tommaso79

Co-produced with Beyond Saving

Introduction

What is your picture of the “perfect” retirement? Some people might imagine being on a sailboat, sitting on a beach, spending time traveling, seeing the grandkids, golfing, or rebuilding a classic car. Everyone has their preferences for activities and hobbies, yet they all have a common theme: relaxation.

For decades we tolerate the demands of work. Getting up at a certain time, being at a certain place, and making decisions. Stress is an integral part of our lives. We are constantly juggling our work, families, and relationships. For most people, the idea of retirement is to remove a large part of that stress by no longer working.

Yet the bills don’t stop coming in just because you stopped working. We might lose the stress of daily work but gain new stress. How do we manage our retirement assets?

For most retirees, their retirement accounts amount to the largest amount of money they’ve ever managed. It is a daunting task. One that, for many, becomes all-consuming.

Managing your portfolio can be fun. The High Dividend Opportunities chat is always full of a great community exchanging ideas, socializing, and opining on the changing market. For those who enjoy the day-to-day socialization and trying to squeeze a little extra out of the market, great.

On the other hand, some might find that managing their portfolio is very stressful. They worry about whether they will have enough money. They panic over changes in prices. They second-guess every decision they make, often indecisively trading in and out of the same ticker.

Trading One Stress, For a New Stress

We all have different amounts of money in our retirement accounts. Some have tens of thousands, others have tens of millions. One thing is the same for all of us: the amount in our brokerage is “a lot.” It represents many years of our prior salary. It is an amount of money that is well beyond what we are “used” to handling.

When we are working, most of us got paid on a relatively short schedule. Your budget probably revolved around one month at a time. If you had a savings account with 4-6 months’ worth of income, you probably felt good about it.

When you retire, you’re handed an amount of money that is now supposed to last many years. How many years? Nobody knows. It could be less than five, it could be 30 years or even more.

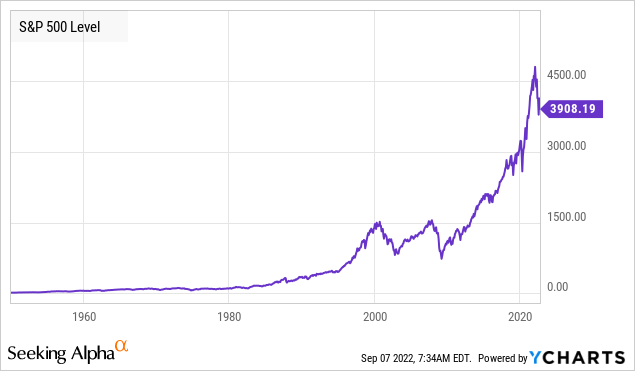

I see this a lot, retirees realize their retirement nest egg’s importance to them, so naturally, they want to manage it themselves. They start investing in the stock market. After all, look at how rich the stock market can make you:

Those little bumps over the years look so innocuous!

Let me assure you when they happened, those “little bumps” felt like the end of the world to retirees everywhere. The stock market will frequently fall. Sometimes by 50% or even more. You must be mentally prepared for such dramatic falls if you invest in stocks. I can’t say when, but I can assure you it will happen. If you are blessed with long life, it will happen multiple times.

Is it stressful? Yes. Does it have to be? No.

Panic Is Unhealthy

Unfortunately, too many retirees panic when faced with changing market prices. After all, it is “a lot” of money at stake for them. Have you ever found yourself:

- Staying awake at night worrying about the market?

- Glued to 24/7 cable news trying to determine what it means for your investments?

- Crossing your fingers while booting up your computer, fearful of what color the market will be today?

- Getting upset at short-term price movements?

- Selling a stock because “it just keeps going down”?

- Getting worried about your financial future because of share price movements?

Investors who get emotional lose money. They make poor decisions. Stock prices fall because a lot of people are desperate to sell. History has consistently shown us that the market rebounds. Sometimes very quickly, like after COVID. Sometimes it takes longer, like from 2000-2010.

Low Prices Are Bad: For Sellers

Consider this, for every stock that is sold, there is a buyer. If there is no buyer, the price declines until there is a buyer. Do you want prices to be higher or lower if you are a buyer? Well, I won’t speak for you, but I love when the prices of the things I buy go down!

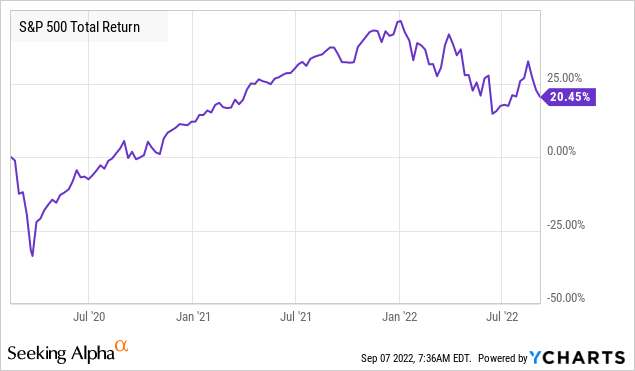

February 14th, 2020 was the absolute market peak before COVID. Was buying on that day a good idea?

Let me rephrase the question: If I came back from the future and guaranteed you that you could buy an investment today and have a 20% return within 2.5 years, would you buy it? Of course, you would.

Well, all those “stupid” buyers buying at the absolute peak have a 20% return if they matched the S&P 500.

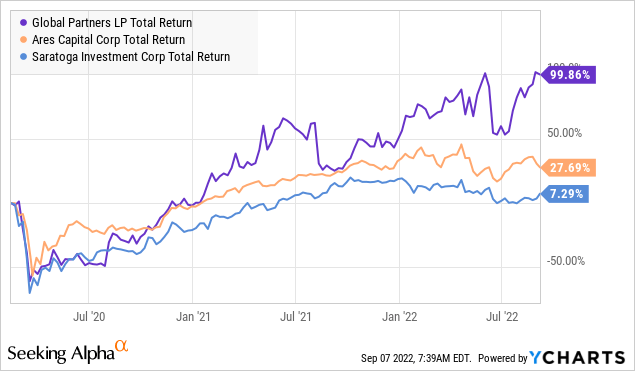

But let’s not talk about the generic S&P 500 Index. What was HDO buying on February 14, 2020? We published an article recommending three stocks that are still in our portfolio today:

- Saratoga Investment (SAR)

Was it the “ideal” time to buy? Clearly not. All of these picks pulled back 50% in a little over a month.

If we had a time machine, we’d go back to February 14th, 2020. Would we sell GLP, ARCC, and SAR? No. We’d buy a $2 Powerball ticket with the numbers 16, 32, 35, 36, 46, and 3 – making $40 million in a one-day “investment.” This lottery game is a piece of cake when you can see the future!

The point is, that we can’t see the future. We are making investment decisions in real-time with imperfect information. In hindsight, the 14th was the “worst” day to buy, yet even those who made that mistake have experienced good returns if they didn’t panic and sell over the next month.

Most Sellers Sell at Poor Times

From February to late March 2020, the market had numerous red days. It was one of the fastest crashes in market history. As each red day went by, buying became an even better choice, while selling became a worse choice.

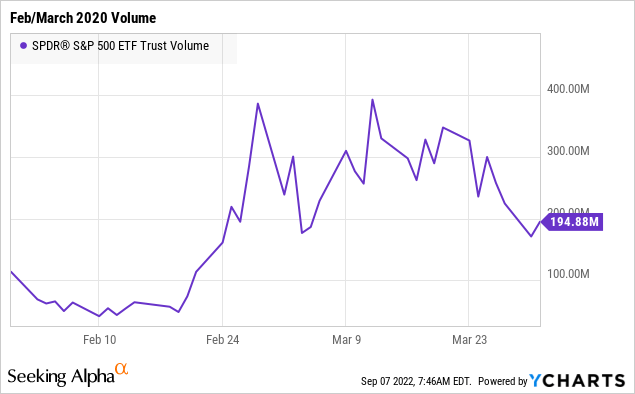

When did most people sell? Here is the trading volume of SPY:

Note that on February 14th, volumes were low. They spiked the highest on February 28th. By the 28th, when people were selling the most, the market had already pulled back. Volumes remained high as prices kept getting worse and worse…for the sellers. The people who were buying during that period did better. Investors who were “waiting on the sidelines” for a few months to see how things shook out? They missed most of the recovery.

The point is that even those who bought on the worst day to buy, had a favorable result if they didn’t panic. As an investor, you will make errors. You should always err on the side of owning more of the economy. In the short term, the decision to buy might look horrible. In the long run, those who consistently buy do better.

Solution: Be a Buyer, Not a Seller

How do we avoid selling at poor times? Don’t be a seller, always be a buyer.

But wait! You are retired, so where do you get funds always to be buying? This is a crucial part of my Income Method. By investing in stocks that pay a high level of dividends, you can build an income stream that is large enough to meet your personal financial needs and have a little excess.

I recommend planning on reinvesting about 25% of your dividends into your budget. You took a portion of your income your entire life and devoted it to investing for the future. Retirement doesn’t change that, you still have a future!

Every month, take a portion of your dividends and reinvest. Buy a few more shares. True. Sometimes that day you decide to deploy your dividends will be the “worst” possible day, that’s ok. As shown above, even investing on the “worst” day often leads to good results. You’ll also be much more likely to buy on the best possible days when the market is panicking around you.

DepositPhotos

Less Stress, More Income

You aren’t retiring to become a gambler. Do you want to have a second career as a day trader? Do you want to be chained to your computer, constantly watching the market and trying to time the top and bottom?

If that is what you want to do, be my guest. It is stressful and can be quite costly. Some people enjoy it, but most don’t.

I advocate another way:

- Buy investments that provide immediate income.

- Maintain a diversified portfolio of income-producing assets to limit the impact of dividend changes.

- Devote a portion of that income to buying more shares growing your income more with each purchase.

- Take out the income you need without selling a single share.

- Spend time doing what makes you happy.

You shouldn’t feel like you need to hover over your portfolio every second the market is open. You should feel like you can walk away, go on a vacation for a month, go on a cruise or visit family without interrupting your vacation to stare at your portfolio. You have retired after all!

Most importantly, you need to look out for your health. Retirement should be a time of low stress. Make sure you are at peace with your portfolio and that you are comfortable letting it run on autopilot for a while. Make sure you are comfortable holding everything through a major sell-off event.

Will every pick be a huge winner all the time? No, and that is ok. You will have more long-term winners than losers with a well-diversified portfolio. Will the market go up or down in the next year? I don’t know. Nobody else does either. Investors who buy more of the U.S. economy do well in the long run. Investors who panic and sell don’t.

Buy, hold for the income, and don’t stress about the share price. Since you are a buyer, you want prices to come down. Lower prices mean that you can buy more income at a cheaper price!

Most importantly, don’t let the stress of managing your portfolio negatively impact your quality of life. You worked hard to get to retirement, you deserve to enjoy it!

Be the first to comment