demaerre/iStock via Getty Images

DocuSign Inc (NASDAQ:DOCU) offers the leading “e-signature” solution which transforms the process of signing contracts and agreements by eliminating paperwork. From an early pandemic winner benefiting from trends like remote work, the stock has trended lower over the past year against a slower growth outlook and the broader market selloff. Indeed, DOCU is down by more than 80% from its 2021 high through a reset of expectations.

Despite the extreme volatility, we highlight what remains overall solid fundamentals. DocuSign continues to generate positive operating metrics by capturing an expanding market opportunity. The company is profitable with a net cash balance sheet position supporting new growth initiatives. We are bullish on DOCU which is well-positioned to rebound with an improving outlook going forward.

Did DocuSign Beat Earnings?

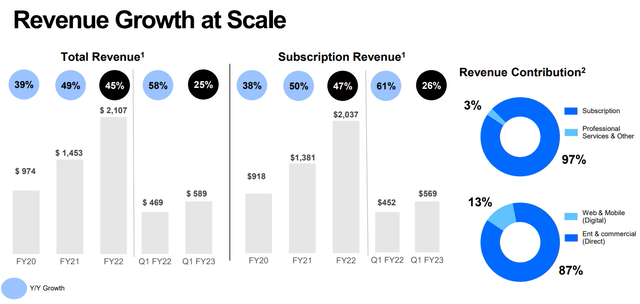

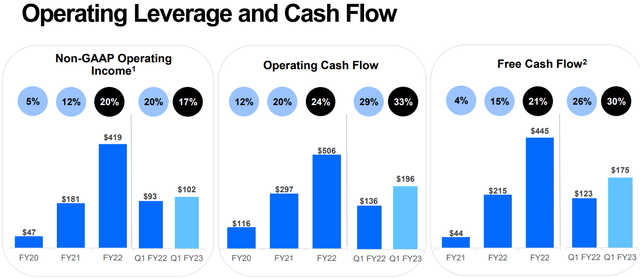

The company reported its fiscal 2023 Q1 earnings on June 9th with non-GAAP EPS of $0.38, which missed expectation by $0.08. Revenue of $589 million, up 25.5% year-over-year, was slightly ahead of the market estimate. The non-GAAP operating income this quarter at $102 million increased by 10% y/y.

source: company IR

In explaining the weakness in the stock price, the context here is that total revenue growth slowed from 58% y/y in the period last year and is also just 1% higher compared to the prior Q4. The other challenge is the softer trends in margins with the adjusted gross margin of 81% flat compared to last year while the non-GAAP operating margin of 17% declined from 20% in Q1 fiscal 2022. Part of this considers ongoing investments to support new initiatives, including through a larger employee headcount. Still, free cash flow improved this quarter to $175 million, up 42% y/y based on the top-line momentum and higher billings.

source: company IR

The company notes it has reached a global customer base of 1.2 million, adding 67,000 during the quarter. A strong point has been the strength in the international segment, where revenue climbed 43% y/y in Q1, and now represents 25% of the total business.

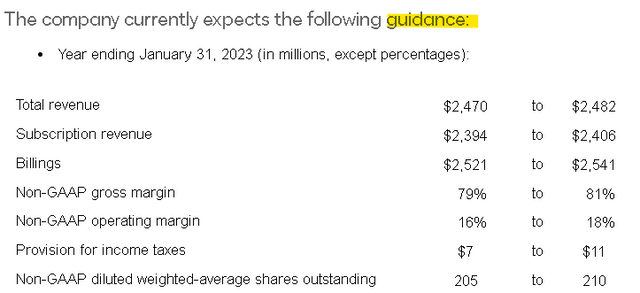

Management is guiding for Q2 revenue of around $600 million, representing a 2% increase from Q1 of 17% above the quarter last year. For the full fiscal year 2023, a revenue target right around $2.475 billion, if confirmed, will be 17% above the result in fiscal 2022. The current guidance suggests a flat gross and operating margin compared to the latest Q1. Finally, we note that DocuSign ended the quarter with $1.1 billion in cash, equivalents, and investments which cover the $750 million in long-term debt.

source: company IR

Is DocuSign A Good Investment Long-Term?

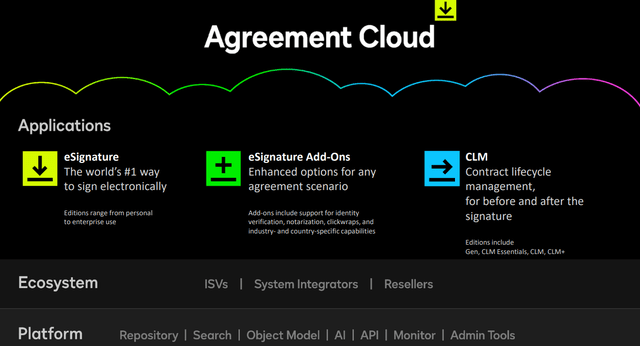

A big theme for DocuSign is the move beyond just e-signatures to an entire “agreement cloud” ecosystem. In particular, Contract Lifecycle Management (CLM) is seen as the long-term growth driver referring to all the processes before and after the initial signing that often includes amendments and renewals, while also providing a system to track records. CLM allows customers to generate agreements, and facilitates negotiation as a complete document management platform.

source; company IR

This type of application is particularly relevant to major corporations that often deal with thousands or even millions of documents. The upside here is that through these types of critical solutions, DocuSign enters the realm of a necessity to complete core business functions for many of its largest customers.

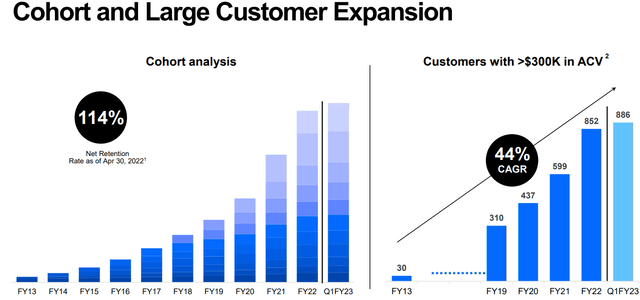

DocuSign notes it now has 886 customers generating over $300k in average contract value, a level that has climbed from 599 at the end of 2021. In support of the company’s growth runway, a key metric is the cohort analysis that highlights how existing customers on the platform spend more overtime at a net retention ratio of 114%. This is achieved by adding functionality to the platform and higher utilization.

source: company IR

DocuSign notes that it counts on leading brands as customers across all industry verticals. The trend here adds a layer of quality to the company’s financials, with less variability in quarterly sales. This is because corporations are seen as less likely to switch providers, given the internal compliance costs and investments made to streamline operations.

source: company IR

We can argue about growth rates and financial margins, but it’s clear to us that DocuSign is here to stay. The company is an established leader in the category that may still be in the early stages of reaching its full market potential. Management believes it operates within a $50 billion market opportunity, compared to its $2.1 billion in revenue over the past year. Next-generation features like more integration of AI-driven “smart agreements” within CLM make DOCU a good long-term investment in our opinion.

DOCU Stock Price Forecast

The setup for DOCU considers what has been a terrible market trading action. With the Nasdaq-100 (QQQ) losing a third of its value this year, and down more than 10% just over the past week, the biggest headwind right now is the poor sentiment towards tech and risk assets in general. All this considers record inflation, rising interest rates, and concerns over economic growth. It’s fair to assume that weaker consumer spending and business activity represent a headwind for DocuSign this year.

At the same time, there is a case to be made that shares have already been punished sufficiently. The current level in the stock under $60.00 per share is a range DOCU traded back in 2018 following the IPO. A lot has changed over the period, but we argue that the long-term outlook for the company has improved materially, and the company should be more valuable now. The widespread adoption of e-signatures, efforts toward CLM, and smart agreements opportunity provide the company with greater upside than what may have been imagined five years ago.

Seeking Alpha

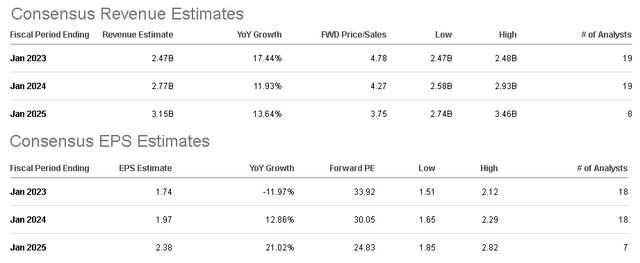

According to consensus estimates, the market sees DOCU full-year revenue growth at 17% which is in line with management guidance. Going forward, growth is expected to average around 12.5% for the next 2-years. As it relates to valuation, DOCU is trading at a forward P/E of 34x on the consensus full-year EPS of $1.74. The expectation is that earnings growth accelerates in fiscal 2024 and 2025 with margins normalizing higher as customer engagement in new use cases and the agreement cloud expands. The 1-year forward P/E narrows down to 30x.

Seeking Alpha

It’s worth mentioning that DocuSign faces competition, particularly with e-signatures including from Adobe Inc. (ADBE) with its “Adobe Sign” product and also Dropbox, Inc. (DBX) “Hello Sign”. Recognizing these companies are not directly comparable as they operate in different software segments, the understanding is that Adobe Sign and Hello Sign are often good options for consumers and small businesses, but the strength of DocuSign is its platform’s more advanced features and API integrations. DocuSign’s leadership position on the enterprise side along with early AI-driven CLM solutions justifies a premium valuation for the stock allowing it to stand out.

Again, DOCU trading at a 30x 1-year forward P/E is in the context of EPS expected to climb 37% over the next 2 years. Our take is that the valuation here is compelling considering both the long-term potential and the earnings momentum which we believe has upside to the current consensus.

Is DOCU Stock A Buy, Sell, or Hold?

We rate DOCU as a buy with a price target for the year ahead at $79.00 per share representing a 40x multiple on the current consensus EPS for next year, fiscal 2024. Our thinking here is that a string of better-than-expected results over the next few quarters from what is now a low bar of expectations can drive revisions higher to earnings estimates. Getting into 2023, the stock would appear cheap with firming margins and fresh sales momentum.

Assuming the market environment towards equities and risk assets at least stabilizes, DOCU should lead higher as a high-quality earnings growth story. Longer-term, shares have significantly more upside as more enterprise-level customers adopt contract lifecycle management features.

The main risk to consider comes down to execution. Weaker than expected results or disappointing trends in customer acquisition could open the door for another leg lower in the stock with a reassessment of the earnings potential. The net retention rate and free cash flow trends are key monitoring points in the upcoming quarters.

Be the first to comment