Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Supply-side platform (SSP) leader PubMatic, Inc. (NASDAQ:PUBM) saw its stock re-tested its March 2022 lows recently, given the headwinds in the ad tech industry. Management also guided to a weaker Q2, factoring in a weaker macro backdrop, coupled with higher inflation concerns, and interest rates.

However, yesterday’s 75 bps rate hike by the Fed could have thrown another curveball at PubMatic, which could impact its forward guidance. In addition, Jefferies had downgraded PUBM in late May, as it saw a worsening macro backdrop, further impacting ad spend in PubMatic’s verticals.

Our price action analysis suggests that PUBM stock is testing a near-term bottom with a potential bear trap. However, the price action trigger has not been validated. Therefore, investors may consider waiting for the signal to be confirmed before adding exposure.

Notwithstanding, our valuation analysis suggests that the premium asked for PUBM stock seems well-balanced, given its growth metrics. Therefore, unless its guidance is revised significantly moving forward, we think it represents an attractive entry level.

Accordingly, we reiterate our Buy rating on PUBM stock.

PubMatic Should Turn The Corner in FY23

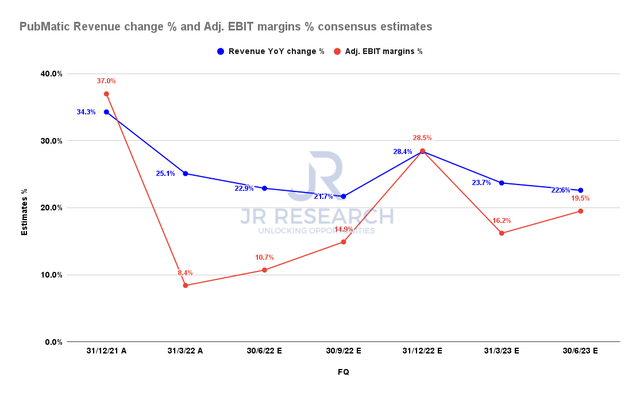

PubMatic revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

PubMatic is a profitable company on both GAAP and adjusted EBIT terms. Notwithstanding, its revenue growth is estimated to fall to 22.9% YoY in FQ2, after FQ1’s 25.1% growth. Management guided revenue growth of 22.5% (midpoint), reflecting their concerns with the weaker macro backdrop.

However, it reiterated its guidance for FY22, as it expects growth to recover subsequently. The consensus estimates indicate that PubMatic’s revenue growth could recover in FQ4 before normalizing in FY23.

Notably, its adjusted EBIT margins is also expected to reach a nadir in FQ2 before recovering through FY23. Therefore, we believe that much of its near-term weakness could have been reflected.

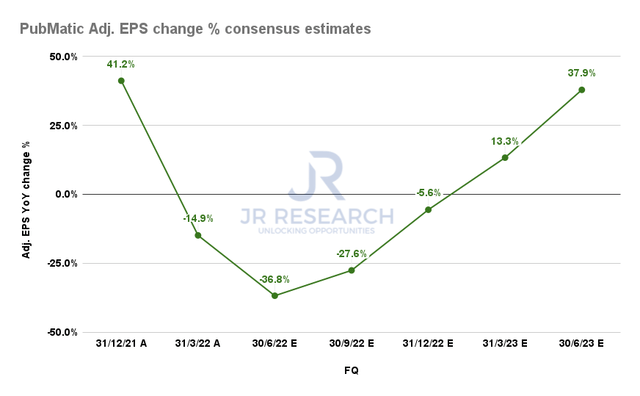

PubMatic adjusted EPS change % consensus estimates (S&P Cap IQ)

Notably, its adjusted EPS growth is estimated to bottom in FQ2 before resuming its upward trajectory through FY23. Therefore, we believe it augurs well for a potential re-rating in PUBM stock from a fundamentals framework.

Valuation Seems Well-Balanced

| Stock | PUBM |

| Current market cap | $0.98B |

| Hurdle rate (CAGR) | 25% |

| Projection through | FQ2’26 |

| Required FCF yield in FQ2’26 | 4.5% |

| Assumed FCF margin in FQ2’26 | 20% |

| Implied revenue by FQ2’26 | $0.54B |

PUBM stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

Our reverse cash flow valuation model indicates that PUBM stock seems fairly valued now. We used reasonable assumptions appropriate for a “high-growth” stock, requiring a hurdle rate of 25% CAGR through FQ2’26.

Furthermore, using an FCF yield of 4.5%, higher than its current NTM FCF yield of 4.06%, we require PubMatic to post a TTM revenue of $0.54B through FQ2’26. Accordingly, our model indicates that PubMatic needs to deliver a revenue CAGR of 21.3%, which we think seems achievable.

Is PUBM Stock A Buy, Sell, Or Hold?

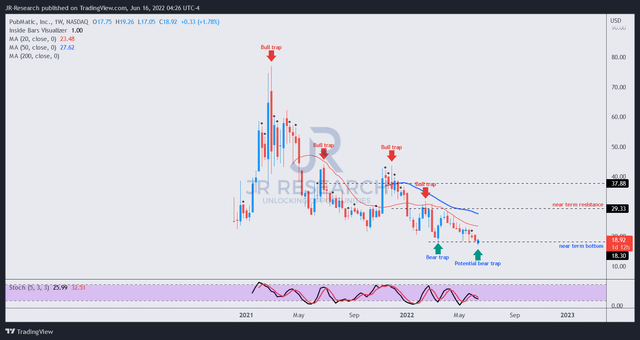

PUBM price chart (TradingView)

Our price action analysis suggests that PUBM stock is at its near-term support. It’s also attempting to form a bear trap (not validated) to help undergird its bottoming process.

However, given the dominant bearish bias, investors can consider watching for a validated bear trap first before adding exposure.

Notwithstanding, we believe PUBM stock attractive valuation is supportive of an entry at the current levels.

Accordingly, we reiterate our Buy rating on PUBM stock. However, as the stock is not undervalued, investors can consider using stop-loss risk management to minimize potential outsized losses if the position becomes indefensible. The stock’s dominant bearish tilt will likely continue unless a bear trap is validated.

Be the first to comment