NotYourAverageBear

All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

The earnings season for rail companies has ended. The Canadian Pacific Railway (NYSE:CP) was the last North American Class I railroad to report earnings. It’s also my 5th-largest portfolio holding and one of the stocks that I have aggressively added to since buying the stock last year. In a recent article, titled “Why I Bought More Canadian Pacific”, I explained the long-term bull case for dividend (growth) investors based on the pending merger with Kansas City Southern, formerly listed under the KSU ticker and in the rail industry referred to as KCS, the company’s strategic footprint in North America, its financials, and much more.

In this article, we get to discuss the just-released 2Q22 earnings, which underlined the company’s strong performance in a challenging time of high inflation, supply chain difficulties, and related labor issues. However, that applies mainly to American railroads, which find themselves in a labor dispute as I covered in this article.

The company beat top and bottom line estimates, it sees a recovery in grain, it benefits from higher potash demand, the auto recovery, and high energy prices. Moreover, it managed operating expenses quite well. As a long-term investor in this company, I’m extremely pleased, although economic headwinds persist.

So, let’s look at the details!

Great Numbers From Canadian Pacific Despite Headwinds

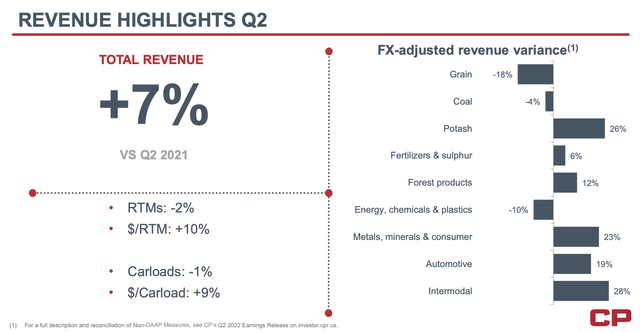

In its 2Q22 quarter, Canadian Pacific did $2.2 billion in revenues. That’s 7.3% higher compared to the prior-year quarter and $10 million higher than expected.

Non-GAAP EPS came in at $0.95, which is $0.01 higher than expected. It’s also down 8% from the prior-year quarter when the company did $1.03 in EPS.

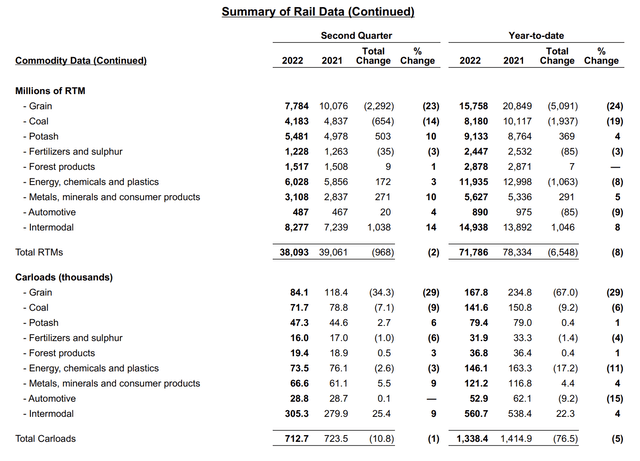

With that said, let’s look at transportation numbers. In 2Q22, the company saw 2% lower RTM – revenue-ton miles. According to the BTS:

Rail Freight Revenue Ton-Miles is the number of rail revenue tons of freight carried one mile.

In other words, RTM means volumes adjusted for mileage. It’s not a financial number.

The contraction was caused by much slower grain volumes, lower coal volumes, and slightly lower fertilizer (excluding potash) volumes. Potash volumes rebounded as a result of the war in Ukraine and export restrictions from producing countries like Belarus and Russia. Canadian Pacific expects strength in potash to last due to these reasons and the general need for fertilizer. Canada is one of the world’s largest exporters of fertilizers.

Automotive RTMs improved as well as we can assume that supply chain problems in the industry have eased. Meaning that producers can work on their backlog at a faster pace, even if demand slows due to weak consumer demand.

When involving pricing, “only” grain and energy, chemicals, and plastics were down, which couldn’t keep revenues from rising by 7% as the company grew revenue per carload by 9%.

The biggest problem for Canadian Pacific is the weakness in grains. Last year’s droughts in big parts of Canada resulted in low volumes until this year’s harvest is over.

