guvendemir/E+ via Getty Images

Thales S.A. (OTCPK:THLEF) will most likely experience a significant increase in orders from European governments as the war in Ukraine evolves. The company’s defense business growth could grow more than expected. In addition, the outlook for the year 2022 appears quite satisfactory with only organic growth up to 6%. In my view, if management is smart, and uses its total amount of cash to acquire other competitors, the upside potential in THLEF’s stock price could go beyond what most investors expect. In my view, Thales is a buy.

Thales

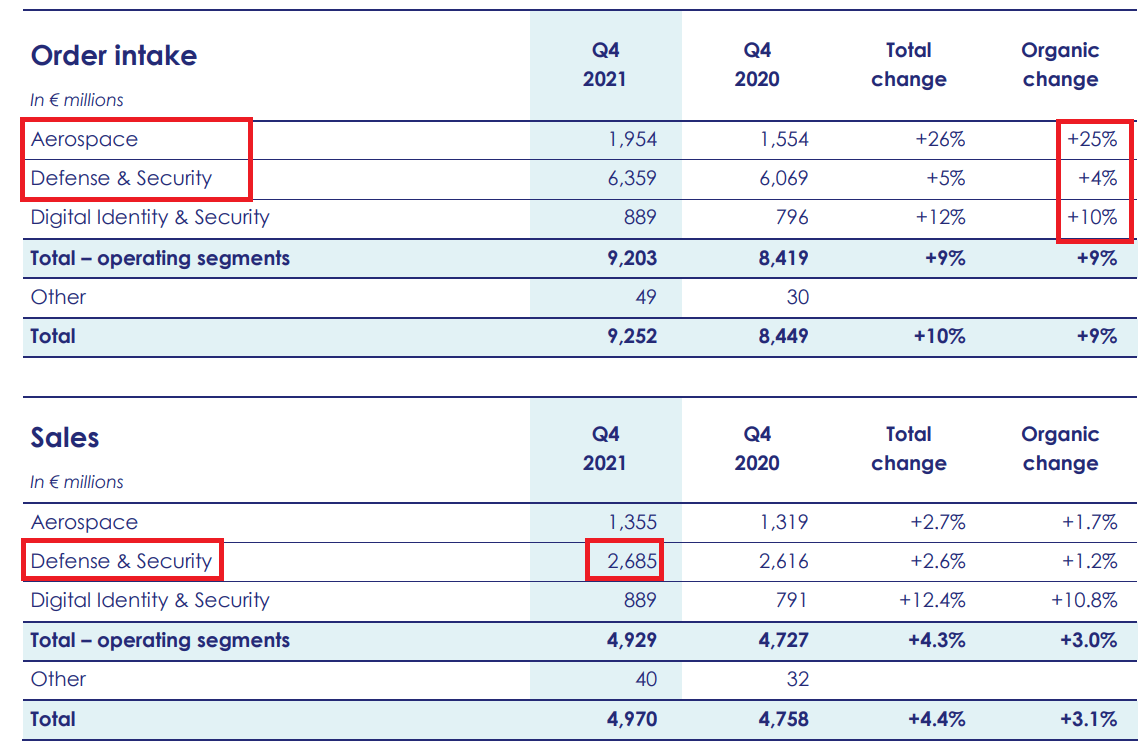

Thales is a European group focused on aerospace, space, and defense. Notice that in Q4 2021, all the company’s business segments reported sales growth. We are assessing the company at a sweet moment:

thalesgroup.com

With many journalists claiming that investments in defense in Europe are increasing significantly, I believe that reviewing Thales right now makes a lot of sense. If the war in Ukraine continues, in my view, investments in defense will likely trend north:

Seven European nations have increased defense budgets in one month. Source: Breaking Defense

Thales has many years of expertise of helping governments in maintaining security by offering services to armed forces. The company also offers solutions in the digital battlefield to protect states, cities, and infrastructures:

In Defence and security, armed forces, governments and global organisations entrust Thales with helping them achieve and maintain security, tactical superiority and strategic independence in the face of any type of threat. In an increasingly unpredictable world, governments rely on our expertise to protect their citizens and make the world safer, from designing smart sensors and connecting soldiers on the digital battlefield to delivering solutions that protect states, cities and critical infrastructures. Source: Defence and Security | Thales Group

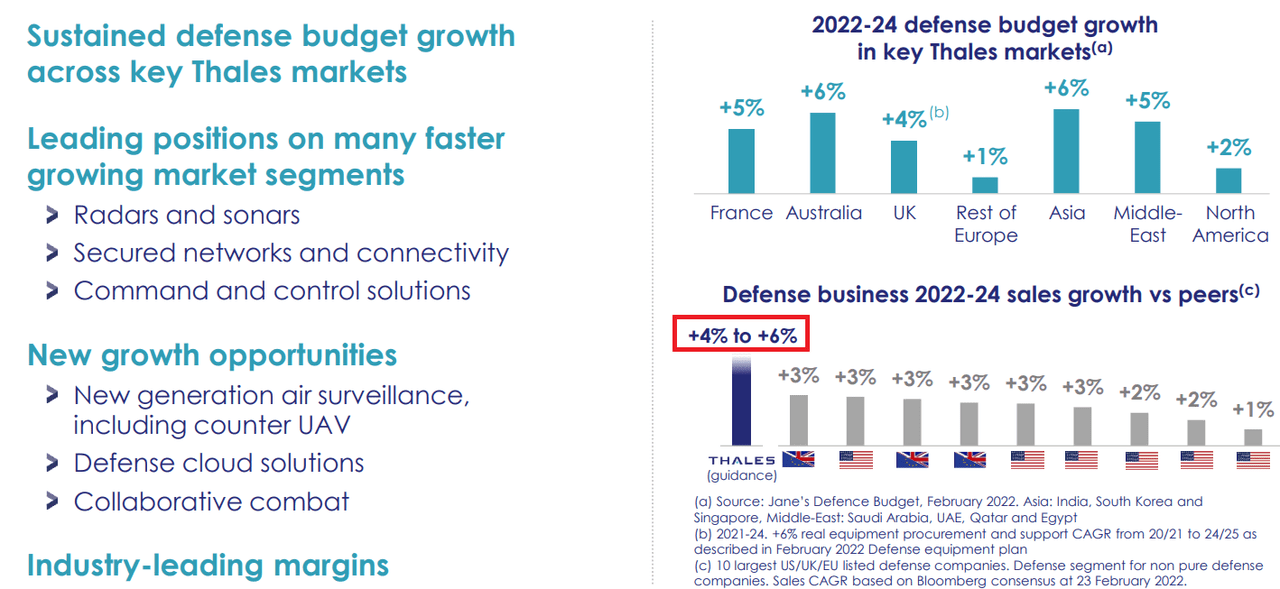

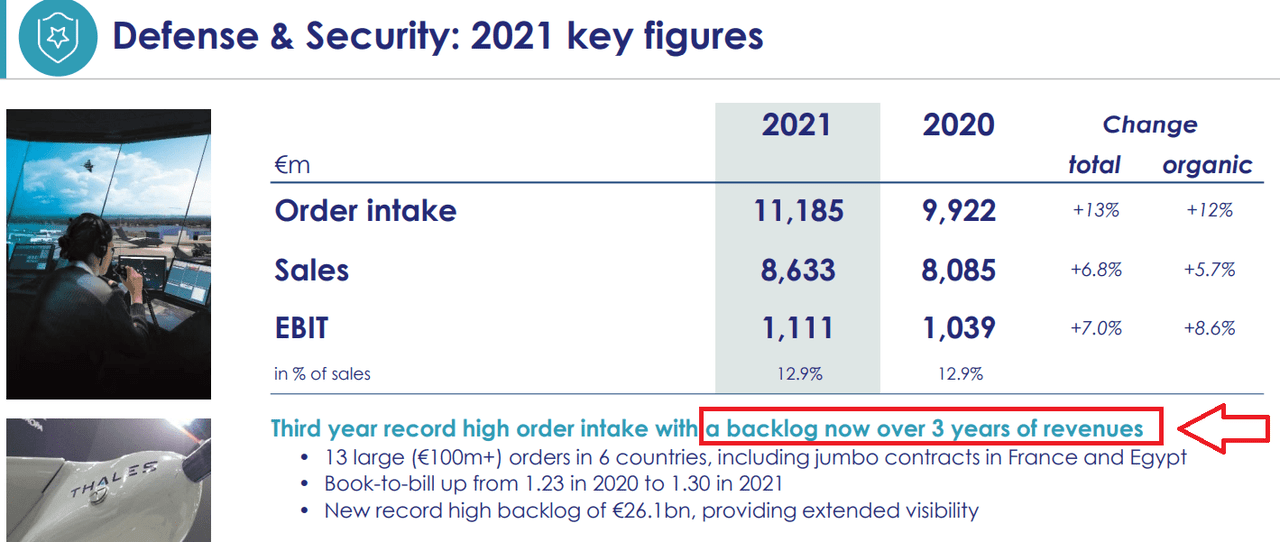

In its last presentation to investors, management noted sustained defense budget growth across key markets, and higher defense business sales growth in 2022 and 2024. Besides, management identified new opportunities in air surveillance, defense cloud solutions, and collaborative combat, which will likely enhance sales growth.

