Torsten Asmus

Corporate defined benefit (DB) plan sponsors face two primary risks: equity risk and interest rate risk. Equity risk is taken to generate return, and while there can be volatility, over time this risk has proven to be well compensated. On the other hand, interest rate risk is uncompensated, meaning that we generally don’t expect to be paid for taking on this risk over the long term. Sometimes interest rate risk can help funded status (e.g., when rates rise), while other times it hurts funded status (e.g., when rates fall).

What are the three key ways DB sponsors can improve their hedge ratio?

So why do plan sponsors take on any interest rate risk at all? Or, in other words, why don’t DB sponsors have much higher interest rate hedge ratios? As we explained several years ago, sponsors have three key levers to improve their hedge ratio:

- Improve the funded status directly via contributions

- Increase the physical LDI allocation at the expense of return-seeking assets, or

- Increase duration by extending physical fixed income duration or using derivatives

The first two levers shown above require either higher contributions or a lower allocation to return-seeking assets—both of which could ultimately lead to higher costs to the sponsor. This leaves the third option of extending duration, which is easily the most efficient method for improving hedge ratios.

Increasing duration: The most efficient method

While many sponsors have chosen to extend their LDI duration to improve their hedge ratio, the majority could go further. Doing so will better align the assets with the liabilities and help to dampen funded status volatility in accounting and (in some cases) PBGC measures. This is also critical for closed and frozen plans that have become fully funded and seek to maintain their funded position without new contributions. There is a strong case for this argument regardless of the interest rate environment. So why not extend duration as much as possible? Some have, but many haven’t. Part of this could be because to extend duration that far, you will either need to introduce or increase exposure to derivatives like Treasury futures, or need to lean heavily on STRIPS. Treasury futures are common in larger DB plans as a way of increasing hedge ratios or fine-tuning the hedge, but some sponsors may still have some hesitancy in pursuing. STRIPS do not offer the same potential return as long credit due to the additional spread. Considering the plan holistically, however, this return given up by shifting from credit can be offset with additional return from equity-like assets, which also can help to hedge the credit component of liabilities. Therefore, in many cases, the interest rate hedge can be improved while simultaneously increasing the return potential.

A common concern we have heard for many years is that rates will rise—and that when they do, long duration fixed income will lose big. This may be true for assets in isolation, but for an underfunded plan, the funded status is likely to still improve in this environment (i.e., liabilities will go down more than the assets). But regardless, this concern has persisted over the years—all while rates continued to dip down to record lows just a couple of years ago.

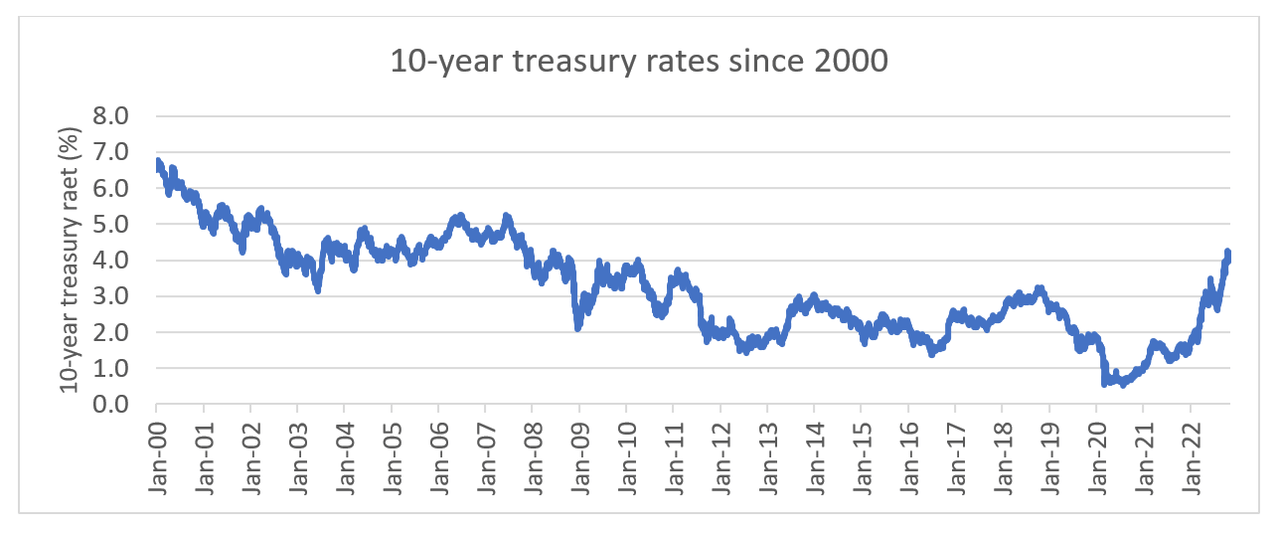

So what about now? Rates have risen dramatically. Treasury rates hit their lowest level in decades in 2020, but since July 2020, the 10-year Treasury rate has increased over 300 bps!

Click image to enlarge

While rates could still increase further, the probability of entering a recession has been increasing. With recessions come uncertainty, particularly for equity returns. Compound this concern with the fact that rates usually fall during a recession. The exact impact of this on DB plans will depend on yield curve changes and liability-specific measures, but aside from our strategic view of the benefits of hedging interest rate risk, the timing now appears to be good.

The bottom line

If sponsors were waiting for rates to rise to extend their LDI duration further, now is the time to act.

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

The Russell logo is a trademark and service mark of Russell Investments.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI-12143

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment