MF3d

The iShares Core MSCI Emerging Markets ETF (NYSEARCA:IEMG) is a pick for investors that are interested in playing the Chinese markets. Featuring heavily in addition to China is Taiwan. We don’t believe an invasion of Taiwan is at all likely, but we worry about other investability issues around Chinese stocks that are likely to continue to mount. The IEMG ends up being very speculative and contrarian where you don’t want it to be. Best to pass on it.

Breaking Down IEMG

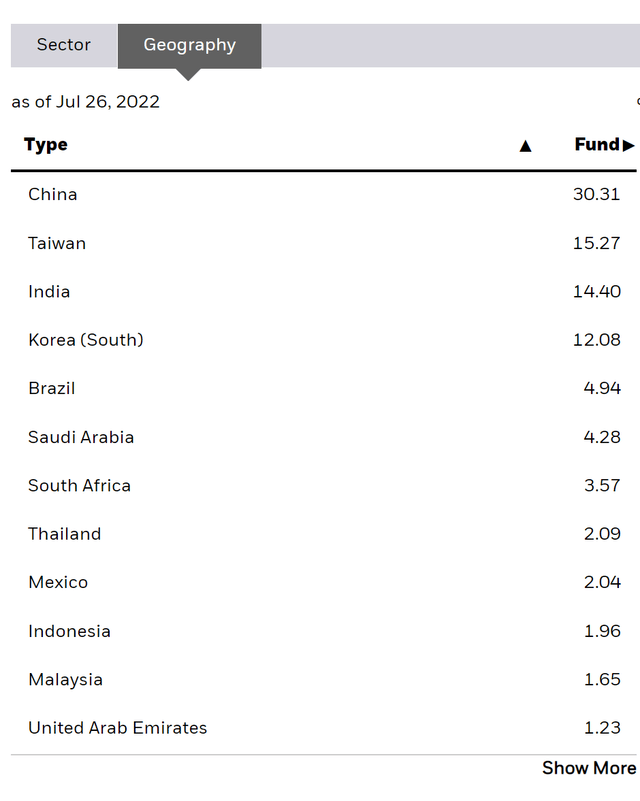

The geographic breakdown ends up being the most important one as far as IEMG goes, because it immediately indicates the key issue around holding this ETF.

Geographic Breakdown IEMG (iShares.com)

A large proportion of it is invested in China. China is not really what we’d consider an emerging market, in fact most of the geographies here are really not emerging geographies. Indeed, South Korea is super advanced and very capitalist, and Taiwan is home to the world’s most important tech foundries. As far as typical emerging market exposure goes, the risks are actually quite limited. FX risks related to reversals in commodities, and a strengthening dollar that further indentures the typical emerging market economy, are not concerns that IEMG investors need to have.

The prime issue is around the investability of China, and to a lesser extent the Taiwan invasion risk.

ADRs

The major holdings of IEMG include Tencent, Alibaba and JD among Chinese companies. They trade as ADRs on US markets, but are also dual-listed on the Hong Kong exchange, or are about to be. The reason this is being done is so that if these stocks become disallowed for US investors, and are forced to delist from US exchanges, the ownership disruptions don’t decimate the stocks. By listing in Hong Kong as well they open the shares up to ownership by people on the Chinese mainland.

This might initially seem like a silver lining for markets, but the investability concerns remain. If substantial amounts of Chinese wealth start getting tied up in these stocks, much like US household wealth is tied up in US stocks, it is likely that the government will keep an even more restrictive eye on these companies’ activities, and not necessarily in ways consistent with what a western shareholder would expect. This is more of an ambiguous risk, but the other issue is that Hong Kong is becoming less independent all the time. Major institutions like HSBC (HSBC) that for centuries was a de facto monetary authority and at times a major impediment to Chinese historical interests is being regarded with ever more suspicion, and its influence likely less tolerable by mainland China which is looking to consolidate these special territories back under the CCP’s hegemony. The point is that institutions in Hong Kong should not be looked at as independent from China anymore. We don’t think that the concerns, especially for US investors, end at the option to invest in these companies on non-US exchanges. With a substantial amount of foreigners holding capital in Hong Kong and Chinese focused businesses, the next move is unpredictable, and investors should maybe look further ahead than a simply solved ADR delisting problem when thinking about ownership in these stocks. Ultimately, it comes down to whether you really want shares in stocks trading in a country with a political set-up like China’s, and in a geopolitical environment where all sorts of power-plays are on the table to subvert non-allied nations.

Conclusions

We will avoid China, but if investors are keen to speculate on these markets, then maybe IEMG is interesting after all, because valuations are very depressed there. Then again, in some cases there are actual business factors to consider such as crackdowns on young people gaming, general economic disruptions caused by a collapsing property market, and a new wave of lockdowns.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment