tifonimages/iStock via Getty Images

Investing in companies that focus on solving significant problems like climate change issues and water shortages can be awfully appealing. Not only are you hoping to generate a profit. You are also on a social mission aimed at making the world a better place. While all of this is important, it’s also important to keep in mind that the main objective when you make an investment is to turn a profit. And with some of these companies, shares are priced so high and growth is so slow that the investment in question just does not make sense from a fundamental perspective. One example of this can be seen when looking at Energy Recovery (NASDAQ:ERII). This play on a healthier planet is interesting from a conceptual perspective. But all the data I see suggests that shares are drastically overpriced at this time and should decline unless something fundamental changes quickly. Because of this, I have decided to rate the enterprise a ‘sell’ at this time.

Energy Recovery – Too much to swallow

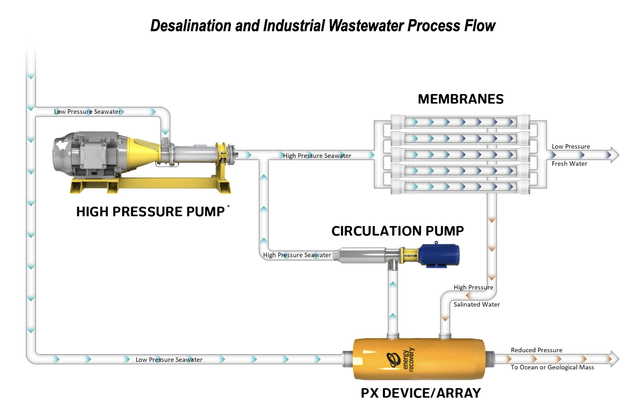

According to the management team at Energy Recovery, the company focuses on producing solutions that help to make industrial processes more efficient and sustainable. The business is doing this largely using its special pressure exchange or technology that, according to management, generates little to no emissions while operating. The company claims that this technology also lowers costs, saves energy, reduces waste, and minimizes emissions for the clients in question. The primary technology the company launched is its PX Pressure Exchanger. This technology is described as an energy recovery device that helps in the seawater reverse osmosis desalination process.

This machine acts like a fluid piston in that it transfers liquid or gas energy from one source to another. By handling this energy, the technology is able to make sure that high-pressure pumps used in the desalination process have less energy to deal with and can even be smaller than they otherwise would have to be. The overall process is a bit complicated. But in short, the interior of the device is made of ceramic. The device welcomes in high-pressure reject concentrate coming directly from the membranes of a reverse osmosis plant, comes into contact briefly with low-pressure seawater, and transfers the energy from the concentrate into the seawater, which then flows back into the system where it meets the stream of seawater coming from the high-pressure pump.

This combined stream then flows into the membranes where it is processed into potable water. Meanwhile, the concentrate, which now has less energy in it, then flows out of the system and is processed accordingly. The reason why this works is that it removes some of the energy requirements that would otherwise have to be met by a larger, more powerful pressure pump. The company also has other technologies that it sells. For instance, it sells a device called Ultra PX, which operates on the same principle but is uniquely suited for the energy-intense industrial wastewater treatment process. The company’s line of products also includes turbochargers, pumps, and other related offerings.

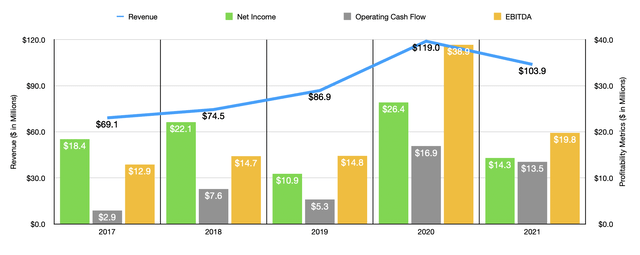

Over the past few years, the general trajectory for the company has been positive. Revenue increased from 2017 through 2020, climbing from $69.1 million to $119 million. Sales dipped slightly during the company’s 2021 fiscal year, dropping to $103.9 million. Although it’s disappointing to see a drop like this, it is worth noting that growth has returned now that we are in the 2022 fiscal year. Revenue in the first quarter totaled $32.5 million. That represents an increase of 12.5% compared to the $28.9 million generated the same time one year earlier. Management expects this growth to continue throughout the year, with revenue forecasted to be as high as $130 million. If the company can hit this target, it would imply a year-over-year growth rate of 25.1% and would be 9.2% above the revenue figure the company reported for 2020.

Fundamental performance on the bottom line has been a bit mixed in recent years. But the picture has been, on the whole, positive. Net income managed to rise from $18.4 million in 2017 to $26.4 million in 2020. But the decline in revenue in 2021 pushed net profits down to just $14.3 million for that year. Other profitability metrics have followed a similar trajectory. Operating cash flow went from $2.9 million in 2017 to $16.9 million in 2020. In 2021, the company saw cash flow total $13.5 million. Meanwhile, EBITDA grew from $12.9 million in 2017 to $38.9 million in 2020 before dropping to $19.8 million last year.

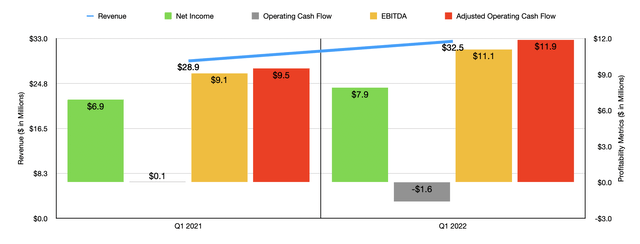

So far this year, the bottom line for the company does look to be improving. Net income in the first quarter of 2022 totaled $7.9 million. That’s up slightly from the $6.9 million reported the same time one year earlier. Operating cash flow did decline, dropping from less than $0.1 million to negative $1.6 million. However, if we adjust for changes in working capital, this metric would have risen from $9.5 million to $11.9 million. EBITDA was nearly identical to this, rising from $9.1 million to $11.1 million. Unfortunately, management has not provided any guidance when it comes to earnings. But if we annualized results seen during the first quarter, we should anticipate net profit of around $16.4 million and operating cash flow of roughly $16.9 million. EBITDA, meanwhile, should be around $24.2 million for the year.

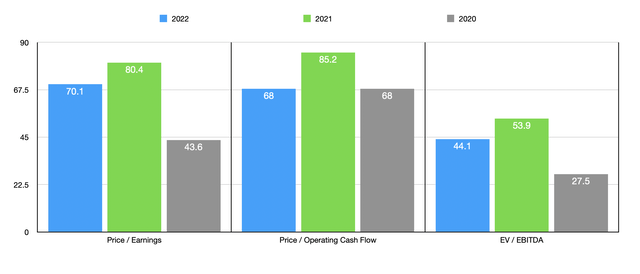

Although the company is interesting and it looks set to continue its growth this year, the sad truth is that shares look very expensive, especially considering the growth the company has exhibited. Using our 2022 estimates, the business is trading at a price-to-earnings multiple of 70.1. This is down from the 80.4 reading that we get for 2021. The price to operating cash flow multiple should drop from 85.2 last year to 68 this year. And the EV to EBITDA multiple should decline from 53.9 to 44.1. Even if the company were to revert back to the kind of performance it generated in 2020, it would still be trading at lofty multiples of 43.6, 68, and 27.5, respectively. To put the pricing of the firm into perspective, I decided to compare it to five similar companies. On a price-to-earnings basis, these companies range from a low of 17.4 to a high of 35. Using the price to operating cash flow approach, the range was from 13.5 to 25.9. And using the EV to EBITDA approach, the range was from 9.5 to 18.3. In all three cases, Energy Recovery was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Energy Recovery | 80.4 | 85.2 | 53.9 |

| Standex International (SXI) | 17.4 | 13.5 | 9.5 |

| Tennant Company (TNC) | 21.5 | 25.9 | 11.1 |

| Enerpac Tool Group (EPAC) | 33.9 | 25.7 | 18.3 |

| Proto Labs (PRLB) | 35.0 | 18.3 | 13.6 |

| Columbus McKinnon (CMCO) | 29.9 | 17.5 | 12.7 |

Takeaway

Understanding the technology that makes Energy Recovery function made me want to be able to rate the business as highly as possible. They have a fascinating technology that is incredibly simplistic and that solves a major problem. Long term, I suspect the company will do quite well for itself. However, shares today just look far too pricey. Because of this, I cannot really justify anything other than a ‘sell’ rating for the firm. But if growth picks up or if the bottom line improves markedly, I hope to change this rating.

Be the first to comment