wildpixel/iStock via Getty Images

By Somya Sharma

Summary

An investment in iShares Exponential Technologies ETF (NASDAQ:XT) is essentially an investment in the technology sector’s future. This fund invests in an index where Morningstar analysts identify key transformative industries to invest in. The fund has a global footprint, provides stock-specific diversification, and plays in high-growth spaces, such as technology and healthcare.

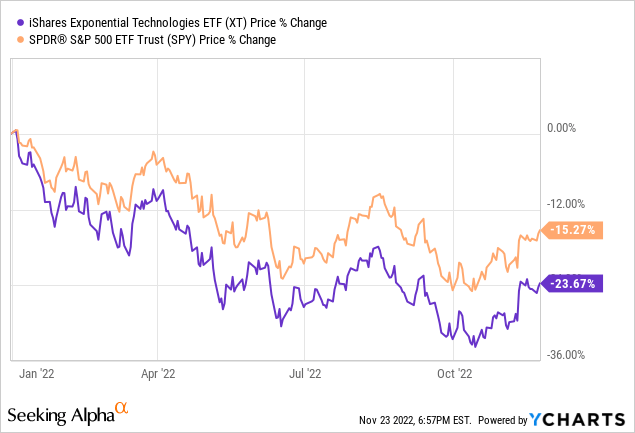

With a near-perfect beta, this ETF is highly correlated with S&P 500, but this year it has underperformed that popular benchmark by a significant margin. We rate this ETF as a ‘Hold’ if you already own it, are thinking very long-term, and can deal with the volatility. We’ll look at it very closely as an aggressive ETF to own once there’s a new bull market.

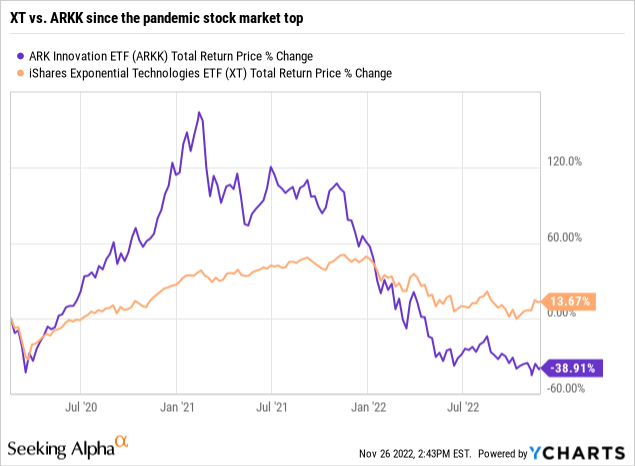

XT vs. ARKK

Cathie Wood’s ARK Innovation ETF (ARKK) has been all the rage since it burst onto the scene during the pandemic. But we prefer XT to go after the “innovative technology” space. There’s less drama here, for at least two reasons. XT is an index ETF, while ARKK is actively-managed. Also, as you can see in the chart below, XT did not track ARKK’s meteoric move higher during 2021, but it still ended up positive since February 19, 2020, pre-pandemic market top. Furthermore, it has outperformed the more popular ARKK by more than 50% since that time! That’s what hype can do to separate investors from their money.

Strategy

XT tracks the Morningstar Exponential Technologies Index. Exponential technology is an emerging innovation that can potentially displace older technologies. By doing so, these businesses can provide meaningful economic benefits to the supplier, user, or producer of these products.

The underlying fund is the subset of the Morningstar Global Markets Index. Morningstar Equity Research analyst team performs the fundamental research to decide the funds to include in the underlying index. In their prospectus, they have identified nine exponential technologies sectors to include in the sub-index. These are:

Big data and analytics, cloud computing, energy transition, fintech innovation, healthcare innovation, hyperconnectivity, nanotechnology, next-gen transportation, and robotics.

These sectors are reviewed annually and focus on issuers developing resources for others or are advanced in their applications. To be eligible, the companies should have at least three-month trailing daily trading volume of more than $2 million and/or float market capitalization of $300 million or more.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Aggressive

- Sub-Segment: New Growth

- Correlation (vs. S&P 500): Very High

- Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

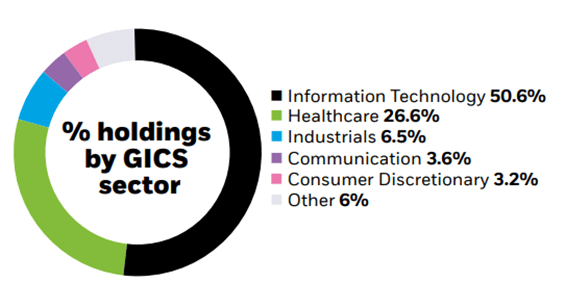

XT is an equal-weighted fund with about 200 securities; thus, it provides a high level of diversification, and greatly reduces the impact of any individual stock. It offers diversified exposure to leading companies in emerging technologies from around the world. The fund invests around 25% in non-US stocks.

BlackRock, as of 9/30/2022

However, innovation doesn’t mean that this fund only invests in technology. It also includes sectors that benefit from advancements in technology. About 50% of the fund’s holdings are outside the tech sector, and a significant share is exposed to healthcare, followed by industrials and communication.

The fund is heavily invested in Giant and Large Market Capitalization stocks, which makes it less volatile, and it has a beta of 1.02 over the past five years, which means, on average, it moves 1.02 times that of the S&P 500.

Strengths

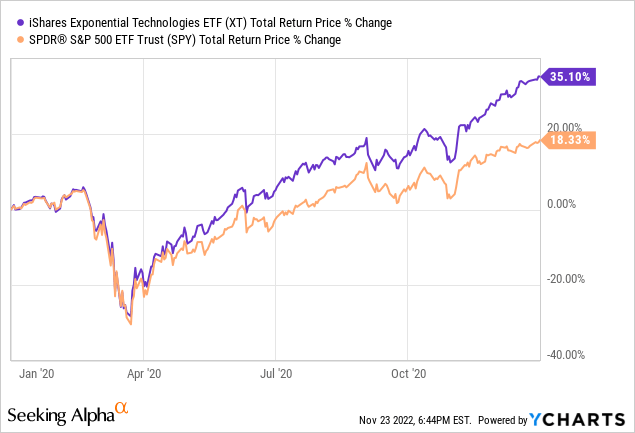

Investors can take advantage of diversification in this ETF instead of betting on a single factor. Investing in it exposes you to giant tech leaders in high-growth sectors. While there will always be risks associated with investments in the high-growth industry, the potential rewards of investing in it are hard to ignore. The Exponential tech sector grew 35% in 2020, outperforming the S&P by two times, and this sector is expected to continue to grow at an incredible rate in the next few decades. Those who are invested early could see significant gains.

Moreover, the fund is equal weightage; the top 25% holdings make up only 21% of the fund, which means small companies can influence results as much as a large firm can do, which is helpful for investors seeking high returns as they can potentially benefit from the growth of these smaller companies.

Weaknesses

While there are many potential benefits to investing in this fund, it is crucial to be aware of the risks involved. One risk that is often overlooked is volatility. While some volatility is expected when investing in technological or international stocks, this fund’s unique approach can make it experience sharp swings in a market like today, leading to significant losses.

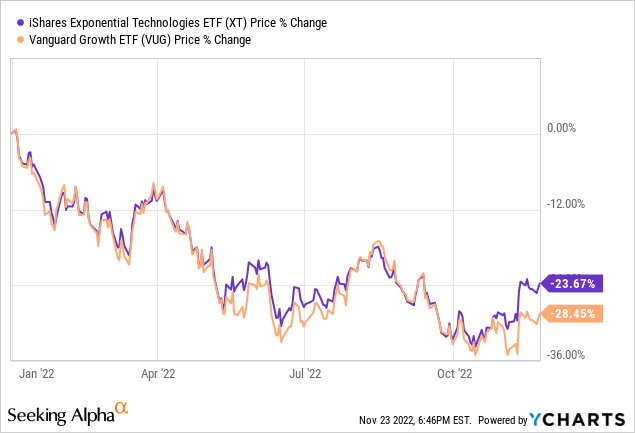

This fund’s index is managed actively, and its expense ratio to 0.46%, which is more than the expense ratio of some of its passively managed counterparts, for example, Vanguard Growth fund (VUG), which has an expense ratio of 0.04%. XT and VUG follow a similar trajectory, with XT leading often.

Opportunities

With the rapid pace of technological change, investing in Exponential tech companies allows you to grab the emerging opportunity at the initial stage.

XT is well-placed to benefit from the innovation and continued rise of the technology sector. Technological advancements are gradually percolating into all industries, providing a new avenue of growth for tech companies. For instance, a recent report by McKinsey & Company found that Internet and Mobile phone usage in Africa is expected to grow sevenfold in 2022. This translates into increased demand for online payments and mobile banking services. With a portfolio that includes leading companies in cutting-edge industries, the fund is blessed for continued success in the years to come.

Threats

The biggest threat for technology stocks this year is valuation. At the start of this year, the valuations of some stocks were at high levels but have slid sharply. The companies that XT invests depend on the equity capital markets. So, these businesses’ financing costs go up when stock prices decline, and interest rates go up. This creates a vicious spiral wherein companies have to spend more money to finance their operations, which in turn causes their stock prices to drop further. This ultimately affects the businesses’ ability to obtain the capital they need to grow and expand.

Moreover, consumer confidence is declining, which is a threat to ETFs exposed to exponential technology. This has resulted in XT underperforming SPY by ~10% YTD. At times like this, XT will likely track the Nasdaq 100 more than the S&P 500, given the tech focus here.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

The fund’s unique investment objective makes XT one of a relatively small set of funds that are both focused on technological advancements and diversified across industries and regions. This fund could be a compelling option for investors looking to profit from the continued expansion of the technology in the long run. It is also near the top of our list for what to consider when a new equity bull market begins…whenever that is.

ETF Investment Opinion

For the most part, the equity markets have been on a tear over the past years, with the S&P 500 Index up more than 25% last year. However, we are now seeing large cracks in the armor, and we are hesitant to be enthusiastic about the prospects for any equity ETF over the next several months.

We rate XT a Hold in the purest sense. If you hold it, can handle the volatility of ETF when tech is out of favor, and keep your investment allocation to it reasonable, it’s a Hold. But if you don’t own it, consider it a short-term trade until the equity bear market resolves itself.

Be the first to comment