jetcityimage/iStock Editorial via Getty Images

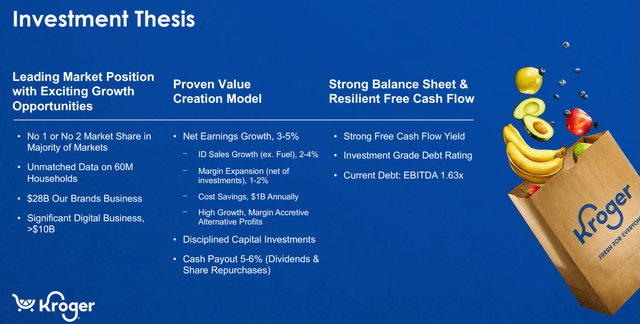

The Kroger Co. (NYSE:KR) is the largest supermarket chain in the United States with over 2,700 locations, operating across a portfolio of banner names. The company has been generating solid growth over the last several years and even benefiting from a boost during the pandemic with more consumers eating at home and ordering online. The story this year has been an impressive outperformance from its stock with Kroger representing a consumer staples leader offering a relatively resilient outlook against broader macro uncertainties and extreme market volatility.

Indeed, the company’s latest quarterly results beat expectations while management also raised full-year guidance. Beyond some supply chain disruptions and inflationary cost pressures at the margin, the company’s growth initiatives are on track, supporting a strong long-term earnings outlook. We are bullish on the stock which looks interesting following a recent pullback with the company well-positioned to continue delivering positive returns. A new dividend increase adds to the appeal of KR as a dividend growth stock.

Kroger Earnings Recap

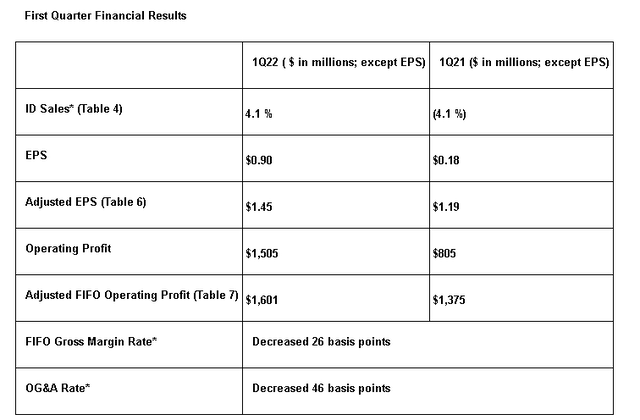

Kroger reported its fiscal Q1 earnings on June 16th with non-GAAP EPS of $1.45, up from $1.19 in the period last year, and also $0.17 ahead of estimates. Revenue of $44.6 billion climbed 8% year-over-year and beat the consensus by a solid $1.6 billion.

The adjusted operating income at $1.6 billion climbed 16% from $1.4 billion in Q1 2021, achieved from a combination of the top-line momentum and strategic cost savings initiatives. For context, “OG&A” as operating, general, and administrative expenses as a percentage of revenue declined by 46 basis points which more than covered a 26bps decline in the FIFO gross margin rate. Overall, it was a strong quarter financially.

A key metric for the company is its ID sales “identical sales”, up 4.1% y/y as a form of comparable sales which excludes the fuel sold at its company-owned gas stations. Within that figure, a strong point was “brands identical sales” increasing 6.3% y/y. This is important because the Kroger “store brands” of packaged grocery items typically support a higher margin for the company which has added to its earnings momentum. Management explains that a theme this year has been customers switching from name brands as a way of saving money and budgeting amid the record inflation environment. From the earnings conference call:

Our Brands are also proving to be an important differentiator for our customers in this environment, providing an unmatched combination of great quality and great value… When you look at Our Brands overall, our gross margin is about 600 basis points better than the national brand. And if you look at profit per item, it’s similar or in many cases, actually higher.

Digital sales declined by 6% y/y in Q1 which reflected the ongoing post-pandemic shift with more customers choosing to visit the physical stores. Nevertheless, the company explains that it was still able to see an 11% y/y increase in online engagement, that’s considering the number of households that downloaded coupons from the online site and mobile app.

As it relates to the fuel business, keep in mind that the company operates approximately 1,600 fuel centers, which traditionally are low-margin businesses, but they add to the overall company value proposition and helps to support its customer loyalty program at its core grocery business.

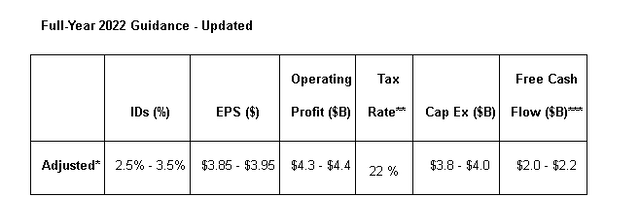

In terms of guidance, citing stronger than expected sales trends, the company now expects full-year ID between 2.5% and 3.5% which is notably up from the previous target range between 2% and 3% discussed during the Q4 earnings release back in March. Similarly, the guidance for EPS at a midpoint of $3.90 has been updated higher from $3.80 last quarter.

Is Kroger A Good Investment Long-Term?

The attraction of KR in the current market environment is the company’s “defensive” profile with overall strong fundamentals. The thinking here is that even as economic growth has sputtered and consumer spending is being pressured by record inflation, groceries are a necessity that naturally has recurring demand. There is also some thinking that Kroger can gain from some substitution effect as consumers choose to avoid dining out with at-home groceries being a more affordable option.

We believe these factors are at play which should keep the stock supported. The trends from Q1 are also encouraging suggesting Kroger has been able to capture market share, while the momentum in its store-brand products suggests an earnings runway.

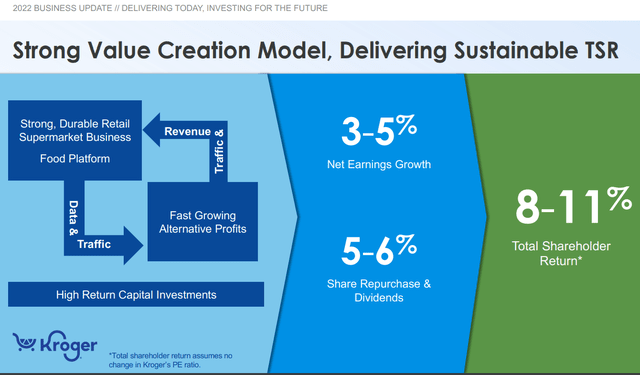

All this confirms the ongoing success of its growth strategy. Kroger continues to open new stores and customer fulfillment centers, expanding its online ordering infrastructure. The plan is to generate net earnings growth between 3-5% per year over the long run through ID sales in the 2-4% range, and a firm-wide margin expansion of 1-2% based on cost savings efficiency measures.

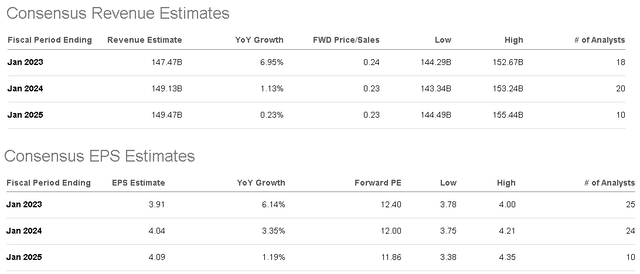

Indeed, the company targets are echoed by current consensus expectations. The revenue forecast for this year at $147.5 billion represents a 7% y/y while the EPS estimate at $3.91 is in line with the latest guidance. Looking ahead, the market expects top-line growth in the low-single digits while earnings trend higher through expanding margins. Again, this type of stability with positive free cash flow and a strong balance sheet with a clear strategic roadmap is part of what makes KR a good long-term investment. The bullish case for the stock is that there is an upside to these estimates.

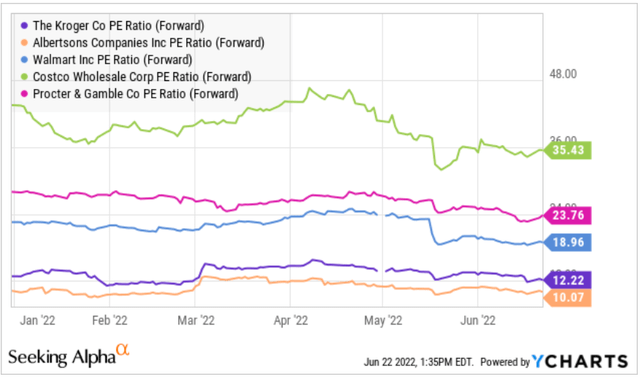

As it relates to valuation, we note that KR trading at a forward P/E of 12x is at a premium to Albertsons Companies Inc (ACI) at 10x which is likely the most directly comparable publicly traded grocery chain. In this case, Kroger stands out with its larger national footprint and its more extensive online presence which we believe justifies the spread. On the other hand, if we look at Kroger compared to other consumer staples stalwarts like Walmart Inc (WMT), Costco Wholesale Corp (COST), and even Procter & Gamble Co (PG); KR trades at a discount to this group.

The argument we make is that Kroger as the leading pure-play on grocery stores is “more defensive” relative to other consumer staples industries which adds to its appeal in a more challenging economic environment. Simply put, Kroger’s sales and earnings outlook should have less variability in a deeper downturn compared to the sector that may capture more volatile consumer cyclical trends. This quality aspect from Kroger can support a multiples-expansion in our opinion.

Kroger Dividend Increase

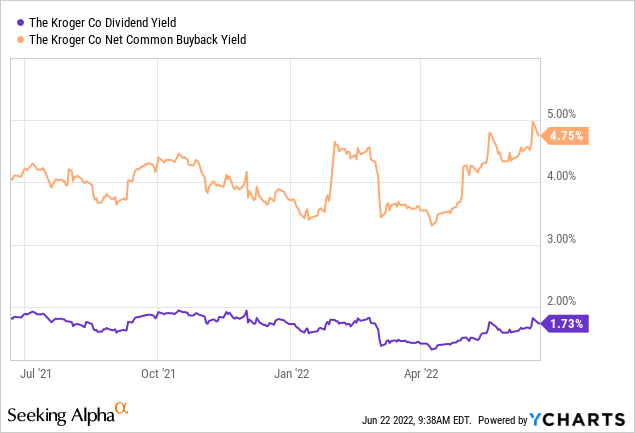

Another important dynamic for Kroger is its commitment to delivering shareholder returns. In addition to net earnings growth, management expects its combination of annual share repurchases and the regular dividend to provide a total shareholder return between 8-11%.

The company just announced its latest dividend increase of 24% to a new quarterly rate of $0.26 per share. This is the 16th consecutive year of annual dividend increases. The forward yield on the stock is now 2.2%, from 1.7% on a trailing 12-months basis. The setup here is room for continued annual dividend growth above earnings for the next few years given the strong cash flow trends.

Separately, the company has also been active with buybacks. In Q1 Kroger repurchased $665 million in shares and nearly $1.9 billion over the past year, representing about 5% of the current market cap. In other words, the capital allocation strategy has been going according to plan.

Is KR Stock A Buy, Sell, or Hold?

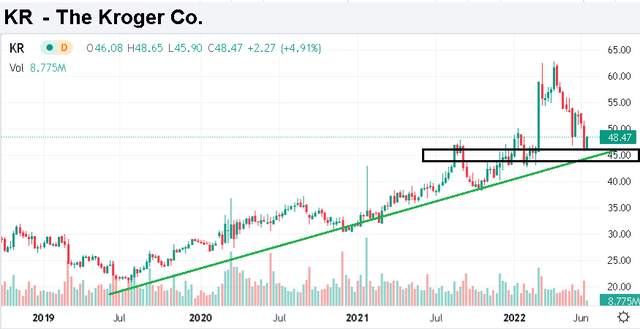

We rate KR as a buy with a price target for the year ahead at $60.00 per share representing a 15x P/E multiple on the top-end of management’s full-year EPS guidance at $3.95. Our price target also considers that the company can outperform expectations over the next few quarters adding to momentum in the stock. From the chart, KR traded above $60.00 per share as recently as early April. We believe this recent correction down to a long-running trendline and area of support above $45.00 offers a new buying opportunity.

While the latest dividend increase is positive for near-term sentiment, the other side to the discussion is that the stock could suffer from a shift in the market away from defensive type names and into more growth categories. The risk here is that economic conditions significantly improve going forward which would consequentially make KR lose its appeal in a flight-to-safety trade. Over the next few quarters, the identical sales trends and gross margin levels will be key monitoring points.

Be the first to comment