Uwe Krejci

Investment Thesis

Zoetis (NYSE:ZTS) develops, manufactures, and distributes animal healthcare products ranging across medicines, vaccines, and diagnostics. Since its spin-off from Pfizer (PFE) back in 2013, Zoetis has grown substantially and garnered a leadership position in the animal health care industry. With their diverse portfolio, global scale, and strong R&D department, I expect they will enjoy long-term success. Also, it’s a great investment choice regardless of the economic conditions, as people tend to remain committed to the health of their pets. I believe Zoetis is a strong investment choice for a long-term investor because:

- Zoetis enjoys a strong economic moat with technological superiority, brand recognition, and economy of scale. They are the market leader in numerous subsectors across the animal healthcare industry.

- Zoetis has been growing at a solid pace, while also expanding their profit margin.

- Strong growth, profitability, and financial position allow them to consistently increase shareholder returns.

Economic Moat and Attractive Market Position

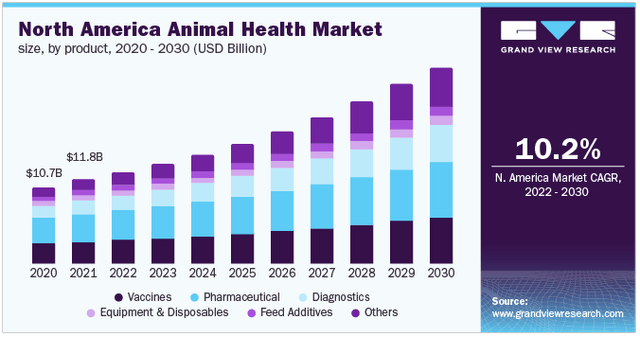

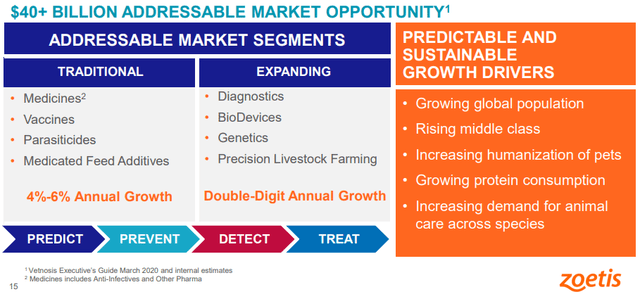

Zoetis is in a really attractive market position. Animal health (both livestock and companion animals) is becoming more and more important, and the market has been growing rapidly. According to research, the animal healthcare market in North America is expected to grow at 10.2% per year. Being the leader in various positions, Zoetis will enjoy a large tailwind from this trend.

Also, this growth in the animal healthcare market is multi-faceted. In the livestock segment, the need for productivity and efficiency, a difficult labor shortage, and food safety and animal welfare are the driving forces for growth of medicines, vaccines, diagnostics. In companion animals, the humanization of pets and pet owner engagement are driving the growth of the animal healthcare budgets and specialty care. Overall, a growing global population, rising middle class, and increasing protein consumption are the macro drivers for the segment.

Animal Healthcare Market (Grandview Research)

Similar to healthcare companies that focus on human treatment, it’s important for animal healthcare companies to maintain a strong pipeline through R&D investment. Zoetis has been excellent at doing this. They employ 1,300 people in R&D operations and have formed collaborations with several different companies/research centers. Recent collaborations include Colorado State University (livestock immune system), Texas A&M (transboundary and emerging diseases), and Syngene (monoclonal antibody for osteoarthritis). With substantial investment in R&D, I expect Zoetis will maintain their strong economic moat going forward.

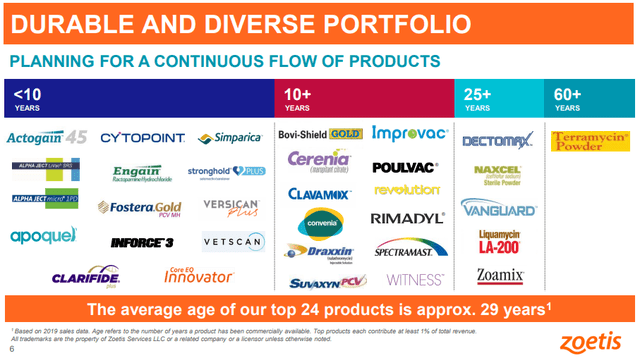

Formidable Pipeline & Growth

Through R&D and collaborative efforts, Zoetis has built a truly formidable pipeline, which naturally leads to strong revenue growth and profit margin expansion. Their revenue has been growing at 10% per year for the past 5 years, and EBIT margin expanded from 24% in 2013 to 36% in 2022. As an investor focusing on fundamentals, profit margin expansion is one of the best indicators of a strengthening economic moat and increasing operational efficiency. Combined with the solid pace of growth, this makes for a great combination of both worlds.

Diverse Portfolio of Zoetis (Zoetis Investor Relations)

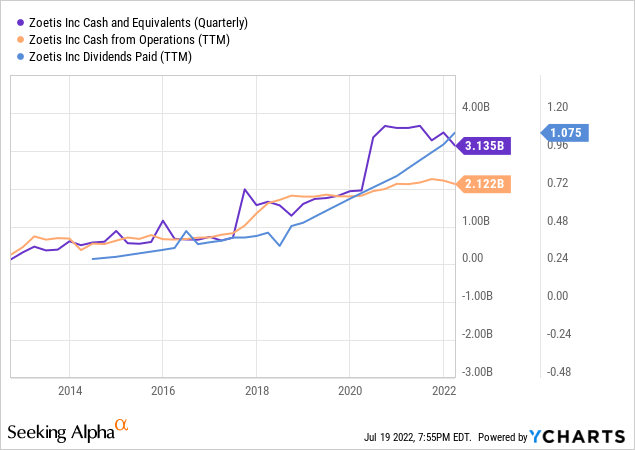

Strong Financial Position and Shareholder Return

Zoetis has a very strong financial position with high liquidity. Their current ratio (2.25x) and quick ratio (1.45x) are much higher than the sector average. Also, their operating cash has been increasing for the past several years. This strong financial position and strong cash flow has allowed Zoetis to consistently increase the dividend. The dividend has grown by 21% per year over the past 5 years. Additionally, they have been repurchasing common stock ($949 M in the last twelve months). I expect them to continue rewarding shareholders in the foreseeable future.

Intrinsic Value

I ran a discounted cash flow (“DCF”) calculation to estimate the intrinsic value of Zoetis. For the estimation, I utilized EBITDA ($3,246 M) as a cash flow proxy and current WACC of 8.0% as the discount rate. For the base case, I assumed EBITDA growth of 23% for the next 5 years (Average EPS growth rate) and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 25% and 28%, respectively, for the next 5 years and zero growth afterwards.

The calculation shows that Zoetis is undervalued by about 10-20% at this point. With a market leading position in the animal healthcare industry and a formidable pipeline, I expect Zoetis to achieve this upside.

|

Price Target |

Upside |

|

|

Base Case |

$185.01 |

4% |

|

Bullish Case |

$198.79 |

12% |

|

Very Bullish Case |

$221.11 |

25% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 8.0%

- EBITDA Growth Rate: 23% (Base Case), 25% (Bullish Case), 28% (Very Bullish Case)

- Current EBITDA: $3,246 M

- Current Stock Price: $177.42 (07/19/2022)

- Tax rate: 20%.

Cappuccino Stock Rating

| Weighting | ZTS | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 4 |

| Growth Rate vs. Sector | 15% | 3 |

| Margin of Safety | 15% | 4 |

| Sector Outlook | 10% | 4 |

| Overall | 4.2 |

Economic Moat Strength (5/5)

Zoetis is the largest animal healthcare company in the world, and this will remain the case for awhile. They have multiple leadership positions across several different fields (vaccines, medicines, and diagnostics). With their formidable R&D team and strong collaborations, Zoetis will maintain their competitive edge going forward.

Financial Strength (4/5)

Zoetis has a solid balance sheet with an ample amount of cash ($3.2 B), and high liquidity (current ratio and quick ratio higher than industry average). Also, their operating cash flow has been steadily increasing. With an expanding profit margin and revenue growth, their financial strength will only improve.

Growth Rate (3/5)

Zoetis has been growing at a solid pace (~10% per year), and this will be the case for the foreseeable future. A steadily growing pet and livestock healthcare market will bring a nice tailwind.

Margin of Safety (4/5)

Market volatility has brought many great companies down, including Zoetis. Their stock price dropped from $250 to its current level, which creates a great opportunity for investors. The current price level is undervalued by 10-20%, and the stock price will continue to grow in the future.

Sector Outlook (4/5)

Just like the human healthcare industry, the animal healthcare industry will steadily grow in the future. A growing population, strengthening middle class, and more interest in animal health will all contribute positively to the growth of the animal healthcare industry.

Risk

Even with the drop in their stock price, the valuation of Zoetis is still above the sector median. Their P/E ratio (33.89x) is almost twice that of the sector median (18.86x). Also, their price/sales (10.31x) is also higher than the sector median (4.66x). This steep valuation represents high market expectations, so if Zoetis misses a growth expectation in the future, it could result in a severe drop in the stock price.

In the most recent quarter, the livestock portfolio experienced 6% decline, mainly due to the swine product struggle in China and increased competition from generic brands. Combined with inflation, the price pressure from generic brands could lower Zoetis’ income margin. Especially during a recessionary time, farmers and ranchers might be more willing to switch to a generic brand. Therefore, the investor should watch this development.

Conclusion

Zoetis has been growing and expanding their margins in the past several years. They have a strong economic moat, and I expect them to defend this moat successfully for a while through their strong R&D team and collaboration. Their formidable portfolio of healthcare products should deliver solid growth. Price pressures from generic brand may bring challenges, so investors should keep their eye on the performance of the livestock segment. Overall, I expect 10-20% upside from here.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment