ipopba

A Quick Take On Riskified

Riskified (NYSE:RSKD) went public in July 2021, raising approximately $368 million in gross proceeds from an IPO that was priced at $21.00 per share.

The firm provides an ecommerce risk management platform to reduce fraud and improve consumer experiences.

With a rising cost of capital pressuring valuations and a slowing global economic environment dampening growth prospects, my outlook on RSKD is Neutral for the near term.

Riskified Overview

Tel Aviv, Israel-based Riskified was founded to create a platform that aggregates data from large online merchants to increase approval rates for online orders while reducing the risk of payment fraud.

Management is headed by Co-founder and CEO, Eido Gal, who was previously an analyst at BillGuard and at PayPal.

The company’s primary offerings include:

-

Chargeback Guarantee

-

Policy Protect

-

Deco

-

Account Secure

-

PSD2 Optimize

The firm pursues customers via a direct sales approach and seeks to ‘land and expand’ its offerings with each customer.

RSKD focuses its efforts on obtaining enterprise size merchants with a minimum of $75 million in online sales per year.

Riskified’s Market & Competition

According to a 2020 market research report by Grand View Research, the global market for e-commerce was an estimated $9.1 trillion in 2019 and is forecast to reach $27 trillion by 2027.

This represents a forecast CAGR of 14.7% from 2020 to 2027.

The main drivers for this expected growth are the growing penetration of the internet and smartphone usage worldwide and a wider use of online shopping by consumers.

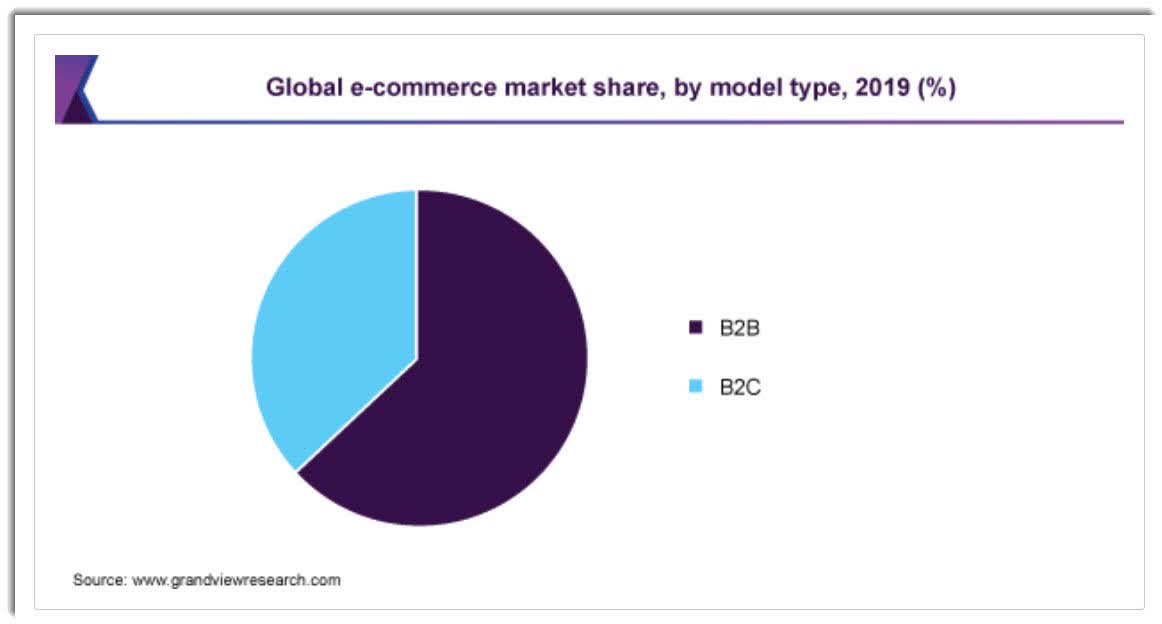

Also, below is a pie chart breakdown of e-commerce by model type in 2019:

Global Ecommerce Market (Grand View Research)

Major competitive or other industry participants by type include:

-

In-house fraud control solutions

-

Risk scoring

-

Liability shift vendors

-

Payment providers bundling fraud protection products

Riskified’s Recent Financial Performance

-

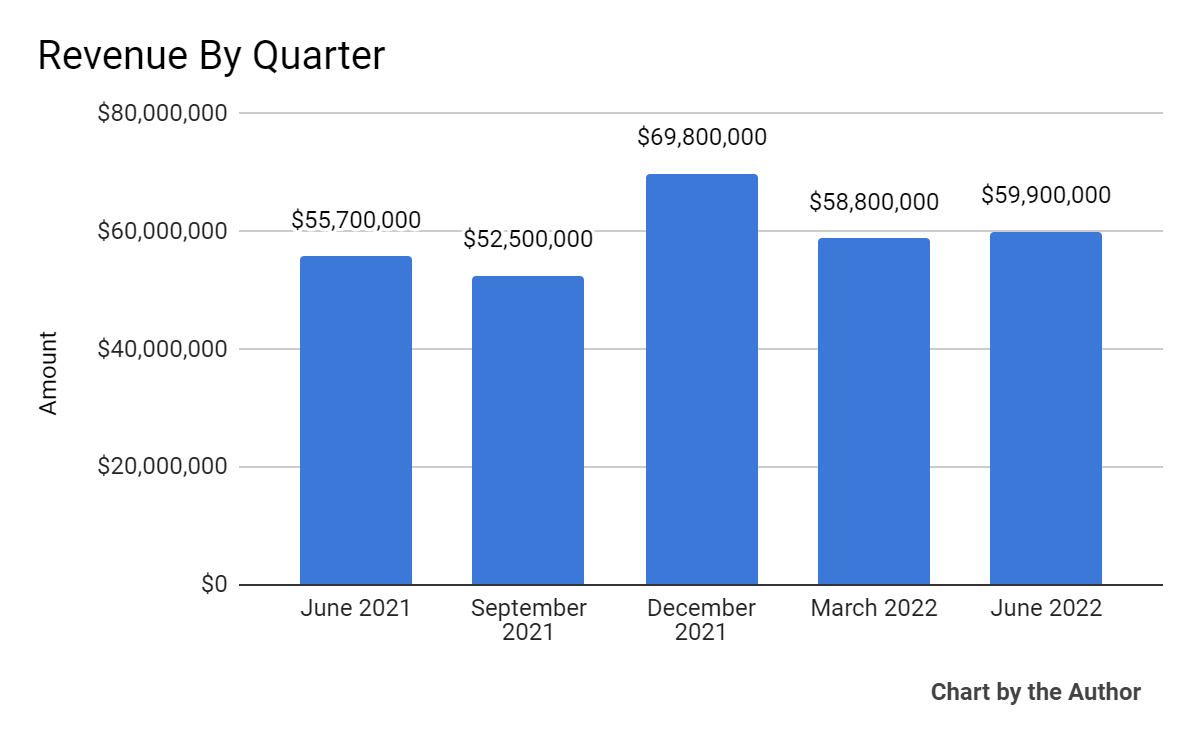

Total revenue by quarter has unevenly trended higher, as the chart shows below:

5 Quarter Total Revenue (Seeking Alpha)

-

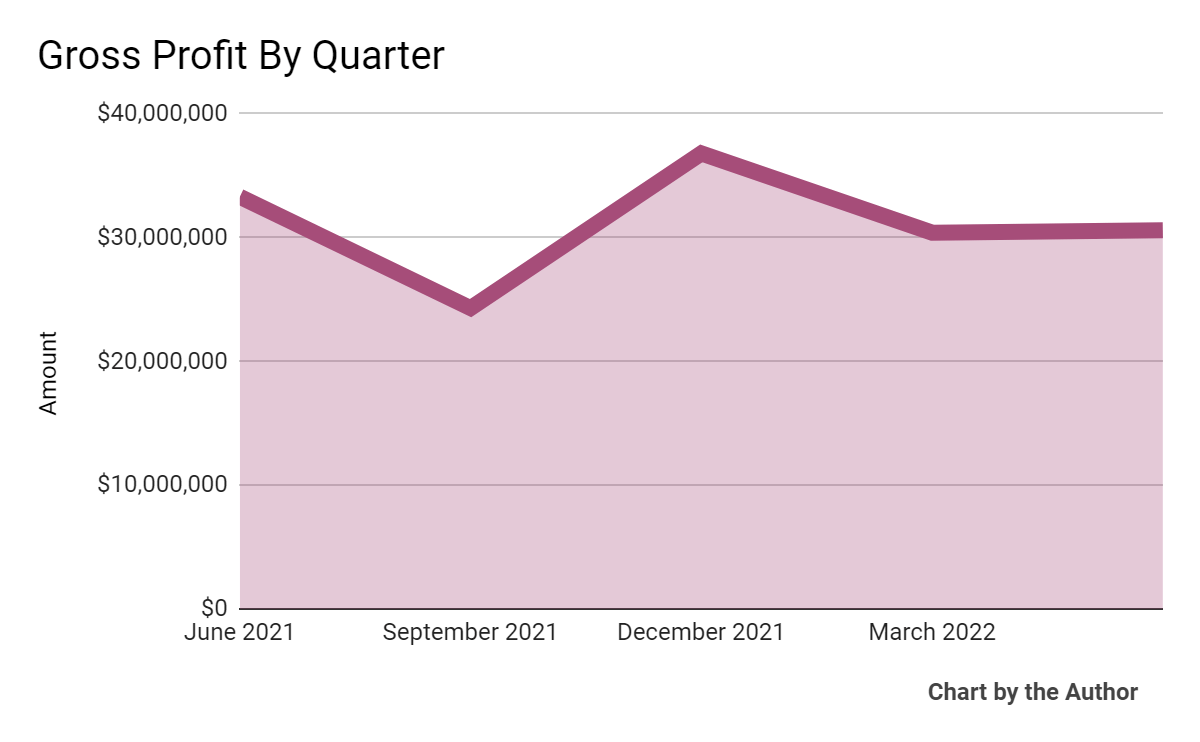

Gross profit by quarter has fluctuated in recent quarters, as shown here:

5 Quarter Gross Profit (Seeking Alpha)

-

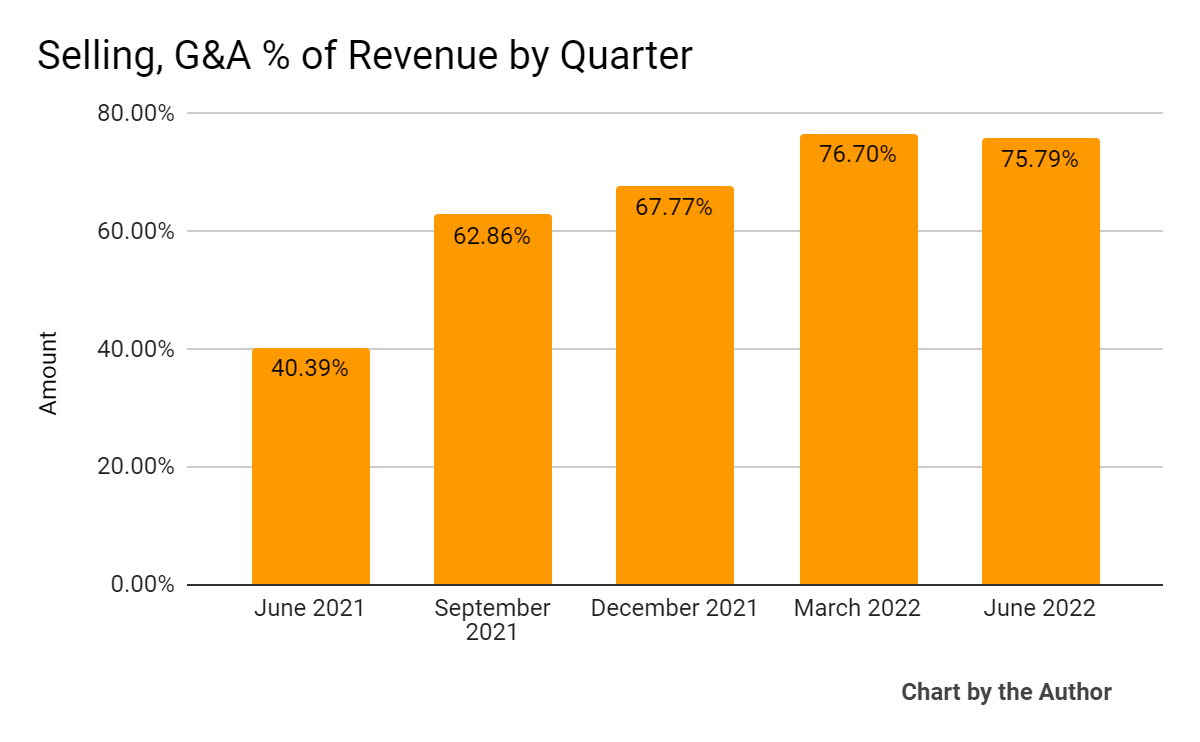

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

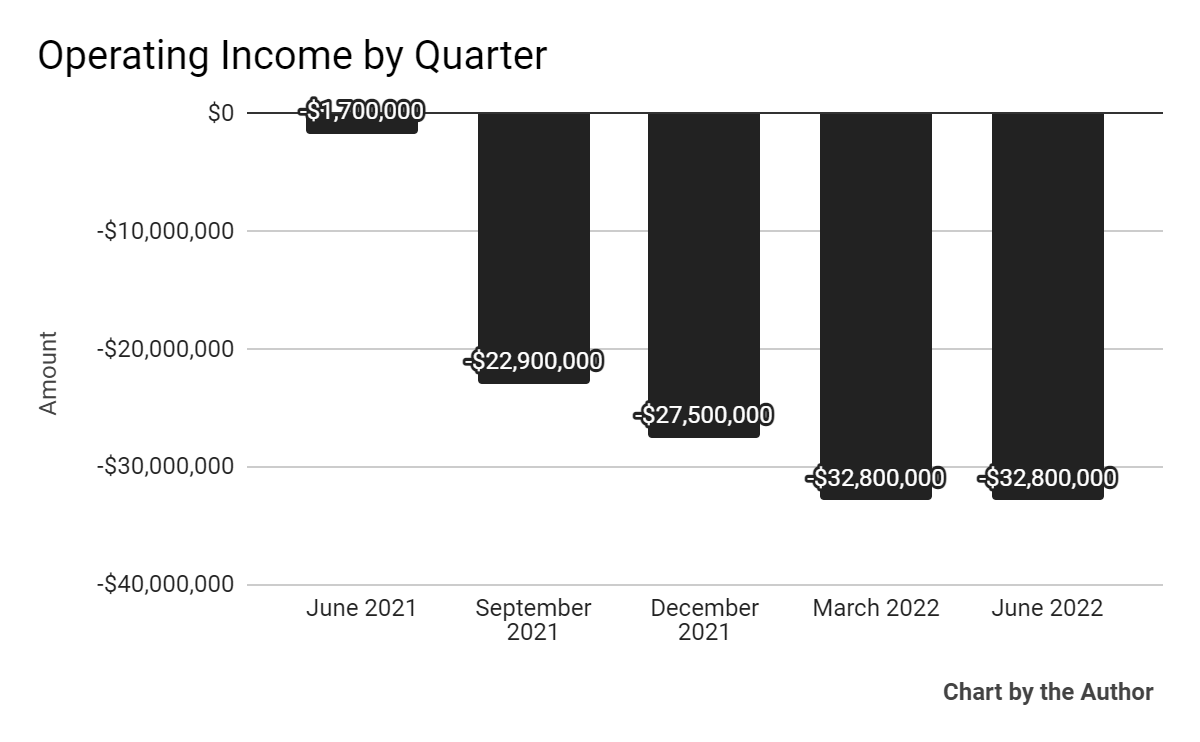

Operating losses by quarter have worsened significantly:

