MichaelRLopez/iStock Editorial via Getty Images

Investment Thesis

In February this year, I had a Hold stance on Shell plc (NYSE:SHEL) in my last article. At that time, the share price was USD $54.85, which I thought was a fair price, but not attractive to add more to my position

It has now come down 16%, and we shall revisit the investment to see if there is a change in my stance.

At an attractive price, I may add to my position, as I believe SHEL’s superior free cash generation will benefit shareholders in the long run.

A Bullish Call On Oil And Gas

If the Executive Director of IEA, Fatih Birol is right about the world going into an oil-induced inflationary pressure worse than what we saw in the 1970s and potentially lasting longer, it is not unthinkable that we could see further increases in the price of oil.

The world has never faced a catastrophic energy crisis of this depth and complexity. This is affecting the entire planet. We may not have seen the worst of it yet” – IEA Executive Director Fatih Birol.

I believe that it is also unlikely that we will see much lower prices for natural gas anytime soon, since the EU is facing the task of shifting reliance from Russia to other suppliers.

SHEL generated USD $14.8 billion in free cash flow from operation in Q1 this year, which is more than Exxon Mobil (XOM) and Chevron (CVX) combined. That is impressive.

Despite the British lawmakers passing a bill to levy a “25% windfall tax” on oil producers from their production in the UK, this will have little effect on SHEL. I believe that we will see decent growth in earning from Shell plc. (SHEL) from second quarter 2022.

Shell Valuation

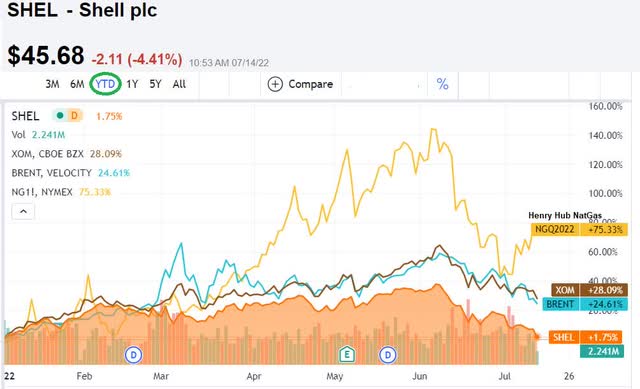

Since the middle of June, we have seen a decline in the share price of the oil majors. It is interesting when we compare the development YTD of the share price of SHEL against Exxon Mobil and the price of Brent crude and Natural Gas ex Henry Hub.

SHEL versus XOM and Brent and NatGas (SA)

The share price of XOM is following the price of crude quite well, both being up mid-20s percentage points this year. Why is SHEL up only 1.75% YTD when we can see that the natural gas price is up as much as 75%?

I look forward to hearing what the SA community has to say. Please comment.

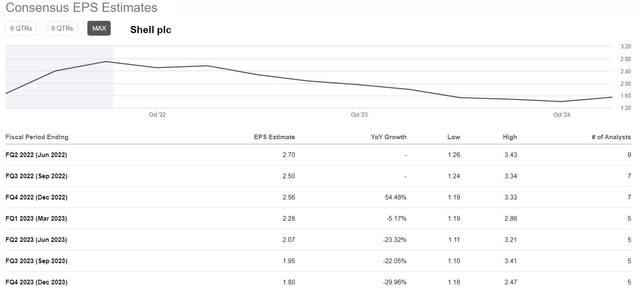

Analysts are upbeat about an improvement in earnings for the 2nd quarter, which is coming out on 28 July, but they are less sanguine about earnings later in the year and 2023.

SHEL – consensus EPS (SA)

Perhaps these analysts believe in a prolonged recession resulting in demand destruction for gasoline, diesel and jet fuel, and even natural gas and LNG.

They believe that on average the EPS will drop by 33% from Q2 this year to Q4 next year, but I believe they are too pessimistic.

It is clear to me that Europe’s current energy problem will take several years to solve. In the meantime, there will be elevated prices of natural gas and crude oil. SHEL is set to benefit from this despite additional windfall taxes.

Demand for oil and gas in China should pick up now that they are coming out of the worst lockdowns for COVID-19. A potential risk to this thesis is a resurgence in infections and a Draconian lockdown limiting people’s movements.

Return Of Capital To Shareholders

We should consider SHEL’s return of capital to shareholders.

In terms of the dividend, it is not particularly attractive at a yield of just 4%

It was acceptable for me when we were living in a zero interest rate environment that SHEL yielded just 3 to 4%. We should have realistic expectations.

However, now that the risk-free return on U.S. 10-year Treasury notes is at 2.96% it leaves you with a very small equity risk premium of just 1.04% on SHEL’s yield.

Not much of a premium.

There is a chance that management and their board will bump the dividend up more than the 4% increase per year which was earlier communicated. They have done that before. Elevated oil and gas prices may be the catalyst that will bring even higher free cash flow generation. They should revisit their policy of returning just 20-30% of their EPS in the form of a dividend.

Some of their large institutional investors may call on them to offer a higher dividend going forward in view of their ability to pay more.

Nevertheless, I believe they will continue to buy back their shares instead.

Their most recent share buyback program of $8.5 billion was completed on the 5th of July 2022. If we use an estimated average price of USD $53 per share, they have then bought back roughly 160 million shares. This equates to about 2% of all the ordinary shares outstanding.

Conclusion

I will be very surprised if the Q2 results are not better than the previous quarter. It should be higher.

What is more important is the trend for the oil and gas market and refinery margin in the coming year. I do believe the analyst community is too pessimistic with their earnings projects for SHEL.

However, I maintain my hold before we can get some more clarity on these important commodity prices and how they will impact SHEL.

Be the first to comment