Presentation To Investors

Thales Trades At 7x EBITDA, Reduced Its Debt, And Reported Very Decent 2022 Outlook

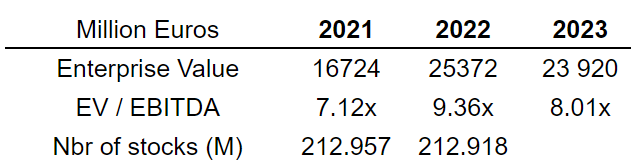

Thales currently trades at close to 7.12x EBITDA. I don’t really see why the company is selling that cheap, because the margins appear stable and quite significant.

marketscreener.com

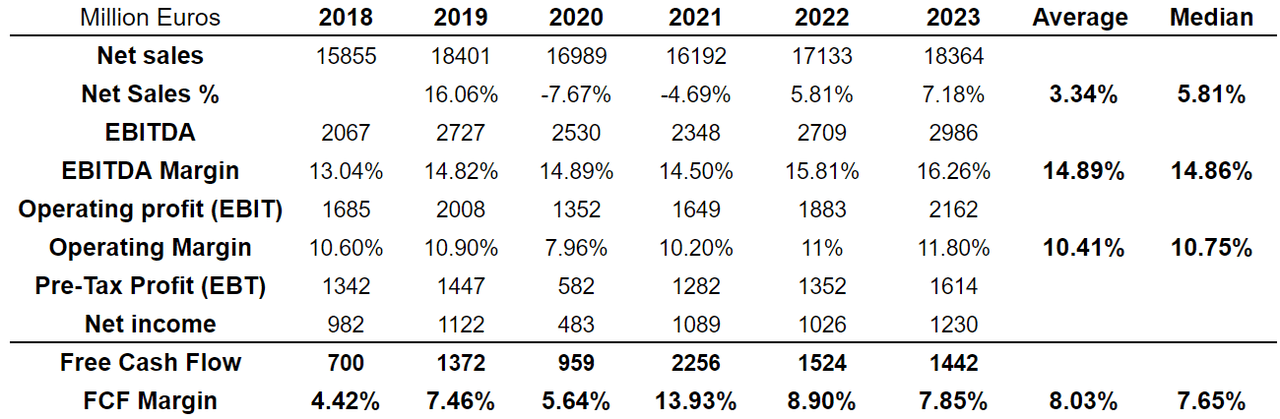

Analysts are also expecting significant sales growth in 2022 and 2023. Their estimates are quite optimistic. Including the sales expectations in 2022 and 2023, Thales’ sales grow at an average of 3%, and have a median of 5.81%. The company’s EBITDA margin’s median is 14.86%, and the EBIT margin stands at close to 10%-11%:

marketscreener.com

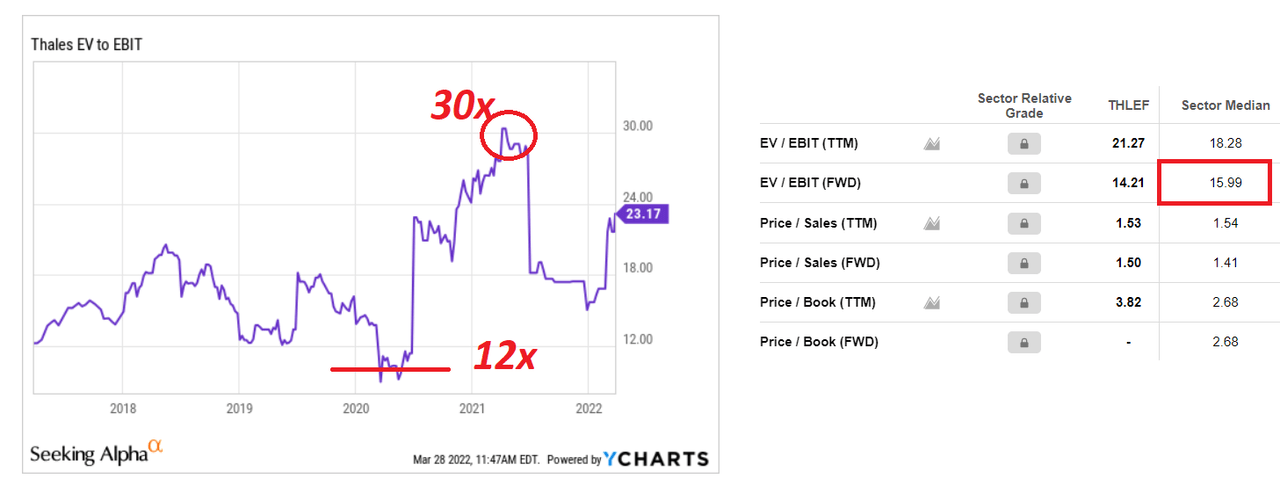

Thales traded at more reasonable marks in the past. In 2021, Thales traded at 30x EBIT, which is significantly higher than its current mark. The sector median stands at 15.99x. In my view, using an exit multiple of 15.99x EBIT makes a lot of sense.

