alexsl

Chinese health authorities have imposed sweeping lockdown measures on many cities across the country lately in a bid to stamp out COVID-19 infections. With millions of people once again limited in their ability to travel freely and to go to work, these new lockdowns are certain to affect large e-Commerce companies like Alibaba (NYSE:BABA) in a negative way. For this reason, I expect the e-Commerce company to report its first-ever quarter of negative consolidated revenue growth in FQ2’23 and revenue estimates to trend lower!

COVID-19 measures are posing a fundamental risk to Alibaba’s growth

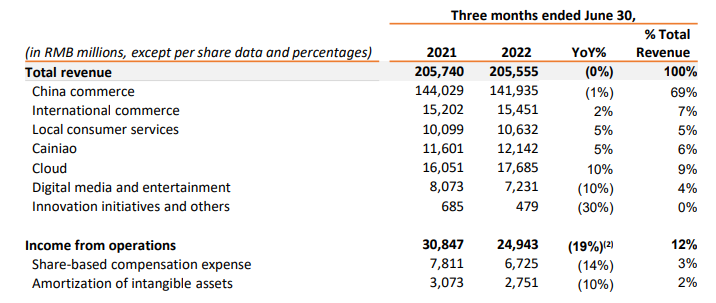

Alibaba’s growth has already slowed down markedly this year, in large part because of COVID-19 lockdowns in China, which included mega-cities like Shanghai and Beijing. Alibaba reported its weakest growth on record in FY 2022, due to a slowdown in the Chinese economy. In FQ1’23, Alibaba’s top line growth slowed to 0% as a new round of COVID-19 lockdowns affected Alibaba’s e-Commerce and logistics operations negatively. Alibaba’s China commerce revenue growth actually declined 1% year over year in FQ1’23. Although Alibaba saw some positive momentum in Local Consumer Services, such as Direct Sales and China wholesale, the segment is not big enough yet to make a real difference for Alibaba… which is why a slowdown in the main China commerce business is a big problem for the e-Commerce company. Local Consumer Services had a revenue share of only 5% in FQ1’23 while China commerce generated 69% of consolidated revenue. If China’s commerce business is not doing well, neither is Alibaba.

Alibaba: FQ1’23 Revenue Breakdown

New, broad-scale lockdowns are a problem for Alibaba

China’s health authorities have announced major shutdowns in August and September to control the spread of COVID-19. According to Caixin Global, 33 cities and 65 million people are currently affected by full or partial lockdowns, including Chengdu, a city of 21 million, which was locked down completely. Seven provincial capitals are also under varying levels of lockdowns.

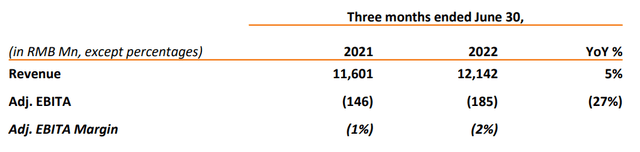

Unfortunately, China’s new lockdown measures are set to make supply chain problems worse. Supply chain issues have their root in the unprecedented shutdowns of manufacturing facilities at the onset of the COVID-19 pandemic and ripple effects are felt throughout the world to this day. New lockdowns in Chinese cities are therefore set to hurt Alibaba’s growth prospects further, especially in the e-Commerce and the logistics segments. Cainiao, which is Alibaba’s logistics enterprise that works behind the scenes to get parcels to customers, has seen a severe slowdown in revenue growth to just 5% year over year in FQ1’23. Two years ago, Cainiao was a growth driver for Alibaba, showing top line growth in excess of 50%. Due to COVID-19 restrictions in Chinese cities earlier this year, Alibaba’s growth prospects in its integrated e-Commerce operations has been stunted and the logistics business may see delayed profitability because of it.

Alibaba: Cainiao FQ1’23 Segment Results

Top line estimates are set to drop further

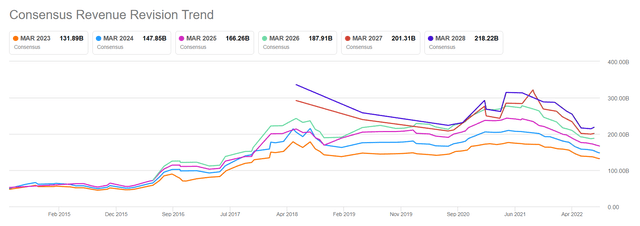

Alibaba’s revenue growth already slowed to 0% in the last quarter, but that doesn’t mean it can’t get worse. Because of Chinese cities going back into lockdown, I believe that we are going to see a wave of revenue estimate down-grades for Alibaba which is set to result in new pressure on Alibaba’s valuation factor.

Revenue estimates have already fundamentally reset to the down-side and there were 34 down-ward revisions (and 4 up-ward revisions) for Alibaba’s annual revenue estimates in the last 90 days. Going forward, I expect at least some estimates to reflect the possibility of Alibaba seeing its first-ever quarter of high single-digit negative revenue growth.

