SWInsider

Freeport-McMoRan Inc. (NYSE:FCX) has suffered substantially through recession fears in the global economy. The company’s share price has dropped by almost 50% over the past 6-months. Despite this weakness, the company’s strong and integrated asset portfolio in a changing market will enable substantial cash flow and shareholder returns.

Freeport-McMoRan 2Q 2022 Performance

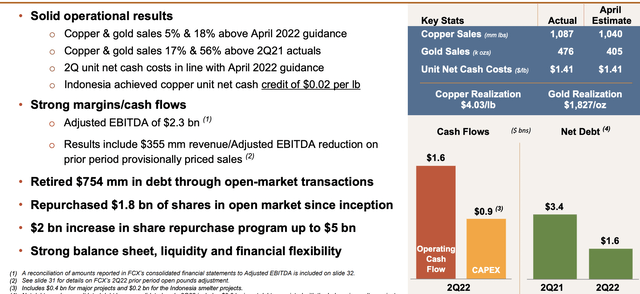

Freeport-McMoRan had a strong quarter, however, recession fears have hurt the company since then.

Freeport-McMoRan Investor Presentation

Freeport-McMoRan has had sales above the company’s guidance and significant YoY growth in its production. The company’s Indonesia unit is so strong that it has a net cash credit per copper pound it produces. That’s akin to having completely free copper production from one of the largest copper mines in the world.

The company has continued to generate strong cash flow, with $2.3 billion in adjusted EBITDA. The company spent $0.9 billion in capex, resulting in $0.7 billion in FCF. The company has continued to repurchase shares, and we’d like to see it expand share repurchases during the company’s share price weakness.

The company has a strong balance sheet and with minimal net debt, it can direct all cash flow towards shareholder returns.

Electric Car Growth

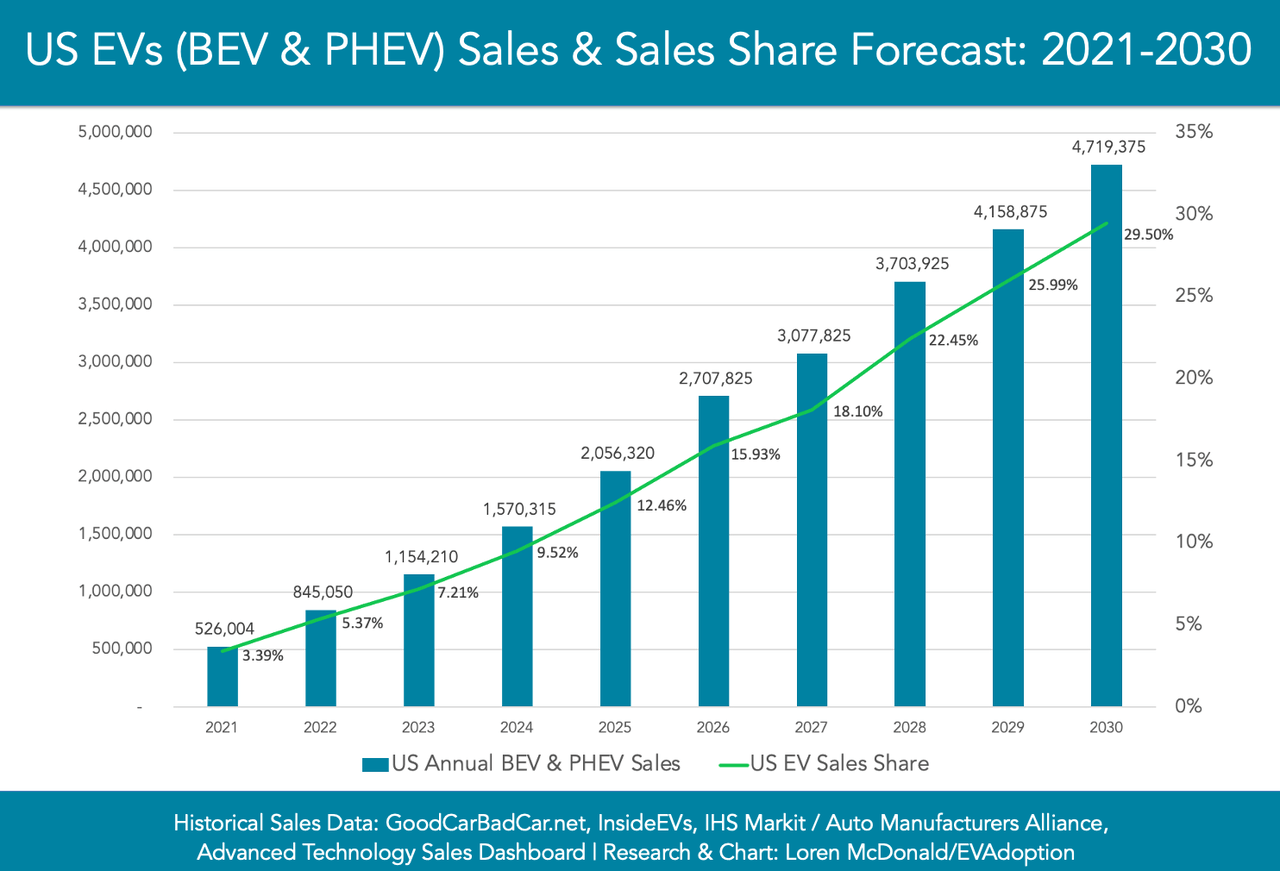

Electric vehicle (“EV”) volume is expected to expand substantially, increasing demand for coppers and other metals.

EV Adoption

Electric vehicle sales are expected to increase rapidly from 5% in 2022 to almost 30% in 2030 in the United States alone. That’s almost 5 million in 2030 EV sales. A fully electrical vehicle uses almost 4x the amount of copper of a normal vehicle, or 60 kg more. That implies U.S. vehicle demand of an almost additional 250 million kg alone.

That’s almost an additional $1 billion worth of copper demand. Across the world, that’s billions in additional copper demand, which will support prices and drive demand for the production. That will all help support prices over the long term.

Recession Fears

Commodity investors tend to be short-term focused due to volatility in cash flow.

The largest current fears in the market are those of a recession. Copper demand is very related to new construction and high-tech construction, making demand extremely volatile in the event of a global economic slowdown. Its cost and ties to these capital projects mean that related projects tend to be delayed in a recession.

Inflation rates have been stubbornly high, and supply chains have been difficult to resolve. Central banks are raising interest rates to control inflation rates, making it something they want to complete at all costs. That could realistically push the globe into a recession, and arguably it already has. Those recession fears are having a strong short-term negative impact on Freeport-McMoRan’s stock.

Freeport-McMoRan Continued Investments

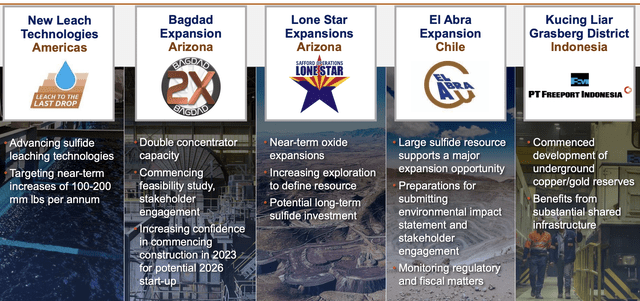

Freeport-McMoRan is continuing to invest heavily in its variety of businesses to the tune of $3 billion in each of 2022-2023.

Freeport-McMoRan Investor Presentation

Freeport-McMoRan’s investments span the globe as the company controls some of the largest copper mines across the globe. The U.S., especially with its large vehicle manufacturing, new laws for defining a vehicle as locally made, and stable geopolitical environment has been a source of focus. The company has been rapidly increasing volumes and plant capacity in Arizona plants.

In South America, where Chile is one of the largest copper producers in the world, the company is evaluating sensible growth opportunities, a long-run strategy that makes sense given forecasts for copper demand to double.

Freeport-McMoRan Shareholder Returns

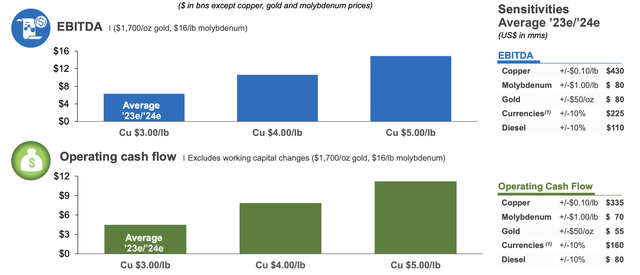

Copper prices have suffered noticeably, impacting the company’s free cash flow (“FCF”) potential.

Freeport-McMoRan Investor Presentation

Current copper prices are just under $3.5/pound, implying roughly $6 billion in annual operating cash flow for the company. That means, given the company’s continued capital spending, FCF is closer to $3 billion for the company. Given the company’s $40 billion market capitalization, that’s an FCF yield of just under 8%.

From that, the company is paying a dividend of 2%. The company has a $3 billion share repurchase program, and we feel that current prices are a good opportunity for the company to take advantage of that. The company has paid an average of more than $38/share so far, so this is a good opportunity to bring that down.

The company does have $11.1 billion in debt and $9.5 billion in cash and cash equivalents for a $1.6 billion net debt position. The debt is well-distributed, and much of it has a 4-6% interest rate, implying roughly $500 million in interest payments annually. That’s a number the company can easily get down paying off debt as it comes due, especially in a higher interest rate environment.

Thesis Risk

The largest risk to the thesis is that short-term cash flow impacts can still have a sizable impact on cash flow. The company nearly went bankrupt from the commodity crash in early 2016. We feel a recession could actually help the company in the long run by delaying new capacity, however, a long recession could hurt the company’s ability to drive strong returns.

Conclusion

Freeport-McMoRan is traditionally susceptible to the impacts of the markets. Commodity companies tend to be massively susceptible and the company’s top commodity, copper, is especially susceptible to fluctuations in the market. As a result, the company’s price and market capitalization have both suffered heavily.

However, the company continues to have an impressive portfolio of assets it’s continuing to spend billions on. There’s substantial and growing long-term demand for copper, especially as the EV transition accelerates. That will enable Freeport-McMoRan to see long-term growth and shareholder rewards, making the company a valuable investment.

Be the first to comment