Clouds are appearing with the Federal Reserve getting aggressive with raising interest rates while simultaneously beginning to wind down the portfolio. crbellette/iStock via Getty Images

One of the topics which comes up quite often on fixed income trading desks, and among those managing fixed income portfolios, is liquidity. Trading bonds, whether they are investment grade, high yield or even government/muni can be pretty tough, especially when trying to execute for realistic pricing. The fixed income market can be the wild west, and two people can trade the same bond at the same time and receive wildly different prices because the market is not transparent and most sales are between two parties rather than occurring in a true open marketplace. Making matters worse, if your counterparty on the trade is not the end buyer, and is instead a broker willing to do the trade with you to provide you liquidity, they will be offering a lower price in order to accept the risk and costs of taking that bond into their inventory and placing it onto their balance sheet/books.

What many investors do not realize is that the bond market is not structured like the stock market. Generally speaking, stocks are shown to the total universe of buyers via exchanges, but bonds do not have exchanges and because of this some bonds can take quite a while to trade. Yes, there are some nice tools which have come out in recent years, including Tradeweb (TW) and MarketAxess (MKTX) but even then you have to deal with a limit on the number of bidders for your bonds and you have to believe that you are getting the best price from that group of traders you decided to include in the bidding. Sometimes you are surprised at who is willing to pay up for a particular bond, and the reasoning can range from they already have an order from a client who has been looking for it to they need to cover a short position. There really is no rhyme or reason sometimes, and those who have traded for years or managed portfolios know that the probability that you get the highest price that someone was willing to pay at that particular time is not always super high on bonds lacking a lot of trading because the chance that you come across the person who wants your exact bond is pretty low. Everyone pretty much accepts this because there is a price for liquidity and cash is king.

So Why Are We Talking About Liquidity?

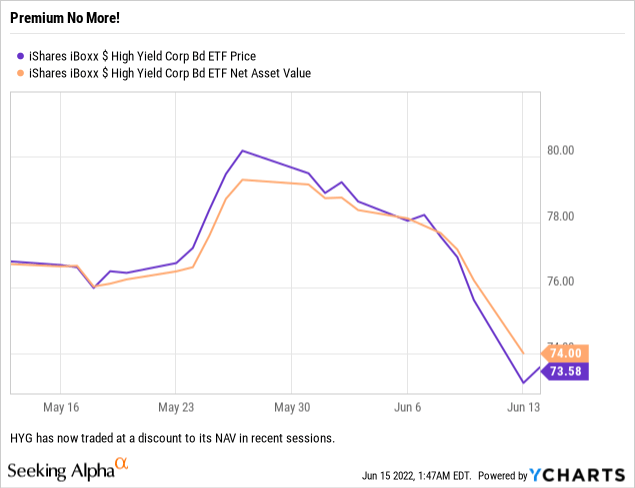

We bring up liquidity because with all of the volatility occurring in the fixed income market, a few of the bond ETFs have actually started to trade below their net asset value, or NAV. While investors are probably used to seeing instances where closed-end mutual funds (or CEFs) trade away from their NAV, this phenomenon can also happen with ETFs, although it is less common. With ETFs, authorized participants are usually able to do a trade with the ETF to rectify the break in the ETF’s trading price vs its NAV – with little to no risk to their capital while simultaneously helping the ETFs trade efficiently for tax purposes and maintain their NAV. The more liquid the holdings of the black box that is an ETF, the easier it is to maintain the NAV when markets become volatile.

We just broke NAV? We just broke NAV!

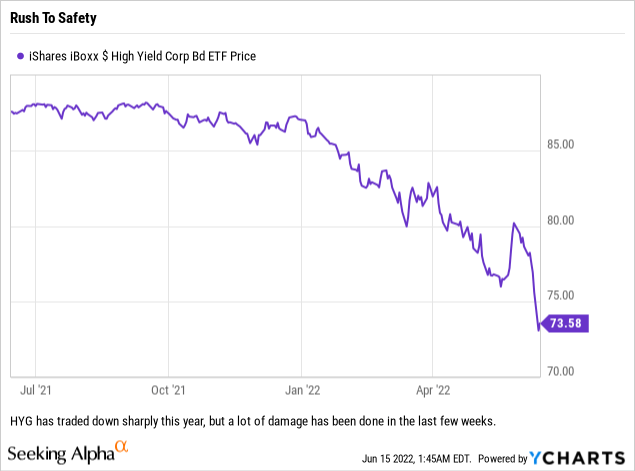

This week, a few large bond ETFs have traded at a discount to their NAV. The iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:HYG) is one of those ETFs, and we find that a bit troubling because the high yield market would be the first to seize up during market duress. Since these are literally baskets of junk bonds, they lack the liquidity measures that investment grade and government-focused ETFs have because they do not allocate funds to U.S. Treasuries or U.S. Agencies nor do they own corporate names that some purchase for safety during rough times; especially Apple (AAPL), Berkshire Hathaway (BRK.B), Microsoft (MSFT), etc.

So while the stock market has been beaten up over the past three trading sessions, we now have a few bond ETFs trading at discounts to NAV. While this happens from time to time, the fact that we are talking about a fund with just under $14 billion in assets which also happens to be the largest of its type tells us something is up. The discount to NAV has shrunk this week, but it is still at nearly 60 basis points and the fact that authorized participants have not stepped in to arbitrage the discount (by buying ETF units to trade for the actual bonds to then trade those and realize a profit) tells us that everyone recognizes that buyers of the underlying bonds are few and they would demand concessions on spread to provide liquidity and take on the risk. Our guess is that this particular ETF is being utilized as a trading tool to easily short the high yield bond market rather than going short individual high yield bonds.

We would also point out that although we call high yield bonds ‘junk’, there are some quality names within the sector, especially those known as “Fallen Angels” (or those companies whose debt has been downgraded from investment grade recently). These bonds are generally the highest quality in the index, and thus generally make up a decent percentage of a fund’s holdings. They would typically be the most liquid and as we scanned the holdings of the iShares iBoxx High Yield Corporate Bond ETF, we came across numerous bonds which we believe could be sold relatively easily – but the fact that no one is attempting to arb the discount indicates to us that even the biggest and best trading floors have doubts in their ability to trade some of these bond issuances at their latest prices.

What To Keep An Eye On

THE FED!

All joking aside, if this is the first crack within the fixed income market, at a time when we have not had any defaults of note in the space, then there are problems moving forward. Investors seeking yield, especially those with larger portfolios, who can rotate out of an ETF and purchase individual bonds, are going to be faced with the prospect of the U.S. Federal Reserve increasing rates so quickly that even Treasuries could (we stress could) generate more income, and total return for that matter, than the iShares iBoxx $ High Yield Corporate Bond ETF. Weird things like this happen only when the Fed moves quickly and traps capital, so we think investors should watch out for outflows on this ETF because shorter duration ETFs with higher quality credit securities could soon start generating higher income than high yield bond funds. It sounds crazy, but if the Fed follows through on expectations and raises by 50 basis points at multiple meetings this year, it could very well be a crazy fact.

Be the first to comment