xavierarnau/E+ via Getty Images

Main Thesis & Background

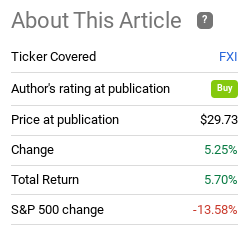

The purpose of this article is to discuss the iShares China Large-Cap ETF (NYSEARCA:FXI) as an investment option at its current market price. This is a fund I covered for the first time back in April, when the underlying weakness in Asia, and China specifically, caught my attention. I thought large-cap Chinese equities have sold off a bit too aggressively, and thought FXI may make for a reasonable hedge against ongoing volatility here in America. In hindsight, this was indeed a smart move, as FXI has shown sharp outperformance since that review was published:

Fund Performance (Seeking Alpha)

Given this divergence, I decided to take another look at FIX, to see if I should change my rating from here. This review is especially timely because FXI had been up by double-digits post-article at one point, but macro-pressures have pushed Chinese equities in to some serious short-term weakness. As a result, investors who picked up the fund then are still holding on to some profit, but it looks precarious at best.

After review, I think it is indeed to take a more cautious stance on this particular fund. China is seeing some bearish momentum, warranting a shift to a “hold” rating, in my view. The government continues to crackdown on its Tech sector, is taking a more aggressive approach to COVID-19 than most nations around the globe, and the stronger dollar is weighing on foreign currencies, in Asia and elsewhere.

China Seeing Short-Term Weakness

To start, I want to highlight that Chinese stocks are losing momentum right now. Certainly the market as a whole is feeling a lot of pressure. This is true in the U.S., Europe, most developed markets, as well as other emerging markets. But readers should note that Chinese stocks have begun to under-perform the world index. This is in stark contrast to the weeks and months immediately following my buy article on FXI, when the fund shot up quickly. Today, Chinese equities are losing ground against their peers:

China vs The World (Bloomberg)

I bring this up because the bullish price action for this theme is eroding quickly. In my view, that signals it is time to take some profit, if one has not already done so. The outperformance against the U.S. and the world was fruitful, while it lasted, but that is a trend that was bound to correct at some point. That correction appears to be taking place today, and investors probably want to protect at least part of their position against it.

Reasons For The Weakness Are Fundamental

Of course, it is important to understand the reasons why this weakness is occurring. This is critical to deciding if taking a position now represents a value opportunity, or a value trap. After all, when I see broad weakness that can often be a contrarian signal, so perhaps that is the case right now.

Unfortunately, I do not believe it is. The markets in China are plunging for very valid reasons. One in particular is the renewed regulatory crackdown within the Tech/Consumer sector in China. This had been a headwind for a whole within the country, but I noted back in April that regulators had been backing off a bit of late – likely in an effort to jumpstart the sector and the economy. Fast forward to today, and the tone has shifted again, this time in favor of more critical regulation.

Specifically, just this past week we saw executives from Alibaba’s (BABA) cloud division summoned for talks by authorities in Shanghai. This was in connection with the theft of a database, resulting in potentially stolen data on as many as one billion residents. Compounding this, regulators in Beijing fined a slew of the country’s largest internet companies, including BABA, for failing to make proper antitrust declarations on previous deals, as reported by Morningstar.

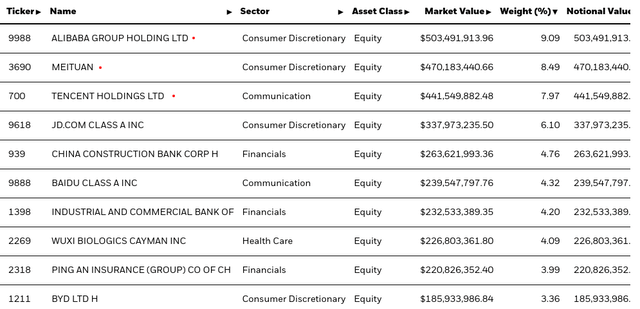

These actions and fines have caused investors to take a renewed approach to the regulatory risk facing some of the biggest names in China, which also happen to be top holdings in FXI:

Just how important is this to FXI? Well, consider that on the backdrop of these actions and fines, BABA has dropped over 15% this week alone:

BABA Stock Movement (Yahoo Finance)

My point here is that FXI is coming under pressure for very valid reasons. The Chinese government is proving that it is not going to set aside regulatory actions and enforcements to placate the market forever. While a shift in tone occurred earlier this year, those days may be over, and investors need to reassess this risk before diving in to positions at the moment.