5 Quarter Operating Income (Seeking Alpha)

-

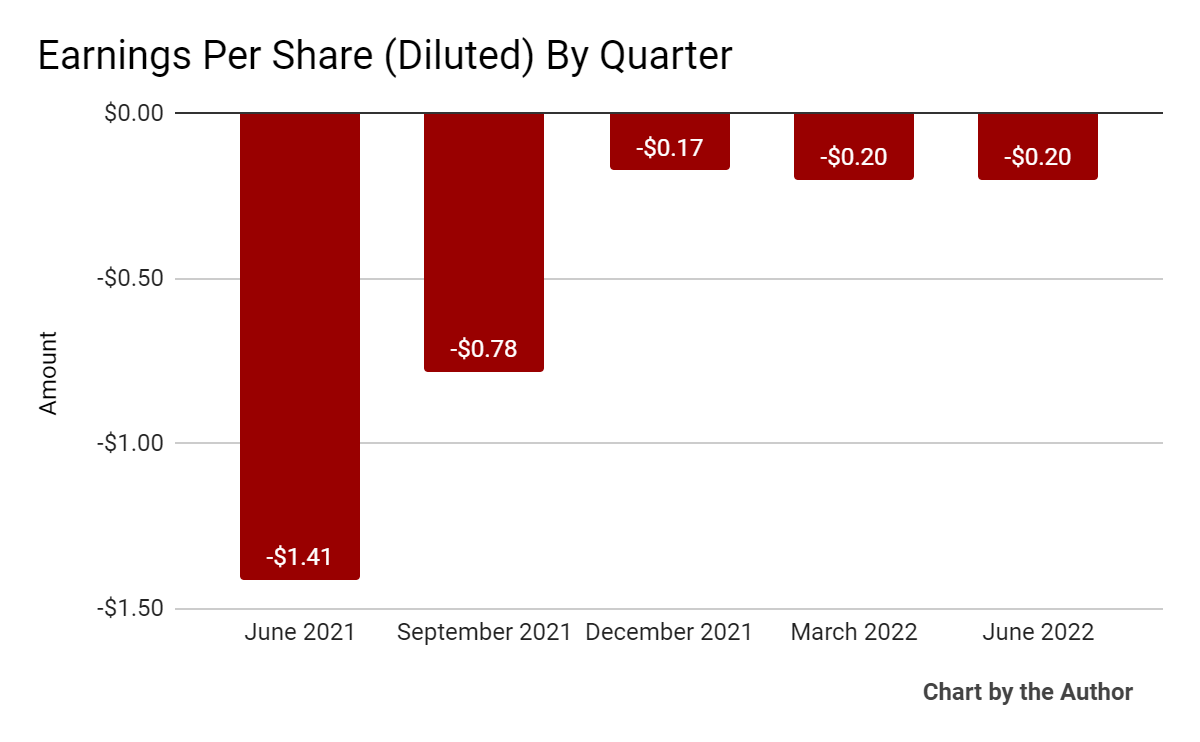

Earnings per share (Diluted) have remained materially negative, as the chart shows below:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

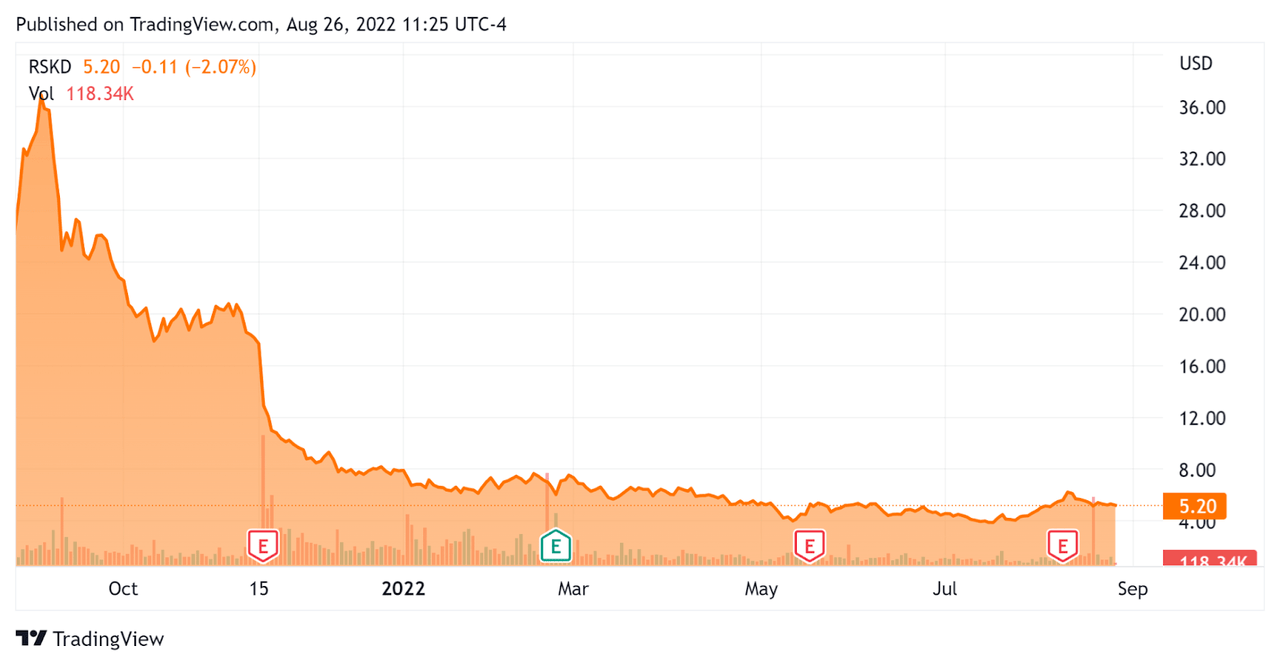

In the past 12 months, RSKD’s stock price has dropped 80.1% vs. the U.S. S&P 500 Index’s fall of around 8.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Riskified

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.83 |

|

Revenue Growth Rate |

17.3% |

|

Net Income Margin |

-75.1% |

|

GAAP EBITDA % |

-46.8% |

|

Market Capitalization |

$887,500,000 |

|

Enterprise Value |

$441,790,000 |

|

Operating Cash Flow |

-$44,940,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.35 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

RSKD’s most recent GAAP Rule of 40 calculation was negative (29.4%) as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

17.3% |

|

GAAP EBITDA % |

-46.8% |

|

Total |

-29.4% |

(Source – Seeking Alpha)

Commentary On Riskified

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its customer base diversification efforts, as to reducing size concentration as well as industry verticals and geography diversification.

Management also intends to continue a slower hiring pace and to reevaluate its spending pace and focus to reduce its overall cost structure.

The company finished the quarter with a 99% customer retention rate, although management did not provide the net dollar-based retention rate.

As to its financial results, revenue grew by 8% year-over-year, and its GMV review volume rose to $25 billion.

However, the firm saw soft activity in the U.S. region, ‘particularly in the stay-at-home category’.

Non-GAAP gross margin was 52%, the same as in Q1.

On the operating expense side, the company has found $10 million in savings for 2022 and now expects ‘only a modest increase in total headcount versus the beginning of 2022.’

For the balance sheet, the firm ended the quarter with $488 million of cash and deposits and no long-term debt.

Free cash flow was a negative $13.3 million for Q2 and negative $23.3 million for the first half of the year, so the company has ample cash reserves to cover its cash flow usage.

Looking ahead, management slightly revised upward its expected revenue for the full year 2022 and did the same for its negative adjusted EBITDA guidance.

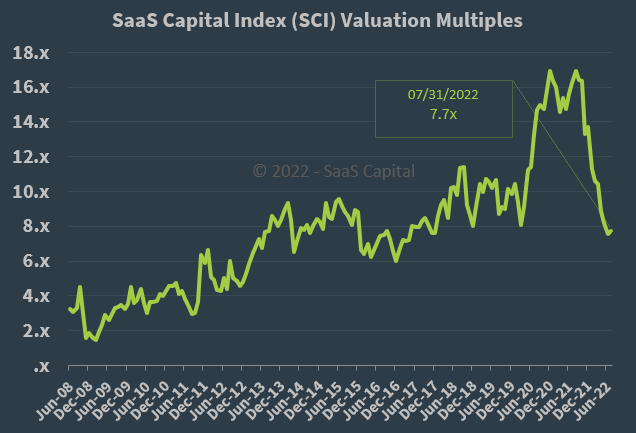

Regarding valuation, the market is valuing RSKD at an EV/Sales multiple of around 1.8x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

Although it isn’t an exact comparable, by comparison, RSKD is currently valued by the market at a significant discount to the SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include an accelerated path to operating breakeven, but it is likely that will take a significant amount of time to achieve.

While the firm is making some moves to reduce costs and slow hiring, its revenue growth is uninspiring.

With a rising cost of capital pressuring valuations and a slowing global economic environment dampening the company’s growth prospects, my outlook on RSKD is Neutral for the near term.

Be the first to comment