Drew Angerer

Introduction

On November 3, Twilio (NYSE:TWLO) presented its Q3 2022 earnings and the market was not happy with what it saw. The stock tanked by 35%. Brutal. In this article, we look at the reasons and if the stock is attractive now.

Let’s dive into the numbers.

The numbers

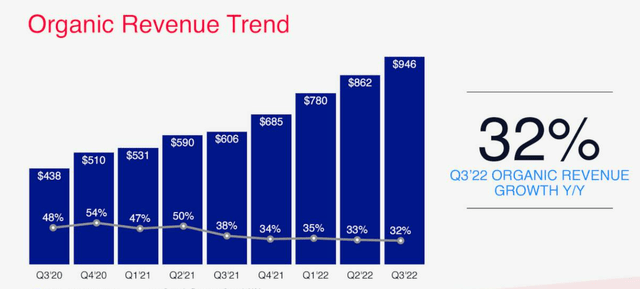

Revenue came in at $983 million, up 32.8% year-over-year, beating the estimated $972 million by $11 million or 1.1%. Organic revenue was up 32%, delivering on management’s goal of 30%.

Twilio’s Q3 earnings slide deck

Twilio now has more than 280,000 customers, up 30,000 year-over-year, or 12%.

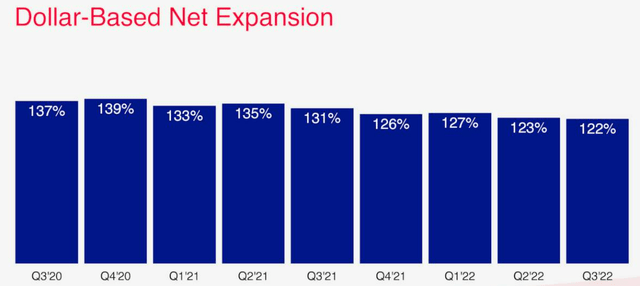

The company reports Dollar-Based Net Expansion Rates, which is not the same as Dollar-Based Net Retention Rates. Retention rates include churn, expansion rates don’t. Let me give you an example.

If a company has 100 customers spending $1,000 in a certain year, that’s $100,000 in revenue. The next year, five customers leave, so you have 95 left. Those 95 now spend $1,300 per year. Dollar-based expansion rates will be 30%, as it only looks at the customers who didn’t leave. But dollar-based net retention rates include churn. So we multiply 95 times $1,300 and then divide by 100, the customers’ cohort of the previous year. That’s $123,500 and therefore a dollar-based net retention rate of 23.5%, quite a bit lower than the dollar-based expansion rate of 30%.

I like the retention rate more, but I understand why Twilio uses Expansion rates. After all, it has quite a few customers that come and go every few years for special events. Up to now, elections were an example. But Twilio refuses to handle elections from now on. More about that later. You can also think of the Olympics and other events. Even yearly events can make a big difference between the quarters. Dollar-based net retention rates would probably be quite lumpy.

Dollar-based Net Expansion was down to 122%, the lowest number ever. The number excludes the acquisition of Zipwhip to have comparable data.

Twilio, Q3 earnings slides

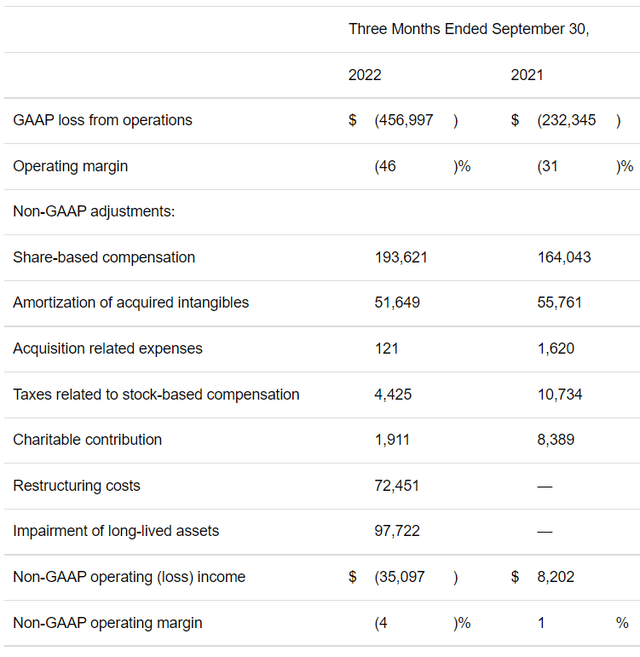

The GAAP loss from operations was $457 million, compared to a loss of $232.3 million in Q3 2021. On a non-GAAP basis, income from operations came in at $35.1 million for the third quarter of 2022 compared with non-GAAP income from operations of $8.2 million in the same quarter last year.

