ADragan/iStock via Getty Images

Real estate has seen massive price growth in the past two years. Rampant inflation and a passive housing shortage have sent prices skyrocketing. As a result, homebuilders’ profit margins improved and their respective stocks did well throughout the end of 2020 and 2021. Up until that point, the real estate sector was prospering. Since then, high timber prices, supply-chain issues, and the peak of unsustainable growth (or, at least, the fear of its advent) have roughed up the majority of stocks in the sector. The Federal Reserve’s response to this was to presumably deflate the inflation/price bubble as lightly as possible. That being said, the largest interest rate hike since 1994 wasn’t exactly subtle, and real estate stocks have since plummeted given homebuilders’ traditional relationship with interest rates. Despite its incredibly cheap valuation, Beazer Homes USA, Inc. (NYSE:BZH) will likely have a rough 2023, creating a potential buying opportunity.

Company Overview

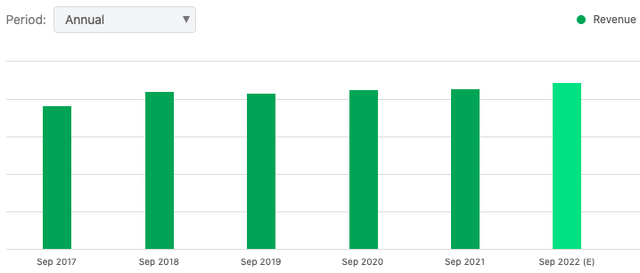

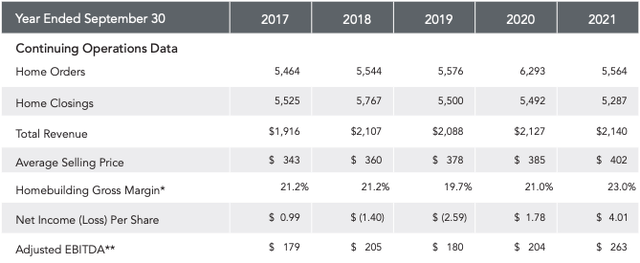

Beazer Homes is a homebuilder headquartered in Atlanta, Georgia. The company constructs homes in thirteen states throughout America. Beazer boasts its competitive advantage in the industry by offering customers to choose their own housing plans and mortgage lenders, personalizing their experience without additional cost. By providing multiple mortgage options, the company stimulates competition between lenders with the hopes of lowering rates and fees for the consumer. In 2021, Beazer Homes closed 5,287 homes with 2,876 units in backlog. I’d like to point out in advance that Beazer has shown to be a relatively slow revenue grower:

Revenue history (Seeking Alpha)

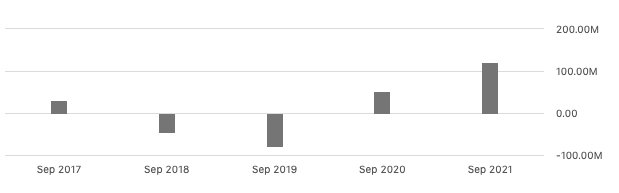

However, the company has seen improvements on all fronts of its balance sheet, increasing operating income, gross profit, EBITDA, and most notably its turnaround in net income:

5yr Net Income (Seeking Alpha)

With a market cap of $401M, Beazer Homes is on the small side of homebuilders and has been traditionally priced cheaper to reflect so. In this questionable housing market, though, this divide has been dramatically emphasized.

The “Coming” Recession

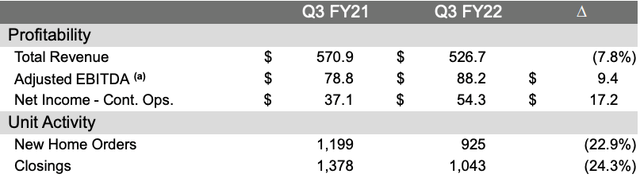

For the past couple of years, housing prices have seen remarkable highs, creating a seller’s market. Yet, if market conditions were so terrible for buyers, what drove sales to begin with? The answer is simple: mortgage rates. Buyers’ largest safeguard against housing prices was record low mortgage rates, and now that the Fed wants to combat inflation through rate hikes, potential home-buyers just lost their greatest brace in real estate. On top of this, the Bureau of Economic Analysis reported negative GDP growth for the second quarter straight. We’re already seeing real estate take a hit through plummeting mortgage demand and Beazer’s quarterly results. Despite relatively strong performance given the company’s rough circumstances, closings in the second quarter decreased 22.3% to 1,078 compared to 1,388 closings in the second quarter of 2021. The trend only continues in the third quarter:

Beazer Q3 Earnings Presentation

Beazer’s CEO, Allan P. Merrill has made several comments about the company’s near future:

While supply chain challenges are expected to continue to impact the level of housing starts and construction cycle times, the larger issue is worsening home affordability as both home prices and mortgage rates have moved higher this year. Although new home orders have not been significantly impacted to date, we expect future periods to present a more challenging sales environment.

The environment for new home sales became significantly more challenging during our third quarter, as higher mortgage rates and rapid inflation – among other macro-economic headwinds – negatively impacted homebuyer sentiment and behavior.

(Source)

In its most recent earnings call, executives outlined their reactions to this changing market as “modest”. They don’t want to sacrifice profitability for maintaining a competitive market share, so price reductions have been relatively reluctant. It appears the company’s plan isn’t to allocate much towards expansion but instead to observe the market on top of an ever-growing cash pile. On the side, executives are focusing on improving book value and expanding lots for future growth through share buybacks and deleveraging. The company’s massive liquidity reserve is supposedly for the sake of capital flexibility given volatile 2023 expectations. In the same earnings call, Allan Merrill describes the market as in a transition period “economically [and] psychologically”. Take away what you will from this, but from what I’ve gathered the company is unsure about its short-term future and the market’s outlook.

Now, why bring all this up? Why mention skyrocketing mortgage rates, interest hikes, rampant inflation, GDP declines, and performance sorrows in the same article about the company I’m rating a buy? Because this isn’t anything new. This isn’t insider information. What I have gathered here is hardly in-depth, complex research, all of it is public information that anybody can access. People know that real estate is in a tricky position, they realize there’s no clear outlook on the horizon, and this uncertainty is priced into homebuilders. Beazer Homes isn’t this cheap due to sentimental noise alone. Before throwing price multiples around without context, it’s necessary to first understand the market’s situation. And from there, determine how accurate the market’s prices are.

Valuation

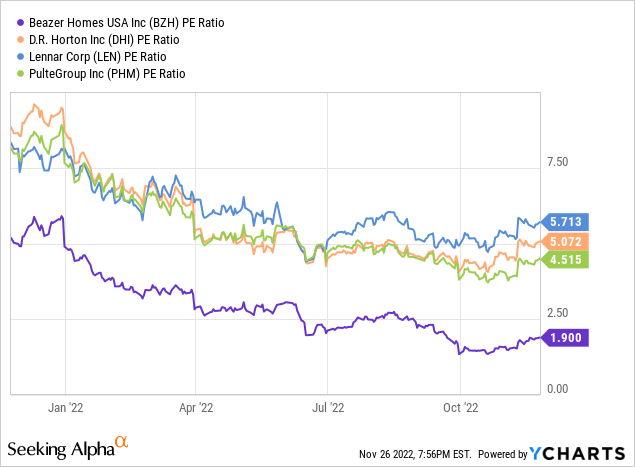

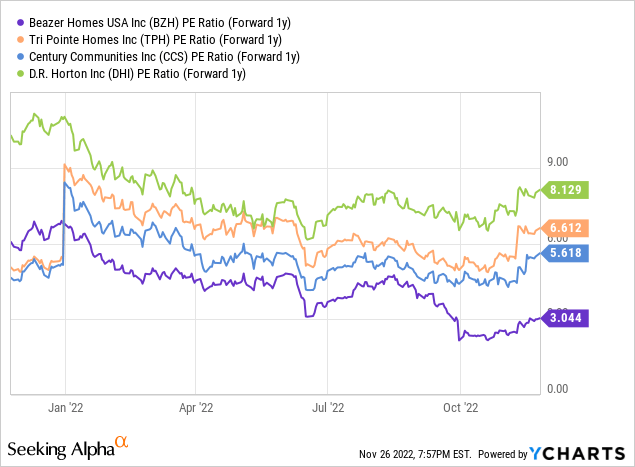

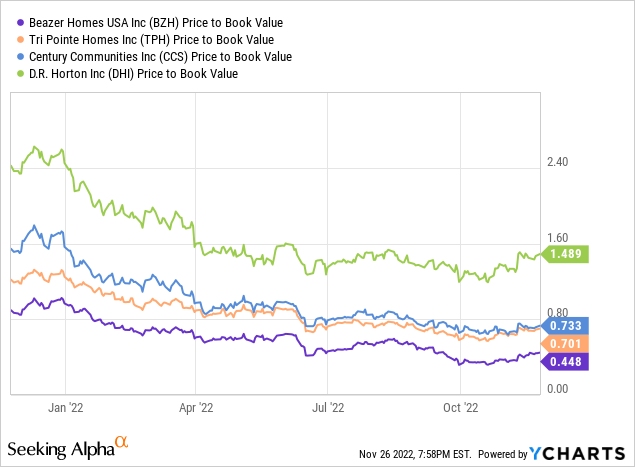

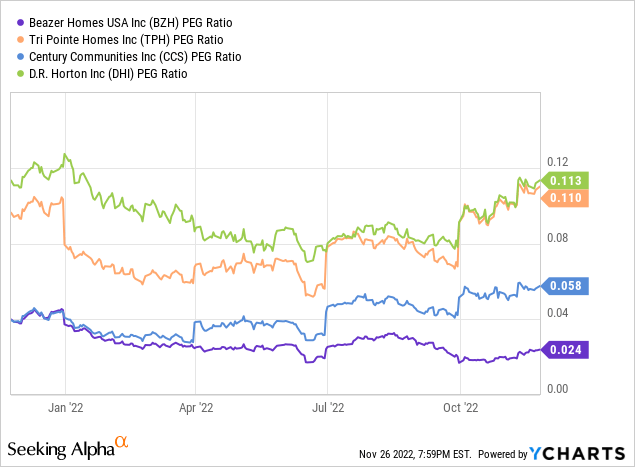

Comparing Beazer to its historic valuation alone will make the company look cheap, but nearly every other homebuilder’s valuation has tanked as well:

Compared to other small and medium-cap (plus D.R. Horton Inc. (DHI) for scale, the largest U.S. homebuilder) however, Beazer Homes is far cheaper:

Lower price multiples in a bull market usually represent a lack of quality, popularity, and/or a mispricing. In the event of a recession, though, lower margins could serve as a cushion against financial trouble. Here, it’s a mixture of Beazer’s profitability and smaller market cap—Doctor Horton has a massive $24.8B capitalization and 19% return on total assets against Beazer’s 8.22%—that sets its cheap price tag. This isn’t a standalone instance; Beazer Homes generally appears to have weaker profitability fundamentals compared to homebuilders big and small:

| Beazer Homes USA, Inc. |

Century Communities, Inc. (CCS) |

Legacy Housing Corporation (LEGH) | Dr. Horton, Inc. | |

| Gross Profit Margin (%) | 22.41 | 27.42 | 42.26 | 29.99 |

| EBITDA Margin (%) | 10.74 | 18.26 | 30.63 | 23.11 |

| Return On Common Equity (%) | 23.83 | 33.73 | 17.54 | 34.93 |

| Return On Capital Employed (%) | 10.98 | 25.38 | N/A | 31.76 |

| Return On Total Assets (%) | 8.22 | 15.38 | 13.60 | 19.28 |

| Forward 1y P/E | 3.98 | 3.02 | 7.11 | 8.52 |

(TTM Data from YCharts and Seeking Alpha)

