Chip Somodevilla

Microsoft (NASDAQ:MSFT) has arguably single-handedly started a rally in tech stocks as it showed that it will take more than inflation or the Russia-Ukraine war to stop the digital transformation growth story. MSFT continues to show secular growth and strong margins – all while rewarding shareholders with growing dividends and share repurchases. While the stock is not trading nearly as cheap as tech peers, this is a company which has earned its right as a sort of tech bellwether and its valuation reflects that. The stock remains a buy, and I could see operating leverage helping the company to sustain double-digit earnings growth for years to come.

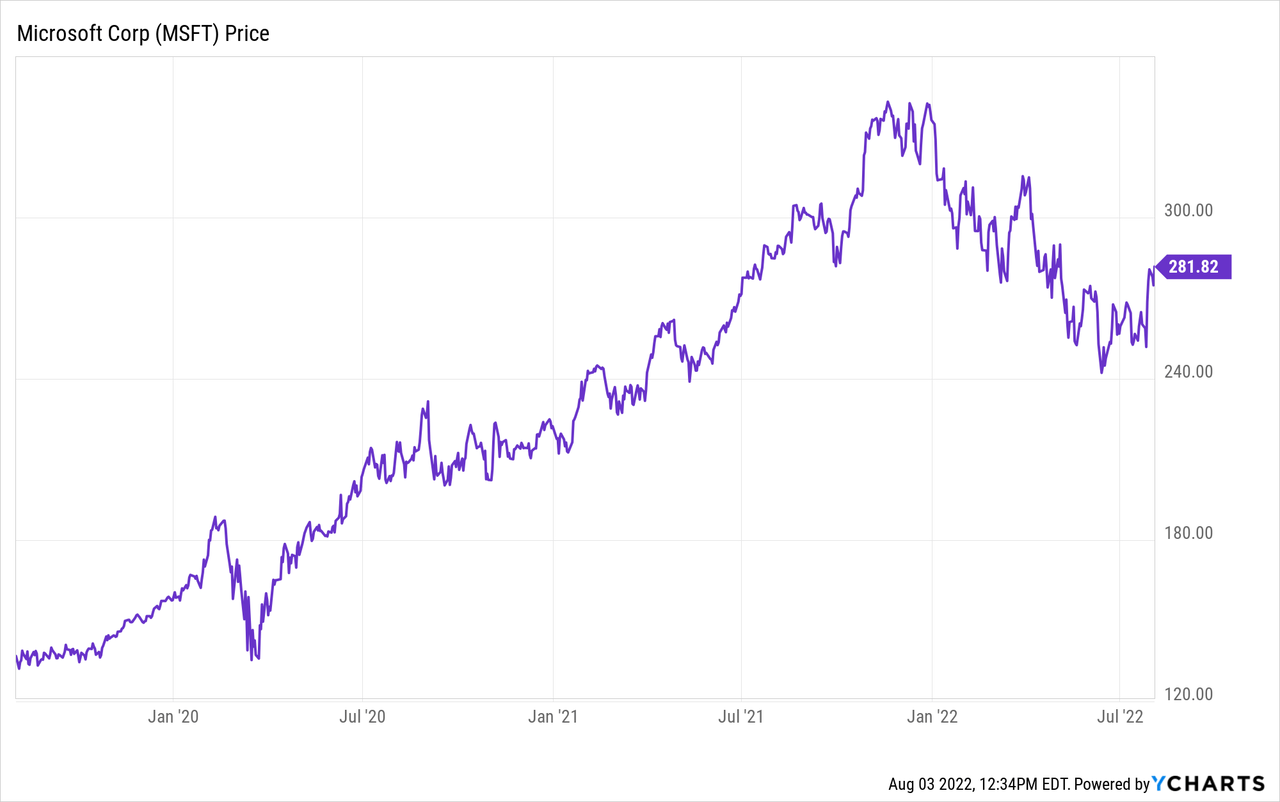

MSFT Stock Price

After peaking at just under $350 per share near the beginning of the year, the stock has since pulled back 20%.

Whenever a stock like MSFT drops by that much, one could logically assume that the rest of tech must be down even further (and in this case, they would be right). I last covered MSFT in May, where I discussed the stock’s virtues as a dividend stock. The company’s continued strong results show that MSFT is a reliable cash flow machine.

What Were Microsoft’s Expected Earnings?

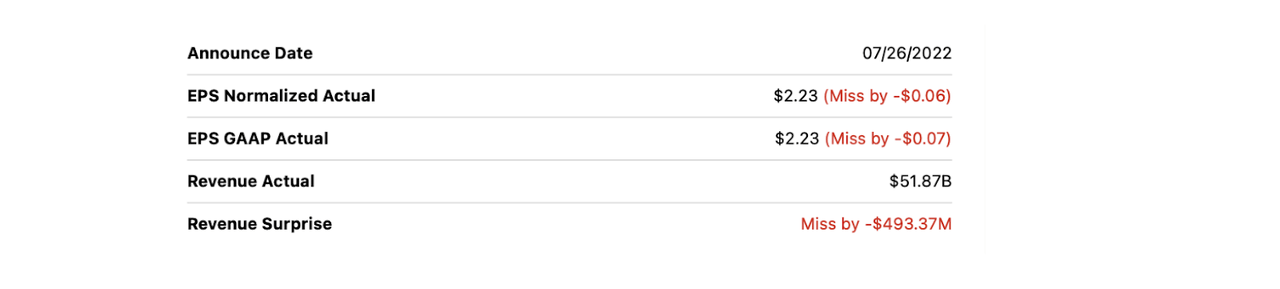

MSFT was scheduled to report earnings on July 26th, when it was expected to report $2.17 in earnings per share and $52.36 billion in revenues.

Seeking Alpha

Did Microsoft Beat Earnings?

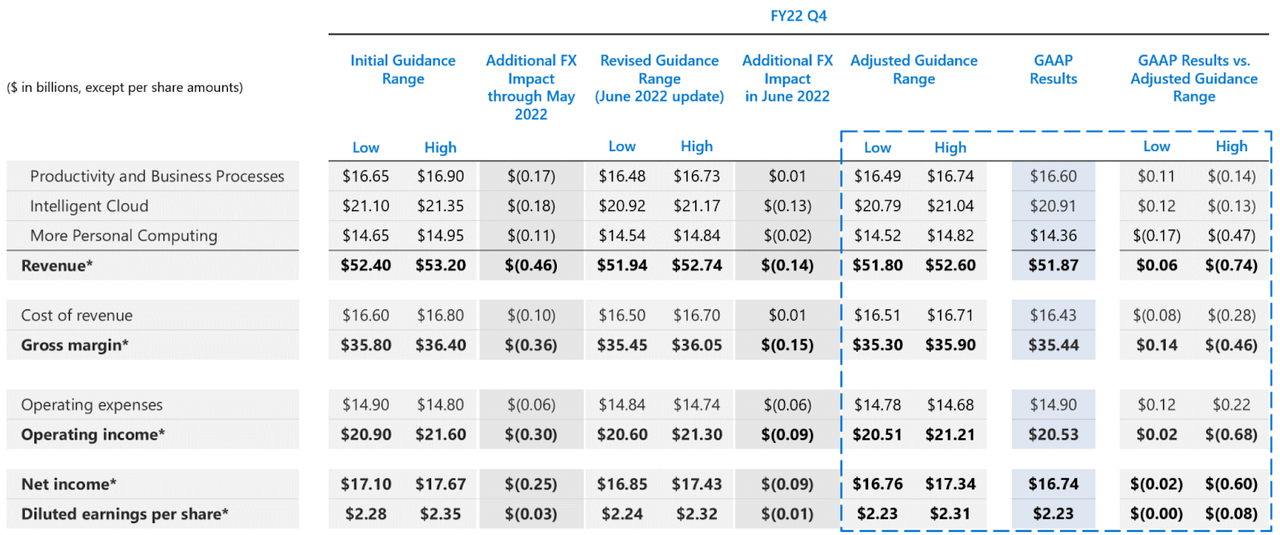

While the company narrowly missed on both fronts, currency exchange headwinds negatively impacted the results. We can see below that after adjusting for constant currency, MSFT’s results fell squarely within its own previously issued guidance.

FY22 Q4 Slides

MSFT Stock Key Metrics

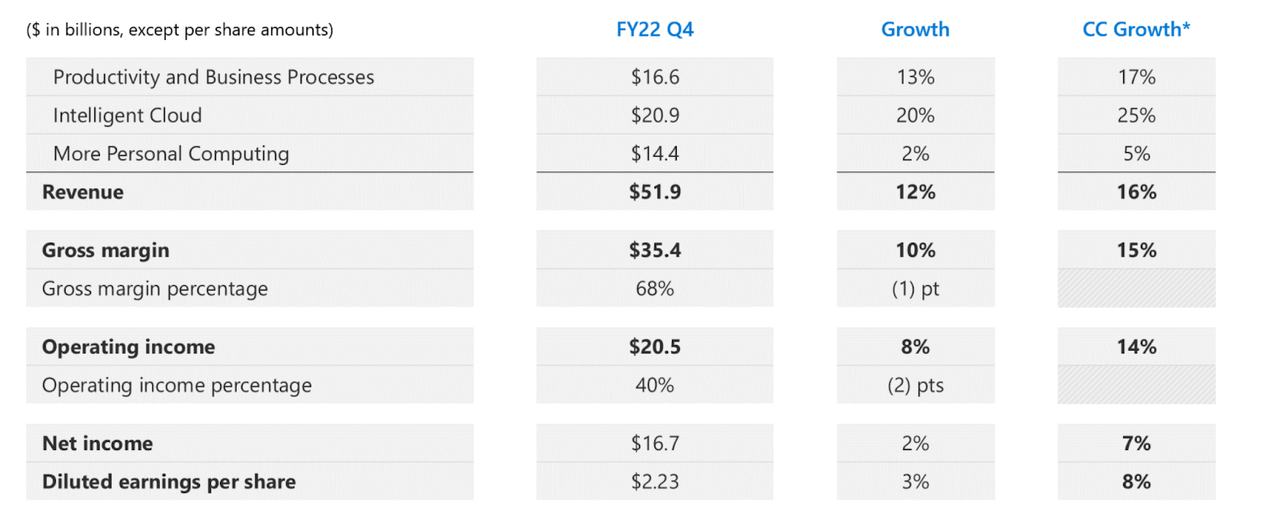

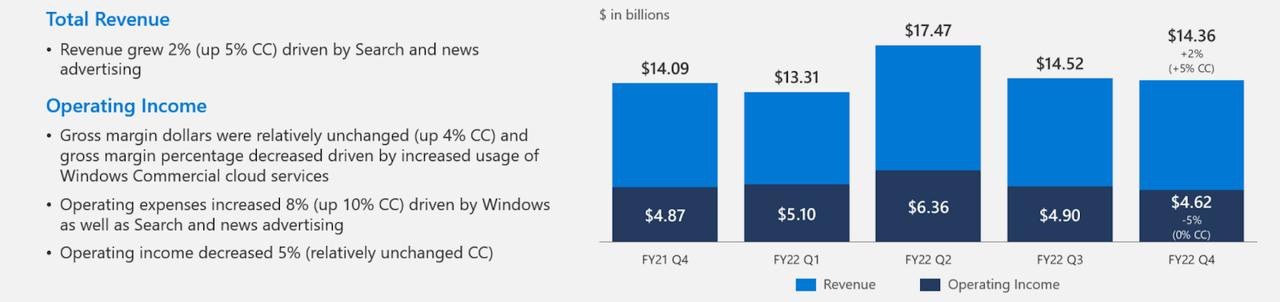

In the quarter, MSFT generated 12% revenue growth (16% constant currency) and 3% growth in earnings per share.

FY22 Q4 Slides

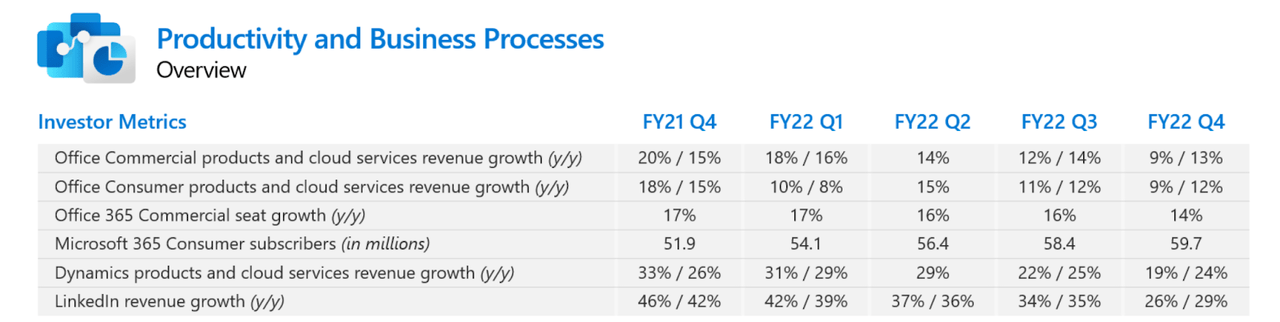

Most investors may know MSFT due to its productivity products like Microsoft Word. Those brand-name products continued to grow at a double-digit clip, with LinkedIn leading the way with 26% revenue growth.

FY22 Q4 Slides

On the conference call, management noted that the strength in LinkedIn was especially impressive considering that, like other online advertising companies, it faced headwinds in the weak online advertising market.

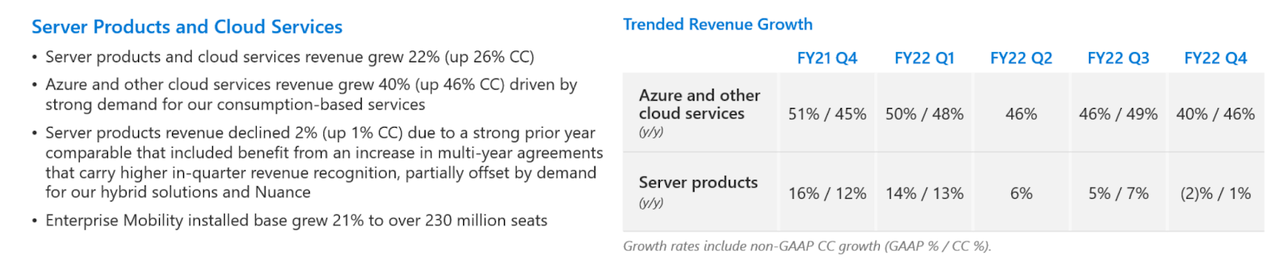

In my view, cloud computing is quickly becoming one of the more important stories at MSFT. Azure and other cloud services grew by an impressive 40% in the quarter, helping overall server products and cloud services grow by 22%.

FY22 Q4 Slides

While MSFT does not explicitly break out Azure financials, based on the disclosed numbers, I estimate Azure and other cloud services revenues to have hovered around $9 billion in the quarter.

MSFT did see a slowdown in its “more personal computing” segment, which is understandable due to the tough pandemic comparables.

FY22 Q4 Slides

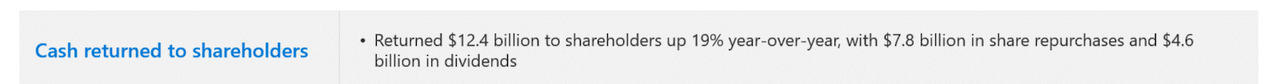

In the quarter, MSFT returned $12.4 billion to shareholders through $7.8 billion in share repurchases and $4.6 billion in dividends.

FY22 Q4 Slides

The company ended the quarter with $104.7 billion of cash versus $49.7 billion of debt – this is the kind of company that I expect to manage net leverage over the long term.

What To Expect After Earnings

Those results were fine, but arguably not too spectacular. Instead, it was the guidance that was “heard around the world.” MSFT guided for “double-digit revenue and operating income growth,” driven by “continued momentum in our commercial business and a focus on share gains across our portfolio.”

In normal times, that kind of commentary is nothing special. But given the brutal stock price movements in the tech sector, that kind of guidance eased fears regarding a tech apocalypse. Given the resemblance between the stock price actions of today and the 2000-2001 tech stock crash, perhaps some investors were expecting tech earnings to greatly disappoint. MSFT has proven them wrong.

Is MSFT A Good Investment Long Term?

