Jeff Swensen/Getty Images News

About two years ago, Lordstown Motors (NASDAQ:RIDE) completed a reverse merger with a special purpose acquisition company to be listed on the NASDAQ. Since then, the company’s stock has fallen more than 91%, leaving early investors with heavy losses. Despite EVs being a strong secular trend in time to come, we think that RIDE has more room to fall, given the company is most likely to raise capital from the issuance of debt or equity, or a combination of both.

Problems with the company

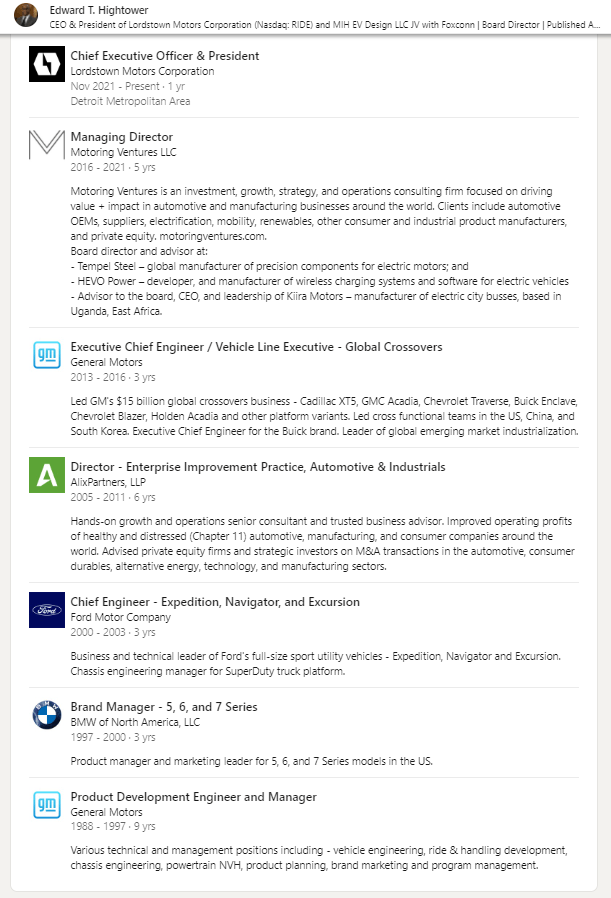

Since the inception of the company, the CEO has been changed twice in less than five years; the first one being Steve Burns, voluntarily leaving the company that he founded a week after amending its annual report with the SEC, stating that the RIDE is at the risk of bankruptcy with insufficient funds to begin commercial production of EVs on 8 June 2021. Subsequently, Daniel Ninivaggi was appointed to help steer RIDE out of bankruptcy in August 2020, after having a successful stint supervising the restructuring process of the Hertz Corporation (HTZ) out of bankruptcy as a director from 2014 to 2021. Naturally, investors would think that the same ripple effect would be replicated again. Unfortunately, as we have noted in our coverage of Foot Locker, a change in management might not solve the issues faced by the company if the root cause has not been resolved. As such, the share price briefly rebounded 21% before continuing its downward spiral. Finally, Ninivaggi moved up to become the Executive Chairman, appointing Edward Hightower as the current CEO to date.

The root cause was rather apparent to everyone but the insiders: no one was an expert in EVs. Starting from its founder, Burns is more of a serial entrepreneur than an industry expert in EVs, despite founding Workhorse Group (WKHS). Remember, WKHS specializes in electric mobility in the last-mile delivery sector, not in the production of electric automobiles and how to ensure profitability. He founded iTookThisOnMyPhone.com, MobileVoiceControl Inc, AskMeNow, PocketScript, Over The Line/AdLink, and the design and development of Suspension Parameter Measurement Machines throughout his career. Next, Ninivaggi is more of a businessman with a proven track record at Icahn Enterprise (IEP), although serving at Icahn Automotive Group for slightly more than 2 years. That is simply insufficient to even understand the entire supply chain of automobiles and how to better improve the efficiency of the vehicle, increase profit margins, etc.

Resume for Edward Hightower (LinkedIn)

We think that the current CEO of RIDE may be the person to turn things around for the company. Given his extensive automobile industry experience and engineering background, RIDE could finally turn things around. However, the company faces another set of issues beyond corporate governance – cash.

After the company announced that it has begun production of the Endurance, its flagship electric pickup truck designed for commercial-fleet use, the company has built two trucks for customers thus far. It expects to complete a third truck shortly. The company aims to deliver about 50 trucks to customers by the end of 2022 and up to 450 trucks in the first half of 2023, as the first batch of RIDE’s saleable vehicles. We think that this lofty goal is rather unachievable given their current progress and the supply chain constraints of automobile parts in the market.

Based on the company’s current projection, it expects to burn about $41 million and $85 million in the third and fourth quarter of this year, leaving RIDE with just $110 million cash on its balance sheet moving into 2023. If the company requires approximately $126 million to produce 50 EVs, it would require significantly more to finish the remaining orders in the first half of 2023.

Valuation

We think that the company would need to raise another $1 billion in capital to build out the remaining orders, projecting the CapEx to be linear with the current Q3 and Q4 projected spending. This would most likely be funded by the issuance of notes, which is a form of healthy debt after its $13.5 million notes payable to Foxconn should be paid down by the end of the year.

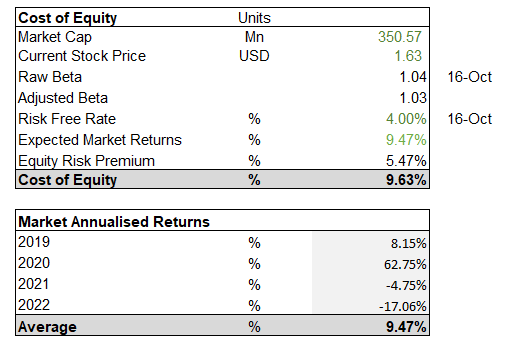

RIDE Cost of Equity (Author’s Spreadsheet)

Despite issuing $27.1 million worth of equity during this quarter, we think that its cost of equity is still higher than the cost of issuing any long-term debt. This is factoring in the current market conditions where the risk-free rate is higher than what it used to be, and expected market returns are depressed by the ongoing market correction. We anticipate an increase in equity risk premium after the macroeconomic headwinds subside, which is costly for the management to continuously raise capital through equity even at this point.

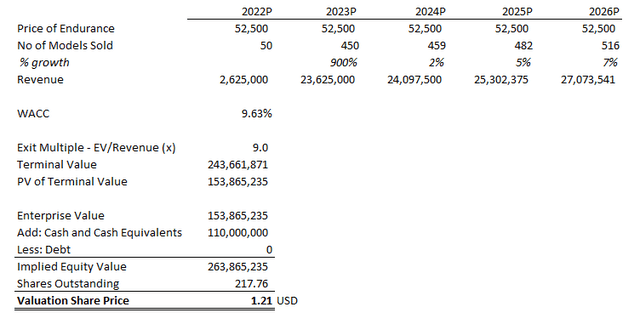

Financial Modelling for RIDE (Author’s Spreadsheet)

To derive a valuation for RIDE, we took the management’s projections at face value and projected that towards 2026 with marginal increases. Assuming the company does not raise any more capital through equity or debt financing after this year, this would mean that the company would finance its CapEx organically from its free cash flow. We decided to use the Exit Multiple method of valuation as the company is not generating any positive EBIT/EBITDA yet. We benchmark the exit multiple according to Tesla’s (TSLA) LTM EV/Revenue, while taking into account Rivian (RIVN), a close peer of RIDE, is 25x. Ideally, if investors see a future of RIDE becoming close to the industry leader, we should be able to get a price target that is 38% lower than the stock price today.

Conclusion

Lordstown Motors is a relatively nascent company with a history of scandals and consistently targeted by short sellers, including Hindenburg Research. We think that the company would need some time to turn around, given a positive change in management. Until it solves its problems with raising capital, the price of the stock is still destined to fall.

Be the first to comment