MediaProduction/iStock via Getty Images

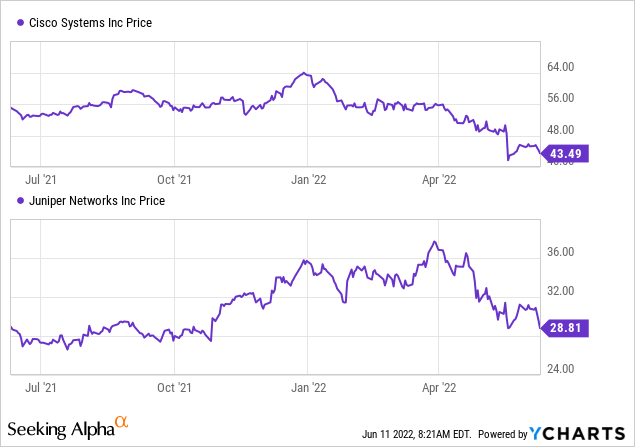

Pairs trading is one of the various options to make money in a volatile stock market. In order to increase the chances of success, it is important to select two stocks that are historically correlated, or whose share prices move together. This thesis considers Cisco (NASDAQ:CSCO) and Juniper (NYSE:JNPR) whose one-year price performance charts are provided below.

As seen, the stock prices moved mostly in tandem with each other in 2021 when market conditions were more conducive to tech, but things have been different in 2022 when more investors have pulled more out of Cisco. This divergence constitutes opportunities for the pair trader as I will demonstrate in this thesis.

First, I provide the reasons for selecting the two.

Reasons for choosing the Cisco/Juniper pair

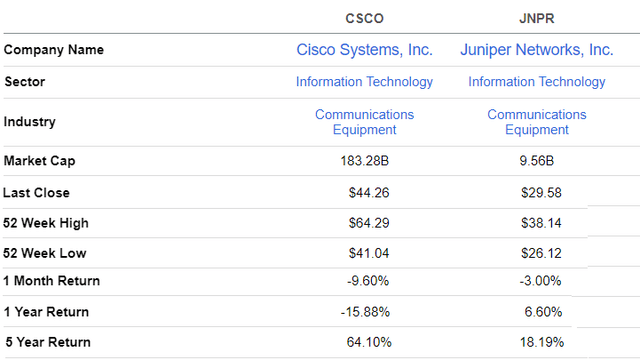

Firstly, they both belong to the IT sector and more specifically to the communications services industry. While the market cap metric is heavily skewed towards Cisco, both companies manufacture networking equipment used by data centers and enterprises to interconnect their IT workloads. Second, they have also diversified in IT security products with firewalls which are essential components of corporate defense strategy against computer viruses and ransomware.

Comparison of key metrics (www.seekingalpha.com)

Both companies are also impacted by supply chain-related risks as they depend on electronics components manufactured in China in order to assemble their routers and firewalls. As such Cisco was the first to be adversely impacted by China’s COVID-led lockdowns which started on March 27. With its third quarter of 2022 lasting from January to April, the company suffered from a revenue loss of $300 million related to component shortages from that country. As a result, Cisco’s stock lost about 15% while it was only around 5% for Juniper. This may be because investors have priced in a possible impact from Chinese lockdowns, as the latter’s next reported quarter or Q2-2022 which started in April should bear the brunt of the lockdowns.

The difference in the degree to which their stocks were adversely impacted resulted in the correlation between them being somewhat unhinged as is evident in the above chart around the third week of May. The objective of pair trading is to take advantage of such instances.

Still, in order to trade these two stocks as a pair, it is important to be more precise and actually assign a value to the correlation.

Valuing the correlation

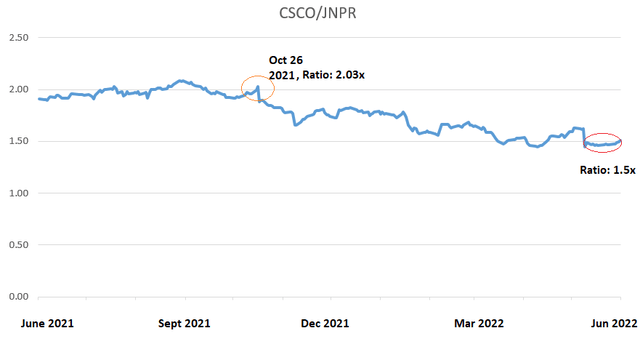

For this purpose, I divided Cisco’s closing share price of $43.24 on June 13 by Juniper’s $28.07 and obtained a ratio of 1.54. Subsequently, I repeated the procedure for the last one-year period and plotted the values to obtain a trend as per the blue chart below.

It is noticed that historically, this ratio has been in favor of the networking giant, for example on October 10 2021 when dividing Cisco’s closing price of $55.81 by Juniper’s $27.49 yielded a ratio of 2.03 as highlighted by the red circle below.

Trend chart built using data from (finance.yahoo.com)

After that, the ratio of Cisco’s stock to Juniper’s went on a downtrend and is currently around the 1.54 level. Now, based on historical data, this ratio should normally rise and, as I will show below, it is not necessary for it to rise all the way to 2.0 to make money.

Another reason that I believe the ratio should rise is that Juniper’s stock, which is the denominator should normally suffer from a revenue shortfall during its second-quarter results on July 26 as a result of components shortage from China, just like for other networking equipment suppliers.

Now, it is time to trade the stock pair.

Trading the stock pair

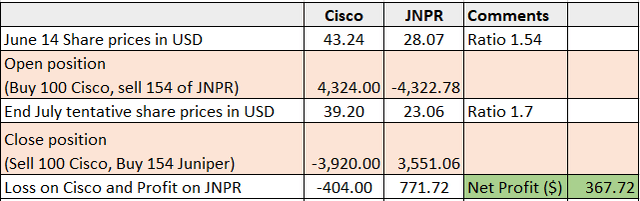

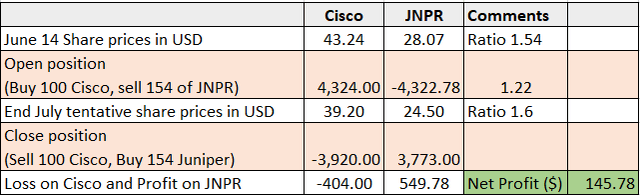

First, I considered an opening trade with Cisco trading at $43.24 and Juniper at 28.07 which gives the ratio of 1.54. In the example below, opening a trade by buying 100 shares of Cisco and selling (being short) 154 shares of Juniper. Now, the objective when choosing the number of shares is to be as market-neutral as possible. Thus, I have adjusted the amount bought and sold so that when adding the total amount invested or (4,324 + -4,322.78), the total comes as close to zero as possible, or $1.22 in this case.

Table built using data from (www.seekingalpha.com)

Now, let us close the position at the end of July assuming that the ratio rises back to 1.7, a figure last achieved in November and December 2021, as well as January 2022. This is done by selling 100 shares of Cisco and buying 154 shares of Juniper at a price of $39.2 and $23.06 respectively as shown in the above table.

Now, to close this position, one incurs a loss of $404 on Cisco (whose shares have fallen) and benefits from a profit of $772 on Juniper. In this case, the short position on Juniper has been beneficial as its shares have gone down. Consolidating up, this nets a profit of $367.72 excluding brokerage fees.

Pursuing further, and as shown in the table below, even if someone closes the position at a ratio of 1.6 with Cisco and Juniper trading at $39.2 and $24.5 respectively, the trade still remains profitable, albeit at a lesser amount.

Table built using data from (www.seekingalpha.com)

According to my calculation, the breakeven trade (no profit or loss) is obtained at a ratio of 1.55 to 1.56. Below this point, the pair trading strategy does not work.

Now, those who are caught off-guard by any sudden movements in the market, always have the option to bail out with a stop loss. Alternatively, while waiting for the right timing, investors can hold on to these two stocks as both of them pay safe dividends with reasonable yields too. This can be viewed as compensation if one has to wait for some time before the two stocks are back in the sweet spot. The dividend factor is another reason why I chose the two stocks.

Moreover, it may happen that both the two stocks go up. In this case, if they both rise and the ratio also rises, then the trade will be beneficial. The underlying mechanism which makes the whole thing work is the degree to which one stock advances with respect to its peer. The more the difference higher will be the ratio of one stock relative to the other in turn resulting in more profits.

Concluding with risk awareness

Finally, given that they belong to the same sector and industry as well as their historical price performances, Cisco and Juniper can be traded as a pair. To this end, one should understand that in contrast to trading individual stocks, either by being long or short, there are two other parameters at play here, namely the ratio of one stock divided by each other and the number of shares to be purchased. Consequently, there are four parameters at work here and one has to be particularly careful about the timing.

Additionally, as some would already have noticed, in contrast to investing, trading stock pairs involves more risks. In this case, some adverse news about one of the companies could send its shares tumbling as seen with the supply-related topline impact above. This can in turn disrupt the correlation. Thus, constant monitoring is key and one can start small before trading big bucks. Finally, some may want to use the simulators provided as part of their brokerage accounts before engaging in real trades.

Be the first to comment