LewisTsePuiLung/iStock Editorial via Getty Images

Investment Thesis

JPMorgan Chase (NYSE:JPM) stock has been battered over the past six months as the market braced for a sharp slowdown in economic activity amid the Fed’s rate hikes and QT. The price action is forward-looking and has likely priced in a significant slowdown in economic activity (but not necessarily a recession).

Our analysis shows that JPM is at a reasonable buy point now, given its discount against its historical valuation. Notwithstanding, we believe some caution is warranted given JPM’s bearish bias and a potential recessionary scenario. Hence, investors should consider layering in close to its near-term support and avoid adding near its resistance levels.

Therefore, we rate JPM a Buy, with a near-term price target (PT) of $126, implying a potential upside of 9.3% as of June 29’s close.

Why Has JPM Stock Dipped?

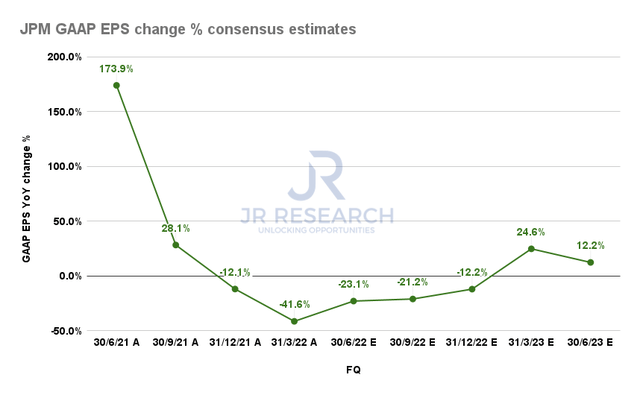

JPM EPS change % (By FQ) consensus estimates (S&P Cap IQ)

After 2021’s massive recovery from its COVID bottom, we believe the market has astutely priced in the deceleration in its EPS growth in FY22, as JPM stock hit its highs in October 2021.

Notwithstanding, JPMorgan’s EPS growth is expected to have hit a nadir in FQ1 (ended March 2022), but it is still facing challenging comps through H2’22. Therefore, it could take at least the next two quarters before the bank recovers its EPS growth rates.

However, investors are reminded that price action is forward-looking. Therefore, we believe that if JPMorgan executes accordingly under CEO Jamie Dimon’s capable leadership, the Street’s estimates seem credible.

Notwithstanding, Dimon also cautioned investors to be prepared for worse outcomes as its profitability normalizes. He articulated at an early June conference (edited):

What protects us in a downturn is virtually you’re prepared. We always talk about through the cycle. So we acknowledge when we’re overearning on credit and that that’s going to normalize. We’re quite clear about that. But your best preparation is that fortress balance sheet. It’s conservative accounting. We have almost no one-time gains or losses. I’m prepared for a non-benign environment by the end of the year. So to me, we try to explain all that as best we can, and I think it’s important we do that. But we’ll be prepared for bad outcomes. (Bernstein 38th Annual Strategic Decisions Conference)

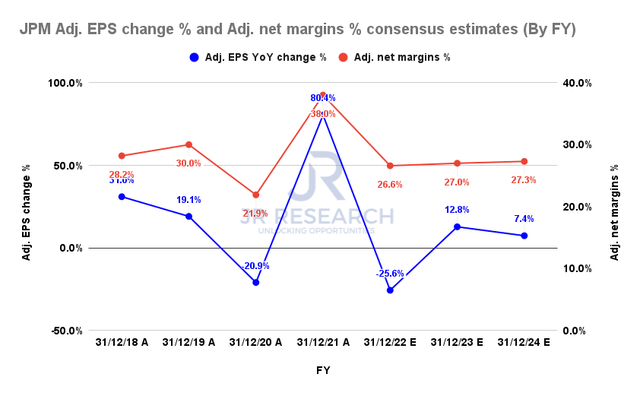

JPM adjusted EPS change % and adjusted net margins % consensus estimates (By FY) (S&P Cap IQ)

Still, the consensus estimates modeled a steep decline in EPS growth, expecting a 25.6% fall from last year’s remarkable recovery. However, JPM is still estimated to post an adjusted EPS of $11.38 in FY22, well ahead of its pre-COVID 2019 metric of $10.72. Its net margins are also estimated to remain robust, despite the deceleration.