One reason for the big drop was Q4 guidance. While the consensus stood at $1.07 billion, the company guided for $995 million to $1 billion, a difference of 7% from what was already a lowered consensus. COO Khozema Shipchandler on the conference call:

I recognize that this is below the 30% revenue target we laid out two years ago, but we’re also facing a very different and rapidly evolving external environment today.

I’m not a big fan of public revenue growth projections over three years or more, but that is what Twilio did. You never know what happens and if you cannot get over the bar you put up yourself, you are punished really hard. If you really want to set goals publicly, let them be much more conservative than internal goals. But I prefer avoiding the practice altogether.

On adjusted EPS, the company guided for a loss of $0.09, better than the consensus of a loss of $0.12.

For the most part, Twilio is not a SaaS company. It’s mostly usage-based. You pay per message that you send, for example. With the tough macroeconomic context, Twilio sees weaknesses in certain markets. On the conference call, and later on CNBC, management called out crypto, retail and e-commerce, for example.

The long-term bull case for Twilio is in its software services, which have a higher margin. COO Khozema Shipchandler on the conference call, which also served as Analyst Day:

For Twilio, messaging often serves as a highly effective initial land with new customers. This provides a foot in the door, allows us to establish a new relationship and over time gives us the opportunity to cross sell our other products, all of which are higher margin.

Elena Donio, President of Revenue since May of this year, said that the company adjusted its sales approach for that goal:

We have adjusted our sales incentive structures to align them with accelerating software. Put really simply those incentives will be highly biased to selling segment Flex and Engage, plus a couple of other higher margin communications products.

All that said, we’ll continue to grow messaging too. We just want to grow it a lot more efficiently and effectively so that we can begin to drive op margin accretion through all of those channels.

While messaging is a low-margin business, Twilio said that its margins per message have improved quite a bit. But the real juice is in the software solutions that Twilio has.

Digging a bit deeper into the losses

The adjusted EPS came in at -$0.27, while the consensus stood at -$0.38, a beat by almost 29%. But last year, Twilio reported 1 cent in adjusted EPS profit. If you look at GAAP net losses, you see -$2.63 for Q3, versus -$1.26 in Q3 2021.

What’s the reason for this big difference between GAAP and non-GAAP? This is the reconciliation.

Twilio’s Q3 press release

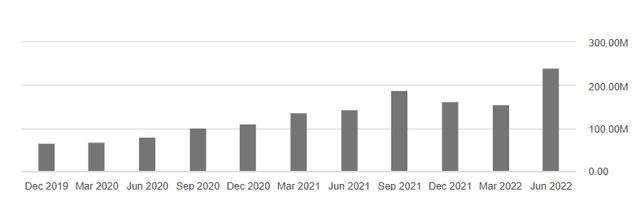

As you can see, there are a few big numbers, but by far the biggest is SBC or share-based compensation. $193,6 million, up 18% compared to Q3 of 2021. With $946 million in revenue, $193.6 million means about 19.5% of the revenue. But for the whole year, this is even higher, at 22% of revenue year-to-date. This is Twilio’s SBC history up to and including Q2 of this year.

Seeking Alpha

Twilio’s SBC is high. Too high. And management addressed the feedback about that. Jeff Lawson:

Another important area of focus as we build leverage throughout the company is stock-based compensation, which averaged approximately 22% of revenue in Q3 year-to-date. As we look at 2023, we do expect SBC to show some increase as we continue to absorb the impact of the high levels of headcount growth we’ve seen the last couple years.

However, we do have a target to reduce SBC in the medium term to 15% to 20% of revenue, and we’ve been proactively taking steps to achieve this leverage over time, including the recent restructuring and slowing of headcount growth, diversifying the locations where we hire employees and targeting lower cost geographies and tying annual equity awards to performance. We’ve heard your feedback and while this is not a number we can decrease immediately, we’re confident that the actions we’re taking will drive this number down over the next several years. (emphasis from author)

To me, 15% to 20% is still extremely high, even more now. If you take 20% of the revenue of $4 billion, that’s $800 million of stock-based compensation per year. With a market cap of $60 billion, which Twilio had in early 2021, that’s 1.3% dilution per year and that’s OK. But with a market cap of just $8 billion, that means a 10% dilution per year. That’s pretty awful, especially because management said that next year, it would be higher than 20%. So maybe that’s a 12% dilution for one year. And if that is to raise money, that’s already a lot, but then it can be used to be productive. Now it’s just to pay insiders. Not a great look.

Before the layoffs, Twilio had 8,992 employees. $193.6 million divided by 8,992 means about $21,500 per employee for one quarter or about $85,000 per year. That is high.

You can also see ‘amortization of acquired intangibles’ on the reconciliation for $51.6 million. If you acquire a software company, there is intellectual property, goodwill, patents, trademarks, tradenames, and other things that are included. Those have to be written off over time. This is not a real expense, so I don’t care about that too much.

There was also a $72 million cost associated with the restructuring. Twilio laid off 11% of its employees, so almost 1,000 people. That’s brutal but it will save the company almost $200 million annually. I don’t agree with adding this back into non-GAAP expenses. For SBC, you can argue, and for amortization of the acquired intangibles, I think it’s normal to add them back in. But not expenses paid for employees’ severance packages. That’s real money.

Impairment of long-lived assets came in at $97.7 million for the quarter. This is probably the goodwill of acquisitions being impaired. Not a great sign, but completely normal in this market and also not something that I think is very important.

If we put this all together, I get $114 million in ‘real’ losses but that includes $72.5 million in restructuring costs. With $5 billion in the bank, you shouldn’t worry about Twilio getting into financial trouble, though.

Usually, elections boost Twilio’s revenue, but the company decided to stop political campaigns. Founder and CEO Jeff Lawson explains why:

Additionally, unlike prior years, Q3 and Q4 largely exclude a political spike because we made the decision to offboard a lot of that traffic from our platform after 2020.

That traffic was from customers who did not intend to honor our Acceptable Use Policy with regards to consumer opt-ins and therefore we refused their business in this election cycle. We presume they went to other providers.

To us, the short term revenue benefit in the election cycle is not worth the friction with consumers who do not want their traffic, or with carriers who have raised repeated concerns about this traffic.

Lawson was also happy to announce a huge deal for Flex, its cloud-based contact center solution:

We signed one of our largest Flex deals for the second quarter in a row – an 8-figure expansion deal with a Fortune 100 insurance provider, deploying Flex for more than 20,000 agents!

Is Twilio a buy now it’s down more than 80%?

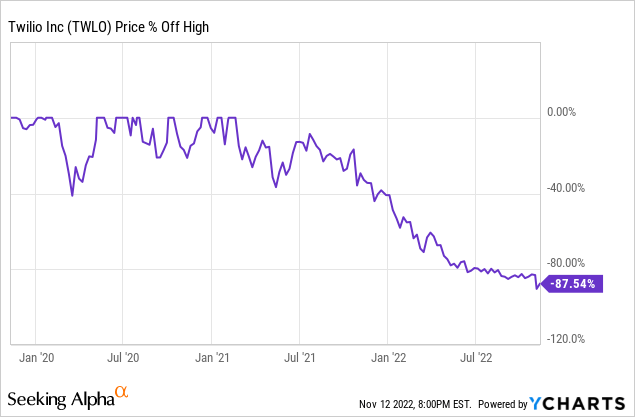

Despite the market rally after the October CPI numbers came in lower than expected, Twilio is still down 87.5% from its all-time high.

Does that mean that this stock is a good investment right now?

The widening losses don’t feel right in this context, especially when Twilio said it would be profitable on a non-GAAP basis in 2023. Management also said it would not meet the 30% revenue growth hurdle it had set.

What worries me is not as much the financial situation or the losses, but the fact that they happen in this environment. There are several possible explanations, and two are really concerning.

1. The company has no leverage. Its customers experience difficult times too. If they push for lower prices by threatening to go to a competitor, Twilio may have to give in.

2. Management still doesn’t care too much about what investors think.

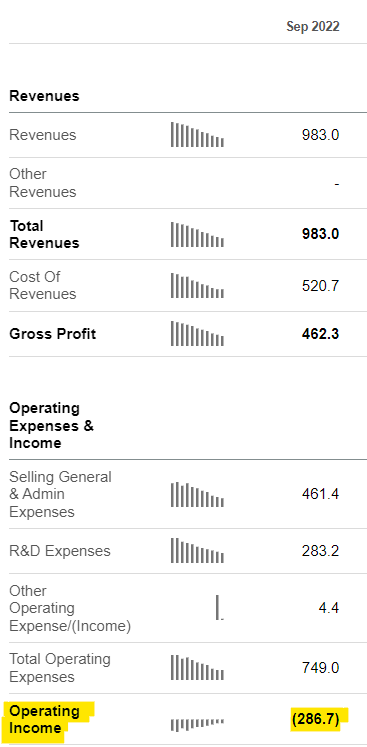

Of course, other plausible explanations are possible. Nonetheless, it’s not a great look. For now, I give management a pass, believing them if they say it just takes more time to turn to profitability, something which is completely new, not just for this team, but for a lot of companies. After all, there was $286 million in operating losses in just one quarter. If that becomes positive in 2023, management has done a fantastic job.

Seeking Alpha, highlights by the author

Management commented:

We do expect to be profitable starting in 2023 and then to increase our operating margins by one to 300 bps per year

Twilio has said that it targets operating margins of 20%. But if it adds only 1% to 3% per year, this will take 7-20 years.

So, let’s look. The company is expected to grow its revenue to $3.8 billion this year. Let’s assume a 20% revenue growth for the first two years, 15% for the next two and 10% for the next three. To be honest, I think Twilio can grow faster, but I want to be conservative. That’s almost $10 billion in revenue after seven years. Let’s take an operating margin of 12% at that moment. That means $1.2 billion. You still have to deduct taxes but even with what I think are pretty conservative assumptions, you get a P/E of around 7.0 or even lower.

This might become an attractive investment for private equity firms or activist investors, especially because the special voting rights expire in about seven months. That means they could buy in now and just wait. Outsiders might cut expenses much faster than Twilio’s management and while I’m usually not a big fan of activist investors, I wouldn’t mind them coming in, in this case.

The market now treats Twilio as if it never will turn a profit and the bigger loss was the reason for the huge drop. While I definitely understand that drop, I think it’s exaggerated.

Pro and cons

I am a Twilio shareholder and the stake makes up about 1% of my portfolio. I was really on the verge of selling my position, as there are plenty of reasons to sell. But in the end, I decided not to sell for several reasons.

- The stock is now very cheap in my opinion.

- The potential for activist investors to give us back some of the value Twilio definitely has.

- It’s still growing at a decent rate.

- It should be profitable next year if management can keep its promise. I want to allow them to prove themselves.

But there are at least as many reasons to sell and they are probably even stronger. I want to spell them out here too:

1. Twilio doesn’t have a separate CFO. Khozema Shipchandler took over the COO role in October last year, while also still executing the CFO role. I think there has to be more attention to this role. I think Shipchandler is a good CFO, so a new COO may be a good solution, but a new CFO could look at the company with fresh eyes and see where there is too much fat.

2. The stock-based compensation is egregious. 20%+ of revenue is already very much, but with gross margins of just 47%, that’s even worse than for a company with gross margins of 75% and more. The dilution next year will be above 10% if the company doesn’t do anything and it probably can’t.

3. Although management said it would focus more on profitability, losses only widened.

4. Management had a goal of 30%+ organic revenue, but it can’t live up to that goal for the next quarter. Of course, there is a very tough macroeconomic situation that nobody had really expected to play out so fast but as a management team, you have to be conservative and take that into your public plans.

5. While for 2023, the company aims for profitability, on a non-GAAP basis, mind you, it says it will only grow profitability by 1% to 3% per year after that. Setting a 20% profit margin as a goal is great, but if it would take 20 years, that’s completely ridiculous. Maybe management is conservative in its projection of the yearly growth, but then it should not have thrown out that 20% profit number.

Despite these very convincing arguments, probably more than the ones to hold Twilio, I’m keeping my shares for now. I want to allow management to prove itself. I will keep the stock on a short leash, though.

I don’t want any substantial acquisitions going forward. The company should focus on integrating what it has bought into a smooth platform and add its own R&D products seamlessly. It has to focus on profitability now, not on integrating another big company into Twilio.

I also want operating margins to be positive in 2023, like the company has promised. If that’s not the case, it’s an immediate sell. If the operating margins are not growing in the years after 2023, it’s also a red flag.

Up to now, the company has kept up its premium revenue growth. If that changes too, I’m out.

Conclusion

Twilio did the exact opposite of what it should have done during these times. Margins kept deteriorating and losses widened. I hope the 35% stock drop wakes up management so they start acting on what they have promised and fast. I’m not selling for now, but I’m not pleased with this quarter. And while I usually build my positions over years through dollar-cost averaging, I will not add to this position because management has a lot to prove.

In the meantime, keep growing!

Be the first to comment