From these numbers, Beazer’s valuation appears a bit more justified. Historical prices tell a different story. Take the company’s situation at the end of 2019: $73.57M EBITDA, -4.27% ROA, and $1.97B in assets selling at around 0.80 P/B and 0.22 P/S. The company most recently made $223.33M EBITDA, with an 8.22% ROA and $2.22B in assets, selling at 0.49 P/B and 0.19 P/S. Furthermore, these numbers are from pre-2020 and 2021, when the stock market’s prices largely ignored the economy’s dismal state. Despite low revenue growth, the company has certainly improved on several major fronts. As outlined before, the Board’s focus isn’t on expanding the company so much as improving on its existing means. Although Beazer still isn’t on the same level of efficiency as larger homebuilders, the Board’s actions have returned pretty consistent results (note that while home prices may have contributed to income, net income per share far outpaced the increase in prices):

Historical Closings (Beazer Homes 2021 Annual Report)

At the time of writing, Beazer Homes is priced at $13.46 and in the final quarter of 2021 closed 1,407 homes. In the third quarter of 2022, the company closed 1,043 homes. Now for the hypotheticals, during the great real estate crash, closings plummeted from 18,361 in 2006, to 12,020 in 2007, and finally 7,692 in 2008. According to Statista, annual U.S. home sales dropped 36.81% during the crash. Let’s assume Beazer’s net income drops 30% in 2023 due to lower demand and a decrease in price following an oversupply of homes. $120.02M to $84.14M over 30.5M diluted shares outstanding yields a net income per share of $2.76. At its current price, this would reflect a P/E of 4.88. Compared to the sector’s median of 9.26 times earnings (it’s hard to determine a typical price multiple with Beazer’s historical broken-up valuations), this valuation hardly seems accurate. In fact, net income would have to collapse to $44.33M, a 63.06% drop, just to match the sector average, and that’s not taking into account the likelihood that the stock price would fall further in the event of bad news. Given a 42% drop from its 52-week high, it appears the market has priced in a recession as if it’s already happened. Of course, real estate could always collapse if the Fed gets too aggressive, but homebuilder valuations are already reflective of a big hit to revenue. While I doubt such an extreme bear case will happen, since the 2007 bubble developed from more fundamental problems than inflation, several risks can’t be ignored.

Risks and Liabilities

The Debt Problem

Beazer Home’s biggest drawback is its debt. In 2015, total debt reached $1.528B. Since then, the company has been slowly paying its dues at around $50 to $80 million a year, reduced to $1.068B in 2021. Interestingly, the Board has been able to build the company’s balance sheet without serious trouble from retiring debt. Still, it’s obviously not an advantage (especially in a high-interest environment). CEO Allan P. Merrill stated that he expects to reduce debt to below a billion by the end of the year on top of earning around $6.50 per share (insane growth, though not likely to continue) by the end of 2022. On May 11, the company revealed a repurchase program to buy back $50 million of shares. While this is a first step towards supporting a beaten-down stock, if the Board truly wanted to reward shareholders, the money’s better off paying down the company’s debt load. The share buyback is a nice gift to investors, but removing this financial overhang should be at the top of the Board’s priority.

Lagging Recovery

How severe revenue and closings will drop is one question, how quickly they’ll recover is another. One thing’s clear: the Fed intends to continue rate hikes through 2023 or a “terminal rate of 4.3%”. Either way, mortgage rates are hardly fast-moving indicators and it will likely take some time for the Fed’s actions to yield results. In the most recent CPI report, inflation rose slightly less than expected, signaling a potential peak in rising prices. It’s obvious that a single report alone is not nearly enough indication and might simply be volatility, so the question of the number of upcoming rate hikes still stands.

Conclusion

Beazer Homes USA has seen incredible improvements on its balance sheet despite stagnant revenue. However, untamed inflation, an uncomfortable sum of debt, and plummeting mortgage demand have largely canceled out any response the stock might’ve had to the good news. The Fed’s policies will certainly result in financial headwinds for homebuilders, the question is whether the market’s expectation of the level of damage is accurate. In anticipation of a hit to income, investors have pinned cheap prices on homebuilders as a whole, but Beazer’s valuation seems extreme compared to others. While management needs to address debt in a more aggressive manner and inflation woes will likely last throughout 2023, progress appears to be in the making for both of these issues. Ultimately, Beazer Homes has potential long-term, turnaround value in its improved efficiency, and cheap valuation.

Be the first to comment