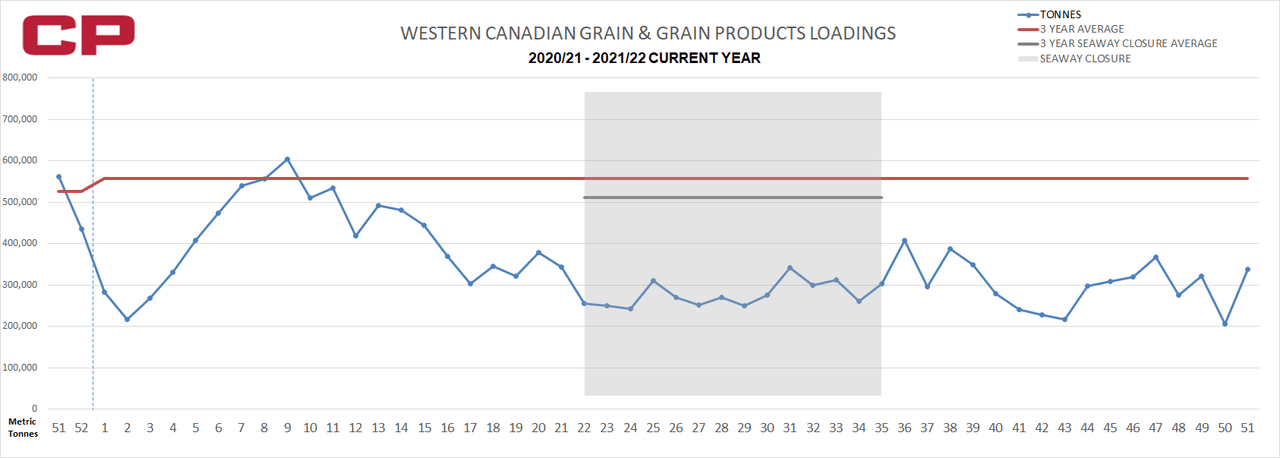

In week 51, the company moved more than 337 thousand metric tons of Canadian grain. That’s an improvement versus week 50, but well below the three-year average close to 560 thousand tons.

Canadian Pacific

The good news is that Canadian Pacific expects this year’s grain harvest in Canada to be at least average, if not better, based on current crop conditions across all major growing areas.

Its American grain franchise is expected to have a record year due to better volumes south of the Canadian border.

Adding to that, the company expects double-digit potash volume growth in the second half as export demand is set to accelerate. Moreover, the revenue result in intermodal was a record. The company continues to seek new opportunities like major transportation deals with Hapag Lloyd and CMA-CGM.

Moreover, and with regard to grains, the company has invested $500 million in new high-capacity grain hoppers. Its customers have invested in new grain elevators. This year, the company will likely benefit from 47 elevators capable of serving 8,500-foot-long trains. In 2024, that number is expected to be 55. In 2017, it was 12. This means more access to grains and an even bigger footprint in that area.

Also, note that the company’s grain trains weren’t 8,500 feet before. This is also new thanks to high-capacity grain hoppers. This now allows the company to transport 15,000 tons of wheat per train.

In its merchandise segments, CP benefits from higher drilling activity thanks to higher energy prices, which benefits fracking sand shipments. Moreover, in this segment, the company is also winning new orders as new refined products and plastics customers are coming online. And, as I already mentioned, car production is rebounding, albeit from low levels.

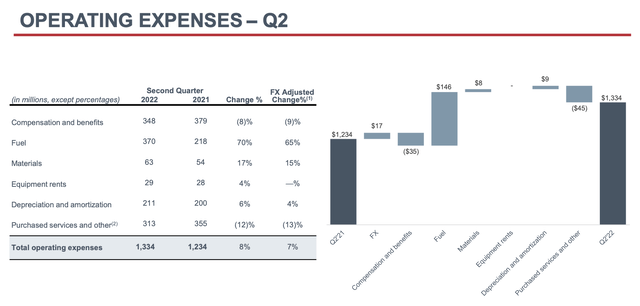

With all of this in mind, total operating expenses rose by 8% (up 7% on a constant currency basis).

The surge in costs was mainly caused by higher fuel prices, more expensive materials, and 4% higher depreciation costs. Compensation and benefits were down as the company is in a very good position to deal with (higher) volumes using its current employment levels.

In this regard, the Canadian railroads are in a better spot than some of their peers south of the border.

Yet, the company still saw a rise in its adjusted operating ratio to 59.7%. That’s 440 basis points higher compared to 1Q21. Please note that the operating ratio shows how much it costs (as a % of total revenues) to run the railroad. The lower, the better.

For now, CP’s operating ratio is in line with other railroads.

Moreover, there are two things worth noting.

First of all, the CP-KCS deal is expected to get approval (early) in the first quarter of 2023.

Second, Kansas City Southern, and its Mexican franchise KCSM got a 10-year exclusivity extension to 2037 in Mexico, which provides both KC and CP with more clarity and certainty when it comes to operations in all three North American countries.

