krblokhin/iStock Editorial via Getty Images

Target (TGT) prides itself for having an uninterrupted dividend policy since 1967. More notably, on June 9, 2022, the company announced an increase in the dividend per share of 20% and now commands a forward dividend yield of 2.62%. But does this bold move make sense in light of changing consumer preferences and high inflation rates? How sustainable is this dividend given Target’s declining cash balance? Is the management just trading higher dividends for much lower or no stock buybacks? Is Target a good long-term investment given that 80% of its sales comes from cyclical discretionary goods? These are the questions I will attempt to answer in this article.

TGT Stock’s Key Metrics

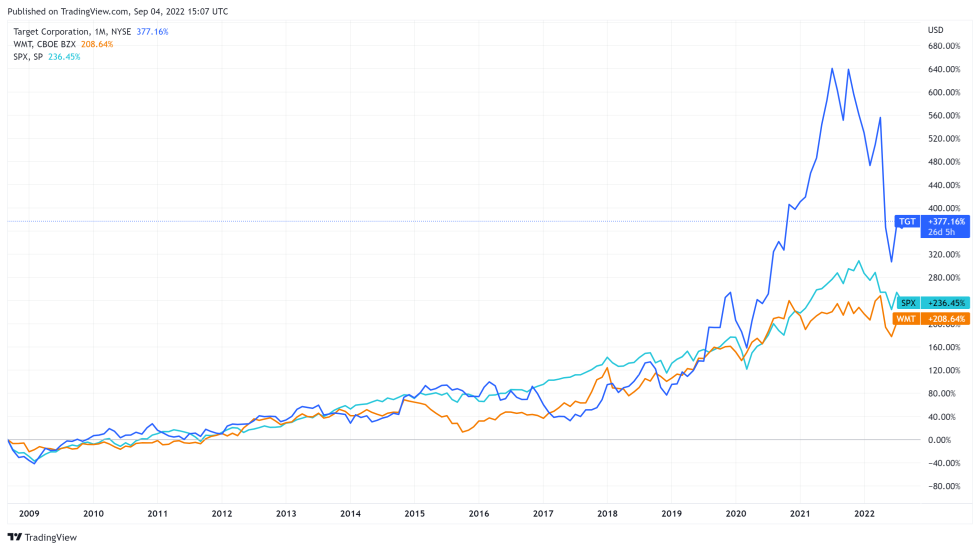

Since 2009 and before 2020, Target showed similar performance relative to the broad market, with some ups and downs.

Figure 1. Target, Walmart (WMT) and S&P 500 Percentage Performance Since 2008

TradingView

Around 2017, Target began lagging peers as its digital footprint was lacking, while other large ecommerce and brick-and-mortar retailers were rapidly expanding their online presence. Since then, Target undertook significant efforts to renovate its stores and make them serve as fulfillment centers to better facilitate online sales. As Covid-19 hit, Target reaped substantial benefits as it stayed open, and its comparable store sales grew in double digits in 2020-2021.

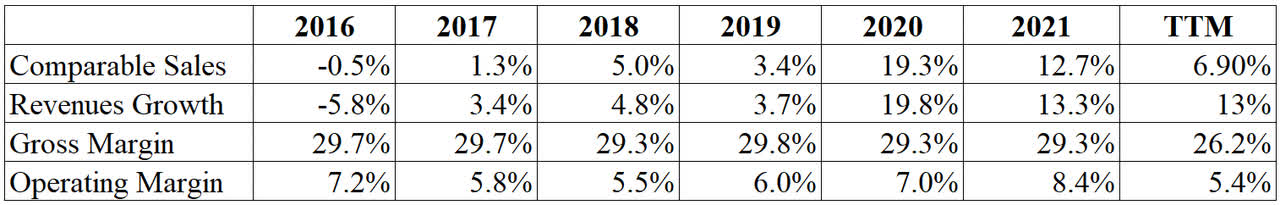

Table 1. Target Sales and Profitability Metrics

Morningstar

Target is known for relying on discretionary goods to drive its sales. About 80% of sales are coming from apparel, beauty, home furnishing and other durable goods. Unlike Target, Walmart sells a lot of food products, which bring about 56% of its total revenues. This partly explains why Target experienced such a large upswing in comparable sales during the pandemic, as people were forced to entertain themselves at home and flocked to stores to buy various sports, home décor and beauty products.

While this was a boon, now comes the hard part. As the economy has been more or less reopened for the past year or so and with inflation looming large, discretionary spending will be the first on the chopping block for middle-income households. Already, Target is facing difficult comparisons, and its comparable store sales grew by 3% over the last two fiscal quarters. Food is an important anchor category that brings recurring traffic to the physical stores. With a relatively small food footprint, Target’s comparable traffic numbers are likely to go down even more in the next several quarters.

Having said that, not only Target but also many other retailers were caught off-guard by rapidly changing consumer preferences in 2022 and are now stuck with excess inventory. Target Corporation expects an additional $200 million of inventory charges in its third quarter. The company’s management had an upbeat tone about focusing on categories that sell well, such as food, essentials and beauty products. But the problem is all other categories (appliances, sports equipment, home furnishings, apparel/accessories) will likely be pulling down the company’s bottom line in the next year, as they account for almost 55% of the company’s sales.

Is Target Undervalued Now?

As these gravitational forces work their way through, Target’s stock price will be pressured even more in the next year. Even after the recent pullback, Target is likely properly valued or slightly overvalued at the current stock price and in the absence of positive news.

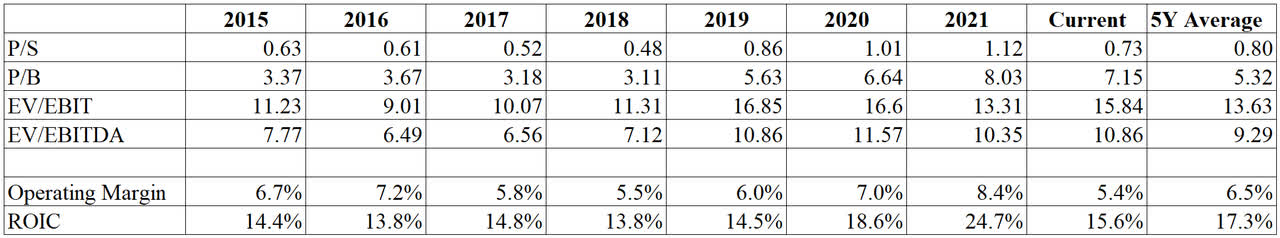

Table 2. Target’s Valuation Metrics

ROIC stands for return on invested capital. (Morningstar)

Looking at Target’s historical valuation in Table 2, the period from 2020 to the present is abnormal. It looks like normalization is underway, judging by how Target’s profitability is leveling off. However, looking at valuation numbers, Target still shows a slight overvaluation by its historical norms, especially judging by pre-2020 numbers.

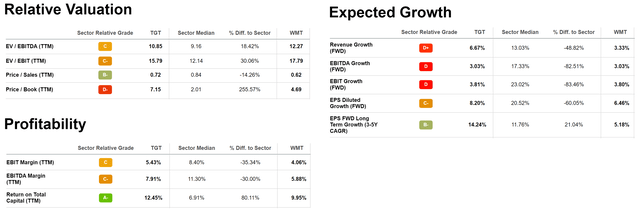

Comparing Target to the overall consumer discretionary sector and Walmart, in particular, shows that Target at best is fairly valued based on Figure 2:

Figure 2. Target’s Valuation Metrics Relative to Consumer Discretionary Sector and Walmart

When comparing Target Corporation to its sector median valuation metrics, it is clear that TGT’s return on total capital is far superior. However, TGT is expected to lag its peers in terms of near-term growth of revenues, EBIT and earnings.

While the analysts’ projection for TGT’s EPS long-term growth is very strong, this indicator is likely noisy and subject to significant fluctuations. This is one of the main reasons why Target is slightly undervalued when compared to Walmart, one of its main brick-and-mortar competitors. Substantial profitability fluctuations are expected going forward due to a large portion of Target’s revenues coming from discretionary spending.

Walmart, on the other hand, is higher valued in terms of EV/EBIT and EV/EBITDA due to the more stable nature of its business with the majority of sales coming from necessity goods. This is so, despite the fact that TGT has shown much better profitability metrics in the most recent trailing twelve-month, or TTM, period.

What Should Investors Know About Target’s Dividend?

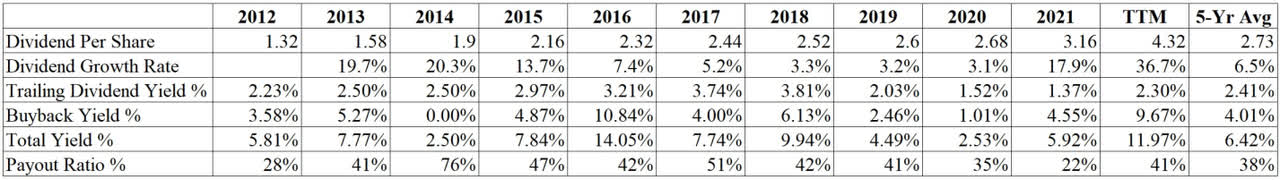

Target has consistently raised its dividends over the last 10 years and typically pays them on a quarterly basis. However, there is a noticeable slowdown in growth starting around 2016-2017 due to lackluster performance for the reasons explained above.

Table 3. Target Corporation Dividend Metrics

Morningstar

In June 2022, Target Corporation increased its dividend per share by 20%. This move can be viewed as a reassurance signal from the management that they expect to generate enough earnings to afford such an increase. Target typically maintains a payout ratio of around 40%. While the TTM payout ratio is in line with this average, the recent dividend hike and potentially lower profits may temporarily increase the payout ratio above 40%. Also, overall, TGT’s current dividend yield of 2.3% is in line with its consumer discretionary sector.

Besides dividends, Target Corporation maintains a share buyback program. The company spent $7.3 billion in the trailing twelve-month period, producing a whopping 9.67% yield to shareholders. I think it is very unlikely that the company will reduce or stop its dividends. However, with pandemic windfall cash going out of the door this fast and with actual cash balance decreasing from $8.5 billion in FY2020 to a mere $1.1 billion as of July 30, 2022, something will have to give. It is very likely that with this announced dividend hike, small cash balance, and recent inventory woes, Target will be forced to substantially scale back its share buyback program to maintain higher dividends.

Is Target A Good Long-Term Investment?

The biggest question to ask is whether the elevated revenues and profits from 2020-2021 are the new norm going forward. Will revenues come down and normalize to pre-pandemic levels and will Target be back to a slower pace of growth? I think the likelihood of this scenario is very high given what we are learning now about consumer habits. There are just so many sports shoes, TVs and treadmills that consumers can buy. Unfortunately for Target, these items tend to last longer than a few months, and the company is facing a traffic cliff in the next year or so.

Also, while Target partially transitioned to online retail, there is growing pressure from Walmart and Amazon, who have much larger scale and highly competitive prices with wide selections of goods. With switching costs virtually non-existent, consumers will flock to general retail places that will give them reasons to shop there: low prices, convenience and competitive selection of goods.

These days, many consumers start their online shopping on either Amazon or Walmart websites. To stay relevant, Target will have to up its game to stay on consumers’ minds. Specifically, Target will have to use various strategies to entice consumers to shop for food in its stores to generate recurring traffic. Otherwise, Target will remain a cyclical store selling mostly discretionary goods with highly pronounced ups and downs in the stock.

Target made a commendable effort in ramping up its digital presence over the last five years, though it was a little too late in the game. Also, about a third of TGT’s sales are from its own private label brands, which probably command strong margins. Finally, Target has been expanding its small-format store network since 2018, which will allow it to build presence in markets, where building large-scale units was economically infeasible. Most likely, Target’s future growth will be driven by these more nimble stores.

Overall, I think Target will likely show outperformance in strong economic upcycles and relative underperformance in downswings due to the cyclical nature of the products it sells. Target will have to make significant investments to compete with its giant rivals, providing little room for error. On average, it is very likely that Target will demonstrate market performance going forward.

Is TGT Stock A Buy, Sell, Or Hold?

This makes Target a Hold at the moment, given high inflation and changing consumer buying habits. While the company’s dividend rate of 2.3% remains somewhat higher compared to its peers, such as Walmart with a dividend yield of 1.7%, investing for the sake of dividend distribution is not the right way to go. Preserving principle and having strong prospects of capital appreciation in the future are the two indispensable characteristics of dividend investing.

As consumers are trading down for lower-priced versions of the same products and postponing expensive purchases, Target is in a tight spot in the short term. There could be more bad news in the next two quarters, which could offer a better entry point for investors interested in buying Target’s stock.

Be the first to comment