pretty uninspiring years themselves. Could we see a repetition of this underperformance?

Well, if there are any silver linings to be spotted, it’s with regard to the forward valuations. Just for some perspective, EWG currently only trades at a forward P/E of 9.69x; conversely, the Vanguard Total World Stock ETF, which focuses on over 9500 global stocks trades at 14.5x, whilst the iShares Europe ETF which covers 385 European stocks trades at 11.43x.

The attractive valuation differential between EWG and these other alternatives may prompt some bargain hunters to come on board. But then again, valuations are just one facet of the German universe, and I’m afraid there are some other pressing issues that could weigh on EWG

The Energy Crisis

At the heart of Germany’s current malaise is an energy crisis, something which I went into great depth with, in my discussion with Alexander Stahel on Lead-Lag Live. I’d like to believe that this will be the biggest short-term driver of the economic performance there.

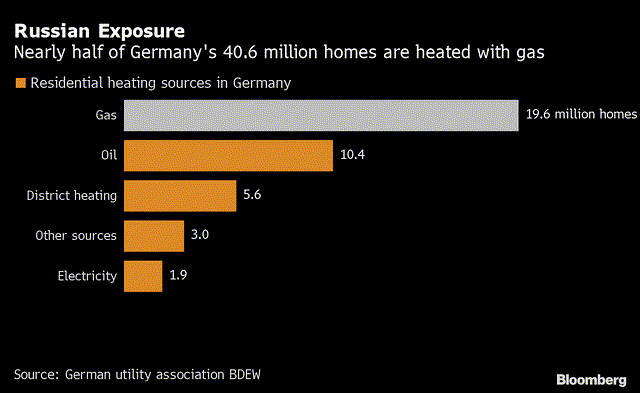

Natural gas is the most popular heating source in Germany, lighting up almost 20m households, which accounts for nearly half the total number of homes there. This doesn’t necessarily have to be a problem if the country enjoyed strong thresholds of energy independence, but that is hardly the case here.

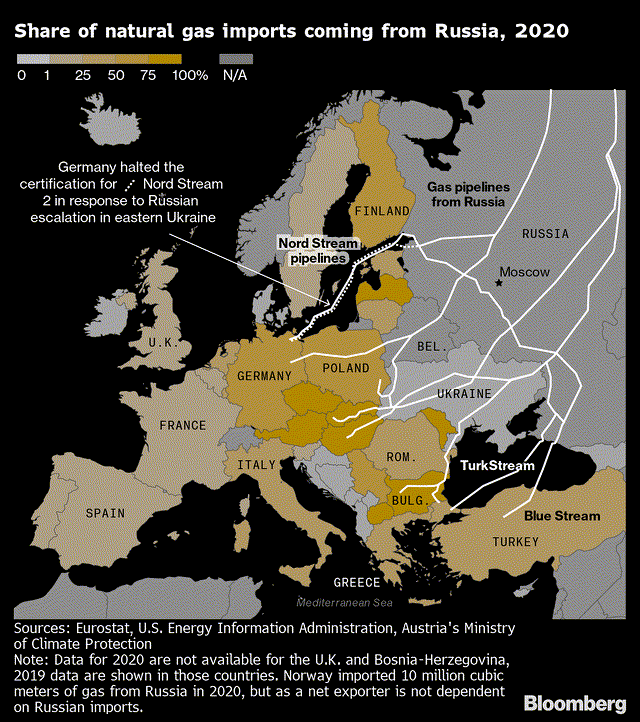

As the image below shows, it is heavily dependent on imports from Russia, which contribute anything between 50-75% of the total gas imports.

Russia recently announced that they would be taking the Nord Stream 1 pipeline offline at the end of this month to cater to maintenance issues. There’s history here, as around a month ago they had done something similar to only bring capacity back to around the 20% levels. The urgency with which they’ve resorted to another maintenance pause makes me wonder if things will ever return to normal. In fact, Bloomberg-related sources close to the Kremlin suggest that Russia will continue to keep flows to Europe at a minimal level as long as the Ukraine fiasco rumbles on. Energy Analysts from Wood Mackenzie suggest that a persistent capacity of just 20% could tilt conditions in Germany to the “danger zone.” Nonetheless, this has put Germany in a particularly vulnerable spot, with reports from Reuters showing that it is keen to procure gas from “just about anywhere“.

