DNY59

Redbubble Takes Another Huge Tumbling

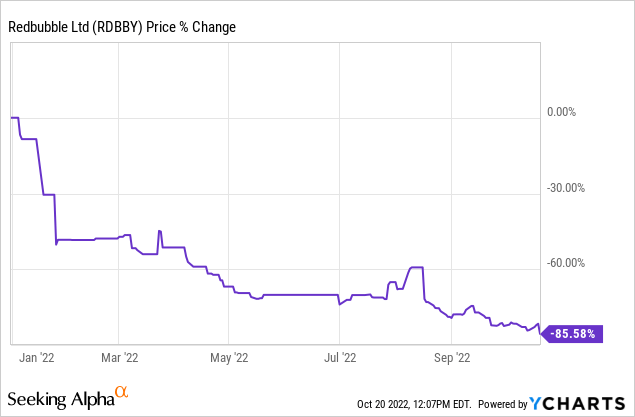

On 20th October, Redbubble (OTCPK:RDBBF) (OTCPK:RDBBY) announced its 1Q23 earnings and its Australia listed stock (ASX:RBL) subsequently tumbled over 26% in one day. Over the past year, the stock has already been facing tremendous downward pressure and has been down a whopping 85% YTD. While a falling share price is justified given inflationary pressures and an impending recession which will result in falling discretionary spending, I firmly believe that with following today’s sharp sell-off, the company is grossly undervalued given its strong long-term fundamentals and pristine balance sheet. In fact, Redbubble today is trading at my doomsday scenario, which reflects falling revenue for the next two years and zero growth subsequently.

This article will mainly address the recent developments to Redbubble’s stock in 1Q23 and 4Q22 (two key earnings call since my previous articles), and provide a worst-case scenario for the company. For a deeper dive into the company’s fundamentals, you may find my past coverage here:

The Bad

From Redbubble’s 1Q23 press release, I will highlight the key developments which are negative towards the company in the near term:

- Marketplace revenue has fallen 5% yoy, with 4% accounted by a reduction of mask sales. This means that Redbubble’s core product categories continue to see a slight fall in demand.

- Artwork and homeward revenue fell in 1Q23, and while not stated in this call, accessories and stationary revenues also fell in 4Q22. The decrease in these segments reflects falling discretionary spending of the consumer.

- Australia, Europe and UK recorded lower-than-expected sales, especially in September. This suggests that we are only at the beginning of deteriorating consumer sentiment in the market, and future quarters could likely see a further decline in revenue.

- EBITDA has turned negative at AUD-14.6 million.

Redbubble’s Fundamentals Remain Strong

Despite poor results in the near term, which should have been expected given the discretionary nature of Redbubble’s products and the extremely uncertain macroeconomic environment we live in today, I believe that the company’s fundamentals still remain strong.

Recall that Redbubble’s unique advantage comes from its three-sided flywheel effect from artists, customers and fulfillers. Hence, assessing the resilience of these three pillars is key to determining if the company’s moat remains strong and ready to take off post-recession.

Artists

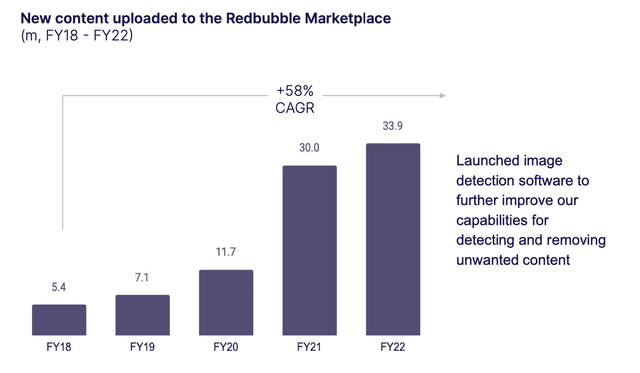

As of the most recent update, Redbubble has over 800,000 artists on their platforms, up from 700,000 in FY21. Additionally, despite falling revenue in FY22, the platform still recorded an increase in new content uploads for the year, further enhancing the ecosystem of designs.

Number of new contents uploaded to Redbubble’s sites (Redbubble Investor Presentation 2022)

Customers

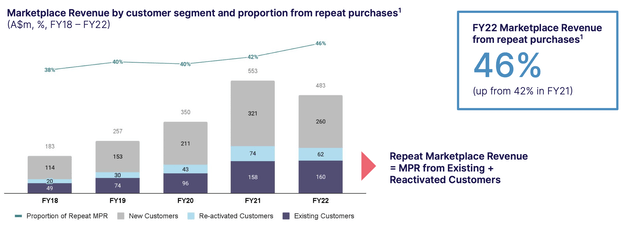

Following a 2021 COVID boom, the number of active Redbubble members fell 7% to 14.4 million, but up 32% from FY20. Active members are important to the topline as they generate 30% more annual revenue on average than non-members.

Next, while the number of unique customers similarly fell, I noticed that existing customer sales remained constant in FY22, which further demonstrates the strength of Redbubble’s proposition to their current customer base. They will be important in driving sales as new customer adoption will inevitably slow during a recession.

Redbubble sales by customer type (Redbubble Investor Presentation 2022)

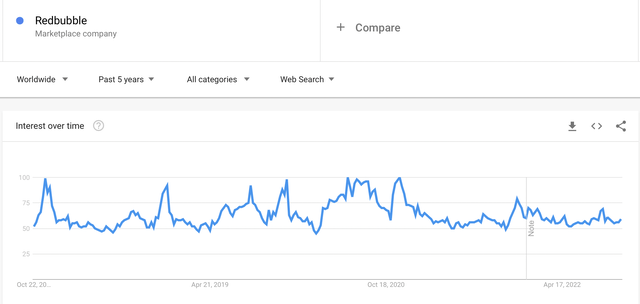

Finally, while purchases may have fallen in 4Q22 and 1Q23, customer awareness for Redbubble still remains high as reflected by Google Trends. This means that while conversion might have fallen (which makes sense when consumer spending falls), Redbubble is still on the consumer’s mind, increasing the likelihood of recovery in demand as the economic situation improves around the world.

Redbubble 5Y Google Trend (Google)

Fulfillers

There have been no major changes to this category as the number of fulfilment locations remains the same at 44. However, shipping days have continued to improve and have been reduced by 28%. Redbubble has also noted improved shipping agreements in Canada, UK and US. Investors should keep a lookout on further developments and results in the upcoming 1H23 presentation.

General

In general, Redbubble’s three key pillars and fundamentals remain strong despite a poor macroeconomic environment. The pool of designs and artwork continues to increase while existing customer loyalty is strong. Additionally, Redbubble has also continued to expand its catalogue base to include pet products and has hiked prices by 6% on average the past year. As we move on from this period of inflation, these prices would likely stay, improving the company’s margins in the long run.

Pricing In The Absolute Worst For Redbubble

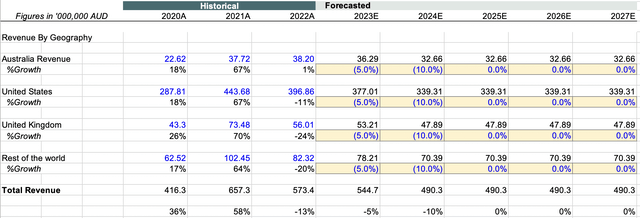

Given the overwhelmingly negative sentiment around Redbubble, I have proceeded to value it in a doomsday scenario. It seems that at the current price of AUD53 cents, the market is pricing in absolutely no recovery in demand growth for Redbubble and persistently negative EBITDA. The following are my extremely bearish assumptions for the DCF model:

- Revenue growth of -5% in FY23 and -10% in FY24 to account for falling discretionary spend. This is in spite of management forecasting revenue growth for the remainder of FY23.

- Revenue growth of 0% from FY25 to the terminal year. This means that Redbubble does not recover from the recession at all.

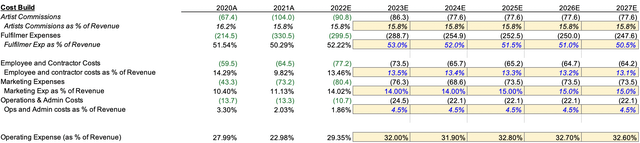

- Operating expenses as a percentage of revenue remain elevated at FY22 levels, increasing till the terminal year as marketing spend picks up.

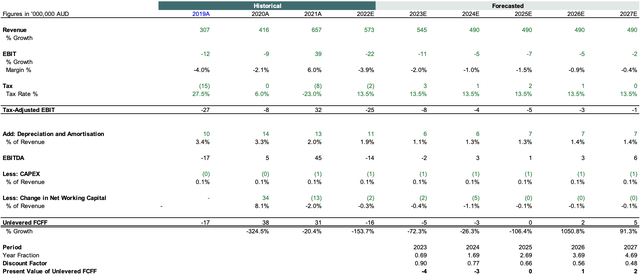

- WACC of 17% is used, derived from 1.95 beta, 6% ERP and allowing for a bear case of a 5% risk-free rate

Redbubble Revenue Model (Author’s calculations) Redbubble’s Cost Projections (Author’s calculations)

Exiting a 5-year forecast horizon at a 2% terminal growth rate, I obtain a share price of AUD51 cents as the target price. With the current price of AUD50 cents, this implies that Redbubble is essentially trading at a zero growth with no margin expansion from FY22.

Redbubble DCF (Redbubble’s Cost Projections)

I would like to reiterate that this is by no means an estimation of Redbubble’s true intrinsic value, rather it serves to show how unjustified the sell-off around the company has become. This also means that there is limited downside risk for buying Redbubble at today’s prices even if the company does not grow over the next five years, while a potential long-term share price could easily range from AUD2-3 as depicted in my previous articles.

More Reasons To Keep Tabs On Redbubble

Beyond the financial model, there are even more reasons why the share price seems unjustified.

1. Redbubble’s P/S is 0.27

This is vastly below the average retail P/S of 0.65. Given Redbubble’s asset lite model and market position as a leading POD platform, such a low P/S does not really seem to be justified.

2. Redbubble Has Proven Its Ability To Be Profitable

The company posted its first positive income in FY21, which has reverted to negative territory since. However, I view this as a testament to Redbubble’s ability to generate a profit, with a breakeven point around AUD650 million in revenue. While recent cost inflation and supply chain woes may have slightly pushed this number up, Redbubble would easily be profitable again if it can grow its topline by another 20% while maintaining its current cost structure, and this growth rate has been easily achievable before the poor macro environment today.

3. There Is No Significant Deterioration In The Company’s Fundamentals

As discussed, there has been no significant worsening of any of Redbubble’s three key pillars that drive their flywheel effect, and they still remain the largest POD company with the widest catalogue. Additionally, the company has virtually no debt and will definitely be able to tide through the coming recession.

4. Half Of The Market Cap Is Cash

With an AUD147 million market cap and 88 million in cash, more than half of the stock’s value is now backed by cash.

Risks To An Investment/The Stock

However, investors should also take note of the following risk factors/limitations that could hinder the thesis from playing out:

1. Prolonged Periods Of Negative Macroeconomic Outlook

The current model forecasts a doomsday scenario using -5% and -10% growth over the next two FYs, followed by 0% till the terminal year. In reality, should a Great Recession style downturn hit the economy, we could be looking at a much greater decline. Additionally, if poor macroeconomic conditions drag on for a prolonged period of time, this could severely hinder the recovery of discretionary consumer spending.

2. Low Liquidity Of Redbubble Stock

The OTC listing of Redbubble is extremely illiquid, hence investors may face difficulties in trading the counter. However, investors can mitigate this by buying the company via the Australian exchange, with an average of 1.8 m shares traded daily.

3. Small Cap Volatility

Redbubble is a small-cap stock with a sub AUD200 million market cap. Therefore, investors must be able to stomach huge amounts of volatility in the share price. This is also reflected in the stock’s beta of 1.95.

Final Thoughts

Despite the negative sentiment surrounding the company, I firmly believe that Redbubble remains a fundamentally strong company, a market leader in a niche industry and one with a unique asset-lite model with a three-way flywheel effect. Hence, at today’s prices, the risk-to-reward ratio seems extremely attractive to buy and hold Redbubble for the long term. There is a very low probability of insolvency due to the company’s strong net cash position, and the stock price is already factoring in a very pessimistic outlook, yet there is an extremely high reward potential should even the slightest recovery in growth takes place.

Be the first to comment