Ridofranz/iStock via Getty Images

Investment Thesis

Ensign Group Inc (NASDAQ:ENSG) provides skilled nursing, senior living and rehabilitative services across 13 states in the U.S. By 2021, approximately 96% of its revenue is generated from the skilled nursing facilities portfolio. The company has an impressive track record, but the Biden Administration proposed a reform to the industry, which may pose some downside risks to ENSG. Despite the company likely to face headwinds in FY23, I will give a “Buy” rating to ENSG considering its current valuation and the company’s financial strength.

All data in this article is abstracted from the company’s conference call transcript and the 2021 annual report unless otherwise specified.

Excellent Track Record

ENSG’s diversified portfolio offers services in 245 skilled nursing and senior living facilities, with over 25,000 operational beds and over 2,000 living units. As the U.S. is facing an aging society, the demand for elderly homes is certainly there, and the company would be benefited from it.

The company has a reliable business and an excellent track record. The financials in the past five years were quite solid. From 2017 to 2021, EPS per share grew a remarkable 45% CAGR from $0.77 to $3.42, and EBITDA per share increased from $1.65 to $5.64. ROIC and margins also expanded within the period.

The company survived the COVID-19 pandemic. The sector faced a tough time during the pandemic, which led to a loss of over 400,000 practitioners and had a historic level turnover rate. ENSG survived this vulnerable period (FY19 to FY21), and improved in various metrics, like revenue, EPS, EBITDA, operating cash flow, etc. If you compare the results of ENSG with other competitors, you will find its performance is very solid and stable.

| Stock Ticker | Revenue % Change (FY19 – FY21) | EPS % Change (FY19 – FY21) |

| ENSG | 29.0% | 73.6% |

| BKD | -32.3% | Negative EPS |

| CYH | -6.37% |

Negative EPS in FY19 Positive EPS in FY21 |

|

Data Abstracted from GuruFocus |

||

In the latest earnings report for Q1 2022, the company reaffirmed its 2022 guidance at $4.01 to $4.13 EPS and $2.93 billion to $2.98 billion in revenue. While ENSG may be one of the best performers in the industry, the company still faces political headwinds ahead in the coming year.

Nursing Home Reform

The long-term care sector has already been critical and fragile due to the prevailing impact of the Omicron variants and the Delta variants. Considering ENSG generates approximately 96% of its revenue from skilled nursing facilities, it is not surprising that recent headwinds to the skilled nursing home industry may also bring adverse impact to the company.

Several months ago, the Biden-Harris Administration called for a reform in the nursing home industry, focusing on improving the quality of nursing care services. To achieve this, the Administration suggested several enforcement actions. I will cover the following policies as they will possibly affect the financials of a skilled nursing home:

- Establish Minimum Staffing Requirement

- Reduce Resident Room Crowding

- Carry Out Adequate Fund Inspection Activities

- Expand Financial Penalties and Enforcement Sanctions

Minimum Staffing Mandate

Centers for Medicare and Medicaid, CMS, will conduct a study on establishing a minimum staffing requirement for nursing homes by February 2023. Back in 2001, the CMS recommended a minimum of 4.1 hours of total direct care nursing time daily per resident. However, only the District of Columbia could meet the CMS recommendation. This indicates that most nursing homes are likely falling short of the minimum staffing requirement. And I believe, where pandemic preparedness is one of the focuses of the Administration, the requirement would not be lenient.

This suggestion unavoidably exerts operational pressure on the industry as operators may struggle to meet the requirement. The sector lost over 400,000 practitioners and had a turnover rate at a historically high level amid the Covid-19 pandemic. And the Great Resignation and labor shortage issues across the U.S. worsened it.

Mr. Barry Port, CEO of ENSG, however is confident that the company does not need to make large-scale adjustments to adapt to the staffing mandate. As ENSG focuses on the higher acuity type of patient, the company has a staffing level higher than the average.

But regardless of what the federal government does with a regulatory mandate around staffing, we’re not too worried about it.

Reduce Resident Room Crowding

Besides, CMS will accelerate the phasing out of multi-occupancy rooms with three or more residents, and promote more private rooms in the nursing homes. Existing nursing homes will need to spend a considerable sum to refurbish the facilities. A research proposed the construction cost for a private room is $16,000 higher than a shared room. Another study found a private room charges only $23 more than a private bedroom per day, which lengthens the overall payback period by about two years, depending on its occupancy rates.

ENSG strategically planned to expand and renovate the existing operations. This policy may add extra cost to the company to upgrade their existing facilities. Stringent development standards and approval procedures for expanding or renovating existing facilities may make it cost-prohibitive or extremely time-consuming.

The company currently has approximately $70 million budgeted for renovation projects for 2022. With the Federal Reserve continuing to increase the interest rate, borrowing costs for upgrading facilities will also be escalating. ENSG currently owns around $260 million in cash and $206 million in free cash flow in FY21. As the company’s short-term debt is just $4 million, and the renovation budget costs about one-fourth of the cash in hand, I believe the rising interest rate would have a limited impact on the company’s planning of refurbishment.

Financial Penalties

The Administration requests CMS to exercise more frequent fund inspection activities and more stringent financial penalties for poorly performed nursing homes. The proposal suggests to raise the penalty from $21,000 per instance to $1 million, which is almost fiftyfold.

Unavoidably, it is likely that ENSG’s expenses on penalties will increase. As written in Form 10-K for FY20.

From time to time, we, like others in the healthcare industry, may receive notices from federal and state regulatory agencies alleging that we failed to substantially comply with applicable standards, rules or regulations.

Overall speaking, setting aside the effectiveness of the policy, the above policies tend to exert an additional financial burden on the nursing homes. But ENSG’s strong balance sheet and excellent track record can make up for the impact. I believe there will be a slightly downward but manageable risk next year.

Valuation

It is also worth noting that the Medicare sequestration cuts were suspended through April 1, 2022, then adjusted to 1% through June 30. Starting July 1, the full 2% sequestration will be back in place. ENSG benefited from the suspension throughout the Covid-19 pandemic, and it will continue to boost the company in FY22. So when the positive effect fades, ENSG will have tougher comps in FY23.

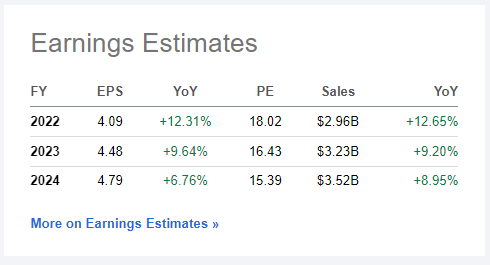

As shown in the picture below, the growth is expected to be slowed down from FY22 to FY23.

Seeking Alpha

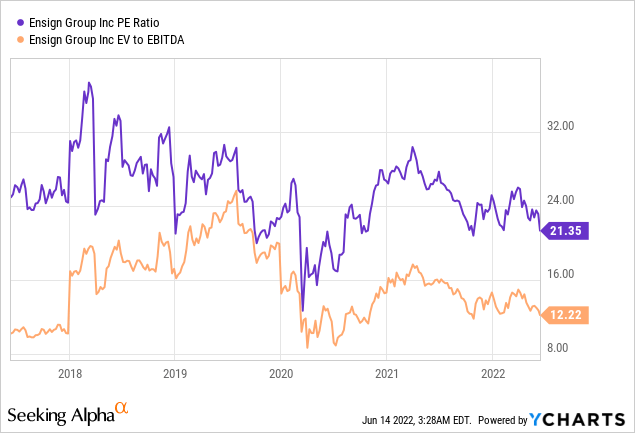

The stock is currently traded with a P/E ratio [TTM] of 21.35 (as of 13 Jun 2022). Compared with a 3-year pre-pandemic [TTM] average (FY17 – FY19) at 23.78, it is currently trading at a 11.4% discount. If ENSG hits $4.48 EPS in FY23 and returns to a 3-year pre-pandemic average [TTM] , the price will hit $106.5 in FY23, which creates a CAGR 20% return.

But considering the potential downside risk and the recession risk over the next twelve months cannot be underestimated, I believe the above estimate tends to be optimistic. Let’s assume the EPS growth will be slashed by 25% in both FY22 and FY23, the EPS in FY23 will be 4.2. If the stock returns to a 3-year pre-pandemic P/E ratio average [TTM] , the price will hit $99.8, which creates a CAGR of 16.2% return.

The valuation of ENSG is indeed becoming attractive. Although the Biden Administration has not yet revealed more details about the reform, ENSG has a strong balance sheet and income stream to support the changes. So the impact of the reform would be limited to the company; thus, I will give a “Buy” rating to ENSG, looking forward to FY23.

However, investors should notice the recent pessimistic atmosphere in the market. It is unsurprising that the stock will break to a lower level in the short term.

Be the first to comment