Canada now appears to be the chief candidate to help bridge the gas shortfall for Germany, but investors ought to consider that is hardly likely to be resolved overnight as the former does not currently have any LNG terminals and is currently in the midst of boosting its natural gas export capacity.

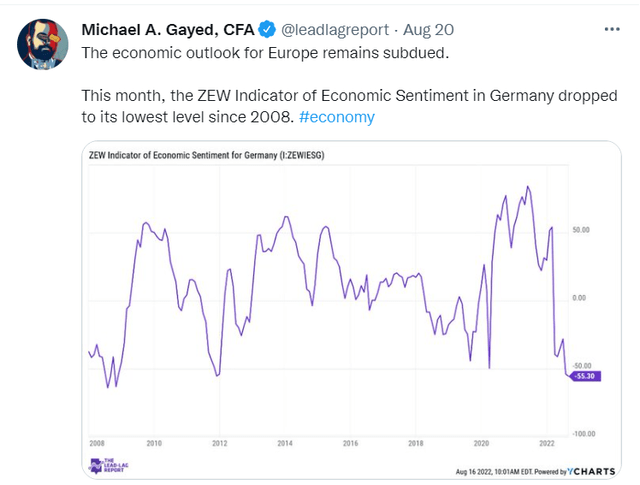

All in all, this energy crisis has annihilated economic sentiment in Europe’s largest economy; as noted in The Lead-Lag Report, the ZEW Indicator has slumped to its lowest point in 14 years. Besides, a survey carried out amongst 3500 German companies by DIHK showed that 16% of industrial companies are looking to stop operations or reduce production. If this crisis persists for a couple of months, expect more companies to join the bandwagon.

Conclusion

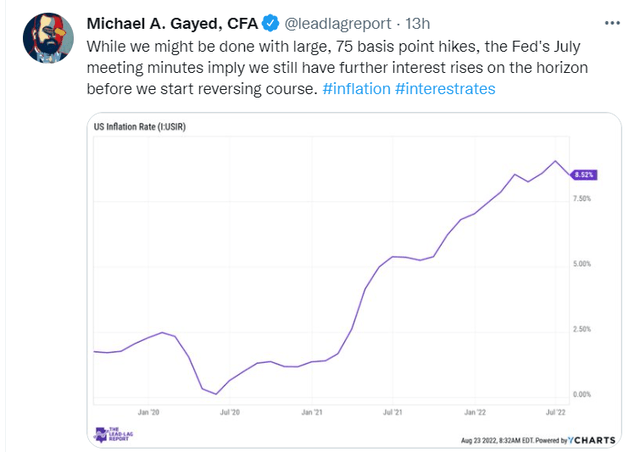

One also ought to keep an eye out for currency dynamics when we’ve just recently seen the dollar hit 20-year highs. As noted in The Lead-Lag Report, whilst fast-growing recessionary conditions may prevent the US Fed from engaging in large 75bps hikes, we have by no means reached a scenario where the Fed could make a pivot and cut rates. Rate hikes will likely be a recurring facet for the foreseeable future, and these tighter conditions will only make the dollar scarcer, thus boosting its allure.

Meanwhile, the European Central Bank’s primary refinancing rate is still at a paltry figure of just 50bps, and that’s unlikely to move the dial on inflationary conditions. The markets there also appear to be pricing in only a 100bps increase by mid-2023. This implies that the priority in Europe is to primarily avoid a recession, with inflation control taking a backseat.

All in all, the reluctance to be as aggressive as the U.S. Fed does not reflect well on the EUR/USD pair, which recently broke parity and appears to be in freefall.

To conclude, whilst the valuation differential of EWG looks enticing, the fundamentals appear to be in a bad shape, and this would prompt me to be cautious on EWG

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment