Wavebreakmedia/iStock via Getty Images

Global Medical REIT Inc. (NYSE:GMRE) is a real estate investment trust (“REIT”) that owns a portfolio of healthcare facilities that are primarily leased to single-tenants under triple-net leases. Their target tenants are strong healthcare systems and physician groups with leading market share. Until mid-2020, the company was externally managed. But they have since terminated that agreement in favor of internalization.

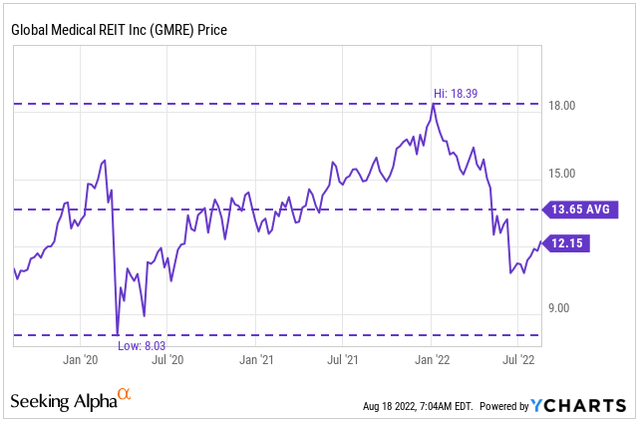

Over the past two years, shares have traded in a fairly tight trading band, hitting a low of $8 during the height of the COVID-19 pandemic to a high in the mid $18s earlier this year. They have since settled into a level representing a multiple of forward adjusted funds from operations (“AFFO”) of 12.2x. In comparison, that multiple stood at 18.7x, 14.8x, and 17.6x at the end of 2021, 2020, and 2019, respectively.

YCharts – GMRE’s Recent Share Price History

Though shares are up about 7% over the past month, they are still down over 30% YTD. The stock, accordingly, appears to have further room to run, especially when considering favorable secular trends in long-term healthcare that will favor the continued expansion of quality facilities.

A further draw is the dividend payout, which is currently yielding nearly 7%. Combined with share price upside potential of over 20%, an investment can provide outsized returns in the coming periods. For investors seeking a higher yielding REIT for their long-term portfolios, GMRE at current valuations provides an attractive entry point.

A Growing Portfolio Of Quality Medical Office Buildings

GMRE’s total portfolio includes 4.5M square feet of net leasable area in 171 buildings throughout most of the United States, but with particular concentration in Texas and Florida, who both account for over 10% of annualized base rent (“ABR”), nearly 20% in Texas, alone.

Since their IPO in 2016, GMRE has significantly grown their healthcare portfolio, from +$94M in acquisitions at IPO to +$1.4B through Q2FY22, a compound annual growth rate (“CAGR”) of 56%.

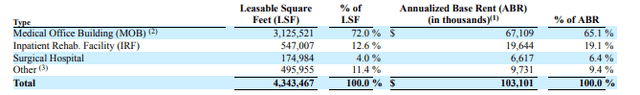

In the most recent full year ended December 31, 2021, GMRE owned three primary property types: Medical Office Buildings (“MOB”); Impatient Rehab Facilities (“IRF”); and Surgical Hospitals. Together, these properties account for approximately 90% of ABR.

2021 Form 10-K – Breakout of GMRE’s Property Types

Favorable Secular Tailwinds

In the coming years, demand is expected to increase for facilities such as those owned by GMRE. The recent census survey, for example, showed that the 65+ population grew by over a third during the past decade, with 3.2% growth from 2018 to 2019, alone. This level of growth is likely to support demand for age-related services, such as orthopedics, gastroenterology, and rehabilitation.

GMRE’s conveniently located facilities is also supportive for the aging population. 90% of Americans aged 50+ desire to age in place, while 65% of seniors between the ages of 60 and 70 find it easy to live independently. Readily available access to MOBs and IRFs is perhaps one such reason why most Americans in this age group prefer to remain in place.

Continuing growth in outpatient operations is yet another draw for GMRE’s facilities, as most of their properties are outpatient focused. Rising behavioral health concerns over the past two years is one example of patient demand that would require more outpatient operations supportive of mental health-related issues.

Capitalizing On The Growth Trends

Robust demand for healthcare facilities, aided in part by favorable secular tailwinds, is reflected in current occupancy levels, which are at 96.5% for the overall portfolio. It is also reflected in the highly competitive acquisition environment, which has seen an influx of investors in search of reliable returns.

As a smaller REIT, the intense competition for acquisitions can be an operational challenge when stacked against more resourced peers. But management continues to display competency in closing on accretive deals.

In Q2FY22, they acquired five properties at an acquisition cost of +$74M and then another 2 properties for +$23M at the start of the third quarter. In addition, they have an additional +$50M of deals under contract and in due diligence. With over +$170M of acquisitions closed or under contract thus far in 2022, management remains comfortable with hitting their target range of +$180M – +$220M for the year.

Rising Rates Are Creating A Few Obstacles

One potential obstacle in the way of their acquisition targets is the current rising rate environment, which has increased financing costs, cap rates, and interest expenses. In the current quarter, for example, the sale of one of GMRE’s MOBs to a potential purchaser in Belpre, Ohio fell through due to financing market conditions.

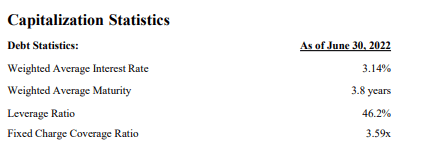

And in GMRE’s own case, their interest expense incurred during the quarter reflected a weighted average borrowing cost just shy of 3%, which is up just 10 basis points (“bps”) from Q1. But for Q3, borrowing costs are expected to be 50-70bps higher than the second quarter. That is a large step-up for just one quarter.

Overall leverage also ended the quarter outside of GMRE’s targeted rate of 40-45%. But this was necessary, given the current competitiveness in the market. Despite the increase, their fixed coverage ratio remained adequate. And through recent actions taken in the capital markets, they were essentially able to fix 80% of their total debt outstanding, thereby minimizing risks associated with a greater quantity of floating-rate holdings.

Q2FY22 Investor Supplement – Summary of Debt Statistics

Numerous Opportunities For Internal Growth, Even If Acquisitions Were To Slow

Even if GMRE failed to hit their investment targets, there are numerous opportunities for internal growth. Continuing lease-up activities on some newly acquired properties is one opportunity. Of the five properties acquired during Q2, for example, there is 30k square feet of cumulative lease-up potential in four of them.

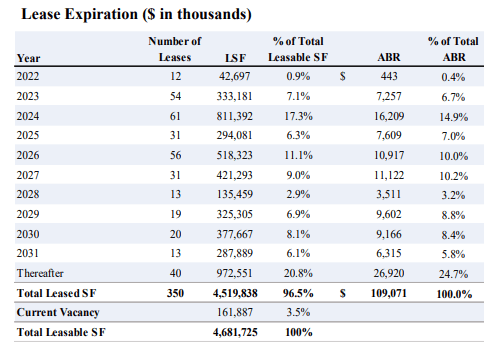

In addition, the rollover schedule looks accommodative for future rental growth, with over 20% of current ABR set to expire through 2024. That should provide a favorable setting for the resetting of rates to market levels.

Q2FY22 Investor Supplement – Lease Expiration Schedule

Recession-Resistant Industry Provides Durability To Cash Flows

A strong tenant base that is comprised overwhelmingly of national and regional healthcare affiliates provides stability to GMRE’s existing portfolio and earnings growth. In the current quarter, on a same-store basis, revenues were up 1.6% from the same period last year, while overall FFO and AFFO were both up double-digits at 16% and 17%, respectively.

The recession-resistant nature of the industry provides further defense against a deterioration in the broader market environment. This stability will ensure continuing cash flow growth necessary to support their major obligations such as rising interest expenses and the maintenance of their quarterly dividend payout.

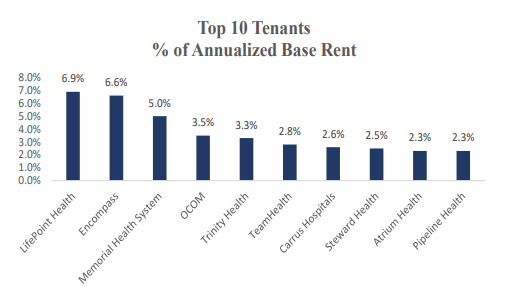

Q2FY22 Investor Supplement – Summary of Top Tenants

At present, GMRE pays a quarterly dividend of $0.21/share, representing a yield of nearly 7% at current pricing and a payout of 84% of current period AFFO. Additionally, total dividends paid during the quarter were 1.4x covered by total operating cash flows. Rising interest expense in later periods will create a drag on earnings as will the increased use of their ATM program for equity financing. Nevertheless, it’s still likely GMRE will end the year with close to $1/share in AFFO. This would keep coverage levels at the status quo.

Outsized Returns Through Current Dividend Payouts And Share Price Upside Potential

GMRE is a REIT that operates in the recession-proof healthcare industry, serving as a triple-net lease landlord to strong healthcare systems and physician groups with leading market share. Following their IPO in 2016, the company has expanded their gross assets at a CAGR of 56% and is still acquiring properties, despite the fiercely competitive market environment that includes greater resourced competitors.

Their expansion has enabled them to capture respectable market share in attractive markets such as Texas and Florida. Additionally, it has also positioned them favorably to reap the rewards of secular tailwinds that are expected to drive continuing demand for outpatient-focused medical office buildings, a key asset within the company’s portfolio.

Rising interest rates do present an obstacle to current operating conditions, as does legislation risk, an ever-present risk which can never be discounted. However, the company has proved adept at navigating through the challenging environment.

With shares down over 30% YTD and valuations at lower levels than they were over the past three years, there is attractive upside in the stock. At 15x forward AFFO, shares would be valued slightly higher than they were at the end of 2020 but lower than they were at the end of 2019 and 2021. Yet, they would have an implied share price of approximately $15, which would be over 20% above current trading levels. In addition to a dividend that is yielding nearly 7%, this can provide outsized returns to shareholders in future periods. For those seeking a higher yielding REIT for their long-term portfolios, GMRE provides attractive upside at a bargain price.

Be the first to comment