shaunl/iStock Unreleased via Getty Images

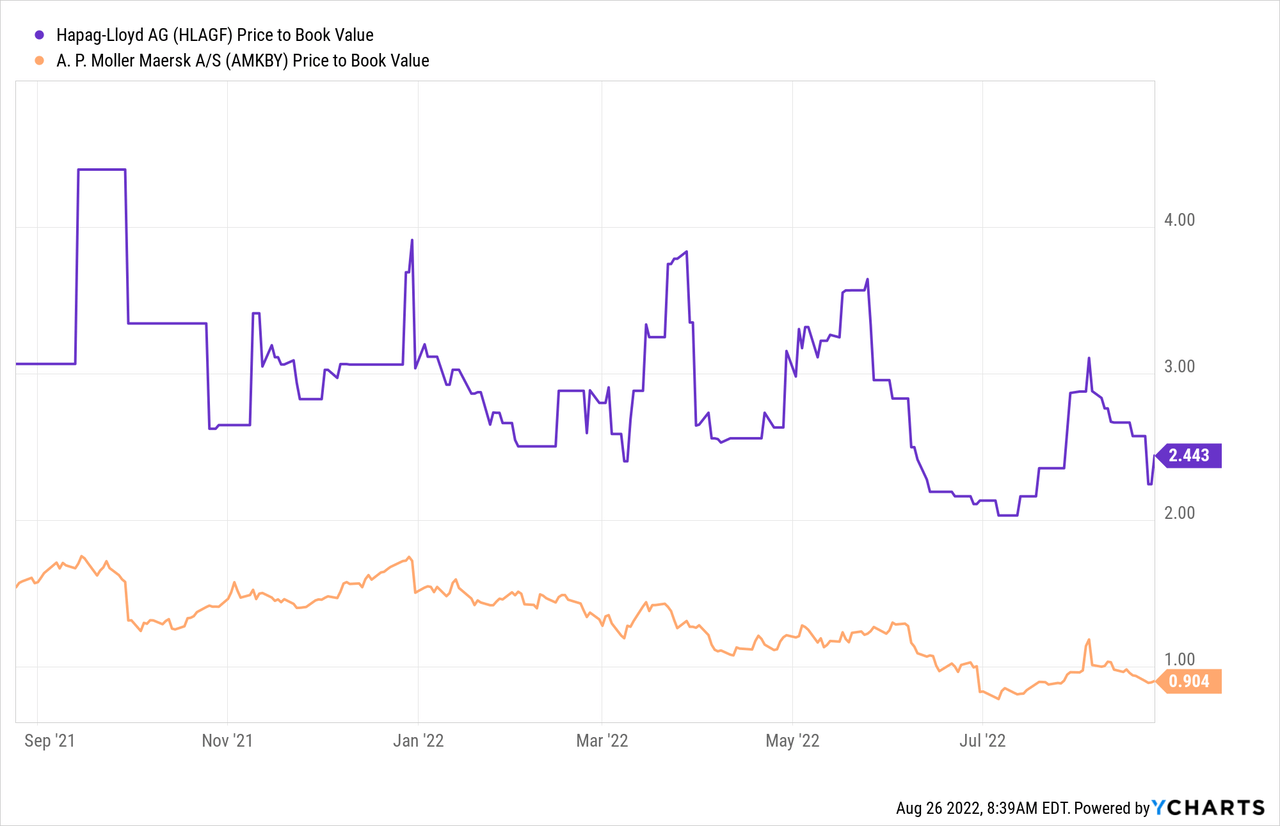

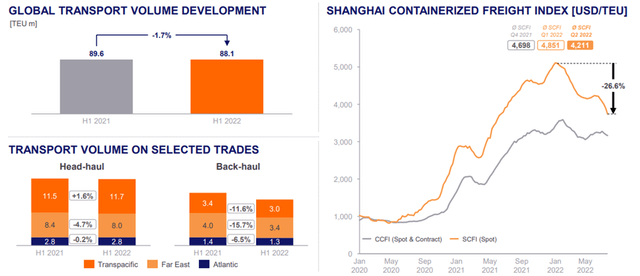

Hapag-Lloyd (OTCPK:HPGLY), the fifth largest container shipping operator by capacity at ~1.7m twenty-foot equivalent units (TEU), recently reported an unsurprisingly strong quarterly update accompanied by new guidance numbers at the upper end of Street expectations. Given management is typically conservative with its projections, there could be more near-term upside to these numbers, particularly with the high degree of operating leverage in the business model. That said, the company is at the mercy of the cycle, and the current run of extraordinary profit numbers will inevitably fade at some stage. Container rates are already showing signs of decline – for instance, the Shanghai Containerized Freight Index (SCFI) is well below YTD highs. With most of Hapag-Lloyd’s business contracted at >1 year, yields will lag as well, so spot prices will be the key metric to monitor in the coming quarters, alongside container capacity and the macro weakness. At the current P/B premium, the stock valuation is difficult to justify based on fundamentals and is likely vulnerable to a de-rating as the container shipping cycle turns.

EBIT Reaches a Record High in Q2 2022

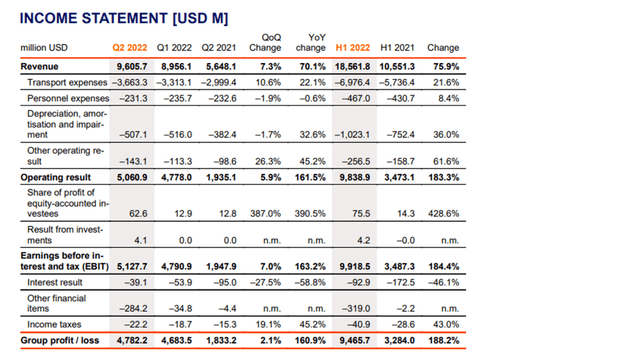

Hapag-Lloyd’s results were strong, as pre-released, on the back of the continued logistical disruptions globally and higher freight rates. Still, the extent of the outperformance was commendable – Hapag Lloyd’s profit reached a record high