YCharts And SA

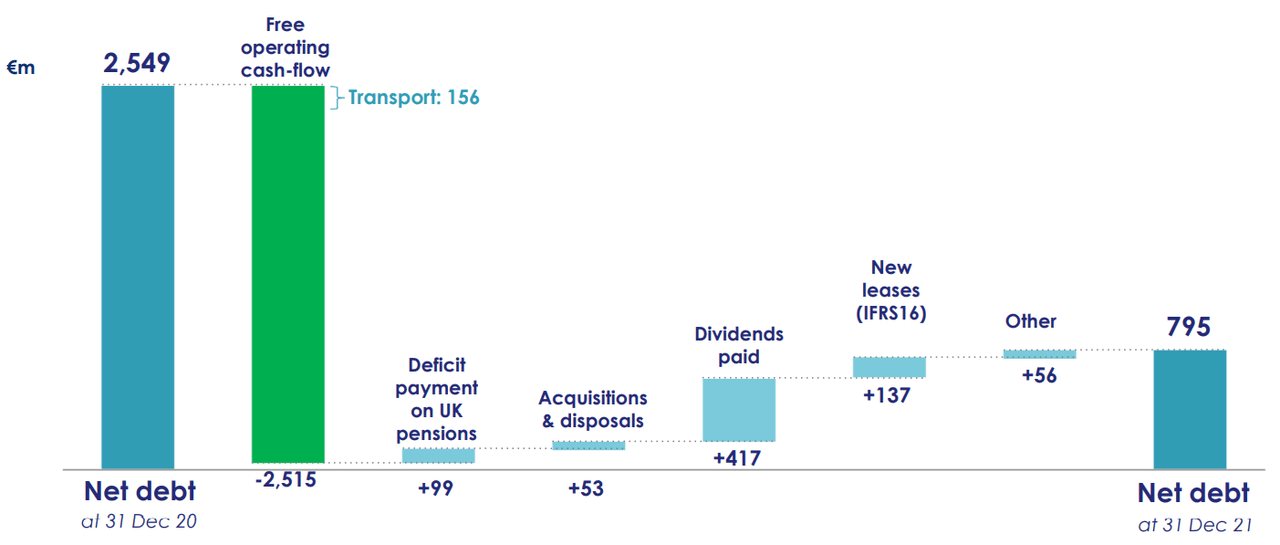

Let’s also note that the net debt currently stands at only €795 million, which is significantly lower than that in 2020. Perhaps, investors didn’t have time to review Thales’ financial accounts. In my view, a decrease in leverage usually leads to an increase in the corporations’ EV/EBIT and EV/EBITDA multiples.

Presentation To Investors

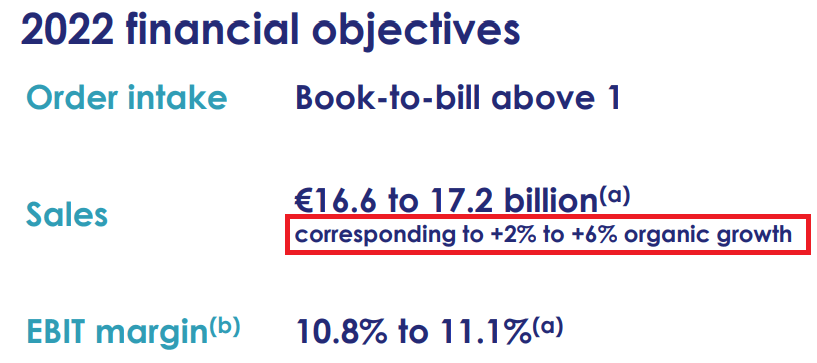

I believe that the guidance for the year 2022 is also quite beneficial. Management expects organic growth close to 2%-6% and EBIT margin of 10.8%-11.1%. I used some of these figures in my financial models.

Presentation To Investors

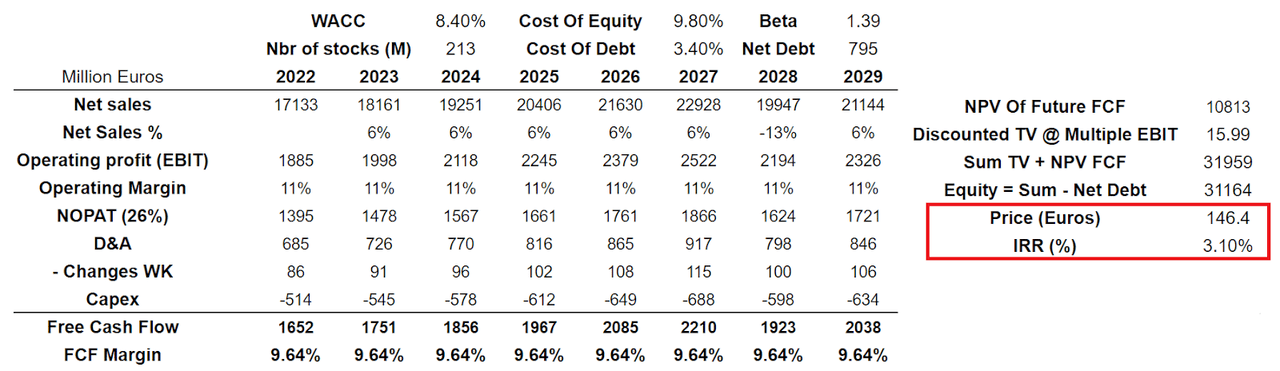

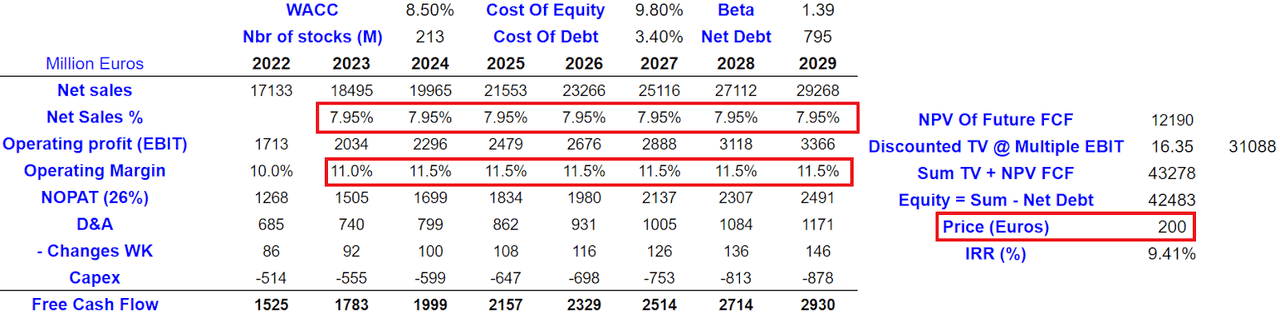

Base Case Scenario With Sales And Organic Growth Of 6% Implies A Valuation Of €146

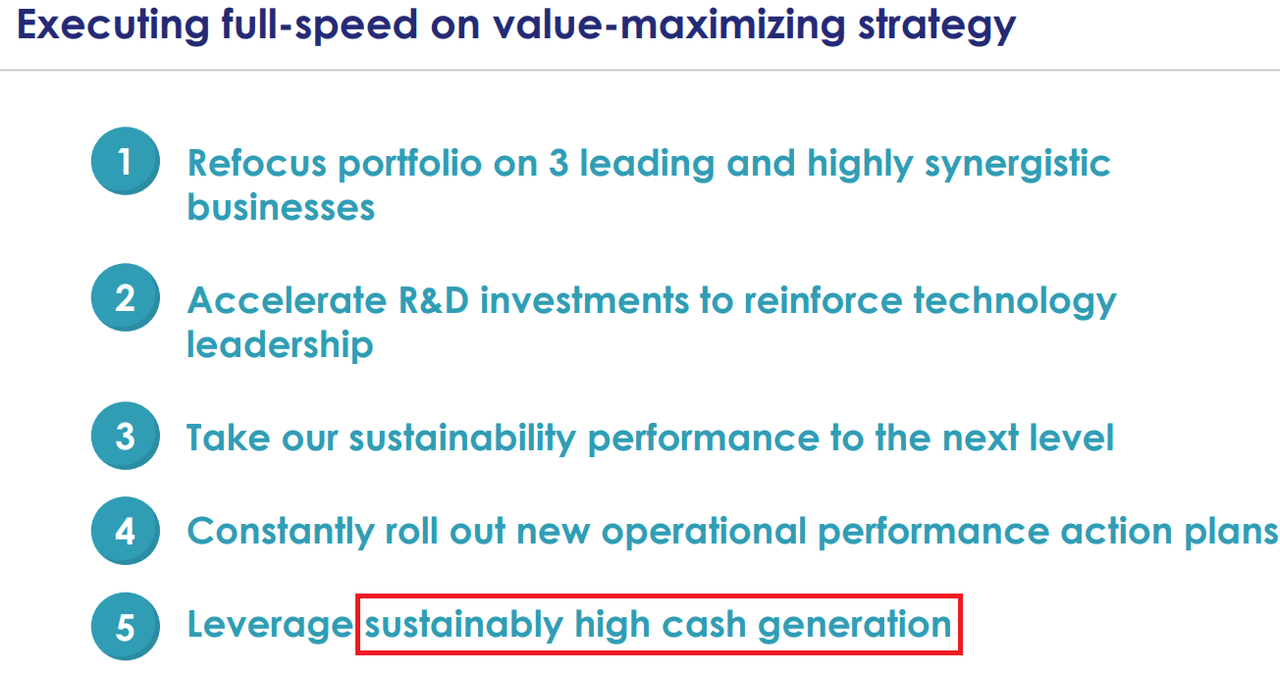

Under my base case scenario, I assumed that management will successfully accelerate R&D investments, and operational performance will be even more efficient. Besides, I also expect that management will successfully focus on cash generation, so that FCF margins will remain elevated.

Presentation To Investors

In line with my previous words, it is especially important to include the words of Thales’ chairman and CEO. He claimed that the company can expect nearly €5.5 billion of free operating cash flow over the 2021-2023 period. Let’s note that my figures are a bit less optimistic than that of Patrice Caine:

Thales concluded 2021 with an excellent fourth quarter in terms of order intake and operating free cash flow. Commercially, the Group achieved the best year in its history. These successes with our clients, combined with the remarkable mobilization of our teams, have resulted in cash generation of well over 2 billion euros. Considering this performance in 2021 and the outlook for 2022 and 2023, we are revising our cash generation target strongly upwards: the Group should thus generate nearly 5.5 billion euros of free operating cash flow over the 2021-2023 period. Source: Thales reports its 2020 full-year results| Thales Group.

Under this scenario, I included sales growth of approximately 6% from 2023 to 2029, which should imply 2029 revenue of €21 billion. If we also assume an EBIT margin of 11%, 2029 D&A close to €846 million, and 2029 capex of €634 million, 2029 FCF should stand at close to €2 billion. With an exit multiple of 15.99x EBIT, the implied price should be close to €146.

YC

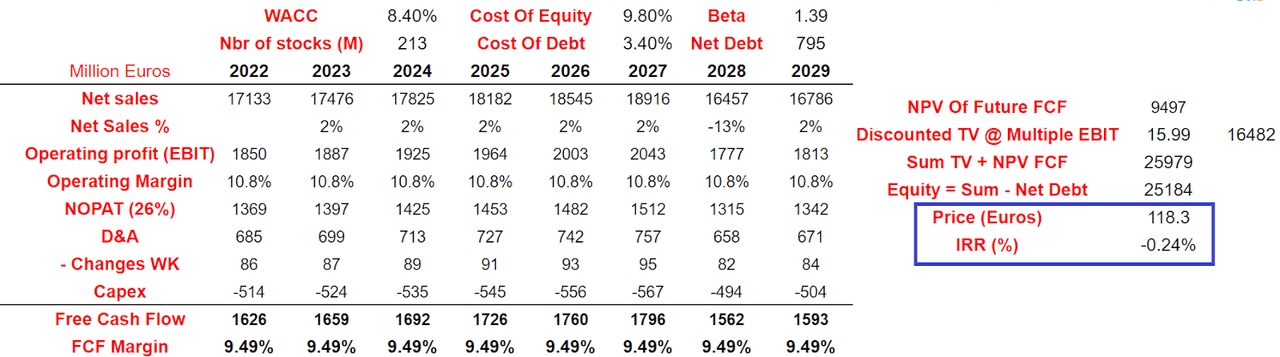

Worst-Case Scenario With Only Organic Growth Of 2% Implies A Valuation Of €118

In the worst-case scenario, Thales will not acquire other businesses. Under this case scenario, I included a drastic reduction in the number of orders in the company’s defense and security business segment. Note that sales in this business segment reached 6.8% in 2021. Under this scenario, revenue growth would decrease by approximately 50% as peace talks evolve in Europe.

Presentation To Investors

Under this scenario, I would also expect an issue with the sale of the company’s Ground Transportation Systems business, which was valued at an enterprise value of €1.66 billion. Many things could go wrong in an international transaction such as this one. If journalists notice that the sale is not going well, articles about the company could push the share price down:

All Thales teams are committed to implementing our strategic roadmap. The disposal of the “Ground Transportation Systems” business is proceeding in line with the plan. Source: Full Year 2021 Results

Finally, I also assumed that Thales will continue to suffer from the health crisis on air transport. The company already noted an initial recovery in sales, but we don’t know for how long the recovery will last:

The aerospace segment recorded an initial recovery in revenues and profitability. Nevertheless, with revenues nearly 20% lower than 2019 and an operating margin of 4.5%, it is still very much affected by the impact of the health crisis on air transport. Source: Full Year 2021 Results

Management expects 2022 organic sales growth to be at least 2%. In this scenario, I assumed that Thales will grow at 2% y/y from 2022 to 2029. I also assumed that the management will not acquire other targets in the near future, which is a bit unlikely. With the conditions given, I assumed an operating margin of 10%, changes in working capital between -€80 million and -€95 million, and conservative capital expenditures. The results include 2029 FCF of €1.5 billion, and FCF margin close to 9.5%. Finally, with an exit multiple of 15x, the implied stock price should be a bit larger than €115:

YC

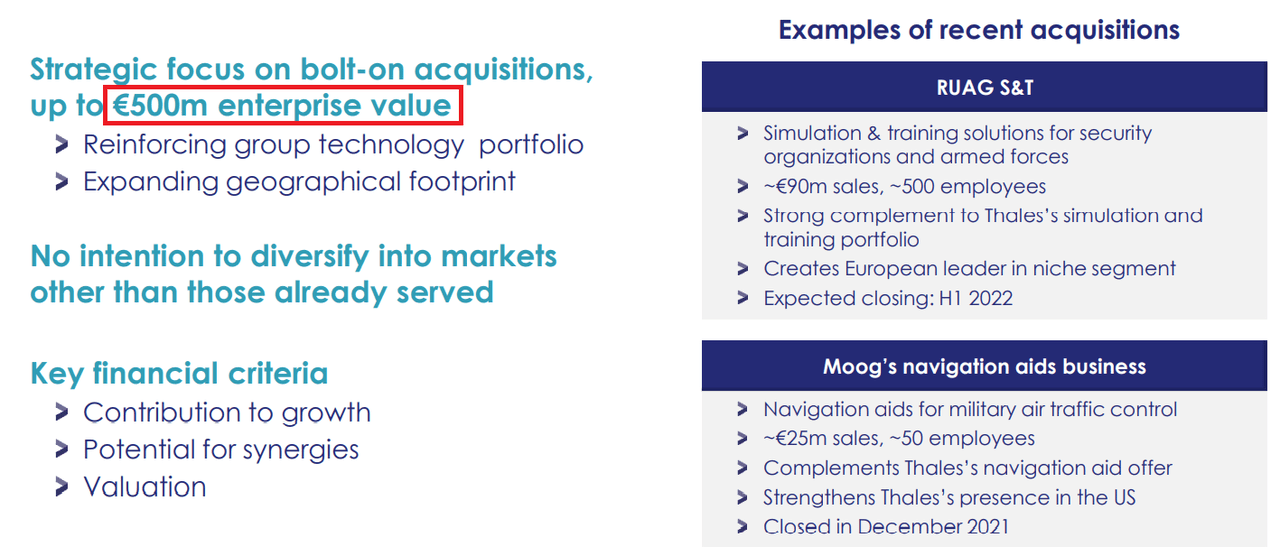

With €5 Billion In Cash, Acquisitions Could Increase Sales By 1.95% Y/Y

Under this scenario, I expect that management will successfully acquire a significant number of targets, so that revenue growth is larger than that in the previous case scenarios. I don’t have to research a lot to find successful transactions executed in the past like that of Ruag or Moog’s navigation aids business. Clearly, management knows how to acquire targets, and how to integrate them. Also, note that Thales promised to expand its geographic footprint as well as to reinforce group technology portfolio through inorganic growth.

Presentation To Investors

As of December 31, 2021, Thales reported €5 billion in cash. If we assume that the company uses its liquidity to acquire other competitors, in my view, sales growth could increase to up to 1.95% y/y. By assuming organic growth of 6%, I obtained 2029 net sales of €29 billion. I also included an increase in the operating margin from 11% in 2023 to 11.5% in 2029. My assumptions are quite conservative, but they really made a significant change in the free cash flow and the implied stock price. My results included 2029 FCF of almost €30 billion, and with an exit multiple of 16.35x, the fair price would be €200.

YC

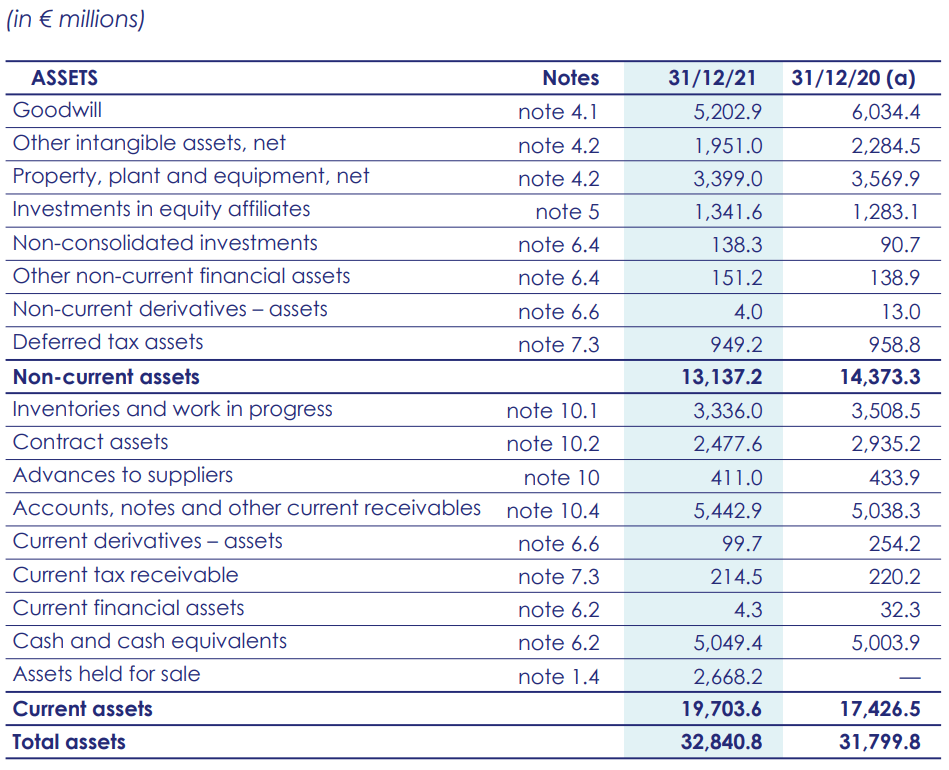

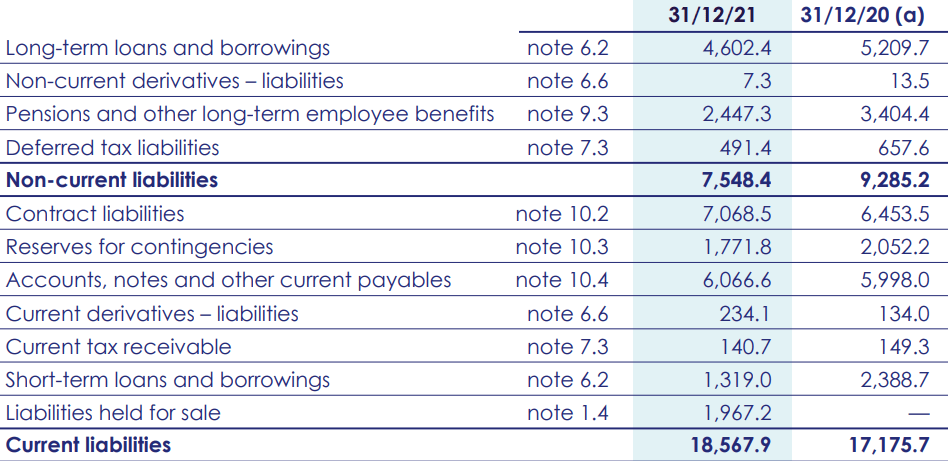

Balance Sheet: Thales Has Tons Of Cash To Finance Inorganic Growth

As of December 31, 2021, Thales reported €5 billion in goodwill, which represents 15% of the total amount of assets. It means that the company may acquire large targets. We can expect more acquisitions in the future because the company has expertise in the M&A markets. Also, with €5 billion in cash and an asset/liability ratio of 1.7x, in my view, bankers will likely give financing to Thales to acquire other competitors.

2021 Financial Statements

The list of liabilities is also not scary. Including long-term loans and borrowings, the total amount of long-term obligations stands at €7 billion. Thales also reports short-term loans and borrowings worth €1.3 billion.

2021 Financial Statements

Conclusion

With a war in Europe threatening, Thales is not only reporting an increase in the amount of defense business growth, the outlook for 2022 includes organic growth up to 6%. Besides, in my view, with the current amount of cash in hand, management has tons of liquidity to acquire other competitors as well as to increase total growth. Even considering M&A risks, health crisis on air transport, and failure in the sale of the Ground Transportation Systems business segment, Thales remains a buy.

Be the first to comment