Hence, we believe the Street’s modeling has accounted for a marked slowdown, but not necessarily an extended recessionary impact. We think the current perspective on consumer spending and household balance sheets is appropriate, despite the moderation in the housing and mortgage market.

However, as Dimon warned, investors should still be prepared for the worst. Therefore, adding exposure in phases over time is critical, leveraging on dollar-cost averaging (DCA) opportunities.

What Is The Short-Term Future Of JPM Stock?

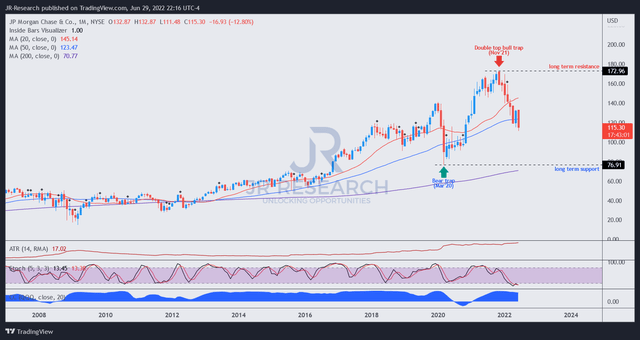

JPM price chart (monthly) (TradingView)

The market used a double top bull trap (significant rejection of buying momentum) in November 2021 to force a steep sell-off in JPM stock over the past six to seven months. It occurred even before the Fed initiated aggressive rate hikes or data showing a potential weakening in economic activity. Therefore, investors are urged to use forward-looking price structures as a helpful tool to anticipate the forward intentions of the market.

Also, the retracement in JPM has brought it back to its long-term support (50-month moving average). Consequently, long-term investors may consider the opportunity attractive, as the 50-month support has held its long-term uptrend since 2012. Until proven otherwise, JPM’s long-term bullish bias remains intact.

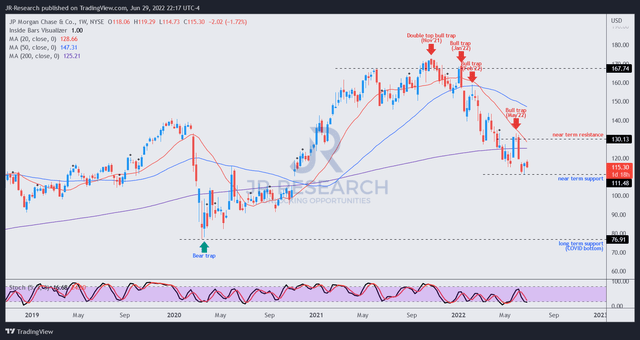

JPM price chart (weekly) (TradingView)

We also observed a validated bear trap at its near-term support ($111), which significantly rejected selling momentum. However, we have not yet observed a more potent double bottom bear trap, which indicates a potential reversal from its bearish bias.

As such, we urge investors to add exposure cautiously near its support and avoid adding close to its near-term resistance ($130). Potentially, another bull trap could form at a lower high if the market intends to force a steeper sell-off in JPM.

Is JPM Stock A Buy, Sell, Or Hold?

We rate JPM stock as a Buy with a near-term PT of $126, implying a potential upside of 9.3% from June 29’s close.

JPM last traded at an NTM normalized P/E of 9.54x, well below its 5Y and 10Y mean of 12.51x and 11.39x, respectively. Therefore, we believe the market has priced in a marked slowdown in its EPS growth. But, it’s still ahead of its 10Y lows of 6.97x, implying that the market may not have priced in an extended recession/slowdown. The market’s view is consistent with the Street’s revised modeling, as presented earlier.

We believe the current perspective is appropriate, as demonstrated by its recent bear trap. But, JPM remains entrenched in a bearish bias. Therefore, a lower-high bull trap could indicate that the market is planning for a steeper sell-off moving ahead. Consequently, we urge investors to monitor JPM’s price action closely.

Be the first to comment