Gilead Sciences (NASDAQ:GILD) watched its stock price perform incredibly well after hours as a result of new information about the company’s Remdesivir drug and its potential in treating COVID-19. I recommend investors start by reading my most recent article discussing the company as a whole, but the point of this article is to discuss the company’s direct financial potential from Remdesivir in detail.

Gilead Sciences’ Remdesivir Drug Trials

I want to preface this section by stating that I’m not a doctor and that as a result of the COVID-19 difficulties, it’s incredibly hard to run a proper drug trial. However, with that said, Remdesivir’s initial results in treating COVID-19 are very promising.

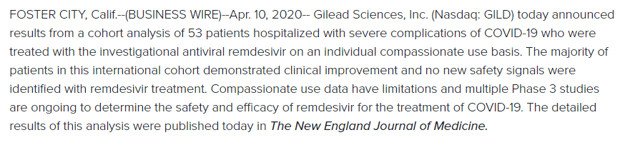

Several days ago, Gilead Sciences published its initial results for 53 patients. The results showed, through compassionate use studies, that 84% of patients saw a need to have ventilation removed or a 2 point improvement in their oxygen scale. Over the timeline of the study, 47% of patients were discharged from the hospital.

Those are impressive results versus an early study from the University of Washington that saw 50% of people die.

However, additional data on April 16 highlights that Remdesivir has the potential to generate even better results for COVID-19 patients. A University of Chicago study showed that 125 people with COVID-19, of which 113 had a severe form of the diseases, who were treated with Remdesivir, saw only 2 deaths.

Given the high death rate for patients with the severe form of the disease, this is promising. New data will be coming over the next several weeks. I recommend investors pay close attention to this data.

A Look At Flu

To analyze the potential benefits of treating COVID-19, we look at one of the widest spread severe diseases known, the flu. It killed 80 thousand people this past year in the United States alone.

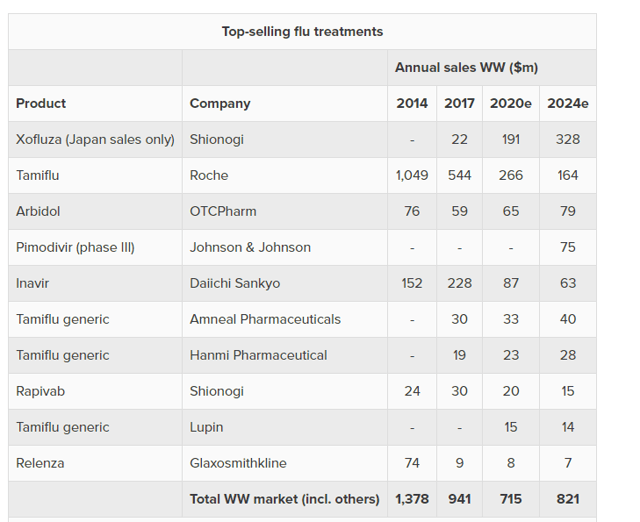

Top-Selling Flu Treatments – Evaluate

The above image shows some of the top selling flu treatments. There are several important things worth noting here. The first is that Xofluza is doing well but selling only in Japan. If it expanded internationally, the overall worldwide flu market could do incredibly well. The second thing to note is several popular drugs (like Tamiflu) coming off patent could hurt the market with generics.

The last important thing to note is that none of these treatments are a true solution for the flu, and that the flu is much less deadly than COVID-19. However, if we assume a new world model that treats COVID-19 as the flu 2.0, then it will effectively be a new $1 billion pharmaceutical market that Gilead Sciences can dominate. Not super-exciting, but not bad either.

A Look At HIV

As a result, we believe that a much better disease to compare Gilead Sciences’ COVID-19 potential to is HIV. HIV is a deadly disease that emerged on the scene in the 1970s-1980s. It rapidly spread to infect 10s of millions of people, causing a significant number of deaths, before treatment standards made it a disease that one can live with.

While people eventually survive COVID-19 and can recover from it without needing continuous treatment, the HIV model is much more similar to COVID-19 that comes back each year, as a deadly disease, like the flu.

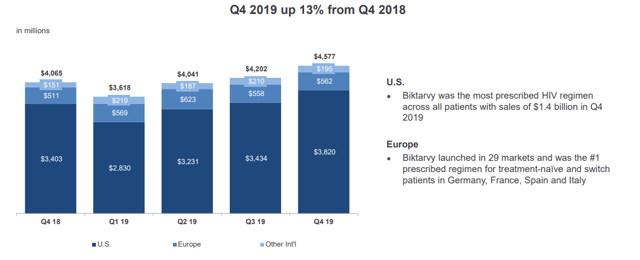

Gilead Sciences HIV – Gilead Sciences Investor Presentation

Gilead Sciences HIV drug sales are visible above. The company has managed to continue to retain and grow its market share, while continuously improving the treatment options for patients. As a result, the company’s HIV revenue is approaching an astounding $20 billion per year, with the company having a long-term pipeline for revenue here.

Gilead Sciences charges roughly $1800 for a 30 pill treatment of Descovy or $60/pill. Let’s assume that COVID-19 patients are treated immediately at a one-time dose of the same amount ($1800). That’s a significant market potential, given that already more than 2 million people have COVID-19.

Remdesivir Financial Potential Forecast

* We assume that Remdesivir will become a front line treatment, given to all symptomatic people regardless of their severity of symptoms.

Putting this together, let’s take a look at Gilead Sciences’ Remdesivir financial potential forecast. We will assume that the company becomes a front-line treatment for COVID-19 and that the price paid for treatment is proportional to healthcare expenditures per capita. We will also assume that this is a one-time deal for shareholders i.e. that a vaccine is created in a year.

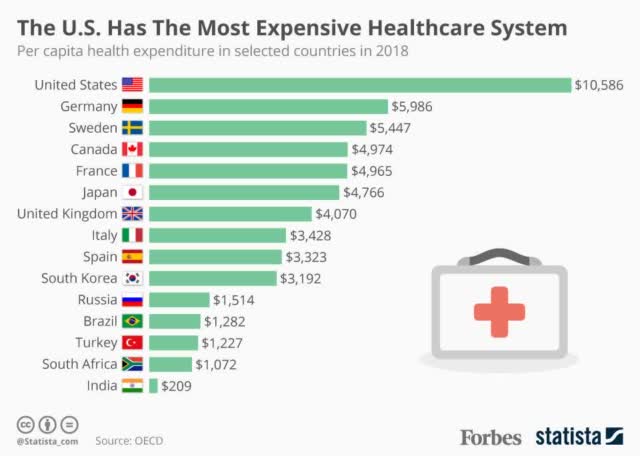

Healthcare Spending per Capita – Forbes

Healthcare Spending per Capita – Forbes

The above image shows healthcare spending per capita by country. We’ll take the $1800 treatment number above for the U.S. and adjust proportionally. That means, for OECD, which has half the average healthcare expenditures of ~45% of the United States. That means that the OECD average expenditure for COVID-19 will be $810/person.

Additionally, let’s look at India ($209/capita, so $36/COVID-19 treatment). China spends more than double that per capita, so we’ll put it at ~$80/COVID-19 treatment. We’ll also stick to estimates that COVID-19 will affect approximately half of the world’s population, and we’ll assume that 25% of asymptomatic people don’t need treatment.

The total OECD population is 1.3 billion people. India’s population is 1.35 billion people and China’s population is 1.4 billion people. Putting all of this together means that these 4 billion people have the potential to generate a massive amount of COVID-19 revenue. In fact, using our 50% statistic, (37.5% with asymptomatic), that’s the potential for more than $450 billion in revenue.

That’s significant potential for shareholder returns and profits.

Additionally, even if the company sells Remdesivir at breakeven prices, or slightly lower prices, the company has significant potential. If it makes only $5 profit/pill with 50% of the population and 25% asymptomatic and our same numbers, that means the potential for $15 billion in profit. For a company with a $100 billion market capitalization, that’s the potential for significant returns.

Even if the company doesn’t make profits, there’s significant potential. That’s because the company becoming the face of COVID-19 treatment could mean significant potential from customers learning about the country’s other drugs. Even if they don’t, the company will get significant benefits from the manufacturing infrastructure selling drugs at cost will subsidize.

Either way, it’s likely that Gilead Sciences makes billions from this.

Risks

The main risk that investors in Gilead Sciences should pay attention to in terms of its COVID-19 potential is investors pricing in too much growth and then an alternative treatment being found. Work is being done around the world to find potential treatments, and success in any of these fields would mean that investors unfairly bid up Gilead Sciences’ share price, and it would drop back down.

However, currently, Gilead Sciences seems to have one of the best treatments.

Conclusion

Gilead Sciences’ recent Remdesivir treatment news is exciting, and we take the time to analyze it in this article. We expect that this treatment has the potential to generate significant results for shareholders, even if the company is incredibly responsible about how much it charges, in one of the world’s worst pandemics ever.

Compared to HIV and the flu, this treatment, which has the potential to be a new front of the line treatment, can save many lives. In the best scenario, the treatment has the potential to return several times the company’s market cap, but even in the worst case, infrastructure will likely be subsidized for the company. Overall, the company is a quality investment.

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long GILD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment