Lemon_tm

California Water Service (NYSE:CWT) has incurred a 22% correction this year, in tandem with the broad market. This is an unusually steep correction for this high-quality utility stock, which is normally characterized by low volatility. The correction has resulted primarily from the surge of inflation to a 40-year high, which has rendered the dividend of the utility less attractive. Nevertheless, as the stock is still trading at a forward price-to-earnings ratio of 30.3, investors should wait for a further correction of the stock before initiating a position.

Business overview

California Water Service is the third-largest public water utility in the U.S. The company provides water to more than 2.1 million customers in California, Hawaii, New Mexico, Washington and Texas.

Thanks to the essential nature of water and the regulated nature of its business, California Water Service is immune to recessions. To be sure, in 2020, when the coronavirus crisis caused a fierce recession, the utility posted all-time high earnings per share of $1.97. The immunity to recessions is paramount in the ongoing bear market, which has resulted from fears that the aggressive interest rate hikes of the Fed may cause a recession.

Given the resilience of California Water Service to recessions, some investors probably wonder why the stock has shed 22% this year. The reason is the surge of inflation to a 40-year high and the resultant interest rate hikes of the Fed, which have rendered the dividend of the utility less attractive.

On the bright side, California Water Service has exhibited a solid performance record thanks to the consistent rate hikes it has earned from regulators, who have done their best to ensure that the company will keep investing in the maintenance and expansion of its infrastructure. During the last nine years, the company has grown its earnings per share at a 7.5% average annual rate. This is certainly an attractive growth rate, especially given the reliability and resilience of the utility.

California Water Service has somewhat stumbled this year due to exceptional drought conditions in California, which have led the Governor to somewhat restrict water consumption. Consequently, California Water Service is expected by analysts to incur a 6% decrease in its earnings per share this year.

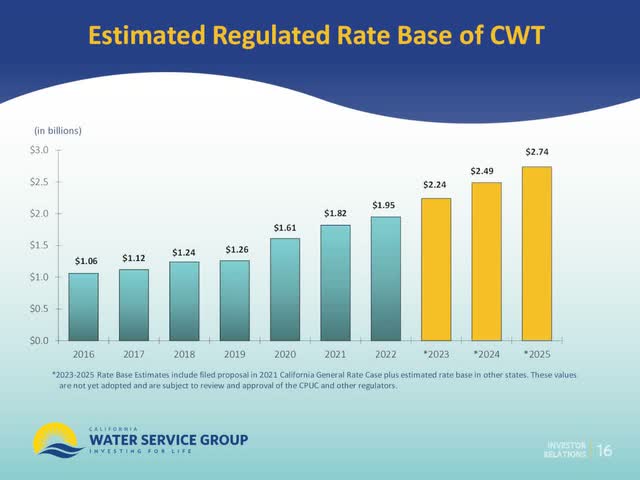

However, this is just a temporary headwind for the company, which is in a solid growth trajectory. To be sure, management expects the regulated rate base to grow approximately 40% over the next three years, from $1.95 billion in 2022 to $2.74 billion in 2025.

California Water Service Growth (Investor Presentation)

Thanks to the expected rate hikes, analysts expect California Water Service to grow its earnings per share by 6% per year on average over the next three years. Such a growth rate is somewhat lower than the aforementioned historical growth rate of California Water Service, but it is still attractive for a stock with such a predictable growth trajectory.

Valuation

Valuation is important for all stocks but it is paramount for slow-growth stocks, such as utilities. If investors purchase a slow-growth stock with an excessive valuation, they may need many years only to breakeven. Therefore, investors should pay special attention on the valuation of California Water Service before purchasing the stock.

Unfortunately, the investing community seems to be well aware of the unique advantages of California Water Service, namely its immunity to recessions and its reliable growth trajectory. To be sure, the stock is currently trading at a forward price-to-earnings ratio of 30.3, which is undoubtedly excessive for a utility stock. This means that the stock has a remarkably premium valuation, despite its 22% correction this year.

Some investors may claim that California Water Service has almost always traded with a premium valuation, with an average price-to-earnings ratio of 27.8 over the last decade. However, it is important to realize that the last decade has been characterized by nearly record-low interest rates and hence the dividend of the utility has been exceptionally attractive. This is not true in the current investing environment, in which the Fed is raising interest rates aggressively in an effort to keep inflation under control.

A more attractive entry point for California Water Service would be the technical support of $48.50, which is the recent low of the stock. This stock price corresponds to 21.8 times the expected earnings per share of $2.22 in 2025. Some investors may still view this valuation level as lofty, but they should be aware that it will be hard to find this high-quality utility at a cheaper valuation level.

Dividend

California Water Service has grown its dividend for 55 consecutive years and hence it belongs to the best-of-breed group of Dividend Kings. There are only 31 stocks that have grown their dividends for more than 50 consecutive years and hence the accomplishment of California Water Service is undoubtedly admirable.

Moreover, the stock has a payout ratio of only 56% and has promising growth prospects ahead. As a result, investors should rest assured that the utility will continue raising its dividend for many more years. Management has raised the dividend by 6.4% per year over the last five years. As the company is on track to grow its earnings per share by approximately 6% per year in the upcoming years, it is likely to keep raising its dividend at a rate close to its historical rate.

On the other hand, due to its premium valuation, California Water Service is currently offering just a 1.7% dividend yield. Such a low yield is insufficient to render the stock attractive for income-oriented investors at its current price.

Final thoughts

California Water Service is a high-quality Dividend King, with immunity to recessions, a solid performance record and promising growth prospects ahead. As the stock has incurred a 22% correction this year, some investors probably think that the stock has reached bargain territory. However, the stock remains richly valued and hence investors should probably wait for a further correction, towards the recent low of $48.5, in order to enhance their future returns.

Be the first to comment