of $4.8bn in Q2 2022, rising ~161% YoY and up on a QoQ basis as well. Freight rates were again the key driver at +9% QoQ (defying the ~13% QoQ decline in the SCFI) at $2,935/TEU, bringing rate levels for H1 2022 up to ~80% above H1 2021 levels. By lane, Atlantic and Latin American rates were strongest, in line with trends in published indices. In contrast, transport volumes were flattish – even with help from the recent M&A in Africa. Among the main lanes, Atlantic volume was the strongest at +5.9% YoY, while Transpacific volume was the main drag at -7.1% YoY. The volume/freight divergence seems to be an industry-wide trend – peer Orient Overseas (OTCPK:OROVY) also noted a similar result with its Q2 numbers (~6% YoY volume decline and flat freight rates).

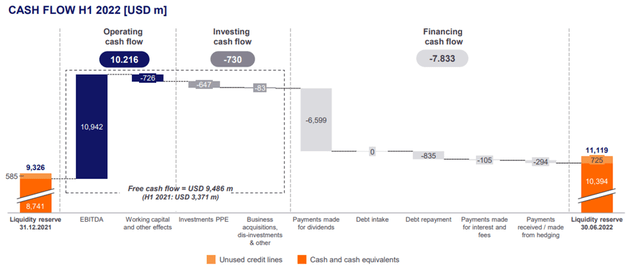

Higher revenue aside, the significant changes to costs have also been notable this cycle – besides high bunker (energy) prices, key expense drivers include handling and haulage costs. As of Q2 2022, Hapag-Lloyd has seen its total unit costs (including bunker) rising ~24% YoY (or ~8% QoQ), driven not only by bunker prices but also currency fluctuations and congestion-related issues. Even excluding bunker, unit costs would have been significantly higher at +15% YoY – almost 30% above the 2019 base. That said, higher freight rates have more than offset the expense headwinds, boosting profitability and cash flow. To recap, operating cash flow ended strongly at ~$10.2bn for the half-year, driving a solid ~$11bn liquidity position against a ~$4.5bn net cash position.

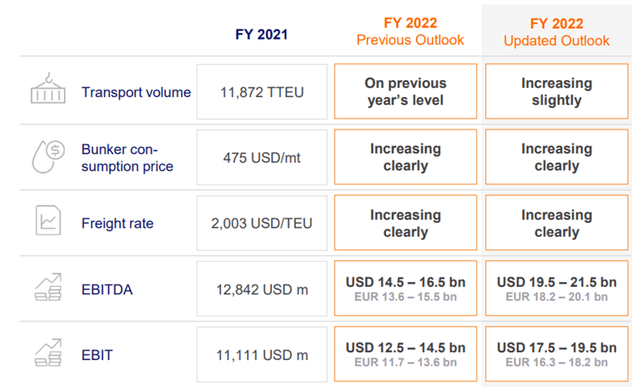

Upgraded Full-Year Outlook Offset by Potential Headwinds in 2023 and Beyond

Building off the strong first-half performance, management has raised its full-year EBITDA and EBIT guidance. The mid-point of the upgraded EBIT range now stands at $18.5bn – ~36% higher than the prior guidance, implying an H2 2022 EBIT increase of +25% YoY. Further, the shipped volume estimate for the year has been raised to “increasing slightly” (vs. the previous “on previous year’s level”) – in contrast to annual container volume growth (still at 2.6%) and the IMF’s downward adjustment to global trade projections at 4.1% (vs. 5.0% previously). In essence, this upgrade looks to be the result of not only a slower YoY spot rate decline in H2 2022 but also stronger contracted rates.

Of note, the Hapag-Lloyd update matches recent commentary from DSV (OTCPK:DSDVF), citing improved visibility in Q3 2022 as momentum from Q2 2022 appears to have carried into July. That said, DSV’s call for a softening demand outlook for H2 2022, mainly on the back of an uncertain Q4 2022, has me concerned. While Hapag-Lloyd is clearly confident in a strong H2 2022, there are emerging signs of a slowdown. Volumes, in particular, are only expected to be slightly above last year, while at the end of the outlook section of the half-year investor report (excerpt below), the company added an important caveat. The caution seems prudent, in my view – looking beyond 2022 into the mid-term, a normalization of supply conditions seems inevitable, as a combination of slower demand and rising ship capacity in 2023/2024 weigh on spot rates.

Despite the good financial business performance in the first half of the 2022 financial year, the Executive Board assesses the market environment for the second half of 2022 as challenging and highly uncertain.

Recent Market Developments Signal a Normalizing Cycle Ahead

While Hapag-Lloyd has benefited from the disruptions in the global logistical chain, signs of easing in some regions have been emerging of late. Within the US, for instance, the West Coast has seen an improvement, while in Asia, South America, and the Mediterranean, rates appear to have eased somewhat. To be clear, congestion issues remain – for instance, conditions remain tight in the US East Coast and Europe, although most of the drivers look to be seasonal/cyclical rather than structural (e.g., the low water level in the Rhine). Container availability is also improving, likely driving Hapag-Lloyd management’s call for demand growth to slow, while increased capacity from 2023 could further improve the supply side dynamics. Even with mitigating factors such as the new environmental regulations and recycling of tonnage, all signs point to a more normalized market over the coming year or so, with long-term net fleet growth likely to drive a further softening of the rate environment as well.

At the Mercy of the Cycle

Hapag-Lloyd’s quarterly update and new guidance numbers highlight the strength of the current container market and the extent to which global logistical issues are persisting. While the company is benefitting from a record-high container cycle and looks on track for another strong year of earnings, I remain concerned about a gradual normalization from 2023 and beyond. Alongside the emerging signs of macro weakness globally, container rates are already showing signs of decline, for instance, with the SCFI moving well below YTD highs. Additional uncertainty owing to the on/off COVID lockdowns in China and the ongoing war in Ukraine pose a risk to the near-term guidance numbers as well. In this regard, the current P/B valuation of Hapag-Lloyd stock is a big hurdle, particularly as the container shipping cycle looks set to normalize lower.

Be the first to comment