Rising Dollar A Headwind

Another factor that has changed since my April article is that the U.S. dollar is getting a ton of bullish momentum. To be fair, the outlook for the dollar was reasonably strong going in to 2022 with expected Fed rate hikes on the agenda. But with inflation rising faster than almost every government official predicted in the first half of the year, the Fed is being forced to move in an even more hawkish manner. With the exception of only a few nations, such as Canada, the U.S. is doing more to support its currency through rate hikes than most of the globe. This includes emerging markets especially, since they are the most vulnerable to a rising dollar as they are often more heavily dependent on trade and have overweight exposure to certain sectors or products.

To see why this matters, consider the world stock index has moved in an inverse manner with the dollar through most of 2022. WIth the dollar spiking in the immediate term (the last few weeks), that coincides perfectly with the renewed weakness in Chinese equities, and FXI by extension:

Dollar vs. World Stock Index (Bloomberg)

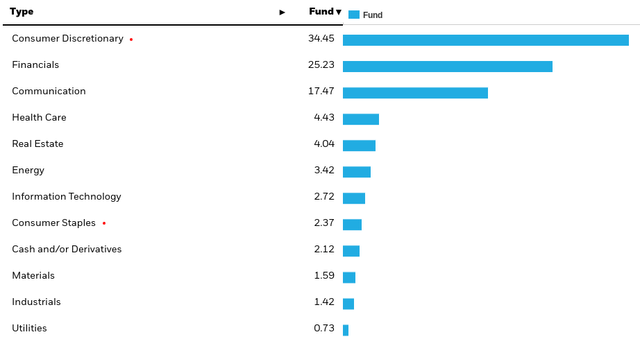

While this extends across the globe and not just to China alone, it is worth pointing out as it does relate to FXI. Aside from the obvious macro-implication, readers should understand that FXI is heavily exposed to consumer spending. Over 1/3 of the fund sits in either the Consumer Discretionary or Consumer Staples sectors, as shown below:

FXI Sector Weightings (iShares)

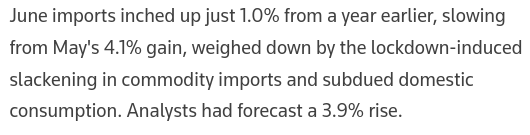

With the dollar continuing to climb, this is a headwind we need to take in to account before buying in to a fund that is so consumer dependent. In fact, while exports from China showed strong figures in June, weaker imports may be relevant to these thesis, suggesting some underlying consumer weakness:

Chinese Import Figures (Reuters)

The conclusion I draw is to approach this fund cautiously for the time being. It is heavily reliant on Tech and consumer spending, both of which are coming under pressure in China for different reasons. This makes me unable to continue to support a “buy” rating going forward.

China’s COVID-Policy Is Disproportionate To The Globe

Another headwind for Chinese equities is the on-going response to COVID-19. Now, I want to emphasize that taking a more proactive approach to the pandemic and health safety is not an inherent “bad” thing. While we can argue the merits behind the individual actions the Chinese government is taking, I don’t want to come across as suggesting that a hands-off approach to COVID-19 is superior. While perhaps good for economic activity in the short-run, a worsening pandemic can have negative longer term impacts, which is clearly something we want to avoid. So while I am suggesting China’s approach to COVID-19 is disproportionate and could hurt equities, I am not faulting them on for taking this mandate for health purposes.

Nevertheless, this is an investment-oriented article. China’s “Zero Tolerance” policy has renewed fears of a resurgence of COVID cases across the country. This has led to lockdowns, driven by an uptick in cases in Shanghai and the resurgence of some cases in Macao. This has led to some risk-off sentiment, as well as a sell-off in the casino stocks that Macao relies on.

This stands in stark contrast with economies in Europe and North America which have largely reversed course on lockdowns and mandates. While there could be a renewed push in that regard as we enter the fall and winter season, so far that has been resisted. On the other hand, China is willing to forgo economic growth in an effort to fight the spread for COVID. This may or may not prove successful in time, but there is no getting around the economic weakness it creates. This clouds the investment outlook for FXI.

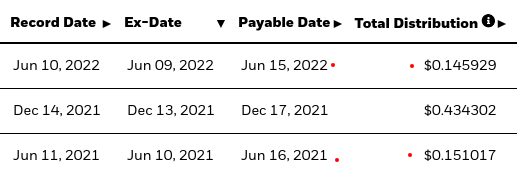

Dividend Story Does Not Impress

A final point on FXI in particular concerns the dividend. As my name implies, this is a focus on most of the investment I make (or choose not to make!). With respect to FXI, the dividend story is not one I can really get behind in 2022. With a current yield under 2%, that is not very exciting in a rising rate environment. Further, dividend growth was slightly negative in June compared to a year ago, which is a metric I am very critical of:

FXI Distributions (iShares)

My takeaway is simply that the dividend isn’t a reason to buy this fund. While I don’t see the story as being extremely pessimistic, it isn’t a tailwind either. In fairness, a 2% yield and flat dividend growth is not awful, but I want to see either rising dividend payouts or a higher absolute yield at the moment, given how aggressive the Fed is being. At this time, FXI offers neither.

A Buy Case Could Still Be Made

My tone in this review has certainly been negative. This is largely due to me wanting to justify why I am downgrading my opinion on FXI, despite its outperformance in the three months since I last covered it. Yet, I will emphasize I am not outright “bearish” on this fund. While I see some headwinds on the horizon that will limit gains in the next few quarters, it is fair to say there is weakness across the globe. So, while China has a challenging outlook, the same can be said for many countries, including the United States.

I bring this up because while the investment landscape in Chinese equities isn’t great, it could still prove to be a reasonable hedge against U.S. stocks. This is important because that is a primary reason I look to EM in the first place – whether it is China or any other non-developed economy. The equity markets in these regions tend to have lower correlations with U.S. stocks than other developed markets. So they remain a viable hedge.

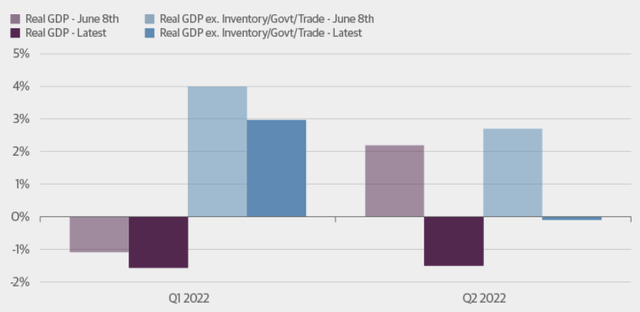

For support, consider that the U.S. is facing its own challenging backdrop. With sky-high inflation, a hawkish Fed, and a weakening consumer, GDP growth is coming in below expectations:

What I am getting at is that the S&P 500, or U.S. markets in general, are not exactly screaming buys right now either. So if one is already heavily overweight American equities, than a move in to the EM space, whether through FXI or another option, can definitely be justifiable. To me, I see more risks than benefits, but that outlook can change quickly if we get some positive macro-news. Therefore, positions in FXI can continue to be justified for the right investor with either a more positive outlook on China or a more pessimistic outlook on the U.S. (or other developed markets).

Bottom-line

This is a difficult investment climate, there is no getting around that. With this in mind, it could be tempting to continue buying FXI at these levels. After a drop in price, the fund still leads the S&P by a healthy margin over the past quarter. That’s the good news.

However, I am more inclined to take some profit here, rather than “double down” on this weakness. The reasons are multi-fold. The momentum case is deteriorating for a few very important reasons. One, Chinese regulators are getting more aggressive again. Two, an uptick in COVID cases has prompted an aggressive response by the Chinese government. This is negatively impacting economic growth. Three, a stronger dollar is putting pressure on EM currencies, including China’s, and that is a trend unlikely to change in the short run. Therefore, I am shifting my rating on FXI to “hold”, and suggest readers approach positions cautiously at this time.

Be the first to comment