4FR

Today’s article critically deconstructs BlackRock’s (BLK) iShares MSCI South Africa ETF (NYSEARCA:EZA). As a regional market participant, we discovered potential fault lines within the ETF’s composition. We’re generally bullish on South African stocks. However, investors need to be picky as regional risk is at a multi-decade high. Moreover, we discovered inefficiencies concerning quantitative risk attribution, which needed highlighting.

Holdings Assessed

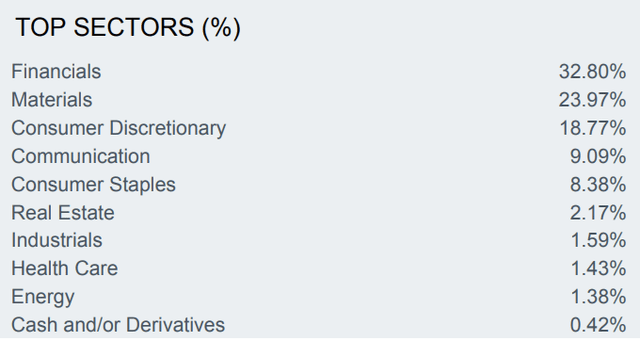

Sector Exposure

The ETF’s sector-based composition comes as no surprise. South Africa’s Johannesburg Stock Exchange primarily consists of basic materials and financial stocks.

It’s easy to see how BlackRock’s team approached its semi-annual rebalancing. Financial stocks are overweight amid rising interest rates (now at 7%). Despite its rising benchmark rates, South Africa’s inflation rate remains resilient, rising by an additional 0.1% to 7.6% in October. Thus, we expect BlackRock to sustain its exposure to the financial sector.

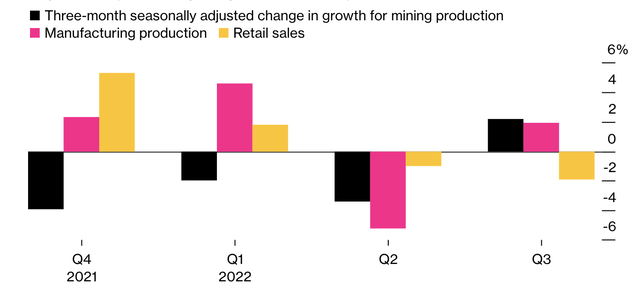

At face value, BlackRock’s strategy seems logical. However, we’re afraid of its financial sector overload as South Africa marginally averted a technical recession in its third quarter. Recession risk remains exceptionally high (elaborated upon later), and financial stocks are susceptible to economic downturns.

South Africa Economic Output (Bloomberg)

The ETF’s materials exposure will likely divide opinion. From an anecdotal vantage point, unlike developed market mining stocks, South African mining stocks can endure recessions as they possess moats with extreme market strongholds. However, a comprehensive global recession might inflict demand destruction, causing a sector-wide slippage.

Lastly, the ETF’s consumer staples exposure seems promising; we’d like to see more weight added to the sector as it would be conducive to the current risk-off market environment. In addition, we think the ETF’s energy exposure is too low; South Africa is a key contributor to Europe’s energy crisis, and coal exposure would’ve been a sound play. However, BlackRock prides itself on ESG, which explains the ETF’s low conviction in energy.

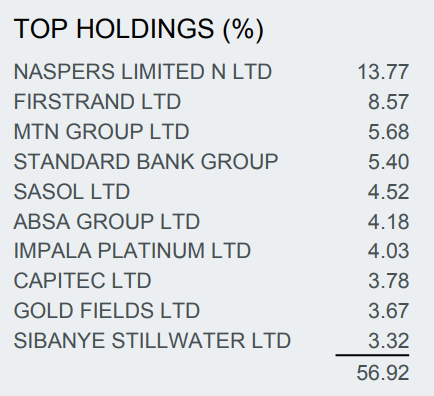

Constituents

Collectively, we’re unimpressed by the ETF’s allocation. Firstly, the fund’s 13.77% exposure to Naspers (OTCPK:NPSNY) is concerning. Naspers’ subsidiary Prosus (OTCPK:PROSY) is the majority shareholder of Tencent (OTCPK:TCEHY), meaning Naspers possesses significant exposure to China. We remain bearish on Chinese stocks as we believe systemic risk will prevail amid rising tensions with the U.S., continuous pandemic lockdowns, and an indefinite ruling by the Communist Party’s President Xi.

Furthermore, the ETF isn’t positioned to take advantage of lucrative coal stocks such as Thungela Resources (OTCPK:TNGRF) and Exxaro Resources (OTCPK:EXXAF). On top of that, we believe the vehicle’s general mining investment thesis lacks novelty as it is invested in big names rather than good opportunities.

Sector Allocation (iShares)

Despite all our negativity, we admire a few of the ETF’s constituents. For example, we’ve previously stated that we believe Impala Platinum (OTCQX:IMPUY) is a lean PGM miner with solid long-term prospects. Furthermore, a sizable commitment to MTN Group (OTCPK:MTNOY) could benefit the ETF’s investors as the telecommunications giant provides a solid risk-off play, especially considering it has a beta coefficient of merely 0.76.