Seeking Alpha: Alibaba Annual Revenue Estimates

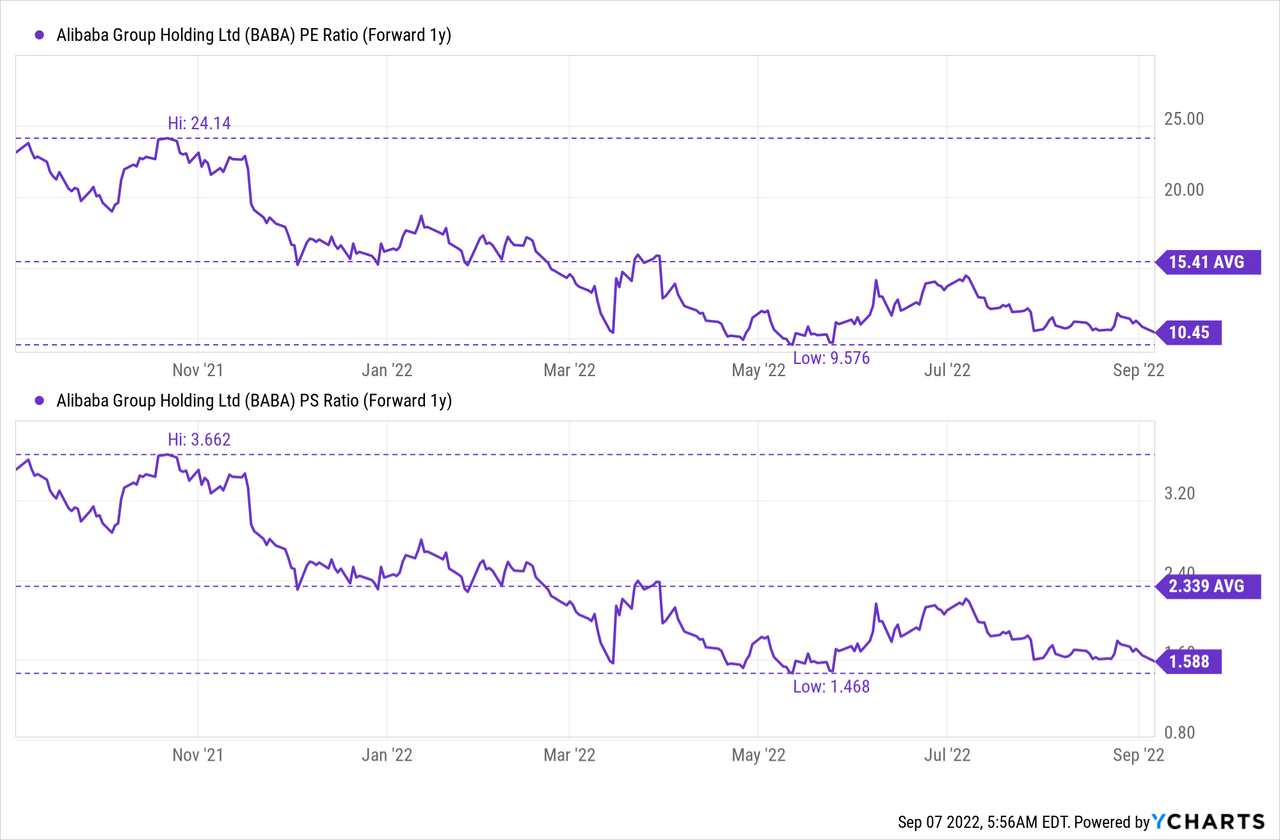

Valuation

Alibaba’s P-S and P-E ratios have both corrected to the down-side in 2021 and 2022 and there were some good reasons for that, such as slowing top line growth and a weakening Chinese economy. However, with new lockdowns stunting Alibaba’s growth, the risk of Alibaba’s shares going into a new down-leg has increased significantly.

Alibaba currently has a P-E ratio of 10.5 X which is below last year’s average P-E ratio of 15.4 X. The P-S ratio is 1.6 X compared to an average ratio of 2.3 X. Both ratios may drop below their most recent one-year lows.

Risks with Alibaba

New lockdown measures are a significant, although not existential, risk factor for Alibaba and its stock. Given the scale of lockdowns that went into effect recently, I believe that Alibaba’s top line and margin risks have increased significantly in the short term and it is entirely possible that the e-Commerce company is going to report its first-ever, high single-digit decline in consolidated revenues in FQ2’23.

A delisting of Alibaba’s shares is still unlikely, however. At the end of August, China’s security regulator, the China Securities Regulatory Commission, and the Public Company Accounting Oversight Board in the US reached an agreement that paves the way for cooperation on inspections of audit papers of US-listed foreign companies. With this framework in place, I believe it is highly unlikely that Chinese companies face an exodus from the US stock exchange.

Final thoughts

The imposition of sweeping lockdown measures across China is set to create significant short term headwinds for Alibaba’s e-Commerce and logistics businesses. Mass lockdowns are almost guaranteed in hurting Alibaba’s growth prospects and top line estimates have further to fall because of it. While I don’t believe that Alibaba’s ADR shares will be delisted — due to the recent agreement between US and Chinese regulators — down-side risk has clearly escalated again and it is entirely because of China. If China isn’t doing well, neither is Alibaba!

Be the first to comment