gk-6mt/iStock Editorial via Getty Images

United Airlines Holdings, Inc. (NASDAQ:UAL) has faced its share of turbulence with the airline industry among the hardest hit by the pandemic. The story now is the ongoing recovery with demand just beginning to approach peak 2019 levels. Ahead of the upcoming quarterly report, the stock has been under pressure against concerns over high fuel costs and uncertainties regarding the strength of the global economy.

That said, we’re taking a bullish view on UAL considering what we believe is its attractive value amid the current market volatility. With 2022 a transition year, the company benefits from several tailwinds including a long-term growth strategy and a plan to drive earnings higher through operational and financial efficiencies. There’s a case to be made that air travel demand can outperform expectations this year while the latest pullback in the price of oil is also positive for the stock.

What To Expect From UAL’s Earnings

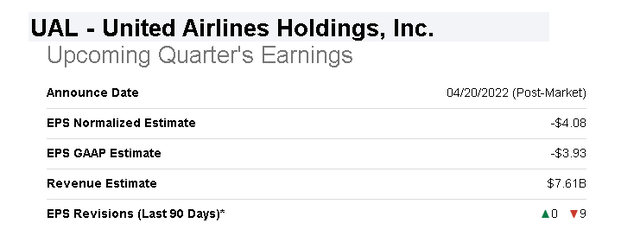

United Airlines is set to report its Q1 earnings on Wednesday, April 20th after the market close. The consensus revenue estimate at $7.3 billion, if confirmed, represents an increase of 136% from the period last year. A lot has changed since Q1 2021 with the widespread availability of Covid vaccines getting people more comfortable flying while the return of international routes into the U.S. in late Q4 has also helped to improve the outlook.

On the other hand, United is expected to report another loss with negative EPS of -$4.08 which reflects ongoing Covid disruptions as well as higher costs. Looking back, the year started with the Omicron-variant wave in early January that kept travelers at home and forced thousands of flight cancellations across the industry. In this regard, the Q1 earnings will continue to be dragged lower by Covid related issues while the forward outlook is more positive.

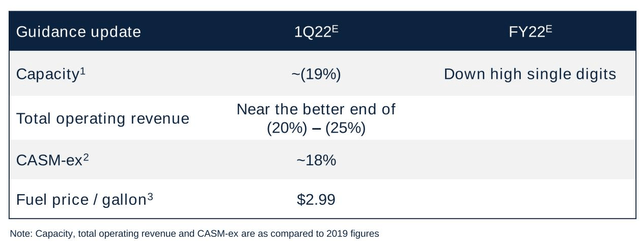

In terms of the latest company guidance from an investor event in March, management sees capacity still around 19% lower than 2019 levels for Q1. The expectation is that this measure narrows throughout the year and ends 2022 averaging down in the “high single digits” but turning positive by Q4.

For the key financial metric of cost per available seat mile excluding fuel charges (CASM-ex), the company sees the level up near 18% from Q1 2019. CASM this quarter reflects the broad inflationary trends including higher labor costs while the rise in fuel prices will separately add to expenses. Putting it together, the reduced capacity and higher costs in Q1 explain the ongoing earnings weakness.

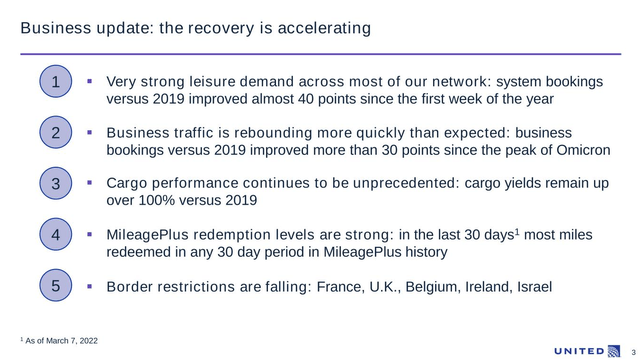

Still, on the demand side, the understanding is that conditions have improved significantly into the current quarter considering the sharply lower Covid figures in recent months that have allowed state and local governments to remove restrictions putting the economy back on track towards a “return to normal”. United management is upbeat on this point citing “very strong leisure demand” while business travel has also rebounded faster than previously expected. Future bookings through mid-March were only 2% below 2019 levels implying a runway for stronger results.

Our take is that while the EPS will be messy, we see room for the top-line figure this quarter to beat expectations also supported by higher average pricing. Whether that’s enough to move the stock higher is going to depend more on United’s updated assessment of the current conditions and trends in bookings.

Does United Airlines Have A Strong Outlook?

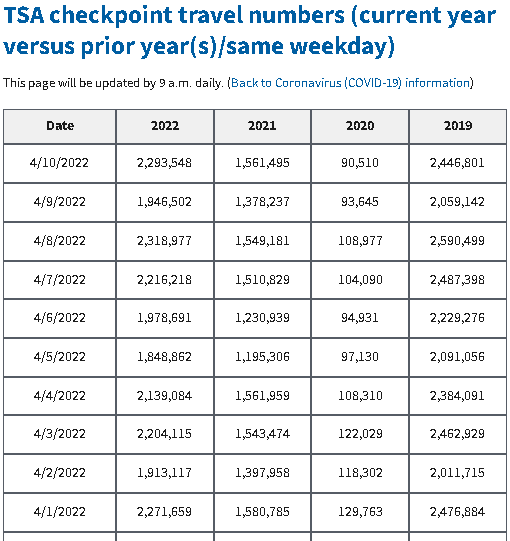

The good news for United is that beyond all the macro noise, the data shows that air travel demand is strong right now. The Transportation Security Administration (TSA) reports daily levels of passenger screening at U.S. airports with the 2-week average at 2.1 million, down just 9.7% compared to the period over 2019. This is an improvement compared to the 20% spread at the start of the year.

TSA

By all accounts, the industry recovery is on track and likely at a pace better than expected. Some of it is pent-up demand while there is also an organic component. International tourism is a segment that is still sluggish, but can pick up. We believe the trends can gain momentum into the summer travel season. We view UAL as well-positioned to benefit from these trends.

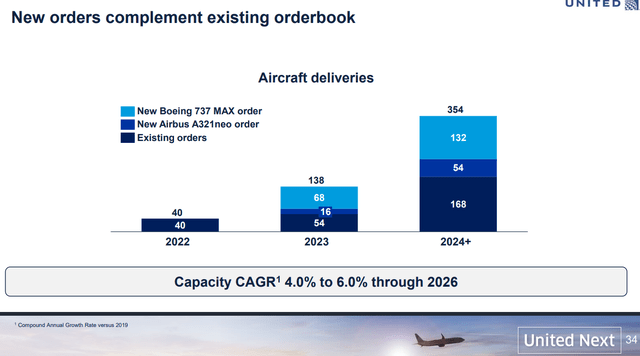

Longer-term, United intends to capture market share by growing its fleet including the delivery of 178 new aircraft just over the next two years and an additional 354 from 2024 and beyond. The effort is expected to increase capacity at an average annual growth rate between 4% and 6% through 2026 compared to 2019 levels. Importantly, the theme for the company is to focus on the premium side of the market including expanded options for business and first-class with features like “lie-flat seats”. The expectation is that the new aircraft can support higher margins and drive profitability.

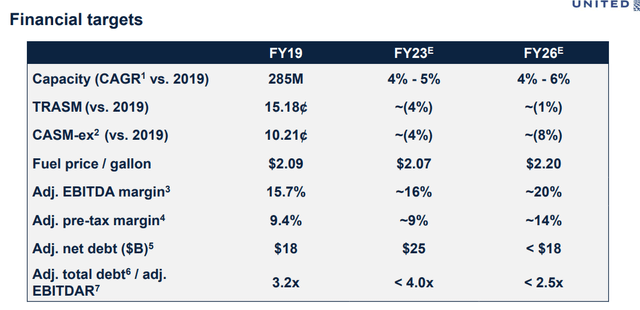

On the cost side, the “United Next” plan is expected to result in an ~8% lower CASM-ex fuel cost of 8% through 2026 with $2 billion in structural savings. United believes it can offset inflationary trends through greater operational efficiencies and asset utilization. The move to retire older aircraft can also improve overall fuel efficiency all adding to higher financial margins.

Management believes that improvement in earnings will allow the balance sheet to return to pre-pandemic levels by 2026 with adjusted debt to adjusted EBITDAR leverage ratio under 2.5x which we view as a stable level. Of course, the strategy here is counting on air travel demand to cooperate with no further significant Covid disruptions. We think United is going in the right direction.

Is UAL Stock Overvalued Now?

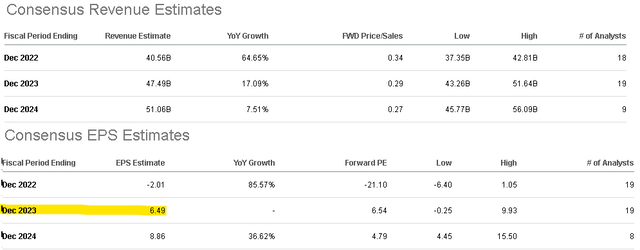

According to consensus estimates, the market expects United’s full-year 2022 revenue to reach $40.6 billion, up 64% over 2021, and climb by 17% next year towards $47.5 billion in 2023. For context, the 2023 forecast compares to the 2019 peak pre-pandemic revenue level of $43.3 billion meaning United is on track to have a larger reach than ever. The market also expects United to return to full-year profitably next year with an estimated EPS of $6.49 with the momentum continuing through 2024 as EPS climbs towards $8.86.

