spooh

Thesis

Leading midstream MLP Enterprise Products Partners (NYSE:EPD) had a remarkable recovery from its June bottom, as investors await a highly anticipated Q2 earnings card on August 3.

We think that EPD is a high-quality energy player with a defensible business model that has proved itself during the previous energy bear markets. Therefore, we expect the company to continue executing well even though a potential recession is looming (but arguably already in one).

Notwithstanding, we believe the energy sector rotation is overplayed. Investors who picked EPD at the COVID bottom astutely are sitting on massive gains as EPD nears its long-term resistance ($30.9). Moreover, given the recent recovery in oil and gas futures (especially in Henry Hub natural gas), we believe the opportunity is timely for investors to consider rotating out of EPD again if they missed the June highs.

As a result, we rate EPS as a Sell and urge investors to use the recent sharp recovery to cut exposure.

Solid Business Model Sustains Enterprise Products’ Profitability

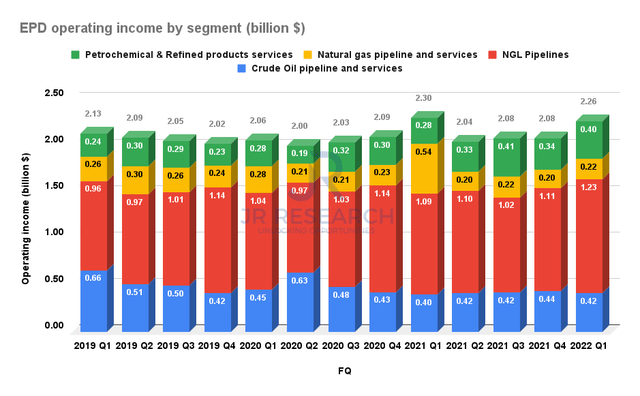

EPD operating income by segment (Company filings)

As seen above, investors can glean the highly-defensive business model which underpins the market’s confidence in its sustainable profitability outlook. It also has a well-diversified income stream, driven mainly by its NGL pipelines.

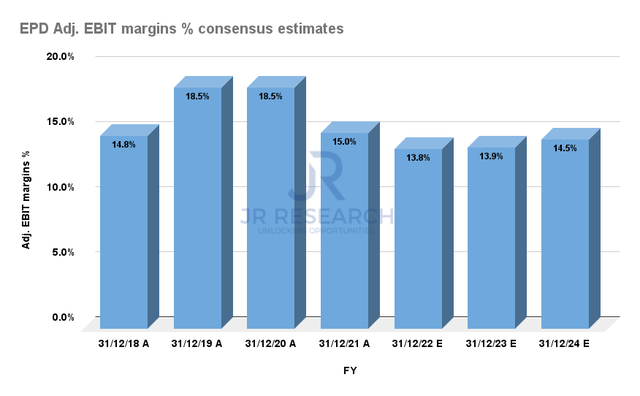

EPD adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Consequently, we believe the consensus estimates (bullish) are credible, as it projects for EPD’s adjusted EBIT margins to remain resilient and consistent through FY24. Therefore, we believe it lends tremendous visibility to underpin its valuation, corroborating the highly defensive nature of its underlying operating metrics.

However, we note that the Street analysts also expect EPD’s EBIT margins to have peaked in FY21, which investors should also consider in their valuation models.

EPD Is Not Immune To The Volatility In Energy Prices

We know the story. The ongoing energy crisis engulfing the US and its EU allies, coupled with the supply/demand imbalance, is likely to keep oil and gas prices high in the medium term.

BlackRock’s analysis also indicates that energy prices are likely to remain high “in large part due to constrained supply from slumping global investment in oil and gas exploration and development, which has fallen by nearly half since prices collapsed in 2014.” Furthermore, the scale in renewable energy isn’t ready to replace such underinvestment in the near term, even with the massive tax incentives embedded through the passage of the Inflation Reduction Act.

Despite that, Morgan Stanley (MS) believes that demand destruction could continue, even as the near-term oil supply remains tight, as it cut its projections into 2023.

In addition, WTI crude (CL1:COM) and Henry Hub natural gas futures (NG1:COM) contracts continue to point to markedly lower prices through 2026.

Enterprise Products also cautioned in its filings that price volatility in its underlying markets could adversely impact its operating results. It added (edited):

Changes in the prices of hydrocarbon products and in the relative price levels among hydrocarbon products could have a material adverse effect on our financial position, results of operations, and cash flows. A decrease in natural gas and NGL prices can result in lower margins from these contracts, which could have a material adverse effect on our financial position, results of operations and cash flows. (EPD 10-Q)

EPD’s Price Charts Show Worrying Signs

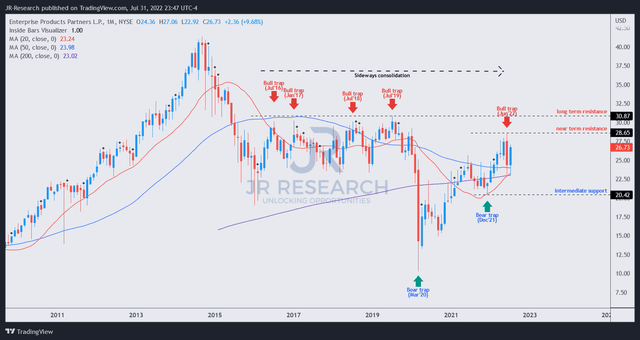

EPD price chart (monthly) (TradingView)

EPD’s recovery from its March 2020 bottom has been tremendous and rewarded its investors very well.

Its robust advance on its long-term chart was also underpinned by two noteworthy bear traps (indicating the market denied further selling downside decisively) in March 2020 and December 2021.

However, EPD formed a bull trap (suggesting that the market denied further buying upside resolutely) in June, which resolved the bottoming signals seen in March 2020 and December 2021.

Furthermore, EPD has been trading in an extended consolidation range since 2016, marked by a series of bull traps close to its long-term resistance ($30.9). Therefore, June’s bull trap warrants significant caution.

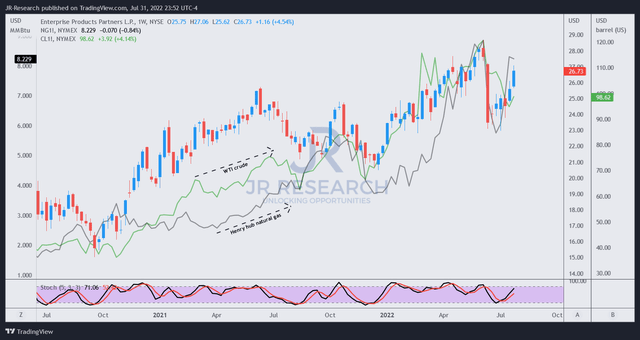

EPD price chart (weekly) (TradingView)

In June, we also noted ominous topping price structures on the WTI crude and natural gas futures. Furthermore, natural gas formed another bull trap last week [which we discussed in a recent EQT Corporation (EQT) article].

Therefore, EPD’s remarkable recovery could also have been driven by the recent surge in natural gas, as WTI crude’s recovery continues to lag behind.

While we have yet to observe a bull trap in EPD’s current rally, we believe the potential upside seems limited from here. Therefore, investors looking for a “confirmation signal” before layering out can wait for a bull trap to appear first.

Is EPD Stock A Buy, Sell, Or Hold?

We rate EPD as a Sell.

Enterprise Products has a remarkably resilient business model that proved its robustness through energy price volatility.

However, its price action suggests that EPD is not immune to price volatility in its underlying products. Furthermore, the recent price action in EPD, WTI crude, and natural gas justifies caution.

Therefore, we urge investors to consider leveraging the recent rally to sell and cut exposure. More conservative investors can consider waiting for a bull trap to form first before layering out.

Be the first to comment