Sjo/iStock Unreleased via Getty Images

Elevator Pitch

My rating for Ford Motor Company’s (NYSE:F) shares is a Buy.

In my previous article for Ford written on June 10, 2022, I analyzed F’s dividend based on the “yield, growth and reliability” attributes and came to the conclusion that the company is “a good dividend stock.”

I determine whether Ford can be considered an appropriate investment candidate to ride on the growth of the Electric Vehicle or EV industry in this latest update.

My analysis suggests that F has an edge over its peers with respect to sourcing, and it is projected to grow the number of EVs it produces at a faster pace than the broader industry. Besides the growth angle pertaining to EVs, F is also a reasonably good dividend yield play. Ford has recently restored its quarterly dividend back to pre-COVID levels, and it currently boasts an enticing consensus forward FY 2023 dividend yield of 3.6%. Therefore, I choose to maintain my Buy rating for Ford.

Is Ford A Good EV Stock?

Ford is a good EV stock, as evidenced by the company’s most recent late-July update on its electric vehicle plans.

On July 21, 2022, F issued a press release highlighting its goal of achieving an “annual run rate of 600,000 electric vehicles by late 2023 and more than 2 million by the end of 2026.” In comparison, Ford boasted a substantially lower EV run rate of 60,000 units last year.

Ford’s Targeted 600,000 EVs Run Rate For 2023 By Model

Ford’s July 21, 2022 Investor Presentation

It is worth noting that F hosted an investor meeting on the same day of the announcement, and it shared some important insights regarding the company’s current positioning and potential for growth in the EV industry.

According to a survey conducted by its internal Global Data Insights and Analytics (GDI&A) department, the company’s F-150 Lightning “beats every EV truck rival in favorability among industry-wide vehicle shoppers.” The company also cites research from Morning Consult, which indicates that Ford is the “No. 1 brand consumers think of when considering an EV truck.” Separately, Ford has made good progress in expanding its customer base with its aggressive expansion in the EV space. Approximately 70% of the Mustang Mach-E units and 50% of the F-150 Lightning units were sold to clients which have never previously purchased a vehicle from Ford.

Ford’s ambitious EV production targets and the favorable reception that F has received for its EVs are impressive. The company also stands out in the EV market for its approach in managing the sourcing of battery cells, lithium and nickel, and its faster growth relative to the industry, which I will detail in the subsequent two sections of the article.

How Is Ford Different From Other EV Stocks?

The key differentiating factor for Ford relative to some of its EV peers is how the company has managed its battery cell requirements and raw material needs, which are the key constraints for EV makers’ expansion plans.

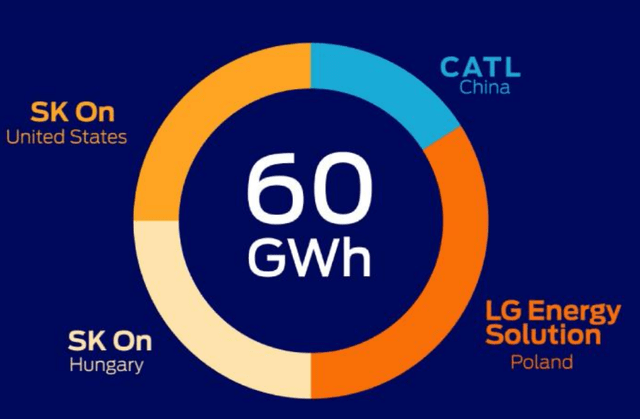

Ford revealed at the company’s July 21, 2022 investor call that it has “already sourced 70% of the battery capacity” required to deliver on its yearly two million EVs run rate target by end-2026. With respect to its intermediate goal of ramping up its annual EVs run rate to 600,000 in 2023, the company has secured the full 60 GWh of battery cell capacity needed from various partners as highlighted in the chart below.

F’s 60 GWh Battery Cell Capacity

Ford’s July 21, 2022 Investor Presentation

In terms of critical raw materials, Ford stressed at its late-July investor briefing that it “direct sourced our lithium and nickel to scale battery production more quickly and keep the volumes and the cost more stable over time.” With respect to nickel supply, F is working with suppliers like Vale (VALE) Canada, PT Vale Indonesia (OTCPK:PTNDF) (OTCPK:PTNDY) and BHP Group (BHP) in Australia. It is worthy to note that the company has indicated in its July 2022 investor presentation that it has “secured most of the nickel we’ll need by 2026.” In relation to the supply of lithium, Ford’s raw material partners include Rio Tinto (RIO), Compass Minerals (CMP), and Australia’s Liontown Resources (OTCPK:LINRF).

Supply is a very important issue for EV makers. The access to battery cells, nickel and lithium is a key factor that determines if a specific EV company has the ability to scale up rapidly. In that respect, Ford has an edge as discussed in this section.

Which EV Stock Will Grow The Most?

It is natural that investors with a keen interest in the EV industry will ask the question “which EV stock will grow the most” in the foreseeable future. Rapid growth means that the EV maker will expand its scale in a shorter period of time and likely achieve profitability faster as a result of positive operating leverage effects.

As such, it is reassuring to know that Ford will be among the fastest-growing EV names in the industry in terms of production ramp-up. At its late-July investor call, F estimated that its EV production CAGR for the 2021-2026 period will be in excess of 90%, which will be a much higher rate of growth as compared to S&P’s EV production CAGR forecast for the industry as a whole at 36% over the same period.

Ford’s rapid expansion in the EV market won’t come at the expense of the company’s profitability in the intermediate to long term. F guided in its July 21, 2022 media release that it is expecting to achieve an operating profit margin of 8% for its EV business by 2026, which is comparable to its expectations of an overall 10% operating margin for the company in the same year.

Apart from economies of scale, Ford’s move towards increasing its proportion of lithium iron phosphate or LFP (as opposed to nickel cobalt manganese or NCM) in its battery mix will also help to boost its EV business’ profitability over time. According to the company, LFP provides BOM (Bill Of Material) savings of approximately 10%-15% as compared to NCM.

In a nutshell, Ford is well-positioned to outgrow the EV industry in the next couple of years, based on third-party forecasts for the EV market and the company’s internal EV production targets.

F Stock Key Metrics

Earlier, Ford reported the company’s Q2 2022 earnings on July 27, 2022, and the key metric to note is that F increased its quarterly dividend per share from $0.10 to $0.15.

In my prior June 10, 2022 update for F, I noted “the market consensus’ fiscal 2023 and 2024 dividend per share forecasts of $0.47 ($0.1175 per quarter) and $0.51 ($0.1275 per quarter)” for Ford. This implies that the market didn’t expect Ford to hike its dividend as early as mid-2022 to return to pre-COVID levels ($0.15 quarterly dividend per share payout), so this was a major positive surprise for investors, especially income-focused ones.

Following the unexpected dividend hike, the sell-side analysts have raised their FY 2023 and FY 2024 dividend projections for F to $0.58 and $0.61, respectively. This is equivalent to consensus forward FY 2023 and FY 2024 dividend yields of 3.6% and 3.8%, respectively, for Ford.

Is F Stock A Buy, Sell, Or Hold?

F remains a Buy-rated stock in my opinion. I think that Ford is an attractive investment candidate offering a favorable mix of growth and yield.

Be the first to comment