onurdongel

Vermilion Energy’s (NYSE:VET) stock price increased by 15% in the past six months. However, according to the company’s financial results in 2Q 2022, my expectation about its 3Q 2022 results, and the energy market outlook, the stock is still undervalued. The company’s international sales in the second half of 2022 will significantly improve its leverage ratios. I am bullish on VET.

North America and International sales

In the second quarter of 2022, Vermilion Energy’s crude oil and condensate, NGLs, and natural gas production volumes were 24801 bbls/d, 8113 bbls/d, and 151 mmcf/d, respectively. The company’s North America sales increased from $225 million, or $42.30/boe in 2Q 2021 to $440 million, or $83.34/boe in 2Q 2022, as energy prices jumped. VET’s Canada sales increased from $207 million in 2Q 2021 to $395 million in 2Q 2022. Also, its United States sales increased from $18 million in 2Q 2021 to $45 million in 2Q 2022. VET’s North America free cash flow increased from $81 million in 2Q 2021 to $239 million in 2Q 2022.

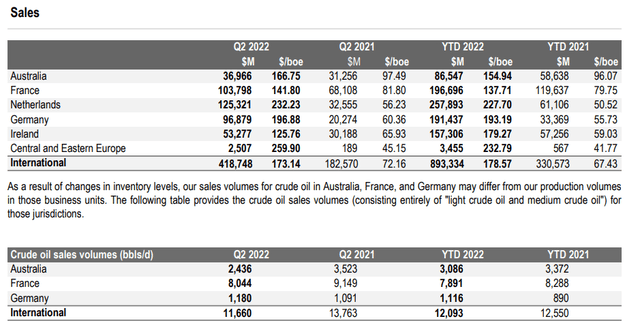

The company’s international total production and sales volumes in the second quarter of 2022 were 26840 boe/d and 26578 boe/d, respectively. Due to hiked prices, VET’s international sales increased from $183 million, or $72.16/boe in 2Q 2021 to $419 million, or $173/boe in 2Q 2022, driven by increased sales in Germany, France, Netherlands, and Ireland (see Figure 1). In Germany, VET’s sales increased from $20 million in 2Q 2021 to $97 million in 2Q 2022. In France, VET’s sales increased from $68 million in 2Q 2021 to $104 million in 2Q 2022. In Netherlands, the company’s sales increased from $33 million in 2Q 2021 to $125 million in 2Q 2022. Finally, in Ireland, VET’s sales increased from $30 million in 2Q 2021 to $53 million in 2Q 2022. The company’s international free cash flow increased from $70 million in the second quarter of 2021 to $202 million in the second quarter of 2022.

Figure 1 – VET’s international sales

2Q 2022 financial results

The market outlook

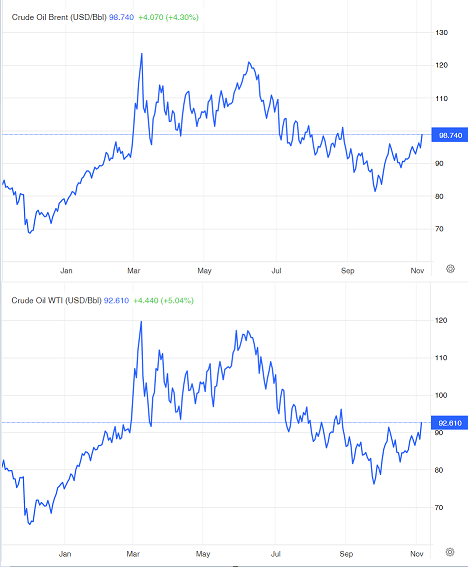

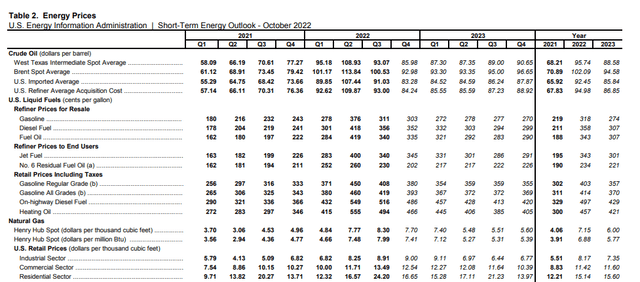

According to IEA’s October oil market report, world oil demand is expected to be 101.3 mb/d in 2023. OPEC plus has decided to cut production by 2 mb/d from November to support crude oil prices. Also, due to the EU’s ban on Russian crude oil import, which comes into effect in less than two months, European countries need to import oil from other countries, like the United States and Canada. Meanwhile, WTI and Brent crude futures increased in the past weeks as China could relax its COVID-19 restrictions soon, boosting the global oil demand (see Figure 2). According to EIA, in the second quarter of 2022, Brent crude oil price was $113.84/b and decreased to $100.53/b in 3Q 20223. EIA expects the Brent crude oil price to be $93/b in 4Q 2022 and $93/b in 1Q 2023 (see Figure 3). However, based on the current market condition, Brent oil prices may reach about $100/b in 4Q 2022 and may remain at this level in the first quarter of 2023.

Figure 2 – Crude oil futures

tradingeconomics.com

Figure 3 – Energy prices

eia

EIA expects that compared with the last winter, expenditures for homes that heat with natural gas will rise by 28%. Henry Hub’s natural gas price was $7.48/MMBtu in 2Q 2022 and increased to $7.99/MMBtu in 3Q 2022. It is expected to be $7.41/MMBtu in 4Q 2022 and decrease to $7.12/MMBtu in 1Q 2023 as natural gas production in the United States and Canada increases. In 2Q 2022, U.S. natural gas supply was 76.04 Bcf/d and increased to 79.04 Bcf/d in 3Q 2022. U.S. natural gas production is expected to increase to 88.98 Bcf/d in 4Q 2022 and 101.21 Bcf/d in 1Q 2023.

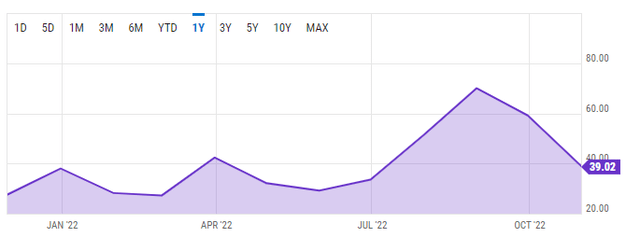

Moreover, compared with the first ten months of 2021, Russian natural gas pipelines to European Union decreased by 50% in the first ten months of 2022 and will decrease further until the end of the year. As European Union was able to import 30 Bcm of Russian gas supply in the summer of 2022 and due to China’s COVID-19 restrictions that decreased its LNG imports, EU gas storage sites are now 95% full. However, As Russian gas pipelines to the EU plunged and China’s COVID- lockdowns are about to finish, the EU will need to increase its natural gas imports from Canada and United States. “Europe could face a gap of as much as 30 billion cubic meters of natural gas during the key summer period for refilling its gas storage sites in 2023,” IEA explained. Furthermore, the European Union natural gas import price increased from $31.64/MMBtu in 2Q 2022 to $60.15/MMBtu in 3Q 2022. In October, the EU natural gas import price was $39.02/MMBtu (see Figure 4). It is important to know that due to the colder temperatures, European benchmark natural gas prices at the Dutch TTF hub increased in the past two weeks.

Figure 4 – European natural gas import price

ycharts.com

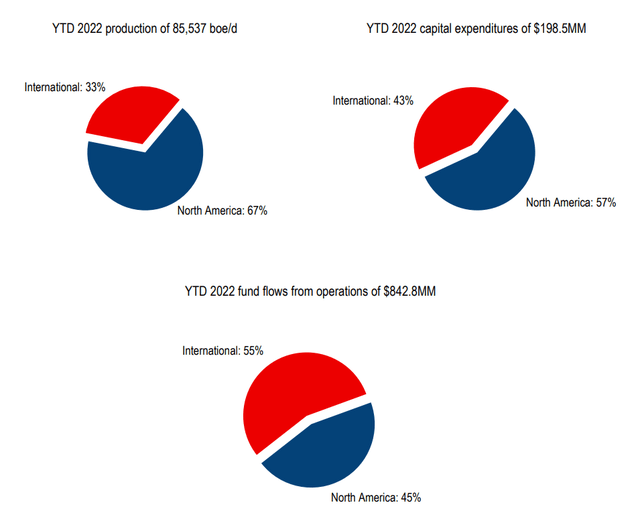

According to Figure 5, in the first half of 2022, VET had an international production share of 33% and a North America production share of 67%. However, due to significantly higher natural gas prices in European Union, the company’s international share of FFO was 55%. It is worth noting that VET’s international capital expenditures in 1H 2022 were higher than its North America capital expenditures. According to crude oil prices, natural gas prices in North America, and natural gas prices in the EU, I expect VET’s international FFO in 3Q 2022 to be higher than its North America FFO. Driven by decreased oil prices in 3Q 2022, I expect the company’s North America FFO in 3Q 2022 to be lower than its North America FFO in 2Q 2022. However, due to significantly higher natural gas prices in the European Union in 3Q 2022, VET’s international FFO in 3Q 2022 will be stronger than in 2Q 2022. Thus, I expect the company’s 3Q 2022 results to be better than in 2Q 2022.

Figure 5 – VET’s International and North America financial results

2Q 2022 financial results

Performance outlook

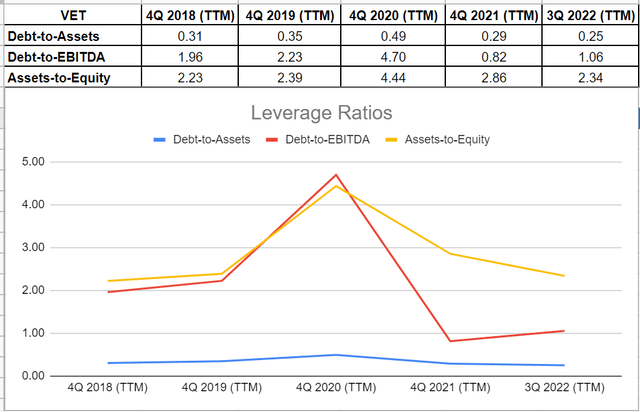

In this detailed analysis, I have investigated Vermilion Energy performance across the board of leverage and coverage ratios. Leverage ratios could be very insightful to show how the company is financing its assets and business operations. In other words, does it use debt or equity financing for most of its operations? In this analysis, I used some common leverage ratios that have significant comparability to its debt. The ratios are calculated in comparison with previous years to be more helpful.

The debt-to-assets ratio is one of the significant calculations that measures the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. Thereby, the higher the ratio, the greater the degree of leverage and financial risks. It is observable that after the downturn of 2020, the debt-to-asset ratio of Vermilion Energy has decreased from 0.49 to 0.29 and 0.25 in 2021 and TTM, respectively. Moreover, VET’s debt-to-EBITDA ratio, which determines the probability of defaulting on debt, sat at 1.06 in TTM. Notwithstanding a slightly higher than the end of 2021, the company’s current debt-to-EBITDA is still in a good condition compared with recent years. Finally, Vermilion Energy’s asset-to-equity ratio has been on a considerably downward path since 2020 of 4.44 and sat at 2.34 in TTM. The decreasing assets-to-equity ratio indicates that the company uses lower debt to finance its assets. As a result, the leverage ratios of Vermilion Energy depict the company’s solvency and its ability to meet its current and future obligations (see Figure 6).

Figure 6 – VET’s leverage ratios

Author (based on SA data)

Summary

I expect Vermilion Energy to report strong financial results in 3Q 2022. Also, based on the results from the continuing war in Ukraine, colder temperatures in the following months, the OPEC+ production cut, and China’s improved demand outlook, I expect energy prices to remain high. Thus, VET will benefit from the market condition in the following quarters. The stock is a strong buy.

Be the first to comment