BalkansCat

Canadian Imperial Bank of Commerce (NYSE:CM) is a compelling play on rising interest rates in the Canadian banking sector. The bank delivered better than expected third quarter results on Thursday, as resilient momentum in its top line growth and improved margins countered a rise in loan loss provisions.

Canadian Imperial Bank of Commerce Q3 Earnings Results

Against disappointing third quarter results earlier this week from Royal Bank of Canada (RY) and Scotiabank (BNS), two of Canada’s ‘Big 5’ banks, CIBC surprised the market as earnings topped analyst estimates. The bank earned adjusted earnings per share of C$1.85 (~$1.43) in Q3, which exceeded the consensus forecast of C$1.81 (~$1.40).

Amid market turmoil and a dearth of deals in the market during the quarter, revenue at its investment banking business held up relatively well.

“Our capital markets business performed well in a volatile market, with top line growth in all business segments, benefiting from increased advisory services, higher foreign exchange trading revenue and growth in our direct financial services business. The latter was helped by rising interest rates, robust volume growth and new client relationships in both Simply Financial and in our alternate solutions group.”

Chief Executive Officer Victor Dodig, CIBC Q3 Earnings Call

The investment bank produced net income of C$447 million (~$346 million) in the quarter, which represented a decline of 9% from a year ago as higher expenses and lower provision reversal was only partially offset by higher revenue. This compared favorably to RBC and Scotiabank, which saw earnings at the segment fall much more sharply, with a decline of 58% and 26%, respectively.

Higher Interest Rates

Net interest income rose not only because of higher interest rates, but also due to its balance sheet growth. Average loans in Canadian banking rose by 3% from the previous quarter, and were 14% higher on a year-on-year basis. The slowing mortgage market was offset by growth in other categories of lending, including loans to businesses, which rose by 21% from a year ago.

Higher interest rates have only just started to feed into its margins; net interest margin, excluding trading, rose by 4 basis points in the quarter to 1.68% in Q3. Overall, net interest income was 5% higher on a quarterly sequential basis, and 12% higher on the prior year.

Looking ahead, there’s room for meaningful upside as the re-pricing of its loan book takes time to feed into its margins. Variable rate mortgages account for just over a third of its mortgage portfolio, but even fixed rate mortgages come up for renewal before the end of its amortization term. More than a tenth of its C$234 million (~$181 million) mortgage loan book is due to be renewed over the next 12 months.

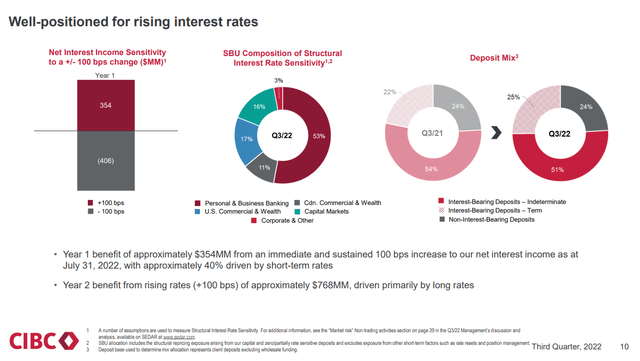

NII Sensitivity to Interest Rates (CIBC Investor Relations)

According to CIBC’s interest rate sensitivity analysis, a 100 basis points increase in interest rates would lift its net interest income by C$354 million (~$274 million) in the first year, with the benefit rising to C$768 million (~$594 million) by the second year.

CIBC’s earnings outlook is particularly sensitive to rising interest rates because the bank’s net interest income accounts for a significant majority of its revenues – at 58% in Q3 2022.

CIBC’s Credit Quality

The rise in net interest income in Q2 was big enough to offset the increase in its provision for credit losses, as the bank tempered its economic outlook in both Canada and the US. A further C$87 million (~$67 million) provision charge was booked on currently performing loans for the deterioration in forward-looking indicators from last quarter and other portfolio movements. Overall, provision for credit losses were C$243M (~$188 million) in the quarter, against a reversal of C$99M (~$77 million) last year.

Credit quality remains strong, in spite of the negative shift in the economic outlook. The level of non-performing loans remains historically low, while impaired provisions continue to perform better than pre-pandemic. This enabled CIBC to reverse provisions in its business and government loan portfolio, and helped it to book lower provisions for credit losses than in Q2 2022.

Its adjusted return on equity in Q3 was 14.6% – down from 17.1% in the previous quarter, but higher than the 14.0% return in the same quarter last year.

Rising Costs

One area of concern is costs at CIBC are rising at a faster pace than at its peers. Bank expenses were 10% higher, on an adjusted basis. Cost growth outpaced revenue growth in its US business, as it continued to support organic growth in its platform there. Additionally, higher expenses were associated with the Costco credit card portfolio.

When these growth investments were stripped out, together with the impact of variable compensation, adjusted operating costs were still 6% higher than a year ago. This reflected inflationary pressures, particularly higher wage costs and increased technology spending.

CIBC has historically had lower than average profitability than its peers, so investors will be watching closely to see if its cost to income ratio will begin to stabilize. There will likely be some relief on the horizon here, as the pace of rising costs should slow due to the completion of certain growth investments and easing inflationary pressures in Canada.

Housing Market Concerns

The worsening economic outlook is not the only headwind clouding CIBC’s prospects, with the slowing housing market set to hurt mortgage demand and credit quality going forwards. The bank is particularly exposed to a housing correction as mortgage lending accounts for 53% of its loan book – a higher proportion than many of its peers. This proportion has, however, fallen somewhat in recent years as the bank has diversified towards lending to businesses and other forms of consumer lending, including credit cards.

Canadian home prices have fallen by 3.3% from its peak in April 2022, and the trajectory is expected to continue for some time as tightening monetary policy puts pressure on valuations. This would not only affect mortgage revenue in the near term, but also credit quality, as collateral on loans decrease.

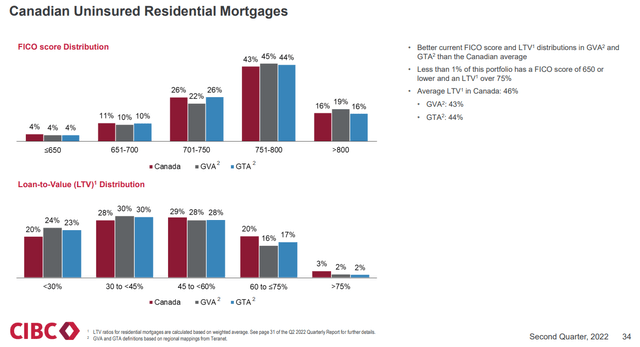

These concerns will be somewhat mitigated by its disciplined underwriting and falling loan-to-value ratios. The average LTV ratio of its uninsured mortgage portfolio is now just 45%, down from 52% in 2020. Exposure to less credit-worthy borrowers is also low, with only 4% of uninsured mortgages exposed to customers carrying a FICO score of 650 or less.

CIBC Residential Mortgages (CIBC Investor Relations)

On the upside, Canada’s economy is still expected to hold up well, even after the latest downward revisions to its GDP growth forecasts. IMF estimates in July show Canada to be the fastest growing G7 country over the next two years, with real GDP growth of 3.4% and 1.8% in 2022 and 2023, respectively.

This resilient macroeconomic backdrop should keep unemployment low and maintain wage growth, which in turn, underpin high levels of mortgage affordability and keep default rates low. Additionally, the continuing economic recovery should see further growth in business borrowing and other forms of consumer credit, which will offset some of the housing market pressures.

CM Stock Valuation

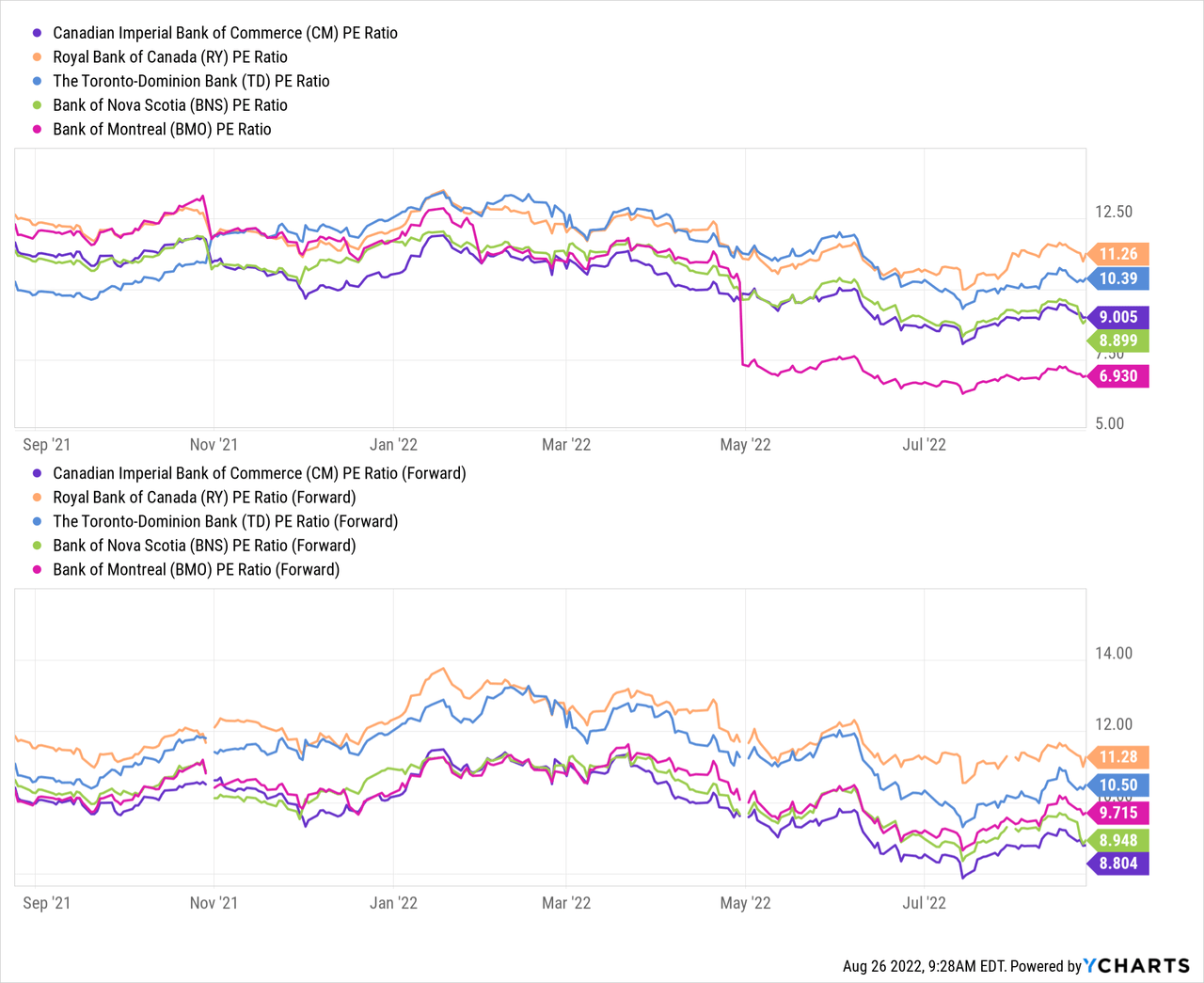

CIBC is attractively valued in the Canadian banking space, with the stock’s forward PE of 8.8 making it the cheapest of the ‘Big 5’ banks. Although the valuation discount is a longstanding characteristic, reflecting historically lower profitability due to its smaller size, it may not reflect its ability to outperform in the medium term.

Recent growth investments, both organic and inorganic, are medium-term catalysts that have yet to feed significantly into its bottom line. What’s more, its higher income sensitivity to interest rates means it should stand to benefit more considerably from rising benchmark interest rates compared to its peers.

Final Thoughts

I think the medium-term fundamentals for CIBC remain attractive. Although additional headwinds cannot be ruled out, its earnings outlook remains positive on rising net interest income and a resilient Canadian economy.

Be the first to comment