simonkr/E+ via Getty Images

Alexander & Baldwin, Inc. (NYSE:ALEX) is the only real estate investment trust (“REIT”) that is geographically focused on the State of Hawaii. While there are other REITs that own assets in the state, ALEX is the dominant presence, whose operations have been exclusively limited to the state for over 150 years.

Space constraints and the high cost of doing business in the state create high barriers to entry that continues to insulate ALEX from meaningful competition. This provides them with significant pricing power to drive rents and negotiate deals at favorable terms.

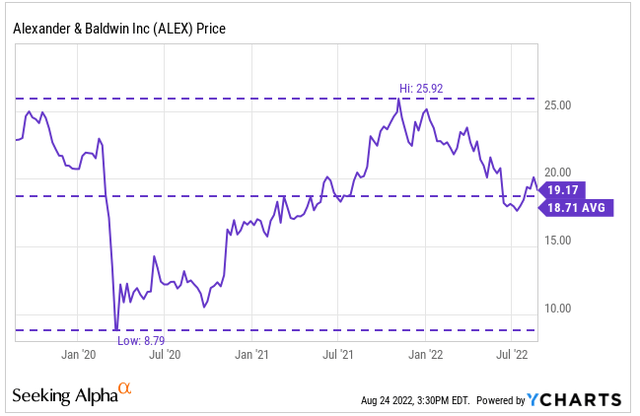

The competitive moat has enabled ALEX to carry a higher earnings premium, currently 18.7x forward funds from operation (“FFO”) versus a sector median of about 16.6x. Nevertheless, shares are still down over 20% YTD and are trading at the lower end of their 52-week range. This is worse than the 12% decline in both the broader FTSE NAREIT and S&P 500 indexes.

YCharts – Recent Share Price History of ALEX

The YTD declines follow three consecutive quarters of dividend growth, approximately 5.5% in both the first and second quarters and 10% in the third quarter, and strong overall quarterly results that continue to reiterate the company’s competitive strengths, which include a dominant geographic presence, a minimally levered balance sheet, and steadily improving occupancy figures.

While there is opportunity for upside in the shares, it may not be enough to justify new initiation, given current risk premiums. Though their concentration in the Hawaiian Island Chain provides numerous niche advantages, it does limit their growth opportunities. While there is room for internal growth through their development projects and/or occupancy improvements, this is likely not enough of a catalyst to send shares significantly higher. ALEX is a worthwhile holding for existing shareholders, but new investors may be better off seeking opportunities elsewhere.

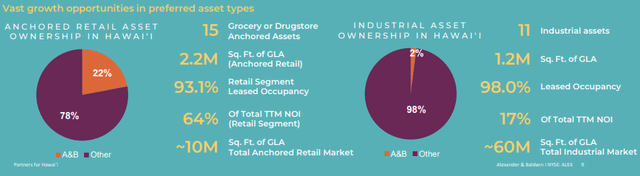

Largest Portfolio of Grocery and Drug-Anchored Retail In The State of Hawaii, As Well As Impressive Supplementary Asset Classes

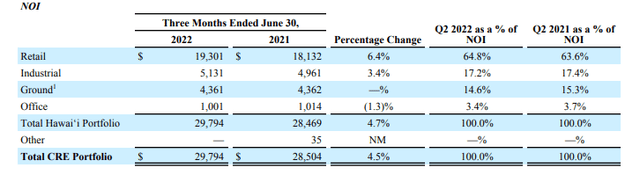

ALEX’s portfolio consists of 3.4M/square feet (“sqft”) of retail, industrial, and office space throughout the State of Hawaii. Among the three property classes, grocery and drug-anchored retail centers represent about 65% of total net operating income (“NOI”). This provides downside protection to ALEX due to the recession-resistant nature of groceries and medications. And as seen throughout the COVID-19 pandemic, these stores are essential and are the least likely to close or shutdown.

Q2FY22 Investor Supplement – Breakout of ALEX’s Asset Classes & Their Share of NOI

Contrary to these essential properties are the offices, which are at heightened secular risk due to the rise of remote/hybrid working arrangements. ALEX’s exposure to this sector, however, is limited, at less than 5% of NOI. Additionally, leased office occupancy stood at 88.1% at the end of Q2. This is just 280 basis points (“bps”) lower than 2019 levels. And it is up about 40bps from Q1. There is also 270bps of opportunity in their pipeline of pending commencements, which should provide accretive benefits to NOI in the coming periods.

A small but growing asset class is their industrial properties, which account for approximately 17% of NOI but only 2% of total gross leasable area (“GLA”), at 1.2M/sqft in a Hawaiian market size estimated at 60M/sqft. Additionally, given the limited supply of industrial land supply in the state, industrial market rents and per-square-foot values are typically higher than those achieved in other U.S. markets. The annualized base rent (“ABR”)/sqft in ALEX’s industrial properties as of Q2, for example, was $15.48/sqft versus a national average of less than $10/sqft and just under $7/sqft for Prologis (PLD), the global leader in the space. Given the favorable dynamics in this asset class, it is one potential source for future growth.

June 2022 Investor Presentation – Growth Opportunities Available In The Retail & Industrial Asset Classes

Aside from their core and shell properties, ALEX owns over 140 acres of land under ground lease arrangements. These operations represent about 15% of total NOI and is a minimal maintenance segment that provides for attractive fair value step-ups and escalation, in addition to the opportunity to take possession of the property atop the land upon expiration of the lease.

Monetization Of Non-Core Assets

In addition to their commercial real estate (“CRE”) segments, ALEX has a portfolio of legacy land holdings and a materials & construction (“M&C”) business that operates as one of Hawaii’s largest asphalt paving contractors. This M&C business is primarily operated through Grace Pacific, LLC (“Grace”), which is a wholly-owned subsidiary that was acquired in the early 2010s.

Recently, ALEX has pursued the simplification of their business to focus more on their CRE business. This has resulted in the increased monetization of their legacy land holdings. In the current period, for example, they closed on the sale of approximately 19k acres of non-core land holdings and 100% of their ownership interest in McBryde Resources, Inc, a large operator of hydroelectric power facilities on the island of Kauai. The collective sale brought in about +$75M, which was then recycled into debt repayment.

In addition, ALEX also received Board approval during the quarter to market Grace, which is their last significant remaining non-core asset that they still own. At present, efforts are underway to find a strategic buyer, but little else was revealed regarding the process. It will most certainly be raised as a discussion topic in Q3, however.

Capital Recycling In The Current Market Environment

If the Grace sale were to close, ALEX will need to recycle those proceeds into a venture accretive to FFO. In the current market environment, however, external growth through acquisitions may be more challenging due to changing expectations between buyers and sellers around market performance and pricing.

ALEX does benefit from the lock-out of most buyers resulting from tightening financing conditions. But the market is tight, with more sellers stepping back into their corners. The tightness can even have an impact on the Grace sale, resulting in the business staying on the books for longer than expected.

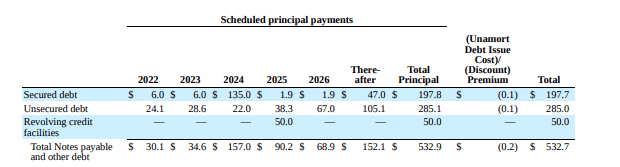

Further debt paydown is one option, but the balance sheet is already minimally levered, with a debt capitalization of sub-30% and a net debt multiple of just 2.4x. 5x when excluding one-time items undertaken during the current quarter.

Additionally, 100% of their debt is fixed, which minimizes their interest rate risk. Limited maturities until later years also provides near-medium term flexibility. And with over +$500M in available liquidity, there is ample funds available to meet their short-term debt servicing obligations. So, while a further de-levering of the balance sheet is one use of funds, it’s not the most pressing concern.

2021 Form 10-K – Summary of Debt Maturities

Over the past three quarters, ALEX has increased their dividend each quarter, the most recent being a 10% increase, bringing the current yield to about 4.5% at current pricing. For income investors, further hikes may be a possibility, given the company’s strong financial position and the cooling environment for acquisitions. A payout ratio tracking in the 80% range provides some cushion. But any growth in the payout would need to be accompanied by growing FFO, which may be harder to come by in the coming periods.

Ample Opportunities For Internal Growth, But Is It Enough?

There are still opportunities for internal growth, however. Overall leased occupancy ended the period at 94.6%, which is still a bit shy of pre-pandemic levels. There is also 200bps of opportunity in pending commencements that should add several points to NOI.

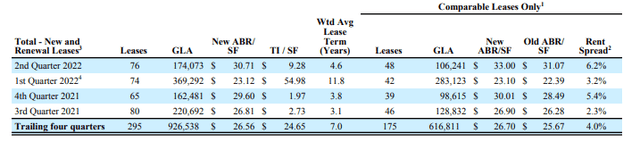

Additionally, strong underlying economic fundamentals in the state, in combination with their market leading position is enabling continued growth in same-store NOI and core FFO/share, each up 4.4% and 12%, respectively during the current period, driven by healthy blended rent spreads of 6.2%, with new leases growing double-digits at 11.9%.

Q2FY22 Investor Supplement – Summary of Leasing Spreads by Quarter

Continued improvements in occupancy paired with favorable leasing spreads should provide further room for earnings growth. Ongoing development projects with near-term stabilizations will also begin to provide incremental benefits in subsequent periods.

With this in mind, full year guidance was revised upwards for both NOI and FFO, with growth in NOI now expected to be 4-6% from 2-4% previously and growth in FFO of 3.5-5.5% from a previous range of 3-5%. While the upward revisions are certainly a positive, is it enough of a catalyst in light of current market conditions?

A Piece Of Hawaii But At The Wrong Price

ALEX is unique in that they are the only publicly traded REIT based in Hawaii. By owning shares in the stock, investors can have a stake in one of the most popular vacation destinations in the world. But similar to everything else in the state, the investment wouldn’t come cheap. At 18.5x forward FFO, shares currently are trading at a premium to the broader REIT index.

Their island presence, however, is their competitive moat. With over 150 years of experience on the island, their dominant position is solidified and insulated from any meaningful competition. A minimally levered balance sheet also provides the company with the flexibility to relocate funds that otherwise would have been spent on debt servicing costs to acquisitions and their dividend payout, which has grown for three consecutive quarters.

Though their properties are located outside of the tourism districts, they are still indirectly benefitting from increasing traffic levels into the island chains, as tourism tends to drive the local economy, which in-turn supports their tenant base and enables them to weather the continuous rental hikes enacted by ALEX.

While the results are strong, there are limited catalysts to send shares significantly higher from current levels. Some appreciation is probable, but there are better opportunities elsewhere. For existing shareholders, the stock makes for a great long-term hold and average-down opportunity on any weakness. New investors, on the other hand, would be better off keeping ALEX on the watchlist and preserving capital for other, more lucrative opportunities.

Be the first to comment