Mario Tama

Investment Thesis

FedEx’s (NYSE:FDX) stock has seen volatile trading over the last month after sharing its FY2025 goals with the street at the June 30th investor day event. The stock declined in the first half of July and then recovered in the second half as investors tried to assess the net impact of tailwinds from the company specific initiatives and headwinds from a tough macroeconomic environment. The company is anticipating a 4% to 6% revenue CAGR over the next three years and a 10% plus adjusted operating margin in FY2025. In addition, the management is targeting a significant reduction in capex, meaningful ROIC improvement, and an increase in cash return to shareholders through repurchases and dividends. Prior to that, in a challenging environment, FDX reported a good quarterly result primarily driven by double-digit yields across all the segments. While there are global supply chain issues and a difficult macro environment, which are impacting its volumes, FDX is concentrating more on yields to drive revenue growth. If we look at the current valuations of FDX, the stock is trading at ~10 times its FY23 EPS and at ~9 times its FY24 EPS. This reflects that investors are clearly worried about worsening macros and don’t have much confidence in management’s growth targets. While I understand investors’ concerns about the macros, I believe even if management is able to only partially meet its FY25 goals, the stock can still outperform given its low valuations.

FDX Stock Key Metrics

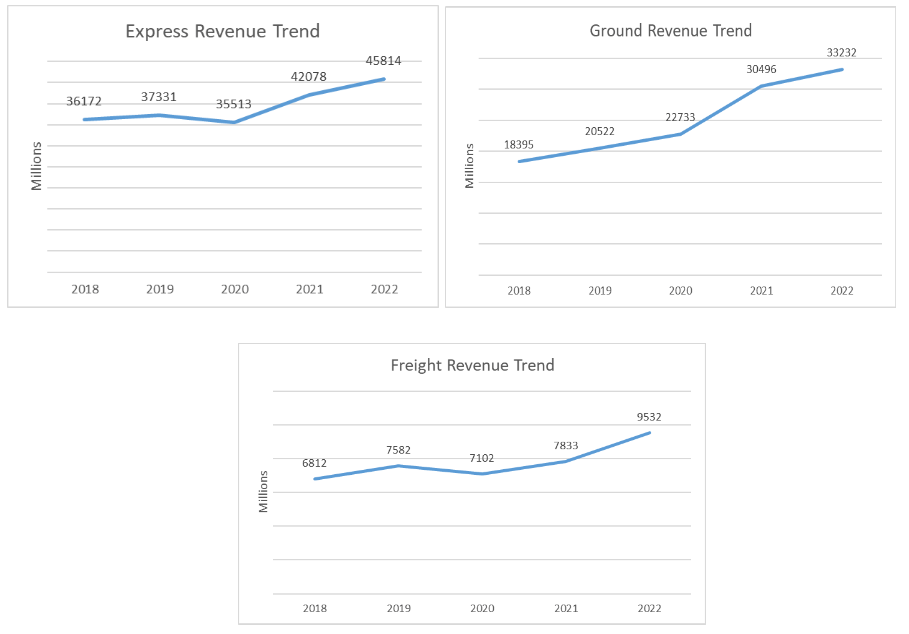

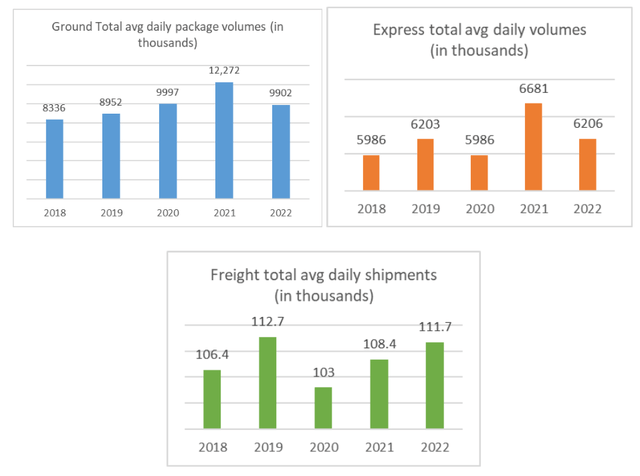

After the pandemic, the company has recorded good revenue growth across all of its businesses with the pandemic acting as a catalyst for E-commerce demand. Due to the growing demand, which was outpacing supply, the company was able to achieve good yield growth. In addition, the company also implemented various pricing strategies, such as E-commerce peak surcharges which helped yields. Residential delivery services at FedEx Ground and US domestic package volume growth at FedEx Express contributed a good deal to revenues. However, the volume trend for the ground segment is now showing signs of normalization. The ground segment’s total average daily package volume declined to 9.9 million in FY22 from 12.3 million in FY21. Volumes for the express segment also decreased to 6.2 million in 2022 compared to 6.7 million in 2021. These declines could be blamed on the difficult comparisons from accelerated E-commerce demand in 2021 and more consumers returning to in-store purchases. Despite volume headwinds, the company was able to increase revenues thanks to an improvement in yields.

FDX Segment Revenue USD mn (Company Data, GS Analytics Research) FDX Segment Volumes (Company Data, GS Analytics Research) FDX Segment Yields (FedEx 10-K filing)

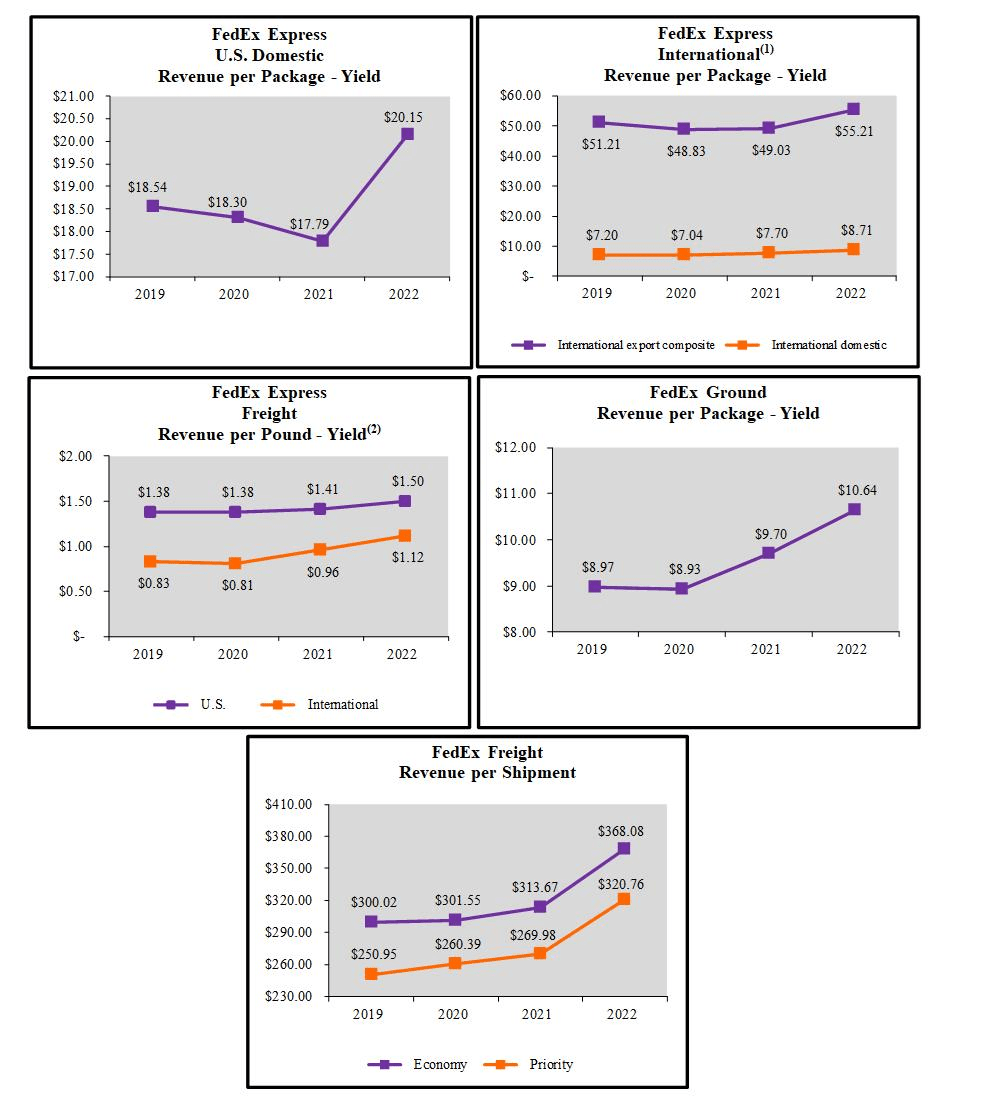

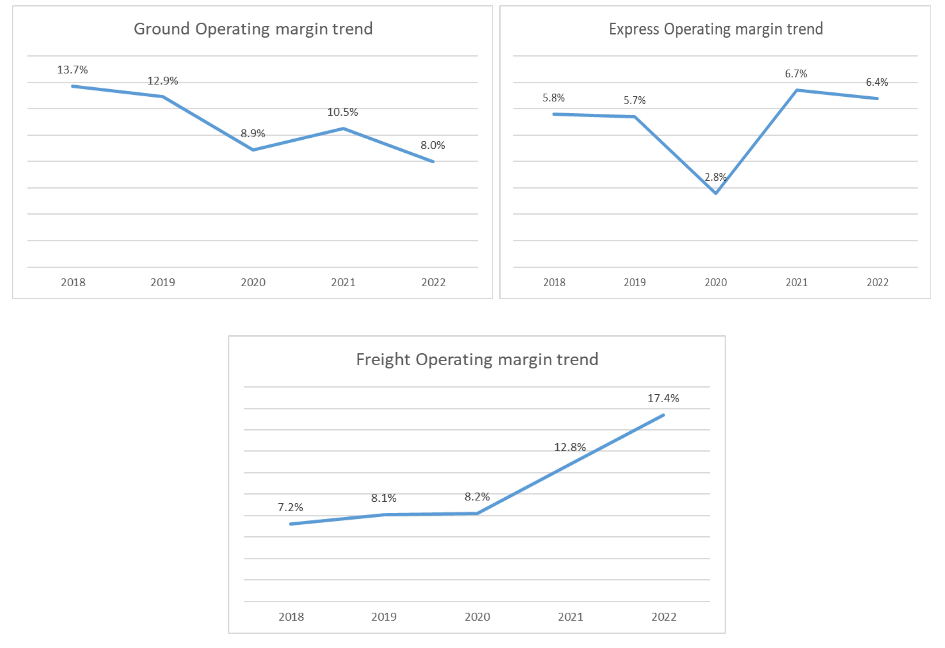

Covid-related shutdowns had a significant impact on FDX’s operations in FY20 and adversely affected operating margins. In 2021, things began improving and the company recorded y/y operating margin expansion across the segments as the higher demand allowed the company to charge more and pricing initiatives like E-commerce peak surcharges further aided to yield improvement. The company’s emphasis on enhancing customer mix also assisted it in getting higher yields. In FY22, the adjusted consolidated operating margin was still lower than pre-pandemic levels primarily due to pressure from the ground segment.

The ground segment’s operating margin for FY22 remained at 8% which is below the pre-pandemic margin of 12.9% in FY19. Higher wage-related costs in a labour shortage environment and increased pressure from purchased transportation were the primary reasons for the sluggish operating margin performance in the ground segment.

The express segment was able to deliver better operating margins compared to pre-pandemic margins as the company has started to realize the benefits of TNT Express air integration. Once the full TNT integration is completed, it can further improve the segment margins. The freight segment is outperforming other segments on the operating margin front with the benefits of good yield growth. The company’s focus on revenue quality has contributed to achieving higher yields in the segment.

FDX Consolidated Operating Margins (Company Filings, GS Analytics Research) FDX Segment Operating Margins (Company Data, GS Analytics Research)

How was FDX’s Future Guidance?

FDX shared its FY25 financial targets with the street at its recent investor meeting. Consolidated revenue is expected to grow between 4% and 6% CAGR over the next three years. Adjusted EPS is expected to grow between 14% and 19% CAGR till FY25, which implies a range of $29 to $35 for FY25. By FY25, management is targeting a 10% adjusted consolidated operating margin (vs. 7.3% in FY22). The ground segment is expected to deliver adjusted operating margins of 11%-12% by leveraging the integrated network by FY25. The freight segment is expected to deliver a 20% adjusted operating margin with an attractive LTL freight market. On the express front, adjusted operating margins are expected to be at 8%-9% by FY25 with the benefits of TNT integration in Europe.

Is FedEx Improving?

If we look at FDX’s future prospects, it is a tale of two stories with company-specific initiatives like yield improvement, cost reduction, TNT integration, and lower capex helping the business while tough macros serve as a headwind. However, I will focus more on the company-specific initiatives as the tough macroeconomic environment with rising interest rates is well understood by investors and is already getting reflected in the current low P/E multiple that the company is getting.

E-commerce to drive ground revenue

The pandemic was the primary reason for the accelerated growth in E-commerce in recent years. While I believe that the E-commerce growth rate will return to a more normalized level over the next couple of years, the long-term outlook remains compelling. E-commerce as a percent of retail in the U.S. is still at ~21%, and there is a multi-year growth story ahead of us. Small and medium businesses are likely to play an important part in this growth. FedEx expects the non-Amazon (AMZN) domestic parcel market to grow from 57 million pieces a day currently to 67 million pieces a day by FY25. So I believe this secular growth story will continue to drive the growth of the ground segment.

The company is also coming up with innovations like the FedEx Surround platform to help its B2B customers manage the supply chain more effectively by avoiding any shipment issues. For example, FedEx Surround helps its healthcare customers identify and avoid any issues with the shipment if it becomes stressed. If the shipment is in the FDX network and if any issue occurs, FDX identifies it and initiates the necessary measures. The company reroutes the stressed shipment and takes measures like intervening, re-icing, and preserving efficacy to solve the issue and get it to the patient. The company is adding new capabilities to FedEx Surround as it allows the company to provide differentiated service to B2B customers. This kind of innovation should help FDX gain more customers and also charge a premium for its services helping both revenues and yields.

Technology to improve efficiency and margins

E-commerce has challenged the productivity of the ground segment over the past few years. Now, the company is taking technological initiatives like network 2.0 to improve network efficiencies and lower the associated costs. The Network 2.0 initiative is expected to help achieve FY25 goals for operating margins. Network 2.0 plans to use an operational insights platform, which will have digital and data capabilities to drive efficiencies across the network and achieve cost optimization. The operational insights platform will help the company improve its efficiency in dock and linehaul operations. The ground segment is expected to achieve a cost efficiency of ~$1 billion annually by FY25 with improved technological innovations and asset utilization.

The freight segment’s margin is also expected to benefit from efficiencies with the help of RFID technology, which allows improvement in visibility on docks and enables control at the handling unit level. In addition, the company is also taking steps like inflation plus pricing and e-Commerce surcharges to improve margins.

TNT integration benefits

The company has completed TNT air integration and should complete the final leg of full TNT integration in FY23. I believe the fully integrated network in Europe with TNT should significantly benefit the express segment in Europe. The integrated air network will bring in lower-cost airlines with more efficiency. Approximately $400- $600 million in profit improvement is expected through FY25 in Europe with the help of air network integration and business optimization and nearly half of the profit improvement in the profitability of the express segment should come from leveraging this integrated network in Europe.

Lower Capex and ROIC Improvement

In addition to revenue growth, yield improvement and cost reduction, the company is also planning to meaningfully lower its capex and improve ROIC.

The annual average capex for the last couple of years has been roughly $2.4 billion, and the company is expecting it to reduce to below $1.5 billion beyond FY25. This reduction will primarily be driven by reduced spending on the air fleet and lower investments in ground capacity. The fleet modernization program over the last few years has reduced the average age of the fleet by four years and has improved capacity by 10 million pounds. Further, the new Boeing 77 planes are much more fuel efficient than older MD-11 planes. The majority of the air fleet is expected to be modernized by FY25. So, beyond FY25, capex requirements will reduce meaningfully and the new more efficient planes will improve profitability.

Further, the company is also working on improving capacity utilization by using resources like the operational insights platform to boost linehaul operation efficiency and leveraging international air partners. These initiatives will help improve ROIC and management expects 200 bps improvement in ROIC over the next three years.

Is FedEx A Value Trap?

FedEx is trading at low valuations due to macroeconomic worries. However, I won’t call it a value trap as the company-specific initiatives can more than offset macro trends and drive earnings growth. So, even without assuming a meaningful improvement in P/E multiple, EPS growth can lead to an upside in the stock price. Further, the company is set to generate higher free cash flows with the combination of lower capex and higher ROIC in the coming years. So, we can see a good amount of share buybacks which can provide downside support.

Is FDX Stock a Buy, Sell, or Hold?

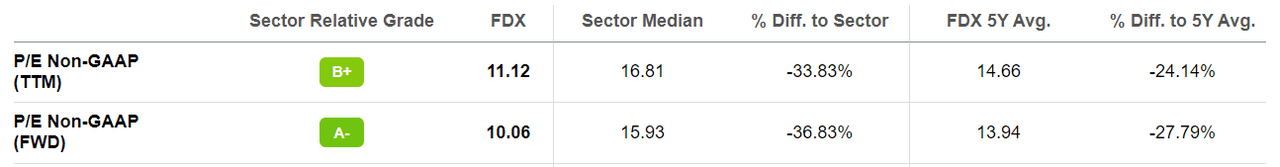

FDX is a good buy, trading at a discount to its historical valuations.

FDX Valuation (Seeking Alpha)

The company can see good earnings growth over the next few years helped by yield improvement initiatives, cost cutting, TNT integration and improving utilization. Further, the company’s ROIC and free cash flow are also poised to improve. While there are macro headwinds, I believe most of them are already priced in at the current valuations. Hence, I have a buy rating on the stock.

Be the first to comment