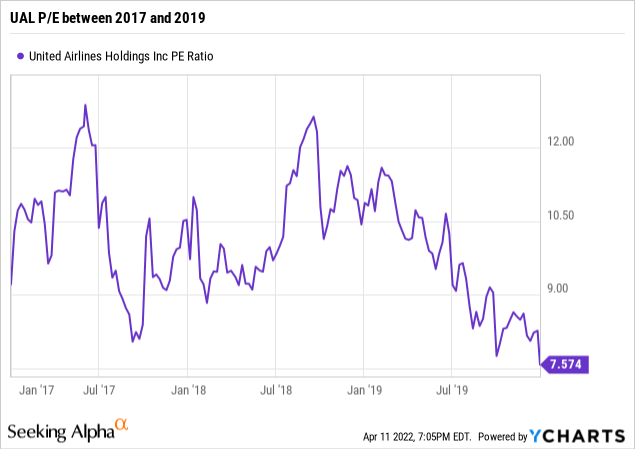

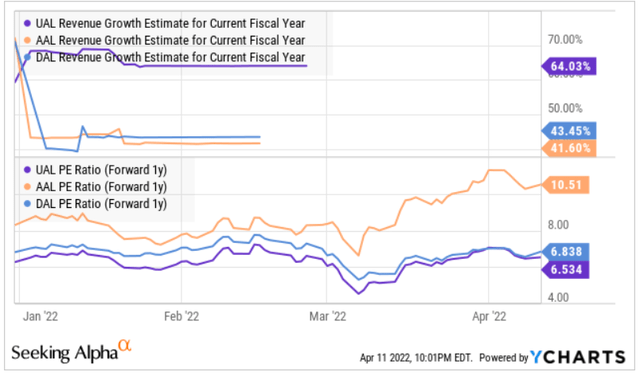

As it relates to valuation, looking out at 2023 when the company will capture a full year of more normalized conditions, UAL is trading at a 1-year forward P/E of 6.5x. The point we want to highlight is that going back to the pre-pandemic period between 2017 and 2019, the stock traded with an average P/E closer to 10x. By this measure, getting past the near-term headwinds, shares of UAL are undervalued in our opinion, and even appear cheap.

Compared to Delta Air Lines, Inc. (DAL) and American Airlines Group Inc. (AAL), we note that United has the strongest consensus growth outlook this year while also trading at a discount to this group in terms of its 2023 earnings multiple. While the big legacy carriers all have their differences, UAL is our top pick with its global reach and premium positioning as an advantage.

What Is United Airlines’ Stock Price Forecast?

Shares of UAL have traded in a relatively tight range between $40 and $50 over the last several months. The call we’re making is that the next move in the stock is higher. The current level appears to be right around some established technical support which we believe will hold considering the solid operating trends.

The biggest challenge right now is likely sentiment considering significant uncertainty over the direction of the global economy. The Russia-Ukraine conflict along with mixed data out of China has added to downside macro risks which could end up limiting the demand recovery for air travel. In the U.S., there is a sense that the high inflation environment is pressuring consumer spending that would be reflected in softer bookings or a substitution towards more budget travel options, although that has yet to materialize.

Favorably, the price of BRENT crude oil currently at $100 barrel has corrected sharply from a level above $130 in early March. While it remains to be seen if this weakness can last, the setup provides some near-term relief for United against what was a more concerning cost headwind when oil reached its high. The potential that the price of oil and its corresponding impact on jet fuel stabilizes can be positive for earnings in the current quarter.

Is UAL Stock A Buy, Sell, Or Hold?

We rate UAL as a buy with a price target for the year ahead at $55.00 representing an 8.5x P/E multiple on the current 2023 consensus EPS. The thinking here is that shares deserve a higher premium for a more favorable operating and financial outlook into next year. We’re expecting a strong Q1 report with positive guidance from management working as a catalyst for shares to gain momentum.

The understanding is that the stock will likely remain volatile and exposed to macro conditions. A deteriorating growth outlook with weaker consumer spending would likely force a reassessment of estimates. Knock on wood, but Covid is also a risk for the stock with the possibility of another Omicron-like surge further delaying the industry recovery. For the Q1 earnings report, the metrics of total revenue per available seat mile and CASM will be key monitoring points.

Be the first to comment