Related, KCS, which is not integrated into CP’s financials because of the pending STB approval grew its revenues by 13% with 3% more carloads. Its adjusted operating ratio rose by a mere 0.1 points to 61.5%.

But wait, there’s more good news. In light of supply chain-related headwinds, the company did very well. While train speeds remained fairly unchanged at 21.7 miles per hour, the average train length increased by 2%. Trains became 2% heavier and 1% less fuel efficient.

This matters because the company has reduced average terminal dwell by 13% compared to 1Q22. Locomotives have become 16% more productive. These numbers are fantastic. If supply chain issues do indeed smoothen in the second half, CP is in a terrific position to improve operating efficiencies again.

Valuation

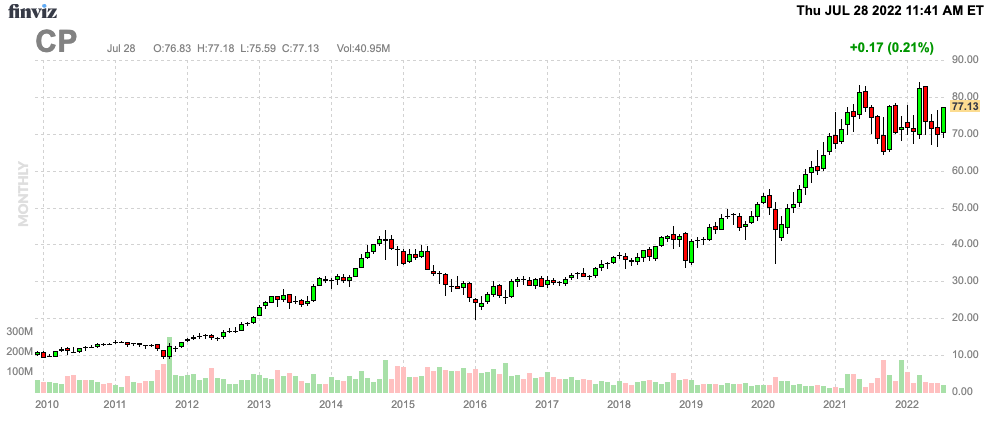

While I am writing this, New York-listed CP shares are 7% up on a year-to-date basis.

FINVIZ (New York-Listed CP Shares)

In order to calculate the enterprise value, I’m using the Toronto-listed shares. In Canada, the company’s equity is worth $92.1 billion. Next year (post-merger), the company is expected to have $17.2 billion in net debt. On top of that, CP has roughly $720 million in pension-related liabilities.

EBITDA is expected to rise to $7.4 billion.

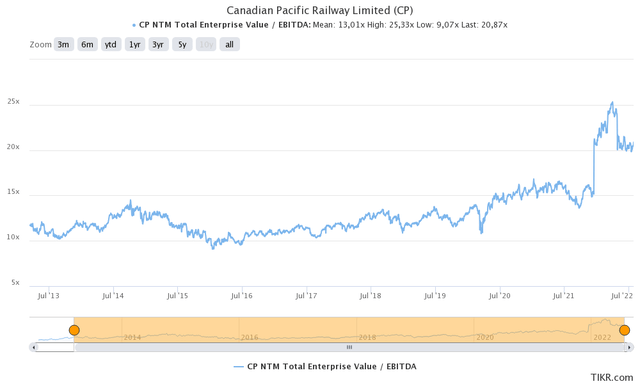

This gives the company an enterprise value of $110 billion. That’s 14.9x expected EBITDA. This means the valuation is back at early 2020 levels.

That doesn’t look like deep value – and it isn’t. However, it’s a fair valuation, which incorporates post-merger synergies and a steep increase in expected growth if economic growth rebounds on top of the (expected) recovery in Canadian grains.

Takeaway

As an investor in Canadian Pacific, I’m extremely satisfied with its numbers. The company has proven to be on top of things as it reduced dwell times, and increased train length without accelerating hiring.

Moreover, revenue growth was looking good despite the weakness in grains. New business in intermodal really helped. As did the recovery in automotive RTMs and high export demand for potash, which is set to last.

Going forward, the company is in a good position to grow revenues by double digits if grain volumes strengthen in the second half of this year. The company is well-prepared to deal with higher volumes due to investments in equipment and customers who are looking to move bigger loads.

So, long story short, I’m very happy I kept adding to CP during the past few months and I’m looking to buy even more if the stock starts to weaken again. I believe it’s one of the best long-term investments in industrials/transportation.

These financial numbers confirmed that once again.

(Dis)agree? Let me know in the comments!

Be the first to comment