Lastly, Absa (OTCPK:AGRPY) is considered a “best-in-class” South African banking play by ourselves and other analysts. In isolation, Absa provides investors with high-quality emerging market debt exposure.

Regional Risk

South Africa’s systemic risk is at a multi-decade high. The nation’s embedded risks don’t mean the country is uninvestable; however, you must be thoroughly familiar with the landscape to ensure you avoid potential value traps.

Production & Export Risks

South Africa’s energy crisis is deepening. The concern isn’t due to a lack of material resources but instead failing infrastructure. The country’s primary energy producer, Eskom, has all but defaulted amid over-employment, looting of materials, and improper allocation of funds. The situation is dire as South Africa now spends nearly a third of the year in darkness, significantly influencing various industries.

Furthermore, national railways are in tatters as Transnet recently declared its sixth force majeure in eighteen months amid severe cases of looting, cyberattacks, abolishment, fires, and wage strikes.

Despite their fundamental resilience, many of the ETF’s constituents could be affected by infrastructure issues, which investors should keep in mind.

Reinsurance Rates

It was revealed in July this year that Lloyds (LYG) raised its reinsurance rate to Sasria (SA’s special risk insurance association) by 1000% amid fears that the nation’s 2021 looting wasn’t a “black swan” event. Increased reinsurance rates remain an indicator rather than having a tangible effect on the ETF’s constituents. Nevertheless, the signs are that regional risk premiums are exacerbating.

Quantitative Metrics

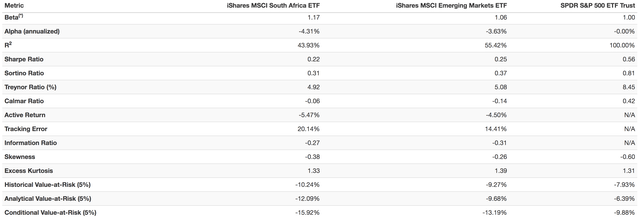

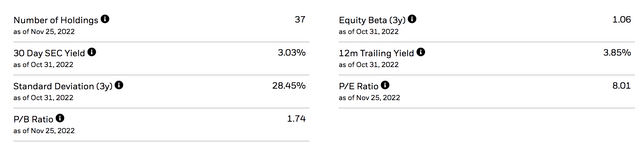

Quantitative metrics are of the utmost importance whenever assessing an ETF as they reveal features such as managerial skill, risk-adjusted returns, and inter-portfolio risk attribution.

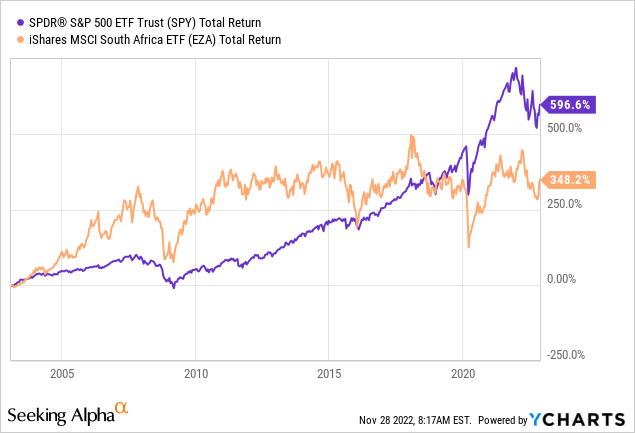

As part of a peer analysis, we compared the ETF to the MSCI Emerging Markets ETF (EEM) and the SPDR S&P 500 ETF Trust (SPY).

- The ETF’s Sharpe and Sortino ratios are unfavorable compared to both its peers, implying that it presents lower returns per unit of volatility.

- The ETF’s active return and tracking errors are worse than the emerging market ETF’s, suggesting poor index tracking.

- A negative information ratio is displeasing and suggests a lack of managerial ‘skill’.

- Excess Kurtosis and negative skewness paint a gloomy picture to those seeking favorable risk-adjusted returns.

Double-click to Enlarge Image (Author in Portfolio Visualizer)

Valuation, Dividends, and Expenses

Despite all of its shortfalls, this ETF might receive support from investors seeking exposure to undervalued, high-dividend, and emerging market assets. The ETF’s price-to-book ratio underscores the SPY’s elevated price-to-book ratio of 3.81x. Moreover, the ETF trumps the SPY’s price-to-earnings ratio (17.66x), implying relative value in abundance.

Furthermore, past distributions imply that the ETF presents investors with a lucrative dividend opportunity. To elaborate, the ETF’s trailing dividend yield of 3.85% exceeds the S&P 500’s dividend yield of 1.64%.

Last but not least, the ETF provides accessibility to a captive market by hosting securities that aren’t easily tradable by non-South African citizens. In addition, it does so at a low cost, with an expense ratio of only 0.58%.

Concluding Thoughts

Fund managers and retail investors alike might opt for portfolio diversification via iShares MSCI South Africa ETF as it hosts a compelling dividend yield and attractive valuation metrics.

However, we argue that the ETF’s allocation efficiency is out of sync, which is conveyed by its asset selection. In addition, quantitative metrics suggest the fund’s risk-adjusted performance is questionable.

Lastly, the ETF’s regional risk is at a multi-decade high, attaching a significant risk premium to the ETF.

Be the first to comment