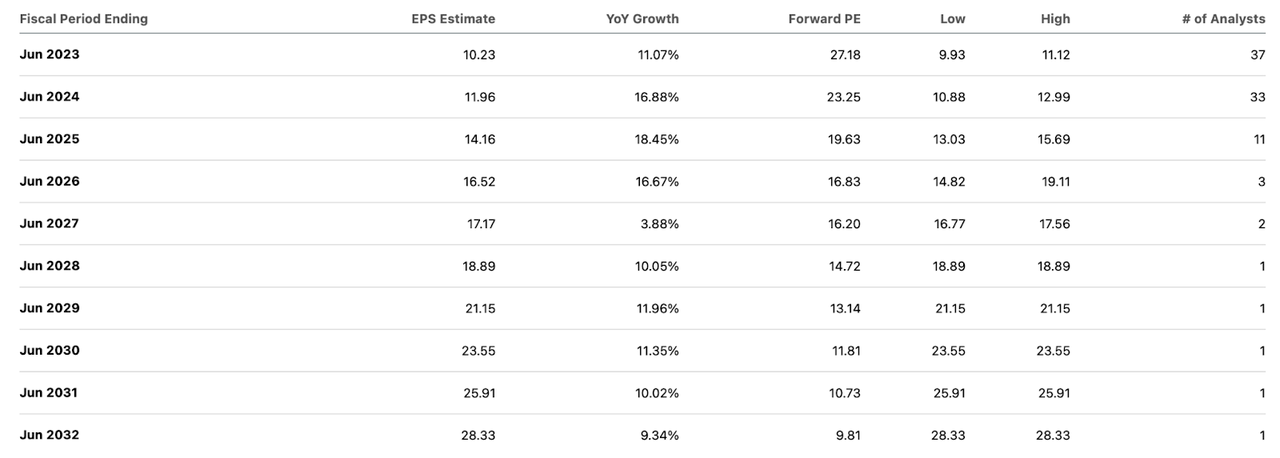

Over the long term, I expect MSFT to continue empowering digital transformation across enterprises while continuing to aggressively grow its cloud operations. Consensus estimates call for double-digit earnings growth to persist over the next decade.

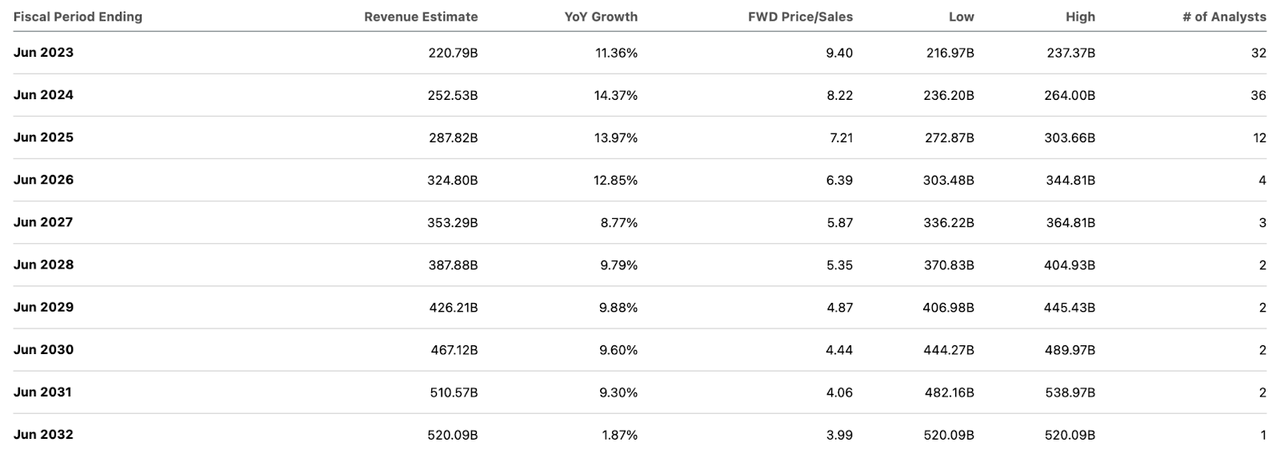

Seeking Alpha

I consider those estimates to be conservative, as it reflects minimal operating leverage as compared to revenue growth.

Seeking Alpha

MSFT is expected to generate 40.7% net margins in 2032 – barely higher than the 34.6% net margin projected this year.

Is MSFT Stock A Buy, Sell, Or Hold?

With the stock trading at 27x forward earnings, the stock might not look obviously cheap to the casual observer. And indeed, that valuation does not reflect nearly the same pessimism seen elsewhere in the tech sector, with many tech stocks down 80% or more. But unlike most tech stocks, MSFT has been able to pair secular growth with robust GAAP profitability – all while rewarding shareholders with dividends and share repurchases. I could see MSFT trading up to 40x earnings over time as it continues to generate double-digit top and bottom-line growth. That reflects 50% potential upside, but I note that in practice that upside may be more likely spread across several years – in conjunction with double-digit growth, that should lead to market-beating returns. There are two key risks here. First, given that MSFT is already a $2 trillion company, the law of large numbers suggests that growth rates should eventually slow down. That in turn may lead to valuation contraction, which may eat away at shareholder returns. While there are many examples of slow-growth stocks trading at rich multiples, there is no guarantee that MSFT can earn a similar shareholder following. My view is that operating leverage should help MSFT sustain faster bottom-line growth for several years at least. I continue to rate MSFT a buy on account of the market-beating potential, but emphasize that there are better buying opportunities elsewhere in the tech sector.

Be the first to comment